Escape To The Country: Nicki Chapman's Profitable Property Investment

Table of Contents

Nicki Chapman's Property Investment Strategy

While the specifics of Nicki Chapman's personal property portfolio remain largely private, observing her on "Escape to the Country" provides insights into potential strategies for successful country property investment.

Understanding Nicki Chapman's Approach

Nicki's on-screen expertise suggests a keen understanding of several key investment principles. Her apparent approach likely involves:

- Location Selection: Choosing areas with strong community spirit, good transport links (even if slightly further from major cities), and access to essential amenities like schools and healthcare facilities. She likely prioritizes locations with proven or projected growth in property values.

- Property Type: Her show often showcases a variety of properties, suggesting a flexible approach, perhaps favoring properties with renovation potential to add value. Period properties and charming cottages are frequently featured, indicating an appreciation for character and potential. Modern builds might also feature in her portfolio, depending on the market and investment opportunity.

- Market Research: Thorough due diligence is crucial. Nicki's experience suggests she likely undertakes extensive market research, analyzing comparable property sales, local economic trends, and potential rental yields before making any investment decision.

- Risk Management: Identifying and mitigating potential risks is paramount. This could include thorough building surveys, seeking independent professional advice, and understanding potential maintenance costs associated with older properties.

Key aspects of a successful strategy (likely mirroring Nicki's):

- Buying below market value whenever possible.

- Focusing on long-term capital appreciation rather than short-term gains.

- Diversifying investments across different property types and locations.

- Maintaining properties well to maximize rental yields and future sale value.

Key Factors for Successful Country Property Investment

Building a profitable country property portfolio requires careful consideration of several key factors.

Location, Location, Location

Choosing the right location is paramount. Consider:

- Commute Times: While the appeal of rural life is undeniable, balancing tranquility with reasonable access to urban centers for work or amenities is crucial.

- Local Amenities: The availability of good schools, healthcare facilities, shops, and recreational activities significantly impacts property values and desirability.

- Property Values: Analyzing historical and projected property value growth in different rural areas is essential for making informed investment decisions. Researching areas experiencing population growth or regeneration can provide opportunities for higher returns.

Identifying Profitable Property Types

Different property types offer varying investment potential:

- Renovation Projects: Buying properties below market value that require refurbishment offers significant potential for added value. Careful planning and budgeting are essential.

- Holiday Lets: Short-term rentals can provide high rental yields, but require more management and potentially higher maintenance costs. Consider factors like local tourism trends and competition.

- Long-Term Rentals: Offering more stability and predictable income streams, long-term rentals are a less hands-on option, though rental yields may be lower than holiday lets.

Pros and Cons:

| Property Type | Pros | Cons |

|---|---|---|

| Renovation Projects | High potential for capital appreciation | Higher initial investment and renovation costs |

| Holiday Lets | High potential rental yields | Higher management demands and maintenance costs |

| Long-Term Rentals | Stable income stream, lower management needs | Lower rental yields than holiday lets |

Financing Your Escape to the Country Investment

Securing appropriate financing is a vital step in your country property investment journey.

Securing a Mortgage

Obtaining a mortgage for rural properties may present some unique challenges compared to urban properties. Lenders may require higher deposits or stricter criteria due to perceived higher risks. Shop around for the best rates and terms, ensuring you understand all associated fees and conditions.

Other Funding Options

Exploring alternative funding options can increase your chances of success:

- Bridging loans: These short-term loans can help bridge the gap between selling one property and buying another.

- Private investors: Partnering with private investors can provide additional capital and expertise.

- Joint ventures: Collaborating with other investors can spread the risk and share the workload.

Resources and Tips:

- Compare mortgage rates from multiple lenders specializing in rural properties.

- Consult with a financial advisor experienced in property investment.

- Develop a robust savings plan to build a substantial deposit.

- Understand the deposit requirements and lending criteria before making an offer on a property.

Legal and Tax Considerations for Country Property Investment

Navigating the legal and tax landscape is essential for successful investment.

Essential Legal Advice

Always seek legal counsel from a solicitor specializing in property law before committing to any purchase. This ensures all contracts are legally sound and protects your interests.

Tax Implications

Understanding the tax implications of property investment is crucial. Consult a qualified tax advisor to ensure you are meeting all legal obligations and optimizing your tax position.

Key areas to consider:

- Stamp Duty Land Tax

- Capital Gains Tax

- Income Tax on rental income

- Allowances for property maintenance and repairs

Conclusion: Make Your Escape to the Country a Profitable Reality

Successful country property investment hinges on careful planning, research, and a strategic approach. By learning from the apparent success of individuals like Nicki Chapman in their "Escape to the Country" journey, and by considering factors like location, property type, and appropriate financing, you can significantly increase your chances of achieving your own profitable rural property investment goals. Remember to seek expert advice on legal and tax matters.

Inspired by Nicki Chapman's Escape to the Country journey? Begin your own profitable rural property investment today! Research potential locations, carefully consider property types, secure appropriate financing, and start planning your dream country escape. Remember, thorough due diligence and expert advice are crucial for navigating the complexities of country property investment and building a successful and profitable portfolio of profitable rural properties.

Featured Posts

-

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 25, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 25, 2025 -

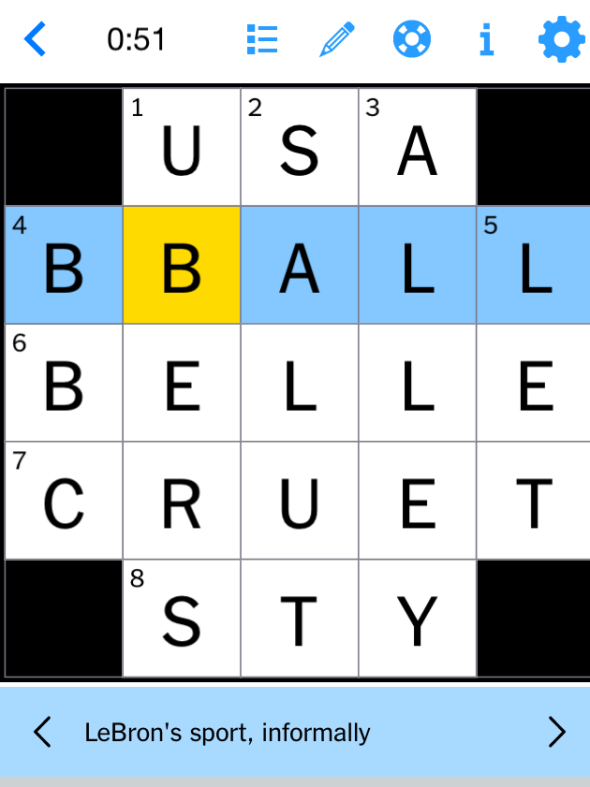

Complete Guide Nyt Mini Crossword April 18 2025 Solutions

May 25, 2025

Complete Guide Nyt Mini Crossword April 18 2025 Solutions

May 25, 2025 -

Novo Ferrari 296 Speciale 880 Cv De Potencia Hibrida

May 25, 2025

Novo Ferrari 296 Speciale 880 Cv De Potencia Hibrida

May 25, 2025 -

Is Kyle Walker Peters Heading To Elland Road Leeds Make Contact

May 25, 2025

Is Kyle Walker Peters Heading To Elland Road Leeds Make Contact

May 25, 2025 -

Significant Delays On M6 Southbound Following Accident

May 25, 2025

Significant Delays On M6 Southbound Following Accident

May 25, 2025

Latest Posts

-

En France La Chine Muselle Ses Opposants Analyse D Une Strategie De Silence

May 25, 2025

En France La Chine Muselle Ses Opposants Analyse D Une Strategie De Silence

May 25, 2025 -

France L Etendue De L Influence Chinoise Et La Censure Des Dissidents

May 25, 2025

France L Etendue De L Influence Chinoise Et La Censure Des Dissidents

May 25, 2025 -

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 25, 2025

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 25, 2025 -

La Repression Chinoise Des Dissidents En France Methodes Et Consequences

May 25, 2025

La Repression Chinoise Des Dissidents En France Methodes Et Consequences

May 25, 2025 -

News Corp A Deep Dive Into Its Business Units And Undervalued Assets

May 25, 2025

News Corp A Deep Dive Into Its Business Units And Undervalued Assets

May 25, 2025