Election Promises And Budget Deficits: The Looming Economic Slowdown

Table of Contents

H2: The Allure of Populist Promises and Their Economic Realities

Politicians frequently employ populist rhetoric, promising sweeping changes and significant improvements to the lives of citizens. While such promises can be effective vote-getters, they often disregard the harsh realities of fiscal responsibility. The allure of immediate gratification for voters often overshadows the long-term economic consequences.

- Examples of unrealistic promises:

- Massive tax cuts without corresponding spending cuts, leading to a widening budget deficit.

- Expansive social programs without clearly defined funding mechanisms, placing an unsustainable strain on public finances.

- Promises of significant infrastructure projects without outlining realistic timelines or funding sources.

- Psychological impact on voters: Voters are often swayed by promises that address their immediate concerns, even if those promises lack practical solutions. Hope and a desire for change can outweigh a realistic assessment of feasibility.

- The role of media: Media outlets, often driven by ratings and sensationalism, may amplify these promises without adequately exploring their economic implications, thereby contributing to an uninformed electorate.

H2: Analyzing the Fiscal Impact of Election Promises

Rigorous analysis is crucial to understand the true cost of election promises. Several methods can be employed to assess potential fiscal implications:

-

Independent economic analysis: Non-partisan organizations and economists can provide crucial independent assessments of the feasibility and financial implications of proposed policies.

-

Government cost estimates: While often subject to political influence, official government cost estimates, when available and transparent, provide a baseline for evaluating proposed spending.

-

Discrepancies between promised spending and available revenue: A critical aspect of this analysis is comparing the projected cost of the promises against the available government revenue. Significant discrepancies highlight a potential for unsustainable budget deficits.

-

Fiscal sustainability: Understanding the concept of fiscal sustainability—the ability of a government to meet its financial obligations without compromising its future economic stability—is essential.

-

Consequences of ignoring fiscal responsibility: Failing to address fiscal responsibility can lead to several serious consequences:

- Increased national debt, potentially leading to higher interest rates.

- Inflation, eroding the purchasing power of citizens.

- Credit rating downgrades, making it more expensive for the government to borrow money.

H2: Budget Deficits and Their Ripple Effects on the Economy

Unsustainable budget deficits directly contribute to economic slowdowns through several mechanisms:

- Increased interest rates: To finance the deficit, governments often borrow more money, increasing demand for loans and driving up interest rates. This negatively impacts businesses and consumers, reducing investment and spending.

- Reduced government investment: To manage debt, governments may reduce spending on crucial areas such as infrastructure, education, and healthcare, hindering long-term economic growth.

- Currency devaluation: Large budget deficits can lead to currency devaluation, making imports more expensive and potentially harming export competitiveness.

- Increased risk of sovereign debt crises: In extreme cases, unsustainable debt levels can lead to sovereign debt crises, resulting in economic instability and potentially requiring international bailouts.

H2: Mitigating the Risks: Responsible Fiscal Policy and Transparency

Preventing election promises from creating unsustainable budget deficits requires a multi-pronged approach:

- Independent economic analysis of election manifestos: Encouraging and promoting independent analysis of manifestos can ensure that voters are aware of the true economic costs of proposed policies.

- Transparency in government budgeting: Open and accessible government budgets are essential for allowing citizens to scrutinize spending and hold politicians accountable.

- Long-term economic planning: Shifting the focus from short-term election cycles to long-term economic planning is crucial for sustainable economic management.

- Examples of successful fiscal responsibility: Learning from countries that have successfully managed their finances and maintained fiscal responsibility can offer valuable lessons and best practices.

Conclusion:

Unchecked election promises frequently lead to unsustainable budget deficits, ultimately triggering significant economic slowdowns. This is compounded by a lack of transparency and independent analysis of the fiscal implications of these pledges. The resulting increased national debt, reduced government investment, and potential currency devaluation create a volatile economic landscape. Demand responsible fiscal planning from your elected officials. Scrutinize election promises and their potential impact on the economy, and hold politicians accountable for their commitment to preventing a further widening of the gap between Election Promises and Budget Deficits.

Featured Posts

-

Double Trouble In Hollywood Writers And Actors Strike Impacts Film And Tv Production

Apr 25, 2025

Double Trouble In Hollywood Writers And Actors Strike Impacts Film And Tv Production

Apr 25, 2025 -

Identifying Emerging Business Centers A Nationwide Overview

Apr 25, 2025

Identifying Emerging Business Centers A Nationwide Overview

Apr 25, 2025 -

Montreal Guitar Maker Details Tariff Import Issues

Apr 25, 2025

Montreal Guitar Maker Details Tariff Import Issues

Apr 25, 2025 -

Is You Tube Everything Exploring Its Dominance In The Digital World

Apr 25, 2025

Is You Tube Everything Exploring Its Dominance In The Digital World

Apr 25, 2025 -

2025s Rpg Phenomenon Uncovering The All Star Lineup

Apr 25, 2025

2025s Rpg Phenomenon Uncovering The All Star Lineup

Apr 25, 2025

Latest Posts

-

Hanh Trinh Xay Dung Mach 3 Du An 500k V Ghi Dau Cong Lao Cong Nhan Dien Luc Mien Nam

Apr 30, 2025

Hanh Trinh Xay Dung Mach 3 Du An 500k V Ghi Dau Cong Lao Cong Nhan Dien Luc Mien Nam

Apr 30, 2025 -

Disneys Alaskan Adventure Two Ships Set Sail Summer 2026

Apr 30, 2025

Disneys Alaskan Adventure Two Ships Set Sail Summer 2026

Apr 30, 2025 -

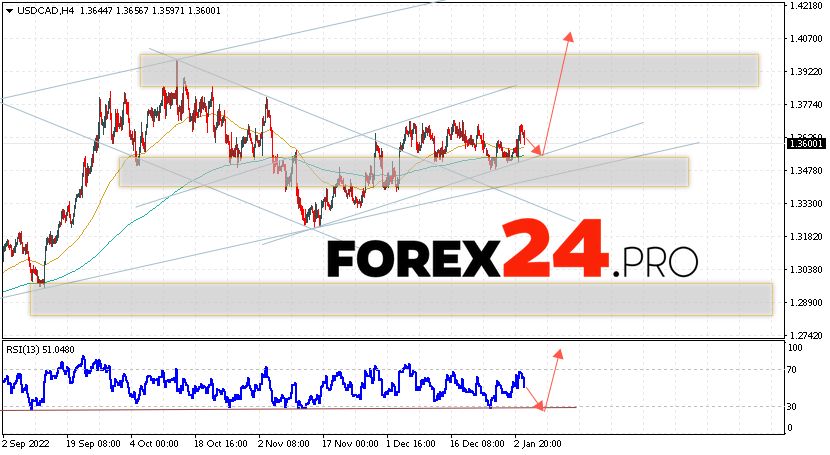

Canadian Dollar Forecast Minority Governments Potential Impact

Apr 30, 2025

Canadian Dollar Forecast Minority Governments Potential Impact

Apr 30, 2025 -

The Geopolitical Impact Of Increased Military Spending In Europe

Apr 30, 2025

The Geopolitical Impact Of Increased Military Spending In Europe

Apr 30, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase

Apr 30, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase

Apr 30, 2025