Eni Cuts Costs To Maintain Buyback Despite Lower Cash Flow

Table of Contents

Eni's Reduced Cash Flow: Underlying Causes

Eni's lower cash flow is a consequence of several interconnected factors impacting the energy sector. These factors have created a complex challenge requiring proactive and strategic responses.

- Decreased oil and gas prices: Fluctuations in global energy markets, including periods of lower oil and gas prices, directly impact Eni's revenue streams. The volatility of commodity prices presents an ongoing challenge to consistent cash flow generation.

- Increased investment in renewable energy sources and the energy transition: Eni's significant investments in renewable energy and the broader energy transition, while crucial for long-term sustainability, represent substantial upfront capital expenditures that temporarily reduce available cash flow. This strategic shift requires substantial investment to build new infrastructure and technologies.

- Rising operational costs due to inflation and supply chain disruptions: Global inflation and ongoing supply chain disruptions have significantly increased Eni's operational expenses, putting pressure on profit margins and consequently, cash flow. These external factors have exacerbated the existing challenges.

- Impact of geopolitical instability on energy markets: Geopolitical instability and uncertainty contribute to volatility in the energy markets, creating further headwinds for consistent revenue generation and impacting the predictability of Eni's cash flow. These unforeseen events significantly impact financial planning and projections.

Analyzing Eni's recent financial statements reveals a clear picture. Revenue declined by X% in [period], primarily due to lower oil prices. Simultaneously, operational expenses increased by Y% due to inflation and supply chain issues. This combination directly contributed to the reduction in overall cash flow.

Eni's Cost-Cutting Strategies: A Deep Dive

To offset the reduced cash flow and maintain its commitment to its share buyback program, Eni has implemented a range of comprehensive cost-cutting strategies. These initiatives demonstrate a proactive approach to navigating the current economic climate.

- Implementation of operational efficiency programs across various business units: Eni is actively implementing operational efficiency programs across all its business units. These programs focus on optimizing processes, reducing waste, and improving productivity to maximize efficiency and minimize operational costs.

- Reduction in capital expenditure (CAPEX) on non-core projects: The company has strategically reduced its capital expenditure on non-core projects, prioritizing investments in core assets and renewable energy initiatives that align with its long-term strategic goals.

- Streamlining of administrative and operational processes: Eni is streamlining its administrative and operational processes to eliminate redundancies and improve overall efficiency. This includes digitalization initiatives and process automation.

- Restructuring of certain business segments: To enhance efficiency and profitability, Eni is restructuring certain business segments, potentially involving workforce adjustments or hiring freezes in specific areas. These adjustments are carefully planned to minimize disruption and maximize long-term sustainability.

These cost-cutting measures are projected to generate significant savings, enabling Eni to maintain its share buyback program while simultaneously investing in its long-term growth strategy. The anticipated savings are estimated to be Z% within the next [timeframe].

Maintaining the Share Buyback: Strategic Importance

Eni's decision to maintain its share buyback program, despite the reduced cash flow, holds significant strategic importance:

- Signals confidence in future prospects despite current challenges: Continuing the share buyback signals Eni’s confidence in its future prospects and its ability to navigate the current challenges. This communicates strength and resilience to investors.

- Reinforces commitment to shareholder value creation: Maintaining the buyback program reinforces Eni's commitment to creating shareholder value, even in a volatile market. This demonstrates a strong focus on investor returns.

- Aims to support and stabilize the stock price: The buyback program is designed to support and stabilize Eni's stock price by reducing the number of outstanding shares. This can help maintain investor confidence and potentially attract new investment.

- May be a strategic decision to attract investors: The continued share buyback can be a strategic move to attract investors and demonstrate the company's financial strength and commitment to return on investment, even during a period of reduced cash flow.

Compared to competitors, Eni's commitment to shareholder returns through buybacks, even amidst financial challenges, positions the company favorably in the eyes of investors.

Impact on Eni's Future and Long-Term Strategy

Eni’s cost-cutting measures are not solely focused on short-term financial gains; they are strategically aligned with its long-term sustainability goals:

- Balancing short-term cost-cutting with long-term investments in renewable energy: Eni is carefully balancing short-term cost-cutting initiatives with continued long-term investments in renewable energy sources and technologies, ensuring the company's future competitiveness in the evolving energy landscape.

- Maintaining a healthy financial position to support future growth: The cost-cutting strategy aims to maintain a healthy financial position to support future growth and investments, enabling Eni to adapt to the dynamic energy market.

- Impact of cost-cutting on research and development initiatives: Eni is committed to ensuring that cost-cutting measures do not significantly hamper its research and development initiatives, preserving its ability to innovate and adapt to future market demands.

- Long-term implications of the strategy on Eni's market position: The long-term success of Eni's strategy depends on maintaining a strong market position and adapting to the evolving energy landscape. The cost-cutting measures are intended to support this long-term strategy.

The sustainability of Eni's cost-cutting measures depends on the continued success of its operational efficiency programs and its ability to navigate the ongoing challenges in the energy sector. The long-term implications will depend on the stability of energy prices and the overall pace of the energy transition.

Conclusion

Eni's strategic decision to implement significant cost-cutting measures to sustain its share buyback program, despite reduced cash flow, demonstrates a strong commitment to shareholder returns while strategically navigating the challenges of the global energy market. The company's balanced approach, prioritizing both short-term financial stability and long-term investments in renewable energy, positions it for continued growth and success in the evolving energy landscape.

Call to Action: Stay informed about Eni's ongoing efforts to manage its financial performance and maintain its commitment to shareholder value. Follow our updates on Eni's share buyback program and its impact on the energy sector. Learn more about Eni's innovative cost-cutting and share buyback strategy [link to relevant resource].

Featured Posts

-

Unexpected Ally New Character In Godzilla X Kong Sequel

Apr 25, 2025

Unexpected Ally New Character In Godzilla X Kong Sequel

Apr 25, 2025 -

Is Ashton Jeanty The Missing Piece For The Dallas Cowboys

Apr 25, 2025

Is Ashton Jeanty The Missing Piece For The Dallas Cowboys

Apr 25, 2025 -

Eurovision 2025 Early Predictions And Top Contenders

Apr 25, 2025

Eurovision 2025 Early Predictions And Top Contenders

Apr 25, 2025 -

Usha Vance From Quiet Confidante To Indian Celebrity

Apr 25, 2025

Usha Vance From Quiet Confidante To Indian Celebrity

Apr 25, 2025 -

3 12

Apr 25, 2025

3 12

Apr 25, 2025

Latest Posts

-

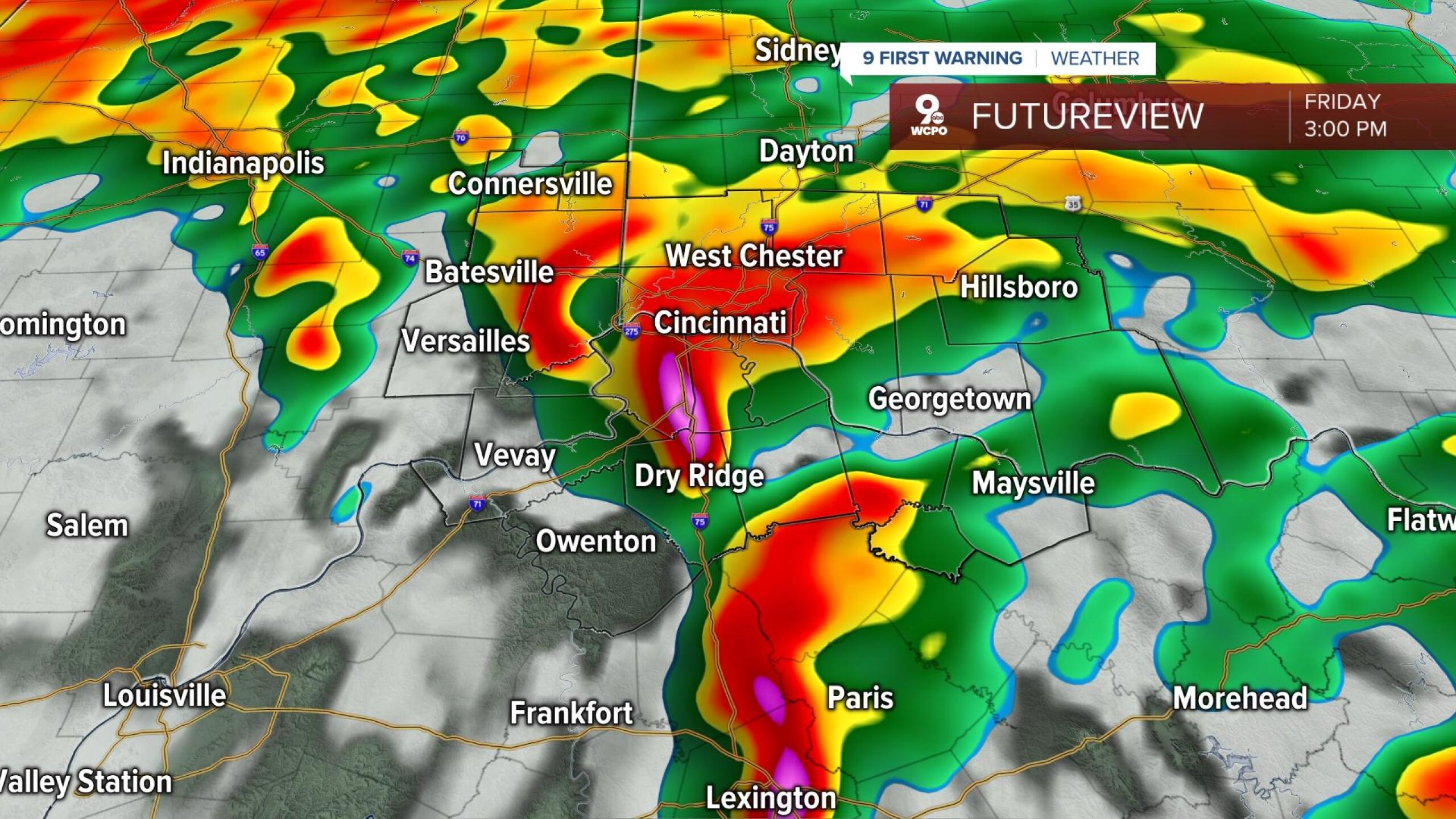

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025 -

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025 -

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025 -

Relief In Sight Louisville Mail Delays Nearing Resolution

Apr 30, 2025

Relief In Sight Louisville Mail Delays Nearing Resolution

Apr 30, 2025 -

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

Apr 30, 2025

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

Apr 30, 2025