Easing Bond Forward Rules: A Key Demand From Indian Insurers

Table of Contents

Bond forward contracts are agreements to buy or sell a bond at a future date at a predetermined price. These instruments are vital for insurance companies, allowing them to manage interest rate risk and optimize their investment portfolios. However, the current regulatory environment in India restricts insurers' access to these crucial risk management tools, hindering their potential. This article argues that relaxing these regulations is vital for the health and prosperity of the Indian insurance sector.

Current Bond Forward Regulations and Their Impact on Indian Insurers

The existing regulations governing bond forward contracts for Indian insurers are quite restrictive. These limitations include strict caps on the notional amount of contracts, limitations on the types of bonds that can be used, and restrictions on the counterparties with whom insurers can enter into such agreements. These constraints severely hamper the sector's investment flexibility.

The consequences of these limitations are considerable:

- Reduced Investment Options: Insurers are unable to diversify their portfolios effectively, limiting their access to potentially higher-yielding investments.

- Increased Hedging Costs: The restrictions make hedging interest rate risk significantly more expensive, eating into profitability.

- Limited Risk Management Tools: Insurers lack the sophisticated tools needed to manage complex risks in a volatile market.

- Lower Returns on Investment: The inability to effectively manage risk and diversify investments directly impacts the overall return on investment. Studies show that restrictive regulations have led to a [Insert data/percentage] reduction in average investment portfolio returns compared to global counterparts.

- Competitive Disadvantage: Compared to global players with access to a broader range of risk management tools and investment opportunities, Indian insurers find themselves at a considerable disadvantage. This is reflected in their [Insert data/market share statistics showing loss of market share].

The Case for Easing Bond Forward Rules: Benefits for the Insurance Sector

Relaxing the bond forward regulations would unlock significant benefits for the Indian insurance sector. A more flexible regulatory environment would empower insurers to:

- Improve Risk Management: More effective hedging strategies would allow insurers to better manage interest rate risk and other market fluctuations, leading to increased financial stability.

- Increase Investment Opportunities: Access to a wider range of bond forward contracts will enable insurers to diversify their investments, potentially achieving higher returns.

- Enhance Global Competitiveness: A more level playing field would enable Indian insurers to compete more effectively with their international counterparts.

- Increase Financial Stability: Reduced risk exposure contributes to a more robust and stable insurance industry.

- Boost Infrastructure Investment: With improved investment capabilities, insurers could potentially increase their investment in crucial infrastructure projects, stimulating economic growth.

Several countries have successfully implemented more lenient regulations on bond forwards, demonstrating the potential benefits. For instance, [Insert example of a country with successful implementation and its positive results].

Potential Concerns and Mitigation Strategies

While easing bond forward rules offers numerous advantages, potential concerns must be addressed. Increased systemic risk and the potential for misuse are legitimate anxieties. However, these risks can be mitigated through:

- Strengthened Regulatory Oversight: More robust monitoring of insurers' activities and their use of bond forward contracts is crucial.

- Robust Risk Management Frameworks: Mandating stringent internal risk management frameworks for insurers would help control risk.

- Stricter Reporting Requirements: More detailed and frequent reporting on bond forward transactions would improve transparency and accountability.

- Phased Implementation: A gradual relaxation of regulations, allowing time for adaptation and monitoring, could minimize disruptive impacts.

Recommendations for Policymakers

To unlock the full potential of the Indian insurance sector, policymakers should consider these recommendations:

- Amend the existing regulatory framework: Specifically, increase the permissible notional amount of bond forward contracts, expand the range of eligible bonds, and ease restrictions on counterparties.

- Consult with industry experts: A collaborative approach involving both insurers and regulatory bodies is essential to develop effective and practical solutions.

- Implement a phased approach: This would allow for continuous monitoring and adjustments to address any unforeseen issues.

Conclusion: The Need for Easing Bond Forward Rules in India

Easing bond forward regulations offers significant benefits to Indian insurers and the broader economy. Improved risk management, increased investment opportunities, and enhanced global competitiveness are just some of the advantages. Relaxing Bond Forward Regulations, making Amendments to Bond Forward Rules, and Modernizing Bond Forward Regulations will contribute to a more robust and efficient insurance sector. We urge policymakers to seriously consider the arguments presented and take concrete steps toward creating a more enabling environment. Share this article to raise awareness and help drive the necessary changes to allow the Indian insurance sector to thrive in the global marketplace.

Featured Posts

-

Accident Mortel A Dijon Un Ouvrier Chute Du 4e Etage

May 09, 2025

Accident Mortel A Dijon Un Ouvrier Chute Du 4e Etage

May 09, 2025 -

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok Uchastnikov

May 09, 2025

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok Uchastnikov

May 09, 2025 -

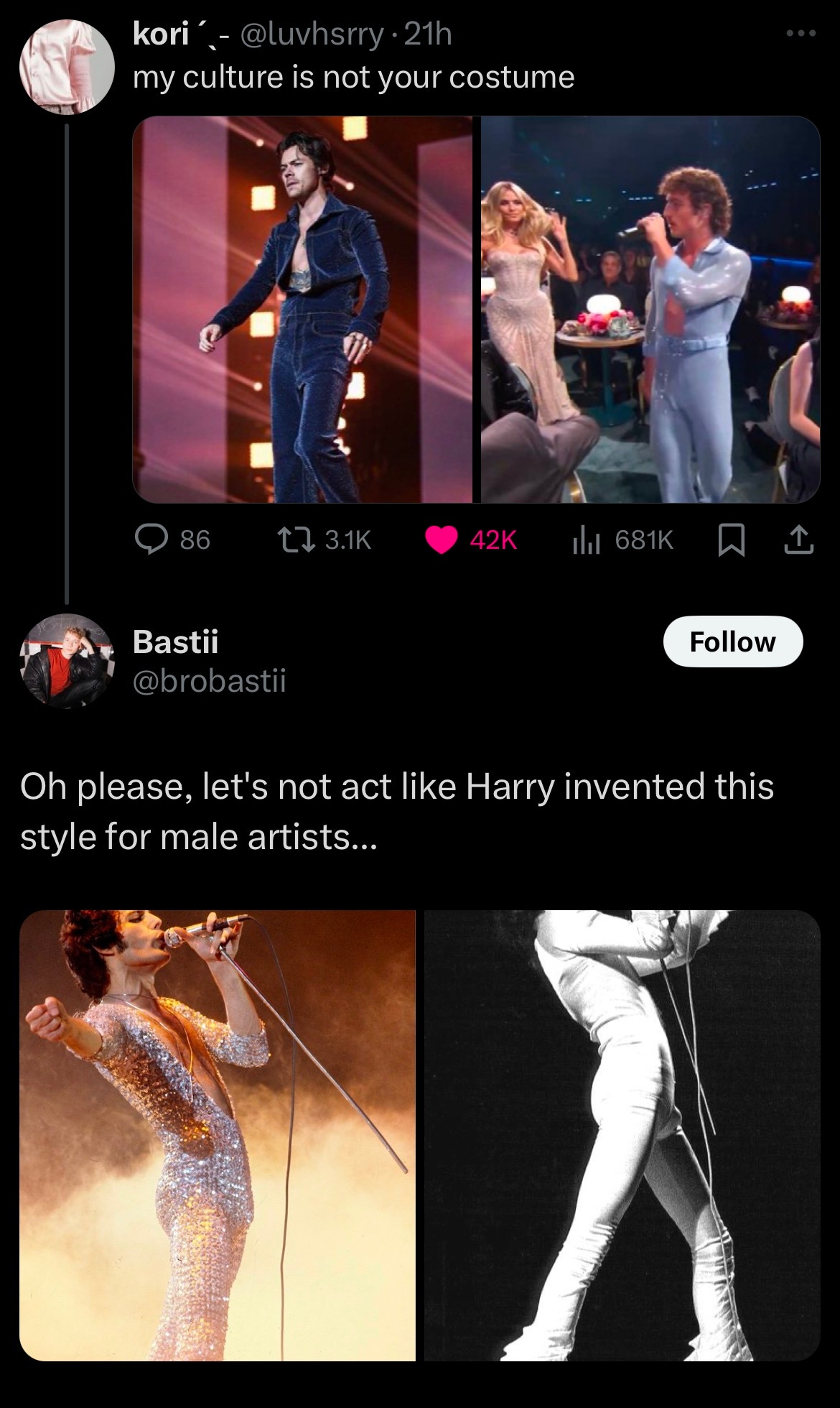

Benson Boone Addresses Harry Styles Comparison A Direct Response

May 09, 2025

Benson Boone Addresses Harry Styles Comparison A Direct Response

May 09, 2025 -

From Scatological Documents To Podcast Gold An Ai Driven Approach

May 09, 2025

From Scatological Documents To Podcast Gold An Ai Driven Approach

May 09, 2025 -

Bundesliga 2 Matchday 27 Results And Table Update Cologne On Top

May 09, 2025

Bundesliga 2 Matchday 27 Results And Table Update Cologne On Top

May 09, 2025