Elon Musk Net Worth 2024: The Influence Of US Economic Policies On Tesla

Table of Contents

The Intertwined Destinies of Elon Musk's Net Worth and Tesla's Success

Elon Musk's wealth is profoundly linked to Tesla's performance. A significant portion of his vast fortune is directly tied to his ownership of Tesla stock. The company's stock price acts as a barometer for his net worth; when Tesla's stock soars, so does Musk's wealth, and vice versa. This symbiotic relationship makes understanding Tesla's financial health crucial for comprehending Musk's financial standing.

- Percentage of Musk's net worth attributed to Tesla shares: While the exact percentage fluctuates daily, a substantial majority of Elon Musk's net worth is derived from his Tesla stock holdings.

- Impact of stock price fluctuations on his overall net worth: Even small percentage changes in Tesla's stock price translate into billions of dollars of gains or losses for Musk.

- Other significant holdings (SpaceX, etc.) and their relative contribution: While SpaceX and other ventures contribute to Musk's overall wealth, Tesla remains the dominant factor.

Inflation's Bite: How Rising Prices Affect Tesla's Production and Sales

Inflation significantly impacts Tesla's operations and profitability. Rising prices for raw materials like lithium, cobalt, and aluminum, essential components in EV batteries, directly increase Tesla's production costs. Simultaneously, inflation erodes consumer purchasing power, potentially dampening demand for high-priced electric vehicles.

- Specific examples of rising input costs for Tesla: The cost of lithium, a critical battery material, has seen substantial increases in recent years, directly impacting Tesla's manufacturing expenses. Similarly, increases in steel and aluminum prices affect vehicle body production.

- Impact on Tesla's pricing strategy: Tesla has had to navigate a tightrope, balancing increasing production costs with maintaining competitiveness in a growing EV market. This can lead to price increases, potentially impacting sales volume.

- Potential effect on sales figures and market share: Inflationary pressures could lead to slower sales growth for Tesla, potentially impacting its market share in the face of competition from other electric vehicle manufacturers.

Interest Rate Hikes and Their Ripple Effect on Tesla's Valuation

Increased interest rates significantly influence investor sentiment toward growth stocks like Tesla. Higher rates often lead to a shift in investment preferences towards more conservative, fixed-income securities. This can result in decreased investment in Tesla, putting downward pressure on its stock price. Furthermore, higher rates increase borrowing costs for Tesla's ambitious expansion plans, potentially impacting its growth trajectory.

- Correlation between interest rate changes and Tesla's stock performance: Historically, there's a demonstrable negative correlation between rising interest rates and Tesla's stock price.

- Analysis of Tesla's debt levels and the implications of higher interest rates: While Tesla has reduced its debt in recent years, higher interest rates still increase the cost of servicing any remaining debt.

- Effect on consumer financing for EV purchases: Higher interest rates make it more expensive for consumers to finance EV purchases, potentially reducing demand.

Government Incentives and Tax Policies: A Boon or Bane for Tesla?

US government policies supporting electric vehicles, such as tax credits and subsidies, have been instrumental in driving Tesla's growth. These incentives significantly reduce the purchase price for consumers, stimulating demand. However, changes in these policies, like potential reductions in tax credits, could negatively impact Tesla's sales and profitability.

- Specific examples of government incentives benefiting Tesla: The US federal tax credit for electric vehicles has been a major driver of EV adoption, directly benefiting Tesla. State-level incentives further amplify this effect.

- Potential impact of future policy changes (e.g., reduced tax credits): Any reduction or elimination of these incentives could substantially impact consumer demand and Tesla's market position.

- Analysis of the political landscape and its influence on future policies: The political climate significantly impacts the likelihood of changes in government support for electric vehicles.

Geopolitical Factors and Supply Chain Disruptions: An External Threat to Tesla's Stability

Global economic instability and geopolitical events can significantly disrupt Tesla's supply chain. Disruptions in the supply of raw materials, manufacturing components, or logistical challenges can impact production and sales. Geopolitical tensions can also affect Tesla's international operations and market access.

- Examples of supply chain disruptions impacting Tesla: Disruptions related to lithium mining, semiconductor shortages, and port congestion have all affected Tesla's operations.

- Geopolitical events affecting Tesla's international operations: Political instability in various regions where Tesla operates or sources materials can impact its production and sales.

- Strategies Tesla employs to mitigate these risks: Tesla has implemented strategies to diversify its supply chains, reduce reliance on single sources, and improve its logistical efficiency.

Conclusion: Understanding the Future of Elon Musk's Net Worth and Tesla's Trajectory

In 2024 and beyond, Elon Musk's net worth remains inextricably linked to Tesla's performance. US economic policies, ranging from inflation and interest rates to government incentives and the geopolitical landscape, exert a powerful influence on Tesla's valuation and, consequently, on Elon Musk's financial standing. Understanding these intricate relationships is crucial for forecasting both Tesla's trajectory and the future of Elon Musk's net worth. To stay informed about this dynamic interplay, continue researching US economic policy updates and their impact on the electric vehicle sector. Follow reputable financial news sources and industry analyses for further insights into the fluctuating world of "Elon Musk net worth" and the ever-evolving Tesla story.

Featured Posts

-

Melanie Griffith And Dakota Johnsons Family Unite At Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnsons Family Unite At Materialist Premiere

May 10, 2025 -

Mask Ta Tramp Zradniki Na Dumku Kinga

May 10, 2025

Mask Ta Tramp Zradniki Na Dumku Kinga

May 10, 2025 -

See Dakota Johnsons Perfect Spring Dress Look With Mom Melanie Griffith

May 10, 2025

See Dakota Johnsons Perfect Spring Dress Look With Mom Melanie Griffith

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Prediction Best Bets For Tonights Game

May 10, 2025

Nhl Playoffs Oilers Vs Kings Prediction Best Bets For Tonights Game

May 10, 2025 -

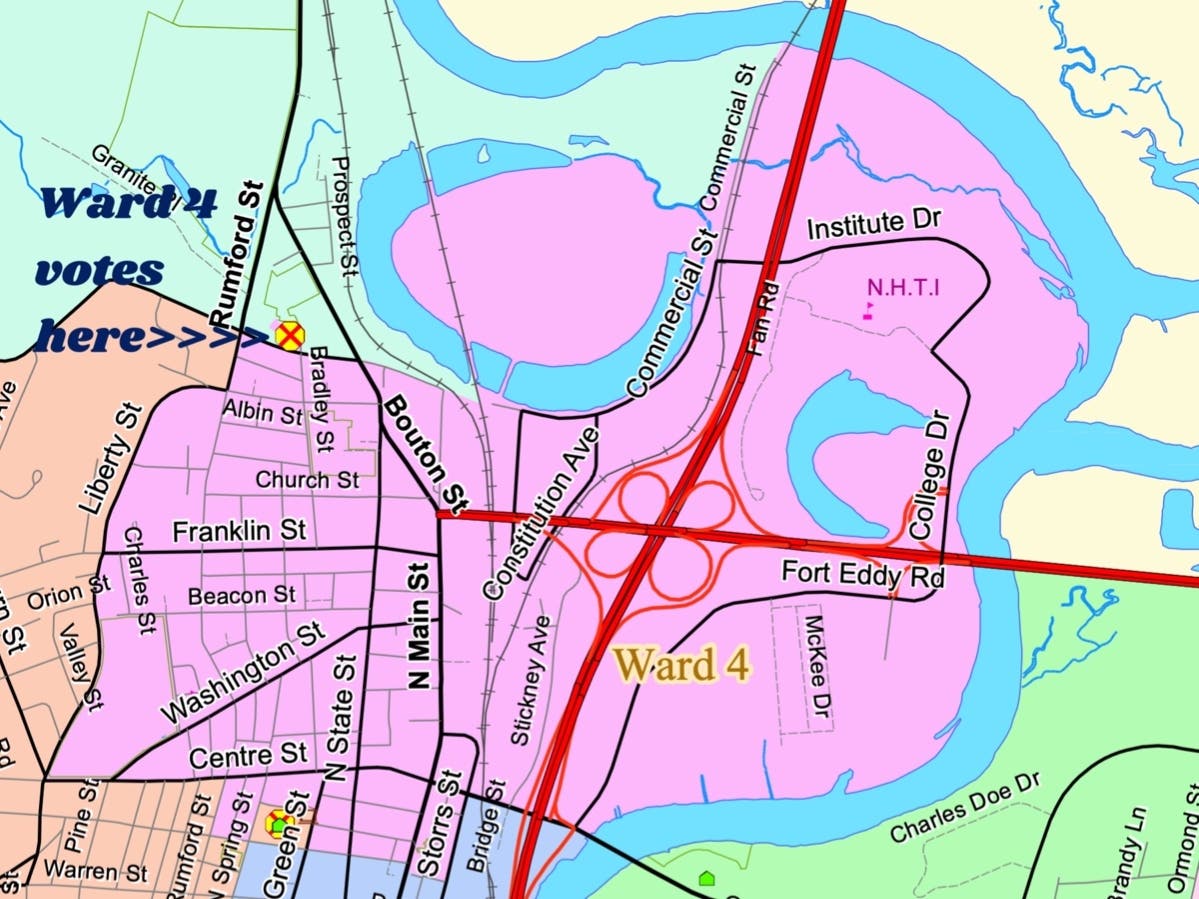

Nl Federal Election A Voters Guide To The Candidates

May 10, 2025

Nl Federal Election A Voters Guide To The Candidates

May 10, 2025