ECB's New Task Force: Simplifying Banking Regulation

Table of Contents

The Rationale Behind the ECB's Initiative

The current regulatory framework presents a significant hurdle for European banks. Fragmented rules across different jurisdictions create unnecessary complexity and inconsistencies, leading to excessive bureaucracy and spiraling compliance costs. This burdensome regulatory environment has several negative consequences:

- Reduced Lending: The high cost of compliance often forces banks to reduce lending to businesses and consumers, hindering economic growth.

- Stifled Innovation: Navigating complex regulations diverts resources from innovation and the development of new financial products and services.

- Increased Operational Costs: The administrative burden associated with compliance significantly increases operational costs for banks, impacting their profitability.

The ECB's strategic goal behind simplification is multifaceted:

- Boosting Efficiency: Streamlining regulations will free up resources within banks, allowing them to focus on core business activities and improve operational efficiency.

- Improving Financial Stability: By clarifying and harmonizing rules, the ECB aims to reduce ambiguity and inconsistencies, thereby reducing systemic risk within the Eurozone financial system.

- Fostering Competition: A simplified regulatory landscape will create a more level playing field for banks of all sizes, fostering healthy competition and benefiting consumers.

Here's a summary of the expected benefits:

- Reduced compliance costs for banks.

- Increased efficiency in banking operations.

- Enhanced financial stability across the Eurozone.

- Stimulated innovation in the banking sector.

Key Objectives of the ECB's Task Force

The ECB's task force aims to achieve concrete regulatory simplification measures. Its focus areas include:

- Capital Requirements: Streamlining the calculation and application of capital adequacy requirements to reduce complexity and improve proportionality.

- Reporting Standards: Reducing the volume and improving the clarity of regulatory reporting requirements, minimizing the administrative burden on banks.

- Supervisory Processes: Improving the efficiency and transparency of supervisory processes, fostering better communication and collaboration between banks and supervisors.

The task force employs a robust methodology involving:

- Extensive consultations with stakeholders, including banks, supervisors, and other relevant parties, to gather diverse perspectives and insights.

- Rigorous data analysis to identify areas where simplification can be achieved without compromising safety and soundness.

- Thorough regulatory impact assessments to evaluate the potential effects of simplification measures on banks, the financial system, and the wider economy.

Key objectives of the task force include:

- Streamlining capital adequacy requirements.

- Reducing the burden of regulatory reporting.

- Improving the clarity and consistency of regulations.

- Harmonizing supervisory practices across different jurisdictions.

Potential Impact and Challenges

The successful simplification of banking regulation holds substantial positive potential:

- Increased lending to businesses and consumers, stimulating economic growth.

- Improved competitiveness of European banks in the global financial market.

- Reduced systemic risk in the financial system, enhancing overall financial stability.

However, achieving simplification presents significant challenges:

- Political hurdles: Reaching consensus among different member states with varying national interests can prove difficult.

- Maintaining adequate risk management: Simplification must not compromise the effectiveness of regulatory oversight in managing and mitigating risks within the banking system.

- Balancing simplification with robustness: The task force needs to strike a careful balance between reducing unnecessary complexity and maintaining a robust regulatory framework to ensure the safety and soundness of European banks.

Key potential impacts and challenges:

- Increased lending to businesses and consumers.

- Improved competitiveness of European banks.

- Reduced systemic risk in the financial system.

- Potential challenges in coordinating across different member states.

The Future of Banking Regulation in the Eurozone

The ECB's task force's work will shape the long-term vision for banking regulation in the Eurozone. Its efforts could pave the way for:

- Enhanced digitalization in banking supervision, leveraging technology to improve efficiency and effectiveness.

- Integration of fintech innovations within regulatory frameworks, fostering innovation and competition in the financial sector.

- Addressing the challenges posed by climate change and sustainability, incorporating environmental, social, and governance (ESG) factors into regulatory oversight.

- Ensuring a level playing field for European banks in a globalized market, promoting competitiveness and protecting consumers.

The future regulatory landscape will require a dynamic and adaptable framework capable of addressing emerging challenges in the financial sector, ensuring the ongoing stability and resilience of the Eurozone's financial system.

Key aspects of the future of banking regulation:

- Enhanced digitalization in banking supervision.

- Integration of fintech innovations within regulatory frameworks.

- Addressing the challenges posed by climate change and sustainability.

- Ensuring a level playing field for European banks in a globalized market.

Conclusion: The Path Forward for ECB Banking Regulation Simplification

The ECB's initiative to simplify banking regulation is crucial for the health of the Eurozone's financial system. The task force's work, while facing challenges, offers the potential to significantly improve efficiency, foster innovation, and enhance financial stability. Its success hinges on navigating political complexities, maintaining robust risk management, and striking the right balance between simplification and effective oversight. Stay informed about the task force's progress and its implications for the future of ECB banking regulation simplification. For further information, refer to the latest publications on the ECB website. The simplification of ECB banking regulation is a vital step towards a stronger and more resilient European financial system.

Featured Posts

-

Ariana Grandes Style Evolution Hair Tattoos And Professional Assistance

Apr 27, 2025

Ariana Grandes Style Evolution Hair Tattoos And Professional Assistance

Apr 27, 2025 -

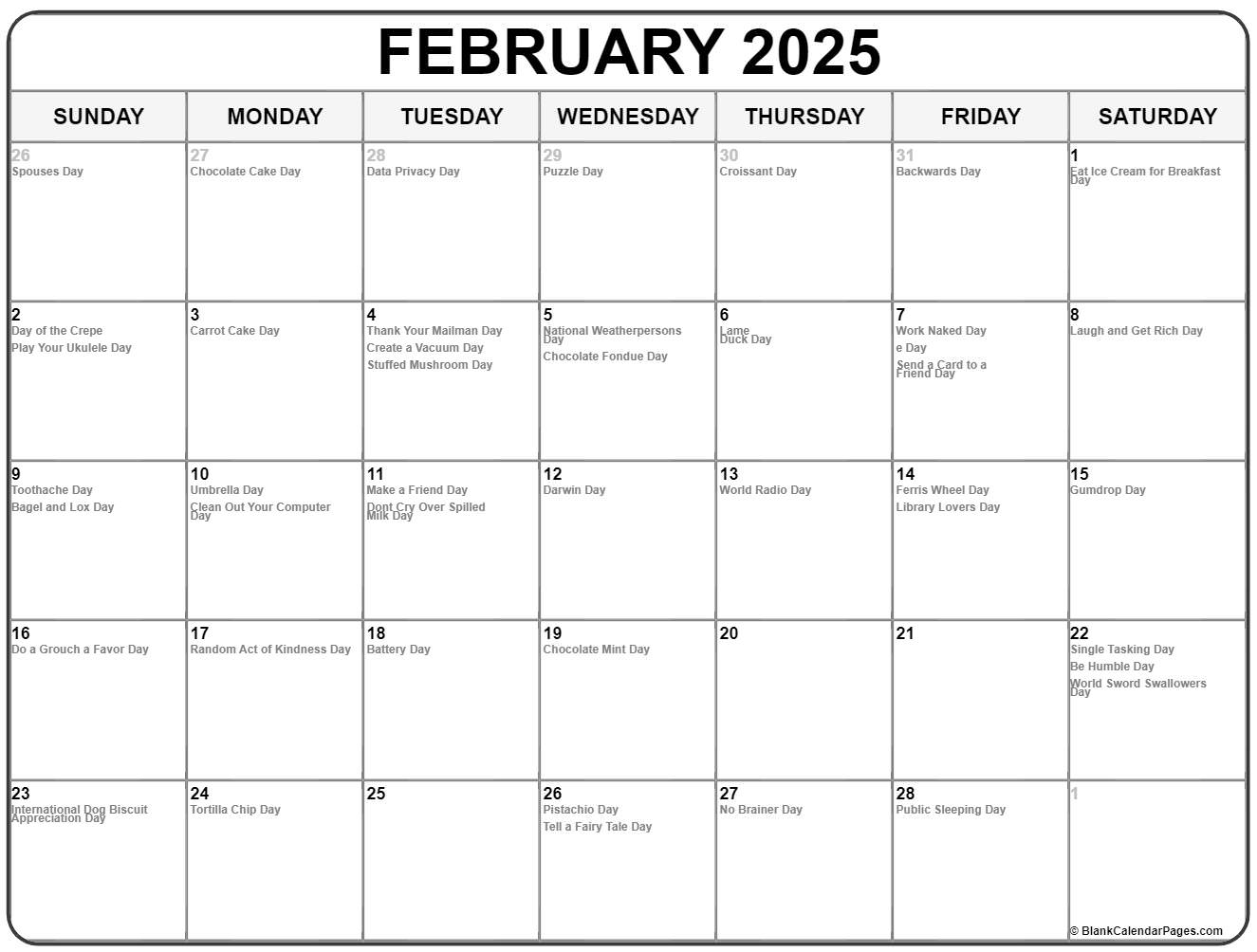

What To Do On Your Happy Day February 20 2025

Apr 27, 2025

What To Do On Your Happy Day February 20 2025

Apr 27, 2025 -

Sinners Doping Case Concludes Details And Impact

Apr 27, 2025

Sinners Doping Case Concludes Details And Impact

Apr 27, 2025 -

Jannik Sinner And The Doping Accusation A Full Report

Apr 27, 2025

Jannik Sinner And The Doping Accusation A Full Report

Apr 27, 2025 -

Canada Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025

Canada Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025

Latest Posts

-

Yukon Politicians Cite Contempt Over Mine Managers Evasive Answers

Apr 28, 2025

Yukon Politicians Cite Contempt Over Mine Managers Evasive Answers

Apr 28, 2025 -

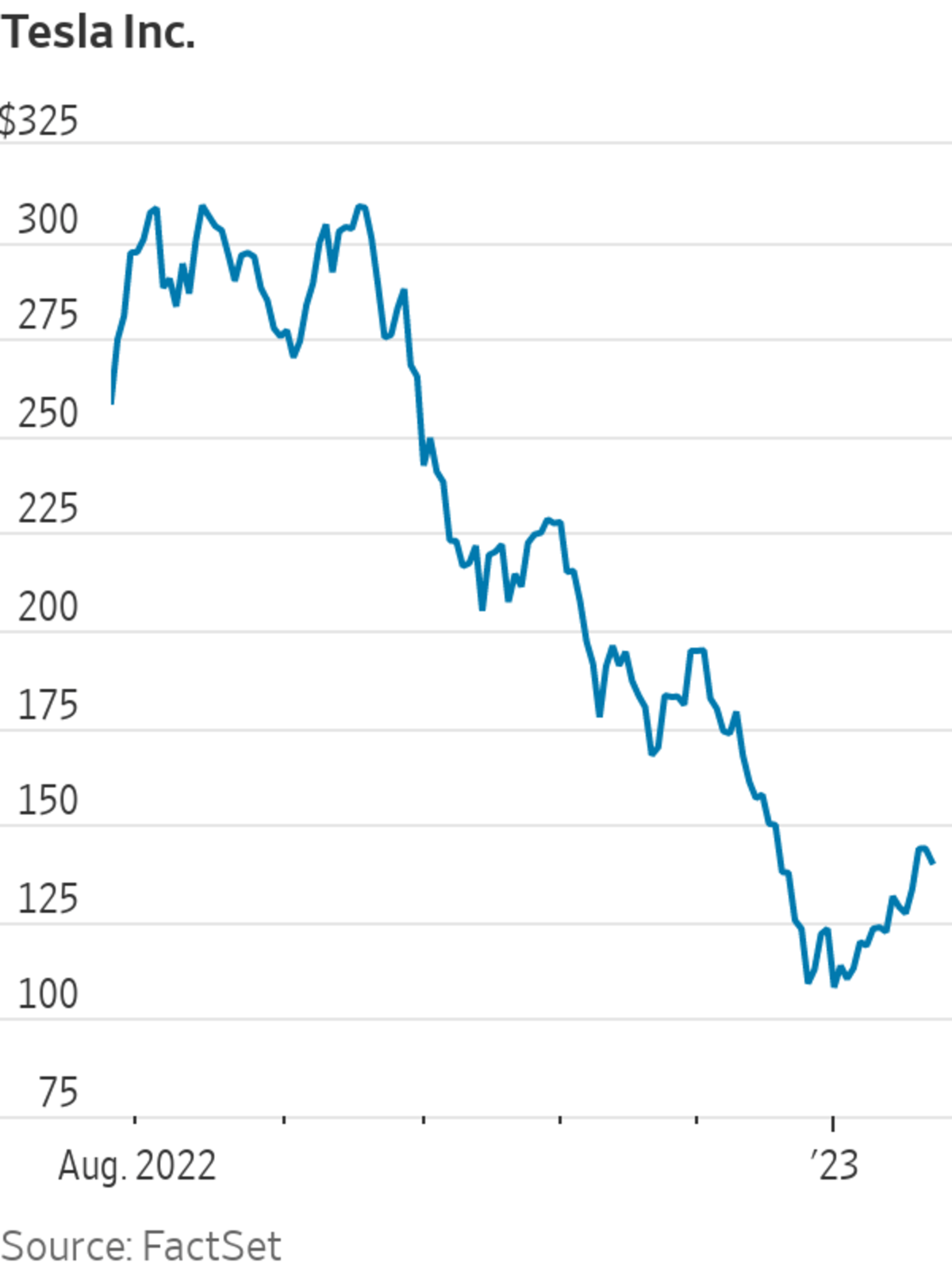

Teslas Rise Leads Tech Driven Us Stock Market Gains

Apr 28, 2025

Teslas Rise Leads Tech Driven Us Stock Market Gains

Apr 28, 2025 -

Tech Powerhouses Propel Us Stock Market Higher Teslas Impact

Apr 28, 2025

Tech Powerhouses Propel Us Stock Market Higher Teslas Impact

Apr 28, 2025 -

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025