Ethereum Price Prediction: Maintaining Strength, Poised For Growth

Table of Contents

Current Market Conditions and Ethereum's Position

The overall cryptocurrency market sentiment is currently showing signs of cautious optimism. While volatility remains a characteristic of the space, a growing number of institutional investors are entering the market, indicating increased confidence. Ethereum, as the second-largest cryptocurrency by market capitalization, reflects this sentiment.

Ethereum's current price and market capitalization fluctuate daily, however, its sustained position in the top two cryptocurrencies demonstrates its enduring value.

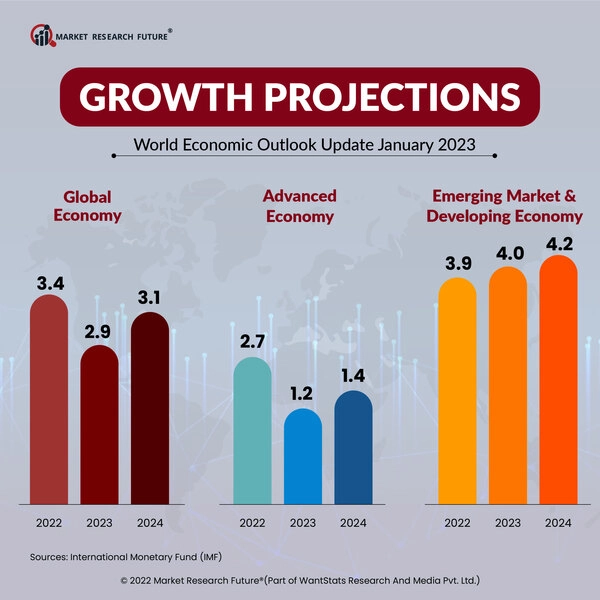

- Recent Price Fluctuations: Recent price swings have been influenced by factors such as regulatory announcements, macroeconomic conditions, and overall investor sentiment towards risk assets.

- Comparison to Bitcoin: While Bitcoin often sets the tone for the broader crypto market, Ethereum’s performance has frequently shown independence, demonstrating its unique value proposition beyond simply being a store of value.

- Market Dominance and Ecosystem Position: Ethereum's significant market dominance, stemming from its robust decentralized application (dApp) ecosystem and the widespread adoption of its smart contracts, positions it for continued growth. This Ethereum price prediction takes this into account.

The Ethereum price is closely tied to the health of the broader cryptocurrency market, but its unique features provide a level of insulation from drastic market downturns.

Technological Advancements and Ethereum's Future

The Ethereum 2.0 upgrade is a pivotal factor in any Ethereum price prediction. This significant upgrade aims to dramatically improve the network's scalability and reduce transaction fees, addressing major limitations of the previous iteration.

The thriving ecosystem of decentralized applications (dApps) built on Ethereum is another key element. These applications range from decentralized finance (DeFi) protocols to non-fungible token (NFT) marketplaces, fostering innovation and driving demand for Ethereum.

- Proof-of-Stake (PoS) Transition: The shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS) has significantly improved energy efficiency, reducing the network's environmental impact and making it more attractive to environmentally conscious investors.

- Layer-2 Scaling Solutions: Layer-2 scaling solutions like Optimism and Arbitrum are alleviating scalability concerns, enabling faster and cheaper transactions, improving the overall user experience.

- NFT and DeFi Growth: The continued growth of NFTs and DeFi protocols on the Ethereum network contributes significantly to network activity and demand, influencing the Ethereum price prediction positively.

These technological advancements contribute significantly to a positive outlook for the Ethereum price prediction, suggesting robust growth potential in the long term.

Adoption and Institutional Interest in Ethereum

Growing adoption by institutional investors and corporations is a key driver of the Ethereum price. Large financial institutions and corporations are increasingly exploring and investing in Ethereum-based solutions, validating the technology's potential and driving demand. Furthermore, regulatory clarity (or lack thereof) plays a significant role in investor confidence.

- Institutional Investment Examples: Several large investment firms have publicly announced significant Ethereum holdings, demonstrating growing institutional confidence.

- ETFs and Investment Vehicles: The emergence of Ethereum-focused exchange-traded funds (ETFs) and other investment vehicles makes it easier for institutional investors to gain exposure to Ethereum, fueling further adoption.

- Regulatory Developments: While regulatory uncertainty can impact price volatility in the short term, clear and supportive regulatory frameworks can lead to increased institutional participation and a more stable market for Ethereum.

Potential Price Scenarios for Ethereum

Predicting the precise price of Ethereum is impossible. However, considering the factors discussed, we can outline potential scenarios:

- Bullish Scenario: Continued technological advancements, increased institutional adoption, and positive regulatory developments could drive significant price increases.

- Bearish Scenario: Negative macroeconomic conditions, increased regulatory scrutiny, or significant technological setbacks could lead to price declines.

- Neutral Scenario: A balanced outlook suggests modest growth, reflecting the inherent volatility of the cryptocurrency market and the interplay of positive and negative factors.

Conclusion

The Ethereum price prediction hinges on several interconnected factors. Current market conditions, ongoing technological advancements, and growing institutional adoption all contribute to a generally positive outlook. While precise predictions are impossible, the long-term potential for Ethereum remains significant. The ongoing development of Ethereum 2.0, the flourishing DeFi and NFT ecosystems, and the increased institutional interest paint a picture of a strong and resilient platform.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem to make informed decisions regarding your Ethereum investments. Continue to monitor our website for updated Ethereum price predictions and analysis. Follow our blog for the latest on Ethereum price and market trends. Remember that this is not financial advice and conducting your own research is crucial before making any investment decisions.

Featured Posts

-

Vesprem Prodolzhi So Pobednichkata Seri A 10 Pobedi Po Red

May 08, 2025

Vesprem Prodolzhi So Pobednichkata Seri A 10 Pobedi Po Red

May 08, 2025 -

Bitcoins Rise Us China Trade Talks Fuel Crypto Investment

May 08, 2025

Bitcoins Rise Us China Trade Talks Fuel Crypto Investment

May 08, 2025 -

First Trailer Hunger Games Directors New Dystopian Horror Film Based On Stephen King

May 08, 2025

First Trailer Hunger Games Directors New Dystopian Horror Film Based On Stephen King

May 08, 2025 -

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025 -

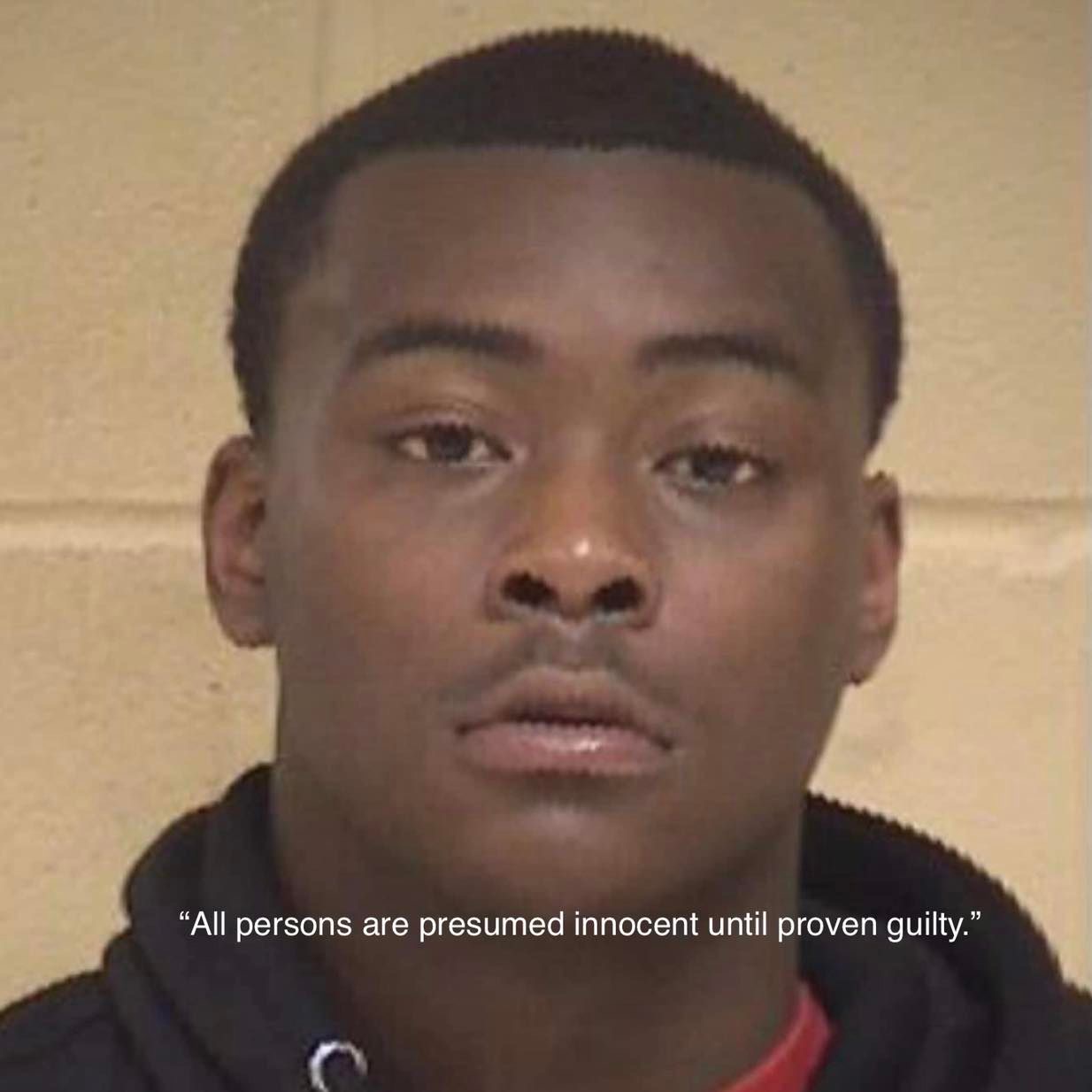

Shreveport Police Make Arrests In Multi Vehicle Theft Case

May 08, 2025

Shreveport Police Make Arrests In Multi Vehicle Theft Case

May 08, 2025

Latest Posts

-

Understanding Xrps Recent Rise The Trump Administrations Influence

May 08, 2025

Understanding Xrps Recent Rise The Trump Administrations Influence

May 08, 2025 -

Why Is Xrp Ripple Up Today A Potential Link To President Trump

May 08, 2025

Why Is Xrp Ripple Up Today A Potential Link To President Trump

May 08, 2025 -

Ripples Xrp Jumps Connecting The Dots To President Trumps Recent Activities

May 08, 2025

Ripples Xrp Jumps Connecting The Dots To President Trumps Recent Activities

May 08, 2025 -

Xrp Rising The Trump Factor And Ripples Future

May 08, 2025

Xrp Rising The Trump Factor And Ripples Future

May 08, 2025 -

Xrp Price Surge Is President Trump The Reason

May 08, 2025

Xrp Price Surge Is President Trump The Reason

May 08, 2025