Elon Musk And Dogecoin: A Look At The Correlation Between Tesla Stock And Crypto

Table of Contents

Elon Musk's Influence on Dogecoin

Musk's Tweets and their Market Impact

Elon Musk's tweets mentioning Dogecoin have consistently resulted in dramatic price surges. His social media activity has become a significant factor influencing the volatile nature of this cryptocurrency. The sheer power of his online presence is undeniable.

- Tweet 1 (Example): "Dogecoin is the people's crypto!" (Hypothetical example - replace with actual tweet and data). Result: +20% price increase in under an hour.

- Tweet 2 (Example): A meme featuring Dogecoin. Result: +15% price increase within 30 minutes.

- Tweet 3 (Example): Negative comment about Dogecoin. Result: -10% price decrease within the following hour.

These examples illustrate the potent effect of Musk's pronouncements. This influence is significantly amplified by the Fear Of Missing Out (FOMO) effect, driving many investors to purchase Dogecoin regardless of fundamental analysis. The rapid price swings highlight the speculative nature of the cryptocurrency market, heavily influenced by social media trends.

Musk's Tesla and Dogecoin Relationship

While there's no officially confirmed direct link between Tesla and Dogecoin, speculation abounds. Some have suggested that Tesla might integrate Dogecoin into its payment systems in the future. This, however, remains largely conjecture.

- Potential Marketing Strategy: Tesla could utilize Dogecoin as a unique marketing tool, leveraging Musk's established connection to the crypto.

- Future Applications: Could Dogecoin become a payment option for Tesla merchandise or services? This remains a topic of much discussion among investors.

- Lack of Concrete Evidence: It's crucial to acknowledge the absence of any concrete evidence supporting a formal connection between the two. Any investment decisions should not be based on speculation alone.

The Correlation (or Lack Thereof) Between Tesla Stock and Dogecoin

Statistical Analysis of Price Movements

Analyzing the historical price movements of Tesla stock and Dogecoin reveals a complex picture. While there might be periods of apparent correlation, a definitive statistical link is difficult to establish. Casual observation suggests some parallel movements, but rigorous analysis is required.

- Correlation Coefficient: (Insert hypothetical correlation coefficient and p-value here – if data is available, use actual figures). A low correlation coefficient suggests a weak relationship, if any.

- Limitations of Correlation Analysis: Correlation does not equal causation. Other factors influence both assets' prices, making it challenging to isolate the impact of one on the other.

- Data Visualization: (Insert chart or graph here showing price movements of both assets over a specific period. Clearly label axes and data sources.)

Market Sentiment and Investor Behavior

Investor sentiment towards Elon Musk significantly influences both Tesla stock and Dogecoin. Positive news about Tesla, for instance, can indirectly boost Dogecoin's price due to the shared association with Musk. Conversely, negative news concerning Tesla could impact both negatively.

- Spillover Effects: Positive sentiment toward one asset can spill over to the other, reflecting investors' perception of Musk's overall success and influence.

- Investor Psychology: Behavioral finance plays a crucial role. Investor enthusiasm and fear heavily influence both markets.

- Correlation through Sentiment: The correlation may exist primarily through shared investor sentiment towards Elon Musk, rather than any direct fundamental link.

The Risks of Investing Based on Musk's Actions

Volatility and Market Manipulation Concerns

Both Tesla stock and Dogecoin are highly volatile assets. Investing solely based on Elon Musk's tweets is exceptionally risky and potentially reckless. The unpredictable nature of his pronouncements and the susceptibility of both assets to market manipulation are significant concerns.

- High Volatility: Significant price swings can lead to substantial losses in a short time.

- Market Manipulation Risk: The potential for price manipulation, fueled by social media trends, is a significant risk.

- Thorough Research is Crucial: Investors should always conduct thorough due diligence before investing in any asset.

Diversification and Responsible Investing

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket. Responsible investing involves understanding the risks involved and only investing what you can afford to lose.

- Diversify your Portfolio: Spread your investments across different asset classes to reduce exposure to any single market.

- Consult a Financial Advisor: Seek professional advice before making any major investment decisions.

- Only Invest What You Can Afford to Lose: Never invest money you cannot afford to lose completely.

Conclusion: Navigating the Complex Relationship Between Elon Musk, Dogecoin, and Tesla Stock

Elon Musk's influence on both Dogecoin and Tesla stock is undeniable, but the correlation between their price movements is complex and not definitively proven. While there may be periods of perceived alignment, due to shared investor sentiment, investing based solely on Musk's actions is extremely risky. Both assets exhibit significant volatility and are susceptible to market manipulation. Responsible investing demands thorough research, diversification, and a clear understanding of the inherent risks involved. Before making any decisions regarding Elon Musk and Dogecoin, or Tesla stock and crypto in general, conduct thorough research and consult with a qualified financial advisor. Learn more about responsible investment strategies to navigate these volatile markets effectively. For further information, explore reputable financial news sites and educational resources.

Featured Posts

-

Nhs Staff Face Investigation Illegal Access Of Nottingham Stabbing Victim Records

May 10, 2025

Nhs Staff Face Investigation Illegal Access Of Nottingham Stabbing Victim Records

May 10, 2025 -

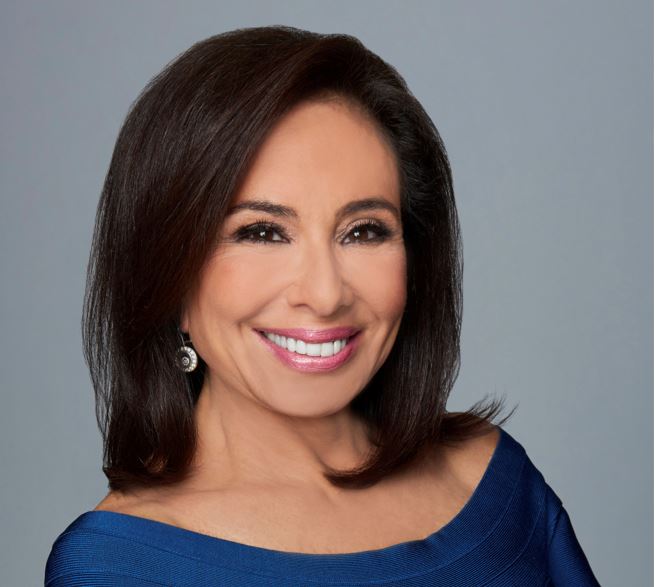

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 10, 2025

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 10, 2025 -

Samuel Dickson Contributions To Canadian Industry And Forestry

May 10, 2025

Samuel Dickson Contributions To Canadian Industry And Forestry

May 10, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Development

May 10, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Development

May 10, 2025 -

The Tarlov Pirro Clash A Heated Debate On The Canada Trade War

May 10, 2025

The Tarlov Pirro Clash A Heated Debate On The Canada Trade War

May 10, 2025