ECB's Simkus Signals Further Interest Rate Cuts Amidst Trade War Impact

Table of Contents

Keywords: ECB interest rate cuts, Simkus, Eurozone economy, trade war impact, monetary policy, inflation, investment, Euro exchange rate, economic slowdown, recession risk

The ongoing US-China trade war casts a long shadow over the global economy, and the Eurozone is feeling the chill. Adding to the uncertainty, recent statements by ECB board member Gediminas Šimkus suggest further ECB interest rate cuts may be on the horizon. This article delves into the significance of Simkus's comments, explores the trade war's impact on the Eurozone, and analyzes the potential consequences of further monetary easing.

Simkus's Statements and Their Significance

Gediminas Šimkus, a member of the European Central Bank's Governing Council, has recently hinted at the possibility of further interest rate cuts. His statements, made during [mention specific date and context, e.g., a press conference or interview], came amidst growing concerns about slowing economic growth in the Eurozone. The context is crucial: inflation remains stubbornly below the ECB's target of "below, but close to, 2 percent," and key economic indicators are painting a less-than-rosy picture.

- Specific quotes from Simkus's statements: [Insert direct quotes from Simkus's statements, ensuring accuracy and proper attribution].

- Analysis of the language used: Simkus's tone appeared [describe the tone – cautious, concerned, etc.], suggesting a preparedness for further action if the economic situation deteriorates. The lack of outright commitment, however, hints at ongoing internal debate within the ECB.

- Speculation on the reasoning behind his statements: The statements likely reflect a growing concern within the ECB about the negative impact of the trade war and the possibility of a more pronounced economic slowdown. Further rate cuts could be seen as a preemptive measure to stimulate growth and prevent a potential recession.

The Impact of the Trade War on the Eurozone

The US-China trade war, characterized by escalating tariffs and trade restrictions, is significantly impacting global trade flows. The Eurozone, heavily reliant on exports, is particularly vulnerable. Reduced export demand from both the US and China, coupled with supply chain disruptions, is dampening economic activity. Investor uncertainty further exacerbates the situation, leading to reduced investment and a general sense of economic unease.

- Statistical data on Eurozone trade with China and the US: [Insert relevant statistics, citing reputable sources like Eurostat or the IMF. For example: "Eurozone exports to China fell by X% in the last quarter," or "The trade war has reduced Eurozone GDP growth by an estimated Y%"].

- Examples of specific industries affected by the trade war: The automotive industry, for instance, is facing significant challenges due to disrupted supply chains and reduced demand. Similar impacts are felt in the manufacturing and technology sectors.

- Expert opinions on the severity of the trade war's impact: [Include quotes or summaries of opinions from economists and financial analysts on the trade war's impact on the Eurozone].

Potential Consequences of Further Interest Rate Cuts

Further ECB interest rate cuts, a form of monetary easing, aim to stimulate the Eurozone economy. Lower interest rates make borrowing cheaper for businesses and consumers, theoretically encouraging investment and spending. This could help combat deflationary pressures and boost economic growth. However, this policy isn't without potential downsides.

- Explanation of how interest rate cuts affect different sectors of the economy: Lower rates can benefit businesses seeking loans for expansion, but might squeeze banks' profitability if lending margins are compressed. Consumers may see increased borrowing for mortgages and other loans.

- Comparison of potential benefits and drawbacks: The benefits include increased investment, consumer spending, and potentially averting recession. The drawbacks include the risk of fueling inflation, weakening the Euro exchange rate, and potentially creating asset bubbles.

- Consideration of alternative policy options the ECB might pursue: The ECB might also consider quantitative easing (QE), whereby it purchases government bonds to inject liquidity into the market. This has its own set of potential benefits and risks.

The Risk of Recession in the Eurozone

Given the current economic climate and the potential impact of further ECB interest rate cuts, the risk of a Eurozone recession is a serious concern. Several key economic indicators are flashing warning signs.

- Current forecasts for Eurozone GDP growth: [Include forecasts from reputable organizations like the IMF or OECD].

- Analysis of key economic indicators: Factors like falling industrial production, weakening consumer confidence, and rising unemployment rates are all contributing to the concerns.

- Expert opinions on recession probabilities: [Include expert opinions from economists and financial institutions on the likelihood of a Eurozone recession].

Conclusion

Simkus's signals of potential further ECB interest rate cuts highlight the growing concern within the ECB about the impact of the ongoing trade war on the Eurozone economy. While such cuts could stimulate growth and combat deflation, they also carry risks, including increased inflation and a weaker Euro. The delicate balancing act faced by the ECB underscores the significant challenges posed by the current global economic uncertainty. The potential for a Eurozone recession, in light of these factors, is a real and significant concern. Stay informed on the latest developments regarding the ECB's interest rate policy and its response to the ongoing trade war by following [link to relevant source/website]. Understand the implications of ECB interest rate cuts and their impact on the Eurozone economy.

Featured Posts

-

How Many Horses Have Died At The Grand National A Pre 2025 Analysis

Apr 27, 2025

How Many Horses Have Died At The Grand National A Pre 2025 Analysis

Apr 27, 2025 -

The Professionals Take On Ariana Grandes Latest Look

Apr 27, 2025

The Professionals Take On Ariana Grandes Latest Look

Apr 27, 2025 -

Professional Analysis Of Ariana Grandes New Look Hair And Tattoos

Apr 27, 2025

Professional Analysis Of Ariana Grandes New Look Hair And Tattoos

Apr 27, 2025 -

Wta Tennis Austria And Singapore To Decide Champions

Apr 27, 2025

Wta Tennis Austria And Singapore To Decide Champions

Apr 27, 2025 -

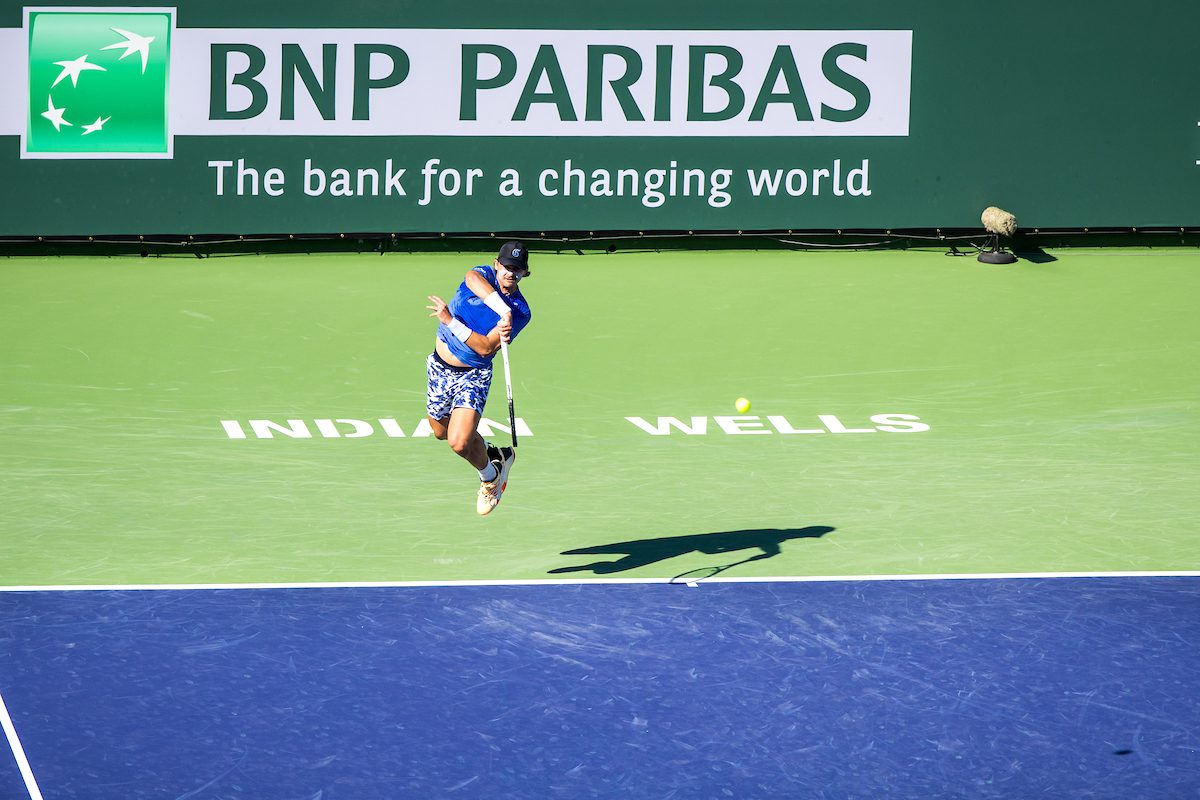

Indian Wells 2024 Eliminacion De Favorita Genera Controversia

Apr 27, 2025

Indian Wells 2024 Eliminacion De Favorita Genera Controversia

Apr 27, 2025

Latest Posts

-

Remembering 2000 Joe Torres Leadership And Andy Pettittes Twin Killers Performance

Apr 28, 2025

Remembering 2000 Joe Torres Leadership And Andy Pettittes Twin Killers Performance

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

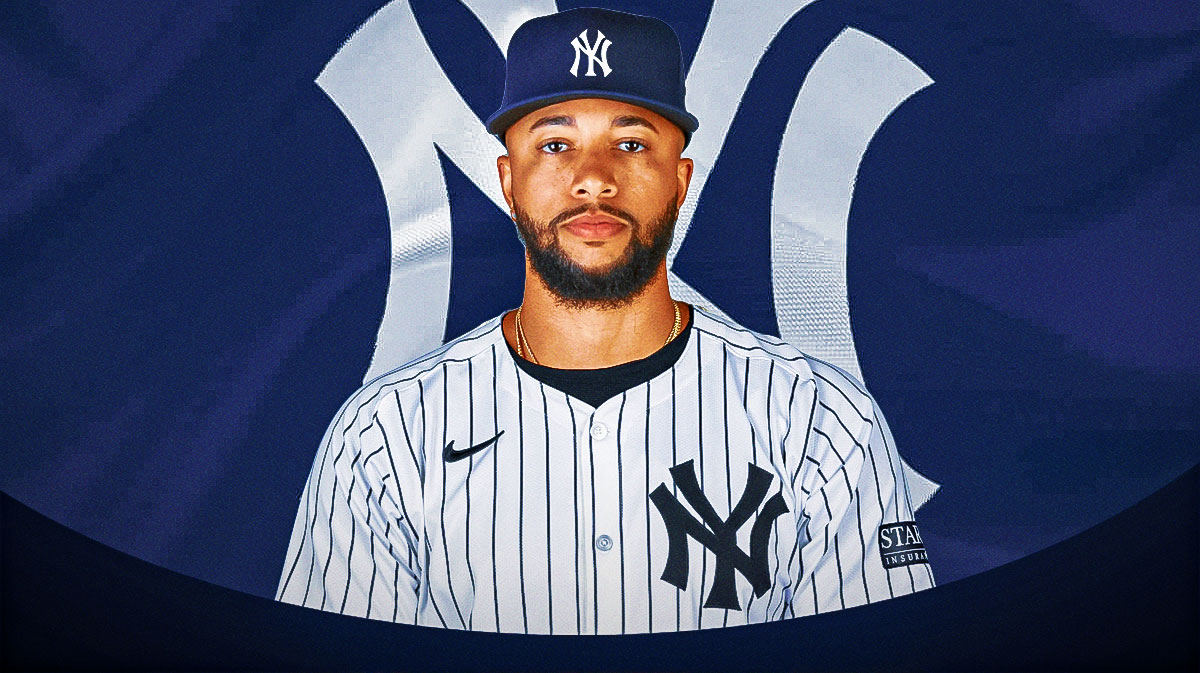

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025 -

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025 -

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025