Effective Use Of Proxy Statements (Form DEF 14A) For Investment Decisions

Table of Contents

Understanding the Components of a Proxy Statement (Form DEF 14A)

Proxy statements are more than just legal documents; they are treasure troves of information relevant to your investment strategy. Mastering their contents allows for a deeper understanding of a company's inner workings and future plans.

Executive Compensation Analysis

Scrutinizing executive pay packages is vital for assessing corporate governance and potential conflicts of interest. By comparing executive compensation to company performance and industry benchmarks, you can gain insights into how effectively management is rewarded for its contributions.

- Analyze salary, bonuses, stock options, and other perks: Don't just look at the headline numbers; delve into the details of each component to understand the total compensation package.

- Identify potential conflicts of interest: Look for instances where executive compensation might incentivize short-term gains over long-term value creation.

- Compare CEO compensation to median employee pay: This comparison helps gauge the fairness and reasonableness of executive pay relative to the broader workforce. A significant disparity might warrant further investigation.

Corporate Governance Insights

The board of directors is responsible for overseeing the company's management and ensuring accountability. A strong and independent board is crucial for long-term shareholder value. Proxy statements provide critical information to evaluate the effectiveness of this governance structure.

- Assess board diversity: A diverse board brings varied perspectives and experiences, leading to better decision-making. Look for diversity in gender, race, ethnicity, and professional background.

- Review committee charters and member expertise: Examine the composition and expertise of key committees like the audit, compensation, and nominating committees. Ensure members possess relevant skills and experience.

- Identify potential conflicts of interest among directors: Look for any relationships or affiliations that might compromise the independence of board members.

Proposed Mergers and Acquisitions

Proxy statements detail proposed mergers, acquisitions, and other significant corporate transactions. Analyzing this information helps assess the strategic rationale and potential risks associated with such actions.

- Review the financial details of the transaction: Scrutinize the proposed purchase price, financing methods, and expected synergies.

- Evaluate the strategic fit between the companies: Determine whether the transaction aligns with the long-term strategy of the acquiring company and enhances shareholder value.

- Assess potential antitrust concerns: Consider the potential impact of the merger on competition and the likelihood of regulatory scrutiny.

Shareholder Proposals

Proxy statements also include shareholder proposals, allowing investors to voice their concerns and suggest changes to company policies. Understanding these proposals and the company's response provides additional insights into corporate governance and shareholder engagement.

- Understand the context of shareholder resolutions: Examine the reasons behind the proposals and the potential implications for the company.

- Evaluate the company's arguments for or against the proposals: Analyze the company's justification for its stance and assess the validity of its arguments.

- Consider the implications for your investment: Weigh the potential impact of the proposals on the company's financial performance and your investment returns.

Utilizing Proxy Statements for Informed Shareholder Voting

Proxy statements are not just for passive observation; they empower you to actively participate in corporate governance through shareholder voting.

Identifying Key Voting Issues

Prioritize proposals with the most significant potential impact on your investment.

- Prioritize proposals related to executive compensation, mergers & acquisitions, and significant changes to corporate governance: These areas directly influence the company's financial performance and long-term strategy.

Assessing the Impact of Voting Decisions

Understanding the potential consequences of your votes is crucial for maximizing your investment return.

- Analyze how voting choices can affect company strategy, financial performance, and shareholder value: Carefully consider the implications of each proposal before casting your vote.

Utilizing Proxy Voting Resources

Modern tools simplify the process of informed shareholder voting.

- Explore tools that facilitate informed voting decisions: Many online platforms and resources provide summaries and analysis of proxy statements, making it easier to understand complex issues.

- Utilize resources provided by your brokerage or investment advisor: Your brokerage may offer tools and guidance to help you make informed voting decisions.

Beyond the Basics: Advanced Strategies for Proxy Statement Analysis

For a more in-depth understanding, consider these advanced techniques.

Comparative Analysis

Benchmarking against competitors reveals best practices and potential risks.

- Benchmark executive compensation, corporate governance structures, and strategic initiatives: Comparing your target company to peers provides context and helps identify potential areas of concern.

Trend Analysis

Monitoring changes over time reveals significant patterns and potential problems.

- Identify potential problems or positive developments within the company: Tracking key metrics like executive compensation or board composition can highlight significant trends that might impact future performance.

- Assess long-term trends impacting shareholder value: Analyzing long-term trends helps you anticipate future challenges and opportunities.

Integrating Proxy Statement Data with Other Financial Information

A holistic view requires combining proxy statement data with other information sources.

- Correlate executive compensation with company performance: This analysis helps determine if executive compensation is aligned with company results.

- Analyze the relationship between corporate governance and financial results: Identify any correlations between strong corporate governance and superior financial performance.

Conclusion

Mastering the effective use of proxy statements (Form DEF 14A) is essential for making well-informed investment decisions. By carefully analyzing the information contained within these crucial SEC filings, investors can gain valuable insights into corporate governance, executive compensation, and proposed actions. Utilizing the strategies discussed in this article, you can leverage the information within proxy statements to enhance your shareholder voting and ultimately improve your investment outcomes. Remember to always thoroughly review relevant proxy statements before making any investment choices and consider seeking professional financial advice when needed. Don't let valuable information hidden in proxy statements slip by; utilize them to their full potential. Start analyzing proxy statements today to improve your investment strategy.

Featured Posts

-

University Of Utah Expands Healthcare Services With West Valley City Campus

May 17, 2025

University Of Utah Expands Healthcare Services With West Valley City Campus

May 17, 2025 -

Trump Tariffs And Rising Phone Battery Prices A Costly Upgrade

May 17, 2025

Trump Tariffs And Rising Phone Battery Prices A Costly Upgrade

May 17, 2025 -

Tshkhys Isabt Stylr Yezz Amal Shtwtjart Fy Nhayy Alkas

May 17, 2025

Tshkhys Isabt Stylr Yezz Amal Shtwtjart Fy Nhayy Alkas

May 17, 2025 -

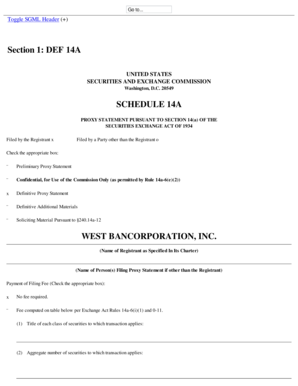

Parents And College Costs A Survey Exploring Shifting Financial Pressures

May 17, 2025

Parents And College Costs A Survey Exploring Shifting Financial Pressures

May 17, 2025 -

Enhanced Fortnite Item Shop A New Feature For Streamlined Shopping

May 17, 2025

Enhanced Fortnite Item Shop A New Feature For Streamlined Shopping

May 17, 2025