Economic Slowdown Risk: How Election Pledges Contribute To Deficits

Table of Contents

Understanding the Connection Between Election Pledges and Deficits

The Nature of Election Promises

Election campaigns are frequently characterized by a flurry of generous promises designed to attract voters. Politicians often compete to offer appealing solutions to complex problems, promising tax cuts, expanded social welfare programs, and ambitious infrastructure projects. While such promises can be popular, they often translate into significant increases in government spending, potentially exceeding available revenue.

- Tax cuts: Broad-based tax cuts, while appealing to voters, can dramatically reduce government revenue if not carefully considered.

- Increased social welfare: Expanding social safety nets is laudable but requires careful budgeting to ensure long-term solvency.

- Infrastructure projects: Ambitious infrastructure plans necessitate substantial upfront investments and long-term maintenance costs.

The Budgetary Impact of Unfunded Mandates

Unfunded mandates, which are government-imposed requirements on lower levels of government or private entities without providing the necessary funding, are a major contributor to increased deficits. These mandates place a significant strain on public finances, pushing budgets beyond their limits and contributing to a widening budget deficit.

- Example: A government might mandate improved environmental standards for businesses without providing financial assistance for compliance.

- Consequence: Businesses may face financial hardship, potentially leading to job losses and economic stagnation. The government may also face increased pressure to provide funds, further expanding the deficit.

The Role of Economic Forecasting in Realistic Pledges

Accurate economic forecasting is crucial for formulating realistic election pledges. Inaccurate predictions can lead to significant budget shortfalls and exacerbate the economic slowdown risk. Transparency and accountability are essential, with candidates clearly outlining the financial implications of their promises.

- Importance of independent analysis: Independent economic analysis can provide objective assessments of the feasibility of proposed policies.

- Long-term considerations: Economic forecasts should encompass long-term impacts, not just immediate effects.

Types of Election Pledges that Exacerbate Economic Slowdown Risk

Tax Cuts Without Corresponding Spending Cuts

Across-the-board tax cuts, without corresponding reductions in government spending, can significantly reduce government revenue, directly contributing to increased deficits. This approach often leads to a widening gap between government income and expenditure, fueling the economic slowdown risk.

- Historical examples: Numerous instances throughout history demonstrate the budgetary strain caused by large-scale tax cuts without spending restraint.

- The Laffer Curve: While the Laffer Curve suggests that tax cuts can sometimes increase revenue by stimulating economic activity, this effect is highly dependent on the specific circumstances and is not guaranteed.

Large-Scale Infrastructure Projects Without Funding Mechanisms

While infrastructure projects are vital for economic growth, undertaking them without clearly defined funding mechanisms carries significant long-term financial risks. Cost overruns are common, often leading to increased borrowing and a substantial rise in government debt. This increases the pressure on public finances and elevates the economic slowdown risk.

- Cost overruns: Unforeseen expenses and delays can dramatically increase the final cost of infrastructure projects.

- Long-term maintenance: The ongoing maintenance and upkeep of infrastructure projects also represent a considerable financial commitment.

Expansion of Social Welfare Programs Without Sustainability Plans

Expanding social welfare programs without considering long-term financial sustainability can create significant budgetary challenges. Without realistic funding models, these programs can become unsustainable, potentially leading to future cuts or increased taxation, which can trigger economic instability and increase the economic slowdown risk.

- Demographic shifts: Aging populations can significantly increase the cost of social welfare programs.

- Funding mechanisms: Exploring sustainable funding mechanisms such as dedicated taxes or earmarked revenue streams is vital.

Mitigating Economic Slowdown Risk: Responsible Fiscal Policy

The Importance of Fiscal Responsibility in Campaign Promises

Politicians need to prioritize fiscal responsibility when making election pledges. Transparency is key, with candidates clearly outlining the costs and funding mechanisms for each promise. Detailed and realistic budget plans are crucial in mitigating the economic slowdown risk.

- Cost-benefit analysis: Thorough cost-benefit analyses should be conducted before making major policy commitments.

- Long-term projections: Long-term financial projections are essential for assessing the sustainability of proposed policies.

Independent Budgetary Analysis and Scrutiny

Independent organizations play a vital role in reviewing and analyzing the financial implications of election promises. The media and civil society have a crucial function in holding politicians accountable for their pledges, ensuring that the public receives accurate information about the potential fiscal consequences of their choices. This accountability is essential in preventing uncontrolled expansion of deficits and mitigating economic slowdown risk.

- Role of think tanks: Think tanks and other independent research organizations can provide objective assessments of policy proposals.

- Media scrutiny: A free and independent press is vital for holding politicians accountable.

Long-Term Economic Planning and Sustainable Policies

Creating long-term economic plans that are sustainable and avoid short-term fixes is crucial for mitigating the risk of an economic slowdown. These plans should prioritize responsible fiscal management and avoid policies that significantly increase government debt. By fostering sustainable economic growth, the economic slowdown risk is reduced.

- Diversification: A diversified economy is less susceptible to shocks.

- Investment in human capital: Investing in education and skills development promotes long-term economic growth.

Conclusion: Avoiding Economic Slowdown: The Need for Responsible Election Pledges

Ambitious but unfunded election pledges significantly increase the risk of an economic slowdown by contributing to unsustainable government deficits. Fiscal responsibility and transparency are paramount during election campaigns. Informed voters should demand realistic and fiscally responsible pledges from candidates to mitigate the economic slowdown risk. Consider carefully the long-term implications of any candidate's plans to avoid increasing the economic slowdown risk. Demand better planning and responsible financial strategies to prevent future economic slowdowns.

Featured Posts

-

Emilia Pereyra Y Carlos Manuel Estrella Ganadores De Los Premios Caonabo De Oro 2025

Apr 25, 2025

Emilia Pereyra Y Carlos Manuel Estrella Ganadores De Los Premios Caonabo De Oro 2025

Apr 25, 2025 -

Ywkryn Pr Hmlh Dwnld Trmp Ke Khyalat

Apr 25, 2025

Ywkryn Pr Hmlh Dwnld Trmp Ke Khyalat

Apr 25, 2025 -

Canadian Regulatory Pause Examining The Controversy Surrounding Esg Reporting

Apr 25, 2025

Canadian Regulatory Pause Examining The Controversy Surrounding Esg Reporting

Apr 25, 2025 -

Fintech Giant Revolut Reports 72 Revenue Jump Driving International Growth

Apr 25, 2025

Fintech Giant Revolut Reports 72 Revenue Jump Driving International Growth

Apr 25, 2025 -

Review Dope Thief Episode 7 Back To Basics Before The Finale

Apr 25, 2025

Review Dope Thief Episode 7 Back To Basics Before The Finale

Apr 25, 2025

Latest Posts

-

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025 -

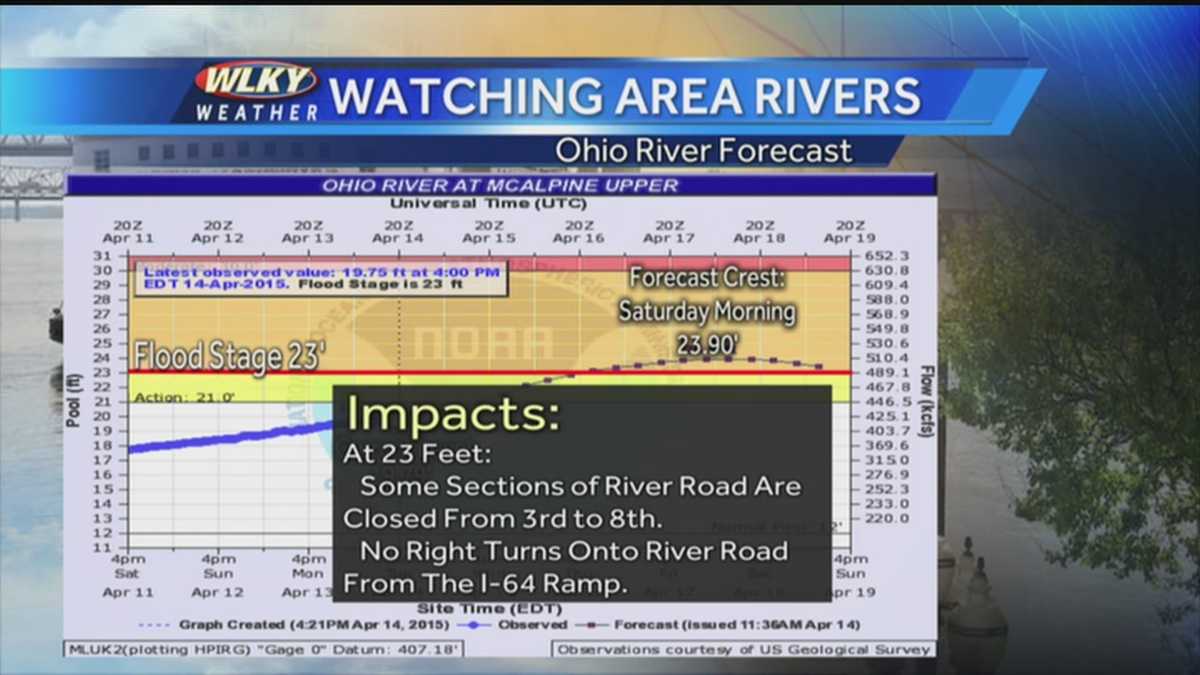

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025 -

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025 -

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025