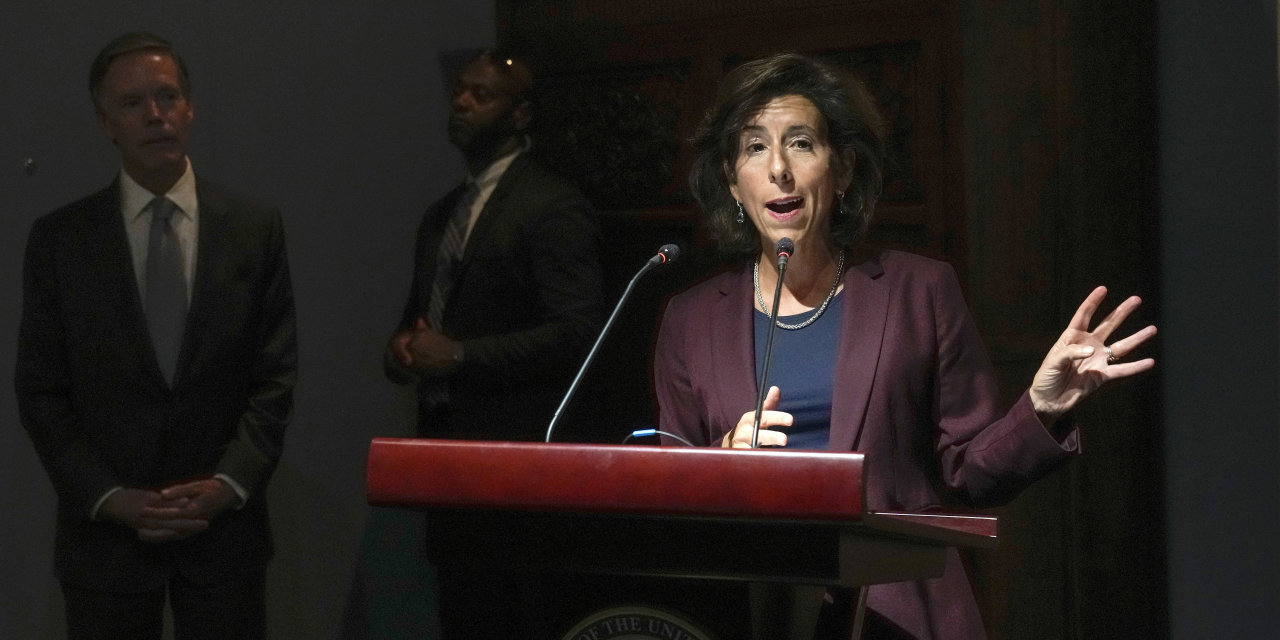

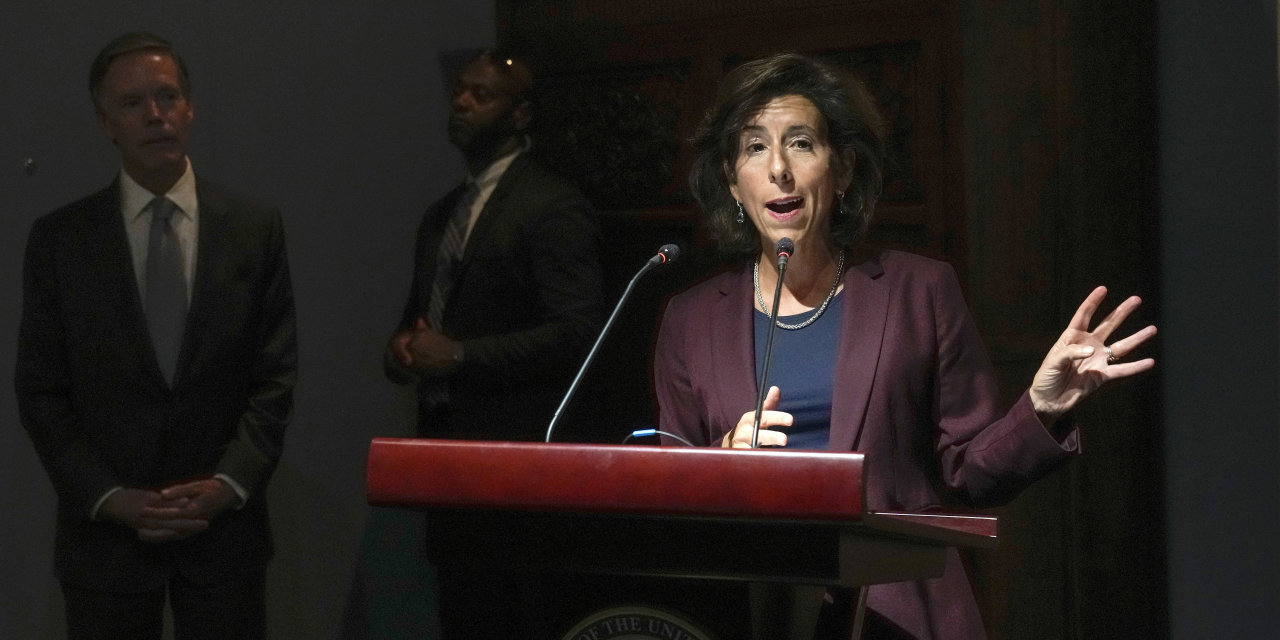

Easing Trade Tensions? Upcoming Meeting Between U.S. And Chinese Officials

Table of Contents

Key Issues on the Agenda

The agenda for these crucial bilateral talks is packed with issues that have fueled the US-China trade war for years. Successful negotiations will require compromise and a willingness from both sides to address longstanding concerns.

Tariff Reductions and Removal

Discussion will likely center on the reduction or removal of existing tariffs imposed by both countries. These tariffs, implemented over several years, have significantly impacted various sectors and represent a major obstacle to improved economic relations.

- Focus on specific tariff sectors: Agriculture, technology, and manufacturing are likely to be focal points, given their significant roles in both economies.

- Potential phased reductions: A gradual reduction of tariffs, rather than immediate removal, might be a more realistic approach, allowing both sides to assess the economic impact.

- Timelines for implementation: Establishing clear and achievable timelines for tariff reductions is crucial for building trust and fostering predictability for businesses.

- Reciprocal actions: Any tariff reductions will need to be reciprocal, ensuring a level playing field and avoiding accusations of unfair trade practices.

The impact of past tariff increases has been substantial. For example, tariffs on soybeans significantly harmed American farmers, while Chinese manufacturers faced increased costs for imported components. The lobbying efforts of affected industries in both countries have put immense pressure on their respective governments to find solutions.

Intellectual Property Rights (IPR) Protection

Protecting U.S. intellectual property in China remains a major sticking point in US-China trade negotiations. Concerns over forced technology transfer and inadequate patent protection continue to hamper bilateral relations.

- Strengthening enforcement mechanisms: China needs to demonstrate a stronger commitment to enforcing IPR laws and punishing violators.

- Addressing forced technology transfer: Eliminating practices that compel U.S. companies to share their technology with Chinese firms is essential.

- Improving patent protection: A more robust system for protecting patents and trademarks is crucial to incentivize innovation and investment.

Numerous cases of IPR violations have been documented, highlighting the systemic challenges that U.S. companies face in the Chinese market. International organizations like the World Trade Organization (WTO) play a crucial role in mediating these disputes and setting global standards for IPR protection.

Market Access and Fair Competition

Ensuring fair and reciprocal market access for U.S. companies in China is another critical element of these talks. Non-tariff barriers and advantages enjoyed by state-owned enterprises (SOEs) have long been sources of contention.

- Removing non-tariff barriers: These barriers, often hidden behind regulations and bureaucratic hurdles, create significant challenges for foreign companies.

- Addressing state-owned enterprises' advantages: Leveling the playing field between SOEs and private companies, both domestic and foreign, is necessary to ensure fair competition.

- Promoting foreign investment: Creating a more welcoming environment for foreign investment, reducing risks, and guaranteeing a fair return on investment are vital for attracting U.S. capital.

- Ensuring a level playing field: This means creating an environment where all businesses, regardless of origin or ownership structure, can compete on merit.

Examples of market access restrictions include limitations on foreign ownership in certain sectors, discriminatory regulations, and difficulties in obtaining necessary licenses and permits. These restrictions have significantly hampered the competitiveness of U.S. businesses in China.

Potential Outcomes and Scenarios

The outcome of these US-China trade negotiations is highly uncertain, with several potential scenarios emerging.

Optimistic Scenario: Significant Progress Towards De-escalation

In an optimistic scenario, both sides agree on significant concessions, leading to a marked reduction in trade tensions.

- Specific examples of tariff reductions: Substantial cuts or the complete removal of tariffs on key goods.

- Agreements on IPR protection: Stronger enforcement mechanisms and a commitment to addressing forced technology transfer.

- Improved market access: Significant reduction of non-tariff barriers and a more level playing field for foreign companies.

- Positive impacts on global trade and economic growth: Increased trade volumes, reduced uncertainty, and a boost in investor confidence.

Pessimistic Scenario: Stalemate or Further Escalation

A pessimistic scenario could see negotiations failing to produce significant results, leading to continued trade friction or even further escalation.

- Potential for new tariffs: Imposition of additional tariffs on goods not currently affected.

- Trade sanctions: Wider use of sanctions against Chinese companies or individuals.

- Further deterioration in bilateral relations: Increased distrust and a decline in diplomatic engagement.

- Negative impacts on global markets and supply chains: Disruptions to global trade, reduced economic growth, and increased uncertainty for businesses.

Moderate Scenario: Incremental Progress and Continued Dialogue

A more likely scenario is a limited agreement addressing some key concerns while leaving others unresolved for future discussions.

- Potential areas of compromise: Partial tariff reductions, agreements on specific aspects of IPR protection, and some improvements in market access.

- Areas where further negotiations will be needed: Lingering disagreements on key issues like technology transfer or the role of SOEs.

- Ongoing need for diplomacy and engagement: Continued dialogue and a commitment to finding common ground will be crucial for future progress.

Impact on Global Markets and the World Economy

The interconnectedness of the U.S. and Chinese economies means that the outcome of these talks will have significant ripple effects across the globe. Reduced trade tensions will likely boost global trade, while further escalation could disrupt supply chains and negatively impact investor confidence. The impact will be felt particularly strongly in countries heavily reliant on trade with either the U.S. or China. The stability of global markets depends, to a large extent, on the success of these negotiations.

Conclusion

The upcoming US-China trade talks are crucial for determining the future trajectory of the bilateral relationship and the global economy. While the potential outcomes range from significant de-escalation to further escalation, the need for constructive dialogue and a commitment to finding mutually beneficial solutions remains paramount. The success of these negotiations will significantly impact global trade, supply chains, and investor confidence.

Call to Action: Stay informed about the progress of these crucial US-China trade negotiations and their impact on global markets. Keep checking back for updates on easing trade tensions between these economic powerhouses. Understanding the intricacies of US-China trade relations is critical for businesses and investors alike.

Featured Posts

-

Analyzing The Ethereum Weekly Chart Buy Signal Implications

May 08, 2025

Analyzing The Ethereum Weekly Chart Buy Signal Implications

May 08, 2025 -

Salud De Central En El Gigante Informe Sobre Su Enfrentamiento Con El Instituto De Cordoba

May 08, 2025

Salud De Central En El Gigante Informe Sobre Su Enfrentamiento Con El Instituto De Cordoba

May 08, 2025 -

Zdravstveno Stanje Papeza Zadnje Informacije In Analiza

May 08, 2025

Zdravstveno Stanje Papeza Zadnje Informacije In Analiza

May 08, 2025 -

First Look The Long Walk Trailer Unveils A Gripping Horror Story

May 08, 2025

First Look The Long Walk Trailer Unveils A Gripping Horror Story

May 08, 2025 -

Ranking Steven Spielbergs War Films Excluding Saving Private Ryan Top 7

May 08, 2025

Ranking Steven Spielbergs War Films Excluding Saving Private Ryan Top 7

May 08, 2025

Latest Posts

-

Check The Daily Lotto Results Thursday 17th April 2025

May 08, 2025

Check The Daily Lotto Results Thursday 17th April 2025

May 08, 2025 -

Check The Latest Lotto Plus 1 And Lotto Plus 2 Numbers Here

May 08, 2025

Check The Latest Lotto Plus 1 And Lotto Plus 2 Numbers Here

May 08, 2025 -

Check The Winning Lotto And Lotto Plus Numbers April 12 2025

May 08, 2025

Check The Winning Lotto And Lotto Plus Numbers April 12 2025

May 08, 2025 -

View The Daily Lotto Results Tuesday 15th April 2025

May 08, 2025

View The Daily Lotto Results Tuesday 15th April 2025

May 08, 2025 -

Saturday April 12 2025 Official Lotto And Lotto Plus Numbers

May 08, 2025

Saturday April 12 2025 Official Lotto And Lotto Plus Numbers

May 08, 2025