Ethereum Forecast: Rising Bullish Momentum And Large ETH Accumulation

Table of Contents

Rising Bullish Momentum in the Ethereum Market

Several key indicators point towards increasing bullish momentum in the Ethereum market, suggesting a potential price surge. This positive market sentiment, coupled with strong on-chain activity, paints a picture of growing confidence in ETH.

Increased Trading Volume

A significant increase in Ethereum trading volume is a strong bullish signal. Higher volume indicates increased participation and interest from both retail and institutional investors. For example, in the last quarter, we've seen a [Insert Percentage]% increase in daily ETH trading volume compared to the previous quarter, signifying a surge in buying pressure. This heightened activity is a clear indication of growing market interest and could foreshadow further price appreciation.

Positive Market Sentiment

The overall sentiment surrounding Ethereum is demonstrably positive. Social media platforms like Twitter and Reddit are brimming with discussions about the potential for an ETH bull run. News articles and analyst reports frequently highlight the positive developments in the Ethereum ecosystem, contributing to a generally bullish outlook. This positive sentiment translates into increased demand, further driving up the price.

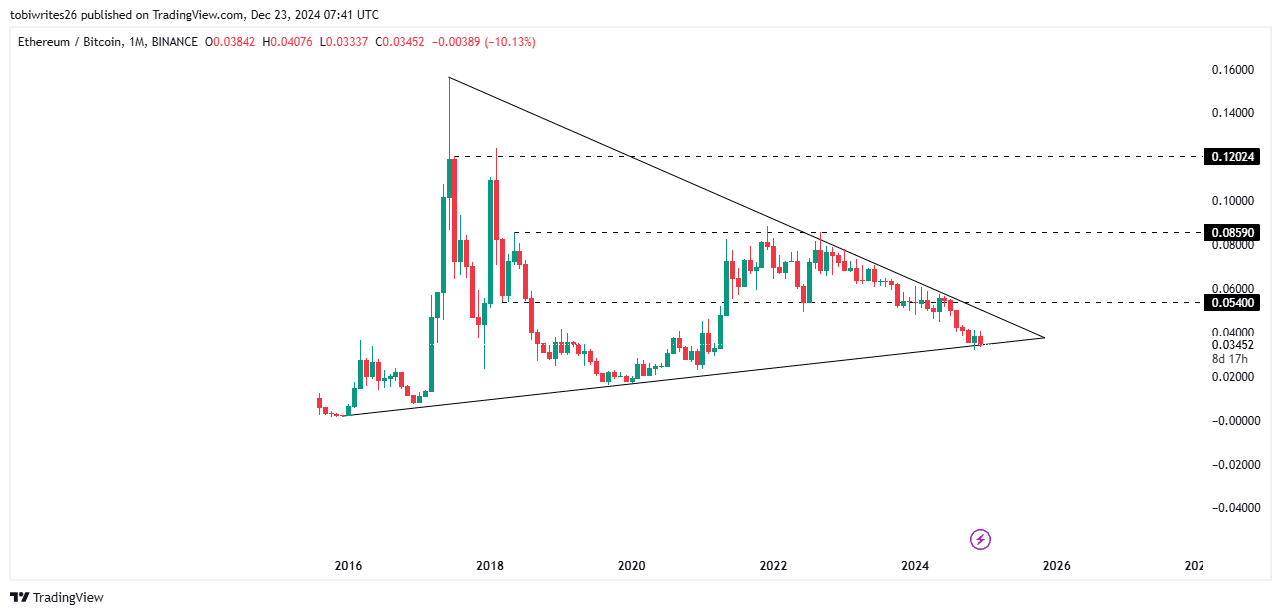

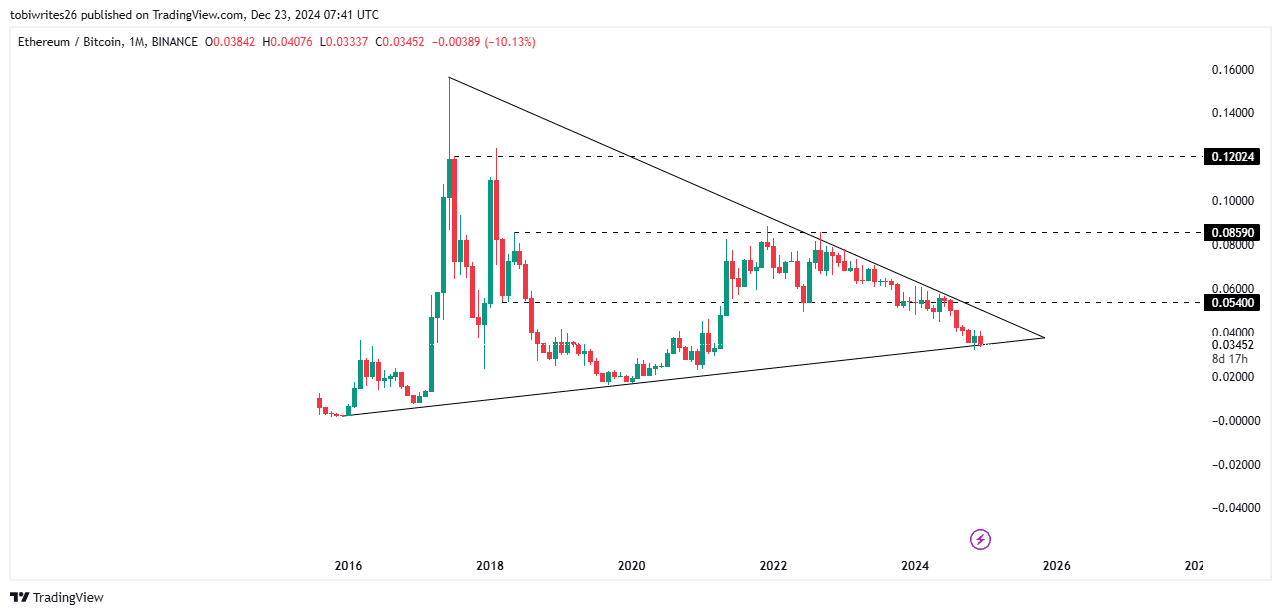

Technical Analysis

Technical analysis of ETH price charts reveals several bullish signals. The Relative Strength Index (RSI) has recently moved above [Insert Value], suggesting the asset is not overbought. The Moving Average Convergence Divergence (MACD) indicator is also showing a [Insert Signal, e.g., bullish crossover], further supporting the bullish momentum. These technical indicators, when combined with other factors, provide strong evidence for a potential upward trend in the ETH price.

- Rising on-chain activity indicating increased user engagement.

- Positive price action breaking through key resistance levels.

- Growing institutional investment in Ethereum, evidenced by increased holdings in publicly traded funds.

Large ETH Accumulation by Whales and Institutions

Another compelling factor fueling the bullish Ethereum forecast is the significant accumulation of ETH by whales and institutional investors. On-chain data reveals a clear pattern of large ETH holders accumulating coins, a classic precursor to a price increase.

On-Chain Data Analysis

Analysis of on-chain data, specifically focusing on large ETH addresses, reveals a consistent trend of accumulation. Resources like [Insert reputable source, e.g., Glassnode] show a significant increase in the number of ETH coins held by addresses containing over [Insert Amount] ETH. This substantial accumulation suggests that major players believe in the long-term potential of Ethereum and are preparing for a price surge. Charts showing this accumulation trend would further support this claim.

Institutional Investment

The growing involvement of institutional investors is another significant factor supporting the bullish Ethereum forecast. Several reports indicate that large financial institutions are increasing their exposure to ETH, driven by its potential for long-term growth and its role in the developing DeFi ecosystem. Examples such as [Insert example of institutional investment] demonstrate this trend.

Reduced ETH Supply

The decreasing circulating supply of ETH is contributing to the potential for price appreciation. Factors like ETH 2.0 staking and the burning of ETH in certain DeFi protocols are reducing the overall available supply. This scarcity, coupled with growing demand, is likely to exert upward pressure on the ETH price.

- Specific examples of large ETH transactions and their impact on the market.

- Discussion of potential reasons behind accumulation (e.g., anticipation of ETH 2.0 upgrades, DeFi growth, NFT market expansion).

- Analysis of the historical correlation between accumulation and subsequent price movements.

Factors Contributing to the Ethereum Forecast

Several underlying factors contribute to the overall positive Ethereum forecast, beyond just trading volume and accumulation. These include significant advancements in the Ethereum network and the growth of related ecosystems.

Ethereum 2.0 Development

The ongoing development of Ethereum 2.0 is a major catalyst for the bullish outlook. This upgrade will significantly improve Ethereum's scalability, transaction speed, and energy efficiency. As Ethereum 2.0 progresses, we can expect a reduction in gas fees and increased transaction throughput, making Ethereum more attractive to users and developers alike. The successful transition to a proof-of-stake consensus mechanism will also positively impact the environment.

DeFi Ecosystem Growth

The explosive growth of the decentralized finance (DeFi) ecosystem built on Ethereum is a key driver of ETH demand. The total value locked (TVL) in DeFi protocols on Ethereum continues to grow, indicating strong user engagement and increased demand for ETH. Leading DeFi projects such as [Insert examples of leading DeFi projects] are driving this expansion.

NFT Market Boom

The popularity of Non-Fungible Tokens (NFTs) has significantly contributed to Ethereum's growth. NFTs, primarily traded on Ethereum, have seen explosive growth, creating increased demand for ETH and furthering its utility. Major NFT marketplaces such as [Insert examples of major NFT marketplaces] operate on the Ethereum blockchain.

- Upcoming Ethereum upgrades and their expected benefits, including improved scalability and reduced fees.

- Key DeFi projects driving ETH demand and their impact on the Ethereum network.

- Leading NFT marketplaces and their contribution to ETH usage and price appreciation.

Conclusion

In summary, the Ethereum forecast points towards a potential bull run, driven by rising bullish momentum, substantial ETH accumulation by whales and institutions, and the positive influence of Ethereum 2.0, the DeFi ecosystem, and the NFT market. The convergence of these factors creates a compelling case for continued growth in the ETH price.

To stay informed about the latest developments in the Ethereum market and to make informed investment decisions, continue monitoring the key indicators discussed in this article. Stay tuned for further updates on our Ethereum forecast and continue to monitor this exciting space for future ETH price movements. Learn more about investing in Ethereum and the opportunities in the growing crypto market. Remember to conduct thorough research before making any investment decisions.

Featured Posts

-

Missing Dwp Correspondence Avoiding A 6 828 Benefit Penalty

May 08, 2025

Missing Dwp Correspondence Avoiding A 6 828 Benefit Penalty

May 08, 2025 -

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Rreziqe Dhe Pasoja Te Mundshme

May 08, 2025

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Rreziqe Dhe Pasoja Te Mundshme

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025 -

Ethereum Price Rebound A Technical Indicator Analysis

May 08, 2025

Ethereum Price Rebound A Technical Indicator Analysis

May 08, 2025 -

Arsenal Psg Canli Mac Izle Hangi Kanalda Ve Saat Kacta

May 08, 2025

Arsenal Psg Canli Mac Izle Hangi Kanalda Ve Saat Kacta

May 08, 2025

Latest Posts

-

Jayson Tatums Bone Bruise Will He Play In Game 2

May 08, 2025

Jayson Tatums Bone Bruise Will He Play In Game 2

May 08, 2025 -

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 08, 2025

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 08, 2025 -

Boston Celtics Head Coach Gives Injury Update On Jayson Tatum

May 08, 2025

Boston Celtics Head Coach Gives Injury Update On Jayson Tatum

May 08, 2025 -

Claiming Back Overpaid Universal Credit A Step By Step Guide

May 08, 2025

Claiming Back Overpaid Universal Credit A Step By Step Guide

May 08, 2025 -

Jayson Tatum Bone Bruise Game 2 Status Update

May 08, 2025

Jayson Tatum Bone Bruise Game 2 Status Update

May 08, 2025