Election Promises: A Recipe For Increased Deficits?

Table of Contents

The Allure of Popular, But Costly, Election Promises

Politicians frequently leverage popular yet expensive proposals to garner support. The inherent challenge lies in balancing immediate political gains with the long-term fiscal repercussions.

Free or Subsidized Services

Promises of free or heavily subsidized services, such as healthcare, college tuition, or childcare, are incredibly popular. However, these initiatives carry substantial price tags.

- Examples: A promise of free college tuition could cost hundreds of billions of dollars annually, while universal healthcare could easily reach trillions. Subsidized childcare programs also represent significant budgetary commitments.

- Impact: While such promises may boost short-term approval ratings, the long-term consequences could include increased national debt, higher taxes, or cuts to other essential programs.

- Challenges: Accurately predicting the long-term costs of such ambitious programs is inherently difficult. Unforeseen expenses and utilization rates can significantly inflate the final price.

Tax Cuts and Their Impact

Tax cuts, another perennial election promise, aim to stimulate the economy by boosting disposable income and business investment. However, the impact on government revenue can be substantial.

- Examples: Promises of significant cuts to corporate income tax rates, individual income tax rates, or sales taxes can lead to substantial revenue losses.

- Laffer Curve: The Laffer Curve suggests that there's an optimal tax rate that maximizes government revenue. Tax cuts beyond this point may actually decrease revenue due to reduced economic activity.

- Economic Growth vs. Revenue: While tax cuts can spur economic growth, this growth needs to be substantial enough to offset the lost revenue to prevent a deficit increase. Overly optimistic projections can lead to a fiscal shortfall.

The Challenges of Funding Election Promises

Funding ambitious election promises requires careful budgetary planning, realistic economic projections, and difficult prioritization choices.

Realistic Budgetary Planning

Transparent and realistic budgetary planning is paramount. This involves a rigorous assessment of government revenue and expenditure.

- Independent Fiscal Analysis: Independent bodies should analyze the financial implications of proposed policies to provide objective assessments.

- Long-Term Financial Planning: Short-term political cycles should not overshadow the need for long-term financial stability. A sustainable fiscal policy considers future generations.

- Revenue Forecasting Challenges: Accurately forecasting government revenue is challenging, particularly during times of economic uncertainty. Unexpected economic downturns can severely impact revenue projections.

The Role of Economic Growth

Realistic economic growth projections are crucial in evaluating the feasibility of election promises.

- Promised vs. Realistic Growth: Politicians often promise higher economic growth than realistically achievable. This can lead to a disconnect between promised spending and actual revenue generation.

- Economic Downturns: Unexpected economic downturns can severely strain government finances, making it difficult to fund even previously affordable programs. This highlights the importance of contingency planning.

Prioritizing Spending

Difficult choices must be made when prioritizing spending, balancing competing needs and considering the impact on different demographics.

- Trade-offs: Increased spending in one area might require cuts in another. For example, increased spending on healthcare may necessitate reduced funding for education or infrastructure.

- Transparency: Open communication with the electorate about these trade-offs is crucial for building public trust and ensuring democratic accountability.

Analyzing the Promises: A Critical Approach

Citizens must critically evaluate the financial feasibility of election promises to ensure responsible governance.

Scrutinizing Campaign Platforms

Voters should delve beyond catchy slogans and examine the details of each candidate's platform.

- Fact-Checking: Verify the claims made by candidates, using independent sources and comparing them to actual government data.

- Budgetary Analysis: Seek out independent analyses of the financial implications of the proposed policies.

- Resources: Utilize government websites, independent research organizations (e.g., think tanks), and reputable news sources to gather information.

The Importance of Long-Term Thinking

Short-term election cycles should not compromise long-term fiscal stability.

- Unsustainable Debt: Unsustainable debt levels can lead to reduced credit ratings, higher interest rates, and diminished public services.

- Future Generations: The burden of unsustainable debt is often passed on to future generations.

Conclusion

In conclusion, the allure of popular election promises often masks the potential for increased deficits and long-term financial instability. Funding ambitious proposals requires realistic budgeting, accurate economic forecasting, and difficult prioritization decisions. To make informed choices, voters should scrutinize campaign platforms, understand the potential financial implications of election pledges, and demand transparency from their candidates. Before casting your vote, research the candidates’ financial plans thoroughly, ensuring that their campaign promises align with fiscal responsibility and long-term economic stability. Don't let attractive election promises blind you to their potential long-term consequences for the nation's financial health. Demand accountability and responsible fiscal planning from those seeking your vote, critically evaluating both the appeal of campaign promises and their budgetary impact.

Featured Posts

-

La Carrera Por La Bota De Oro 2024 25 Analisis De Los Maximos Goleadores

Apr 25, 2025

La Carrera Por La Bota De Oro 2024 25 Analisis De Los Maximos Goleadores

Apr 25, 2025 -

Investing In Volatile Markets Strategies For Success Amidst Huge Stock Swings

Apr 25, 2025

Investing In Volatile Markets Strategies For Success Amidst Huge Stock Swings

Apr 25, 2025 -

Nintendos Action Leads To Ryujinx Emulator Development Cessation

Apr 25, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cessation

Apr 25, 2025 -

Secret Service Investigation Concludes Cocaine Found At White House

Apr 25, 2025

Secret Service Investigation Concludes Cocaine Found At White House

Apr 25, 2025 -

Executive Order On University Accreditation A Deep Dive Into Trumps Actions

Apr 25, 2025

Executive Order On University Accreditation A Deep Dive Into Trumps Actions

Apr 25, 2025

Latest Posts

-

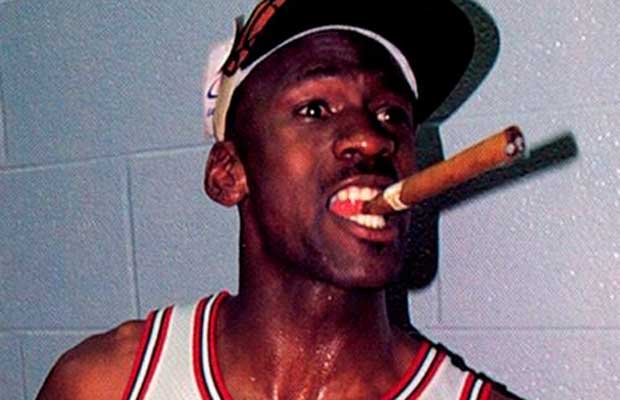

Understanding Michael Jordan Fast Facts And Accomplishments

May 01, 2025

Understanding Michael Jordan Fast Facts And Accomplishments

May 01, 2025 -

Quick Facts About Michael Jordans Life And Career

May 01, 2025

Quick Facts About Michael Jordans Life And Career

May 01, 2025 -

Essential Michael Jordan Fast Facts For Basketball Fans

May 01, 2025

Essential Michael Jordan Fast Facts For Basketball Fans

May 01, 2025 -

Michael Jordan Fast Facts A Quick Look At His Career

May 01, 2025

Michael Jordan Fast Facts A Quick Look At His Career

May 01, 2025 -

Michael Jordan Fast Facts And Key Stats

May 01, 2025

Michael Jordan Fast Facts And Key Stats

May 01, 2025