ECB Launches Task Force To Streamline Banking Rules

Table of Contents

The Goals of the ECB's Task Force

The primary objective of the newly formed ECB task force is to significantly reduce the regulatory burden on banks operating within the Eurozone. This involves a comprehensive review and overhaul of the existing regulatory framework, focusing on improving clarity, transparency, and overall efficiency. The task force aims to achieve several key goals:

-

Reduce compliance costs for banks: Streamlining regulations will directly translate to lower compliance costs for financial institutions, freeing up resources that can be reinvested in core business activities, such as lending and innovation. This reduction in bureaucratic overhead is crucial for enhancing the profitability and competitiveness of European banks.

-

Simplify reporting requirements: The current reporting requirements often necessitate extensive administrative work, diverting valuable resources away from strategic initiatives. The task force aims to simplify these processes, making reporting more efficient and less demanding on banks' internal resources.

-

Harmonize regulations across different member states: Discrepancies in banking regulations across different Eurozone member states create complexities and inconsistencies. The task force will strive for greater harmonization, creating a more unified and predictable regulatory environment.

-

Improve the clarity and transparency of banking regulations: Ambiguous or overly complex regulations can lead to misinterpretations and inconsistent application. The task force will work to improve the clarity and transparency of existing rules, ensuring a level playing field for all banks.

-

Promote a more level playing field for banks of different sizes: The task force aims to ensure that regulatory burdens are proportionate to the size and risk profile of each bank, preventing disproportionate impacts on smaller institutions. This will promote a healthier and more competitive banking landscape.

Key Areas of Focus for Regulatory Simplification

The ECB's task force will focus its simplification efforts on several key areas of banking regulations:

-

Capital requirements: The task force will examine the complexities of capital requirements under Basel accords and other international frameworks, seeking ways to streamline compliance processes without compromising financial stability. This includes exploring potential refinements to the calculation methods and reducing the burden of reporting.

-

Liquidity coverage ratios (LCR): The task force will analyze the LCR framework, aiming to simplify its implementation and reduce the administrative burden on banks while maintaining adequate liquidity buffers.

-

Net stable funding ratio (NSFR): Similar to the LCR review, the NSFR will be examined with the goal of achieving greater simplicity and efficiency in compliance.

-

Anti-money laundering (AML) regulations: Streamlining AML regulations is crucial for maintaining the integrity of the financial system while minimizing the compliance burden on banks. The task force will explore ways to improve the effectiveness and efficiency of AML processes.

-

Know Your Customer (KYC) procedures: KYC procedures are essential for combating financial crime, but overly complex procedures can be burdensome. The task force will focus on streamlining KYC procedures, ensuring compliance without unnecessary administrative overhead.

Expected Impact on the Banking Sector

The successful implementation of streamlined banking rules will have a profoundly positive impact on the European banking sector and the wider economy:

-

Increased efficiency and reduced operational costs for banks: Reduced compliance burdens will directly translate to lower operational costs, improving the profitability and competitiveness of banks.

-

Improved competitiveness of European banks in the global market: A more efficient regulatory environment will enhance the competitiveness of European banks on the global stage, enabling them to better compete with their international counterparts.

-

Enhanced stability and resilience of the financial system: Streamlined and clearer regulations contribute to a more stable and resilient financial system, reducing systemic risk.

-

Potential for increased lending and investment: By freeing up resources and reducing administrative burdens, the initiative could stimulate increased lending and investment, fostering economic growth.

-

Simplified compliance processes, freeing up resources for other strategic initiatives: Banks will be able to dedicate more resources to innovation, customer service, and other strategic priorities, rather than solely focusing on regulatory compliance.

Timeline and Next Steps for the Task Force

While a precise timeline hasn't yet been officially released, the ECB's task force is expected to work diligently over the coming months and years. Key milestones will likely include internal reviews, consultations with stakeholders (including banks, industry associations, and other regulatory bodies), and the subsequent proposal of revised regulations. Public consultations will likely play a vital role, ensuring transparency and allowing for feedback from all interested parties. The composition of the task force itself will include experts from various fields within the ECB and potentially external specialists with extensive experience in banking regulations.

Conclusion: Streamlining Banking Rules: A Positive Step Forward for the Eurozone

The ECB's initiative to streamline banking rules represents a crucial step toward creating a more efficient, competitive, and resilient banking sector in the Eurozone. By reducing regulatory burdens and improving the clarity of regulations, the task force’s work promises to benefit banks of all sizes, ultimately contributing to a stronger and more stable financial system. The potential for increased lending, investment, and improved global competitiveness highlights the significance of this initiative. Stay updated on the latest developments regarding the ECB's efforts to streamline banking regulations by following our website and subscribing to our newsletter. The simplification of banking rules within the Eurozone is a positive step towards a more prosperous future.

Featured Posts

-

Werner Herzogs Bucking Fastard A Look At The Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard A Look At The Sisterly Leads

Apr 27, 2025 -

Paolini Y Pegula Fuera Del Wta 1000 De Dubai

Apr 27, 2025

Paolini Y Pegula Fuera Del Wta 1000 De Dubai

Apr 27, 2025 -

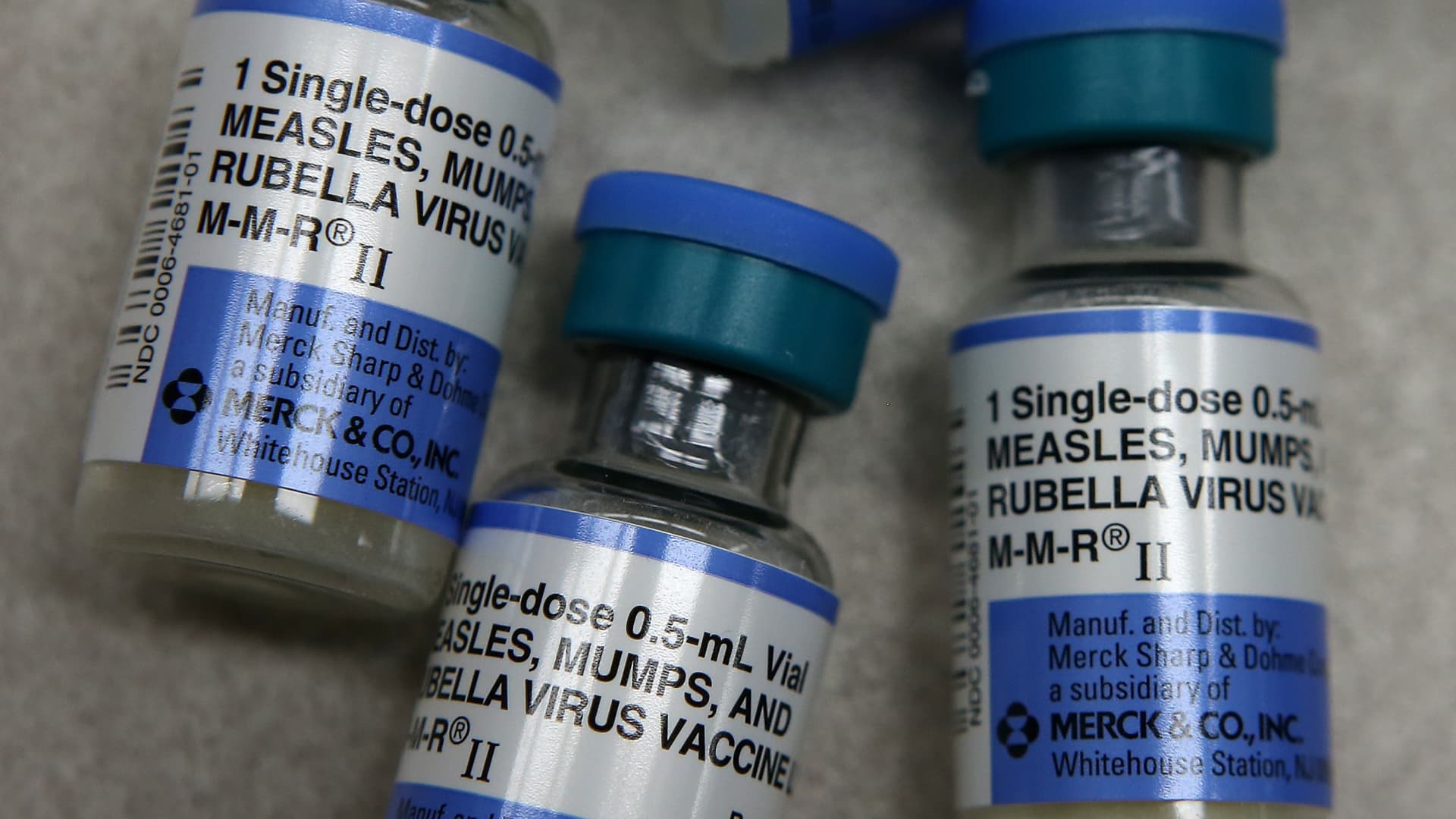

Anti Vaccine Advocate Selected By Hhs To Investigate Discredited Autism Vaccine Connection

Apr 27, 2025

Anti Vaccine Advocate Selected By Hhs To Investigate Discredited Autism Vaccine Connection

Apr 27, 2025 -

Professional Styling And Body Art Ariana Grandes Stunning New Look

Apr 27, 2025

Professional Styling And Body Art Ariana Grandes Stunning New Look

Apr 27, 2025 -

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Latest Posts

-

Lingering Effects Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 28, 2025

Lingering Effects Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 28, 2025 -

Ohio Train Derailment Prolonged Exposure To Toxic Chemicals In Buildings

Apr 28, 2025

Ohio Train Derailment Prolonged Exposure To Toxic Chemicals In Buildings

Apr 28, 2025 -

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 28, 2025

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Apr 28, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 28, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 28, 2025 -

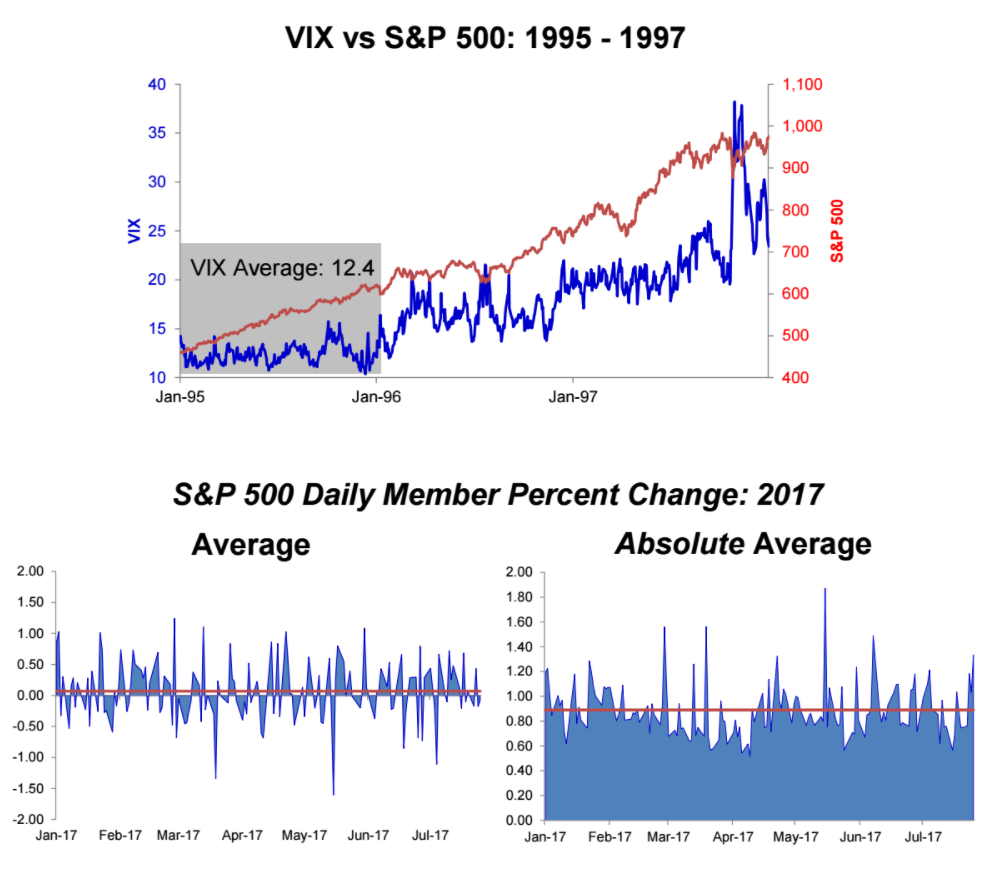

Understanding The Volatility Of Gpu Prices

Apr 28, 2025

Understanding The Volatility Of Gpu Prices

Apr 28, 2025