ECB: Continued Inflation Driven By Pandemic Fiscal Measures

Table of Contents

The Impact of Pandemic Fiscal Stimulus on Inflation

The unprecedented fiscal stimulus packages rolled out across the Eurozone during the pandemic had a profound impact on inflation. These measures, designed to mitigate the economic fallout, inadvertently fueled inflationary pressures through two primary channels: increased aggregate demand and supply-side bottlenecks.

Increased Aggregate Demand

Substantial government spending and generous transfer payments injected significant liquidity into the Eurozone economy, dramatically boosting aggregate demand. This surge in demand far outpaced the capacity of the supply side to meet it, creating a classic demand-pull inflation scenario.

- Increased consumer spending: Governments provided substantial financial aid to households, leading to a significant rise in consumer spending on goods and services.

- Investment fueled by government support: Government support programs, such as loan guarantees and grants, encouraged businesses to invest, further adding to aggregate demand.

- Supply chain disruptions exacerbating demand pressures: Existing supply chain disruptions, already impacting the availability of goods, were further exacerbated by the sudden increase in demand, leading to shortages and price hikes.

These factors collectively contributed to a significant increase in aggregate demand, a key driver of the current inflationary pressures.

Supply-Side Bottlenecks

The pandemic also created significant supply-side bottlenecks, further contributing to inflation. Disruptions to global supply chains, labor shortages, and increased transportation costs all played a crucial role in restricting the supply of goods and services.

- Shortages of raw materials: Lockdowns and logistical disruptions hampered the production and delivery of raw materials, leading to shortages and price increases.

- Labor shortages: The pandemic resulted in labor shortages in various sectors, limiting the capacity of businesses to meet the increased demand.

- Logistical bottlenecks: Port congestion, shipping delays, and other logistical bottlenecks further constrained the flow of goods, adding to price pressures.

- Increased transportation costs: Higher fuel prices and increased demand for transportation services contributed to significantly higher transportation costs, impacting the price of goods.

These supply-side constraints amplified the inflationary pressures generated by the surge in aggregate demand, creating a perfect storm for rising prices.

ECB's Monetary Policy Response to Inflation

Faced with persistently high inflation, the ECB has implemented a series of monetary policy measures aimed at curbing price increases and restoring price stability. These measures primarily involve interest rate hikes and quantitative tightening.

Interest Rate Hikes

The ECB has embarked on a series of interest rate hikes to increase borrowing costs for businesses and consumers. The goal is to reduce spending and investment, thereby cooling down the economy and easing inflationary pressures.

- Impact on borrowing costs: Higher interest rates make borrowing more expensive, discouraging investment and consumer spending.

- Effect on investment and consumption: Reduced investment and consumption help to decrease aggregate demand, easing the pressure on prices.

- Potential risks of aggressive rate hikes: Aggressive interest rate hikes carry the risk of triggering a recession by stifling economic growth and increasing unemployment.

Quantitative Tightening

In addition to raising interest rates, the ECB has also implemented quantitative tightening (QT), reducing its asset purchase program. This reduces the amount of liquidity in the market, further aiming to curb inflation.

- Impact on liquidity: Reducing the ECB's balance sheet decreases the amount of money circulating in the economy, reducing inflationary pressures.

- Effect on long-term interest rates: QT can lead to higher long-term interest rates, further discouraging borrowing and investment.

- Challenges in balancing inflation control and economic growth: The ECB faces the challenge of balancing its inflation control objectives with the need to maintain sustainable economic growth and avoid triggering a recession.

Long-Term Economic Implications and Uncertainties

The ECB's response to inflation driven by pandemic fiscal measures presents significant long-term economic implications and uncertainties. The interplay between inflationary expectations and the risk of recession presents a complex challenge for policymakers.

Inflationary Expectations

The persistence of high inflation can lead to a self-fulfilling prophecy, as higher inflation expectations prompt businesses to increase prices and workers to demand higher wages, creating a wage-price spiral.

- Wage-price spiral: A wage-price spiral occurs when rising prices lead to higher wages, which in turn lead to even higher prices, creating a vicious cycle of inflation.

- Impact on consumer confidence: Persistent high inflation can erode consumer confidence, leading to reduced spending and potentially hindering economic recovery.

- Challenges in anchoring inflation expectations: The ECB faces the significant challenge of anchoring inflation expectations at its target level of 2%, which is crucial for maintaining price stability.

Risks of Recession

The ECB's aggressive monetary tightening measures, while aimed at curbing inflation, carry the risk of triggering a recession.

- Impact on economic growth: Higher interest rates and reduced liquidity can significantly dampen economic growth.

- Potential for unemployment increase: Slower economic growth can lead to job losses and increased unemployment.

- Balance between inflation control and economic stability: The ECB must carefully balance its commitment to controlling inflation with the need to maintain economic stability and avoid a severe recession.

Conclusion

The current inflationary pressures in the Eurozone are significantly linked to the expansive fiscal measures implemented during the COVID-19 pandemic. These measures, while necessary to mitigate the immediate economic fallout, led to increased aggregate demand and exacerbated supply-side bottlenecks, resulting in stubbornly high inflation. The ECB's response, involving interest rate hikes and quantitative tightening, aims to curb inflation but carries the risk of triggering a recession. The long-term implications remain uncertain, highlighting the complexity of managing inflation fueled by pandemic fiscal measures. Further research and analysis are crucial for understanding the lasting effects of these policies and for developing effective strategies for maintaining price stability in the Eurozone. Stay informed on the latest developments concerning the ECB and its ongoing efforts to manage inflation driven by pandemic fiscal measures.

Featured Posts

-

Over 100 Immigrants Detained In Underground Nightclub Raid Cnn Video Evidence

Apr 29, 2025

Over 100 Immigrants Detained In Underground Nightclub Raid Cnn Video Evidence

Apr 29, 2025 -

Will Pitchers Name Crack The Mets Starting Rotation

Apr 29, 2025

Will Pitchers Name Crack The Mets Starting Rotation

Apr 29, 2025 -

Hungary Defies Us Pressure Maintaining Strong Economic Ties With China

Apr 29, 2025

Hungary Defies Us Pressure Maintaining Strong Economic Ties With China

Apr 29, 2025 -

Nyt Strands February 12 2025 Clues Answers And Spangram Solution

Apr 29, 2025

Nyt Strands February 12 2025 Clues Answers And Spangram Solution

Apr 29, 2025 -

Executive Order On Sanctuary Cities A Nationwide Registry

Apr 29, 2025

Executive Order On Sanctuary Cities A Nationwide Registry

Apr 29, 2025

Latest Posts

-

Louisville Tornado 11 Years Later Remembering The Storm And Recovery

Apr 29, 2025

Louisville Tornado 11 Years Later Remembering The Storm And Recovery

Apr 29, 2025 -

Louisville Mail Delivery Issues Union Leader Announces Improvement

Apr 29, 2025

Louisville Mail Delivery Issues Union Leader Announces Improvement

Apr 29, 2025 -

Postal Union Reports End To Louisville Mail Delays Near

Apr 29, 2025

Postal Union Reports End To Louisville Mail Delays Near

Apr 29, 2025 -

Louisville Mail Delays End In Sight Says Postal Union Leader

Apr 29, 2025

Louisville Mail Delays End In Sight Says Postal Union Leader

Apr 29, 2025 -

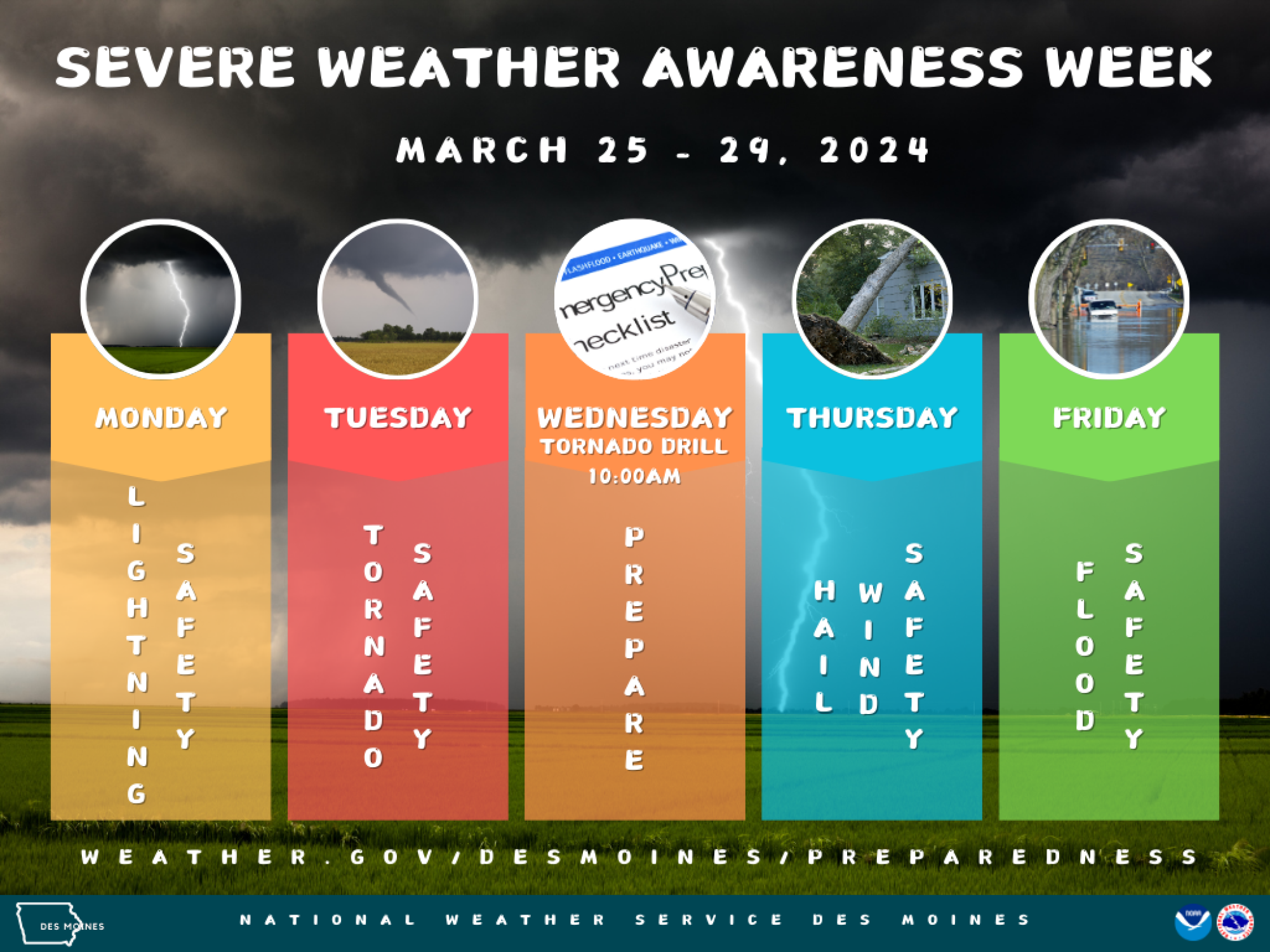

Nws Kentucky Getting Ready For Severe Weather Awareness Week

Apr 29, 2025

Nws Kentucky Getting Ready For Severe Weather Awareness Week

Apr 29, 2025