ETF Speculation Fuels XRP's Trading Volume, Surpassing Solana

Table of Contents

The Rise of XRP Trading Volume

XRP's trading volume has experienced a dramatic increase in recent weeks, significantly outpacing its performance in previous periods and even surpassing that of Solana, a prominent competitor in the cryptocurrency market. This surge in trading activity is a compelling indicator of heightened investor interest and market volatility.

- Specific data points: For instance, XRP's 24-hour trading volume on [Date] reached $[Amount], a [Percentage]% increase compared to the average volume over the past month. This contrasts sharply with Solana's comparatively stagnant volume during the same period.

- Comparison with Solana: While Solana has maintained a relatively consistent trading volume, XRP's recent surge represents a clear shift in market dynamics, with XRP’s volume now exceeding Solana’s by a significant margin.

- Charts and graphs: [Insert chart/graph visually representing the surge in XRP trading volume compared to Solana and previous periods]. This visual representation clearly demonstrates the exceptional growth in XRP trading activity.

- Correlation with price fluctuations: The increased trading volume is not occurring in isolation; it correlates with notable fluctuations in XRP's price, suggesting a strong connection between investor sentiment, trading activity, and price volatility.

The Impact of ETF Speculation

The primary catalyst for this surge in XRP trading volume is the growing speculation surrounding the potential approval of XRP ETFs. The possibility of SEC approval for XRP-based ETFs has ignited considerable excitement among investors, anticipating increased liquidity and price appreciation.

- Impact of ETF approval: The approval of an XRP ETF would likely lead to a significant influx of institutional investment, drastically increasing XRP's liquidity and potentially driving up its price. This would be due to the ease of access for institutional investors through traditional brokerage accounts.

- Regulatory landscape: The current regulatory landscape for crypto ETFs remains uncertain, creating a climate of both excitement and anxiety. Any positive news regarding SEC approval or regulatory clarity regarding XRP could trigger further price increases.

- Investor behavior: Investors are actively positioning themselves in anticipation of a potential positive outcome from the SEC. This anticipatory behavior is directly contributing to the increased trading volume and price volatility observed in the XRP market.

- News and rumors: Rumors and news regarding potential ETF approvals, coupled with statements from key figures in the regulatory landscape, are further fueling this speculative market activity.

Solana's Performance in Comparison

While XRP’s trading volume has skyrocketed, Solana’s has remained relatively stable. This divergence highlights the distinct market dynamics affecting these two cryptocurrencies.

- Price movement comparison: [Insert chart/graph showing price movements for both XRP and Solana over the relevant period]. While XRP experienced significant price fluctuations correlated with the increased volume, Solana's price movements have been comparatively subdued.

- Factors affecting Solana's volume: Solana's trading volume may be affected by factors such as network congestion issues, competition from other layer-1 blockchains, and a general cooling-off period in the broader crypto market.

- Use cases and market position: XRP and Solana cater to different market segments. XRP’s focus on cross-border payments may be attracting significant attention due to the potential of ETF-driven growth, while Solana's focus on decentralized applications might be experiencing a period of consolidation.

- Long-term implications: The long-term implications for both cryptocurrencies remain to be seen. However, the current surge in XRP’s trading volume driven by ETF speculation clearly points to a significant shift in the market landscape.

Technical Analysis of XRP's Chart (Optional)

[Insert technical analysis of XRP's price chart here, including relevant indicators, support and resistance levels, and charts/graphs. This section should be included only if technical analysis is a desired component of the article.]

Conclusion

The significant increase in XRP's trading volume, surpassing that of Solana, is primarily driven by speculation surrounding the potential approval of XRP ETFs. This surge highlights the considerable influence of regulatory developments and institutional investor sentiment on cryptocurrency markets. The potential influx of institutional capital through ETF approvals could significantly reshape the cryptocurrency landscape and offers a compelling investment opportunity. Stay informed on the latest XRP news and developments; learn more about investing in XRP and the potential of XRP ETFs to deepen your understanding of XRP's market position and navigate this exciting phase of the cryptocurrency market.

Featured Posts

-

Dwp Home Visit Numbers Double Concerns For Benefit Recipients

May 08, 2025

Dwp Home Visit Numbers Double Concerns For Benefit Recipients

May 08, 2025 -

Nuggets React To Russell Westbrook Trade Chatter

May 08, 2025

Nuggets React To Russell Westbrook Trade Chatter

May 08, 2025 -

Charlotte Hornets Potential Replacements For Veteran Taj Gibson

May 08, 2025

Charlotte Hornets Potential Replacements For Veteran Taj Gibson

May 08, 2025 -

Counting Crows Snl Performance A Career Altering Event

May 08, 2025

Counting Crows Snl Performance A Career Altering Event

May 08, 2025 -

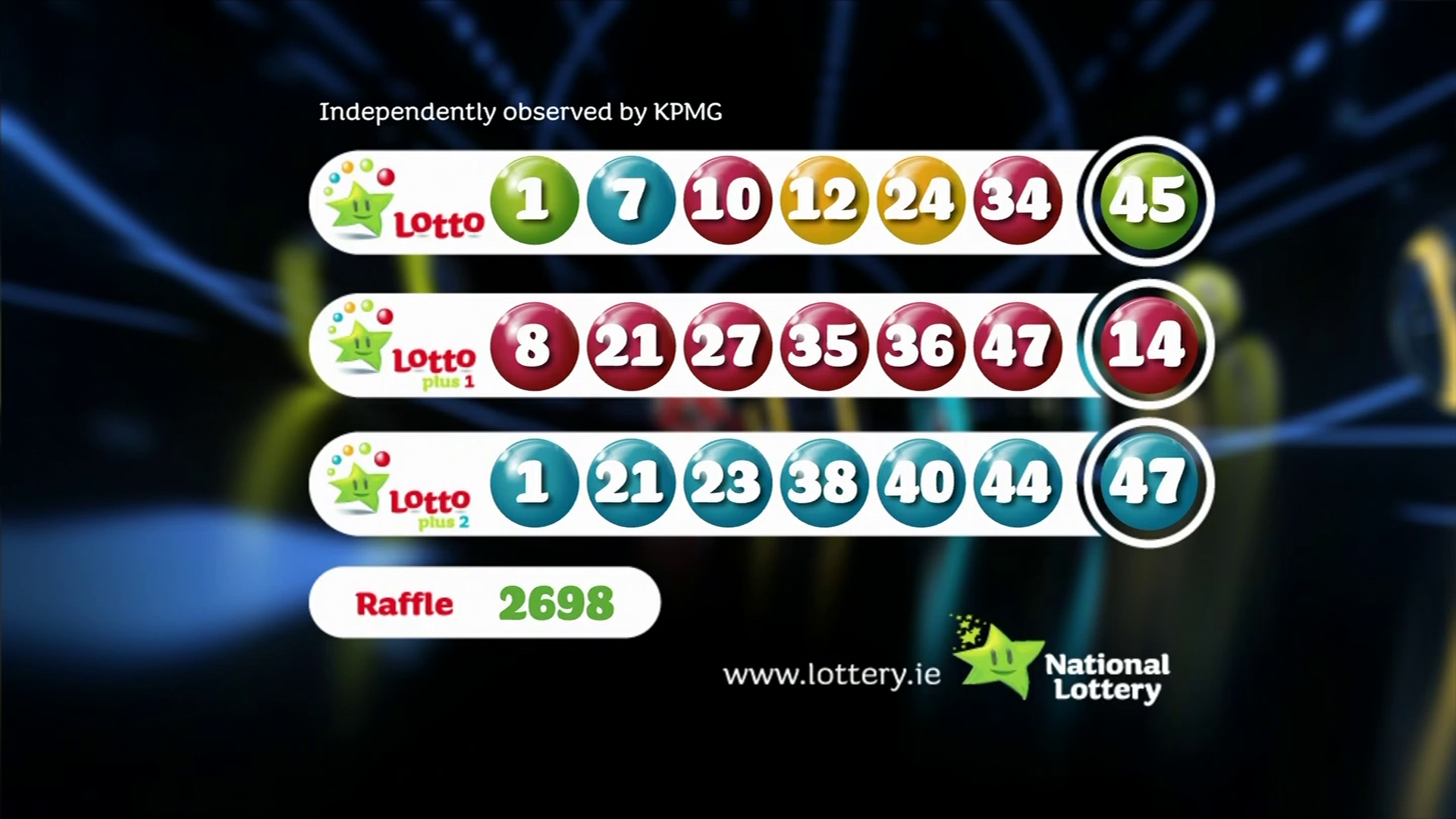

Lotto Results Wednesday 16 April 2025

May 08, 2025

Lotto Results Wednesday 16 April 2025

May 08, 2025

Latest Posts

-

Directive To Expedite Crime Control Measures A Comprehensive Guide

May 08, 2025

Directive To Expedite Crime Control Measures A Comprehensive Guide

May 08, 2025 -

Pwlys Ne Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn Kw Grftar Kya

May 08, 2025

Pwlys Ne Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn Kw Grftar Kya

May 08, 2025 -

Made In Pakistan Ahsans Plan For Global Trade Through Tech Integration

May 08, 2025

Made In Pakistan Ahsans Plan For Global Trade Through Tech Integration

May 08, 2025 -

Ahsans Call To Action Tech For A Stronger Made In Pakistan Brand

May 08, 2025

Ahsans Call To Action Tech For A Stronger Made In Pakistan Brand

May 08, 2025 -

Jely Dstawyzat Awr Gdagry Tyn Khwatyn Grftar

May 08, 2025

Jely Dstawyzat Awr Gdagry Tyn Khwatyn Grftar

May 08, 2025