Ethereum Price Resilience: Upside Potential Ahead

Table of Contents

Strong Fundamentals Driving Ethereum Price Resilience

The impressive Ethereum price resilience isn't merely luck; it's underpinned by several powerful fundamental factors.

The Ethereum Merge and its Impact

The successful transition to proof-of-stake (PoS) via the Ethereum Merge was a monumental achievement. This upgrade drastically altered Ethereum's consensus mechanism, moving away from the energy-intensive proof-of-work (PoW) system. The positive impacts are undeniable:

- Reduced energy consumption: The Merge significantly lowered Ethereum's environmental footprint, addressing a major criticism of PoW cryptocurrencies. This has improved its public image and attracted environmentally conscious investors.

- Improved transaction speeds and lower fees: PoS has led to faster transaction processing and reduced gas fees, making Ethereum more accessible and user-friendly. This is crucial for wider adoption.

- Enhanced network security and resilience against attacks: The PoS mechanism is inherently more secure and less vulnerable to 51% attacks, further bolstering Ethereum's long-term stability. This increased security directly contributes to Ethereum price resilience.

Growing Decentralized Finance (DeFi) Ecosystem

Ethereum's dominance in the Decentralized Finance (DeFi) space is a major driver of its price. The thriving ecosystem built on Ethereum continues to attract users and developers alike.

- Increased usage of decentralized applications (dApps) and smart contracts: Ethereum's robust smart contract functionality underpins a vast array of DeFi applications, from lending and borrowing platforms to decentralized exchanges (DEXs).

- Growing total value locked (TVL) in DeFi protocols: The total value locked in Ethereum-based DeFi protocols continues to grow, demonstrating the increasing trust and adoption of these applications. This growth directly fuels demand for ETH.

- Attracting developers and investors to the Ethereum network: The vibrant DeFi ecosystem attracts top talent and investment, further solidifying Ethereum's position as a leading blockchain platform. This network effect contributes significantly to Ethereum price resilience.

NFT Market and Metaverse Development

The explosive growth of Non-Fungible Tokens (NFTs) and the burgeoning metaverse are also significant contributors to Ethereum's price.

- Continued popularity of NFTs and their use cases: Ethereum remains the leading platform for NFT creation and trading, hosting many of the most successful NFT projects.

- Growing interest in metaverse projects built on Ethereum: Many metaverse projects are built on Ethereum, leveraging its scalability and security to create immersive digital experiences.

- Potential for long-term growth in these sectors: The NFT and metaverse markets are still in their early stages, with immense potential for future growth, further supporting Ethereum's price.

Addressing Concerns and Potential Challenges

Despite its strength, Ethereum faces certain challenges that could impact its price.

Competition from Layer-2 Solutions

The rise of Layer-2 scaling solutions like Polygon, Arbitrum, and Optimism presents both opportunities and challenges for Ethereum.

- Analysis of the benefits and drawbacks of Layer-2 solutions: Layer-2 solutions aim to alleviate network congestion and reduce transaction fees on Ethereum. While they offer scalability improvements, they also introduce complexities and potential security concerns.

- Impact on Ethereum's transaction fees and network congestion: Layer-2 solutions can ease congestion and lower fees, potentially reducing the demand for ETH for transaction purposes.

- Potential for increased adoption of Layer-2 solutions: Increased Layer-2 adoption could shift some activity away from the Ethereum mainnet, but it also expands the overall Ethereum ecosystem.

Regulatory Uncertainty

The evolving regulatory landscape poses a significant challenge for the cryptocurrency market, including Ethereum.

- Discussion of potential regulatory hurdles and their effects: Government regulations can impact the accessibility and adoption of cryptocurrencies, creating uncertainty in the market.

- Impact on institutional adoption and investor sentiment: Regulatory clarity is crucial for attracting institutional investors, and uncertainty can negatively impact investor sentiment.

- Strategies for navigating regulatory uncertainty: Adapting to evolving regulations and advocating for clear and consistent policies are crucial for navigating this challenge.

Market Volatility and External Factors

The cryptocurrency market is inherently volatile, susceptible to broader economic conditions and unforeseen events.

- Discussion of factors influencing broader market trends: Macroeconomic factors, such as inflation and interest rates, significantly influence the cryptocurrency market.

- Impact of global economic conditions on Ethereum's price: Global economic downturns can lead to risk-averse behavior, impacting cryptocurrency prices.

- Strategies for managing risk in a volatile market: Diversification, dollar-cost averaging, and understanding market cycles are crucial for managing risk.

Upside Potential and Future Outlook for Ethereum

Despite the challenges, the long-term outlook for Ethereum remains positive, fueled by ongoing development and growing adoption.

Ethereum 2.0 Development and Future Upgrades

The ongoing development of Ethereum 2.0 (now largely complete with the Merge) and future upgrades will continue to enhance the network's scalability, security, and efficiency.

- Expected improvements in transaction speed and efficiency: Future upgrades will further improve transaction speeds and reduce gas fees, making Ethereum even more attractive.

- Potential for increased adoption and network growth: These improvements will likely attract more users and developers, leading to further network growth.

- Long-term implications for Ethereum's value proposition: The continuous improvements will strengthen Ethereum's position as a leading blockchain platform, driving long-term value appreciation.

Institutional Adoption and Growing Demand

Increasing institutional interest in Ethereum is another key factor driving its price.

- Growth in institutional investment in Ethereum: More institutional investors are recognizing Ethereum's potential and are allocating funds to the cryptocurrency.

- Impact on price stability and market liquidity: Institutional adoption can lead to greater price stability and improved market liquidity.

- Potential for increased price appreciation due to institutional demand: This increased demand from large investors can fuel significant price appreciation.

Conclusion

Ethereum's price resilience reflects strong fundamentals, a thriving ecosystem, and ongoing development. While challenges remain, the potential upside for Ethereum is significant, driven by factors such as the successful Merge, growing DeFi adoption, and increased institutional interest. Understanding the factors contributing to Ethereum price resilience is crucial for investors seeking to navigate the dynamic cryptocurrency market. Stay informed on the latest developments and consider the potential of Ethereum for long-term investment opportunities. Learn more about maximizing your investment strategy with a deeper understanding of Ethereum price resilience and its underlying drivers.

Featured Posts

-

Whos The Thunders Best Leader Kenrich Williams Points To One Player

May 08, 2025

Whos The Thunders Best Leader Kenrich Williams Points To One Player

May 08, 2025 -

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Neden Bu Kadar Popueler

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Neden Bu Kadar Popueler

May 08, 2025 -

Counting Crows Slip Into The Shadows A Deep Dive Into The Aurora Album

May 08, 2025

Counting Crows Slip Into The Shadows A Deep Dive Into The Aurora Album

May 08, 2025 -

Arsenal Vs Psg Key Battles In The Champions League Semi Final

May 08, 2025

Arsenal Vs Psg Key Battles In The Champions League Semi Final

May 08, 2025 -

Oeluemden Sonra Kripto Para Erisimi Yasal Ve Pratik Coezuemler

May 08, 2025

Oeluemden Sonra Kripto Para Erisimi Yasal Ve Pratik Coezuemler

May 08, 2025

Latest Posts

-

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025 -

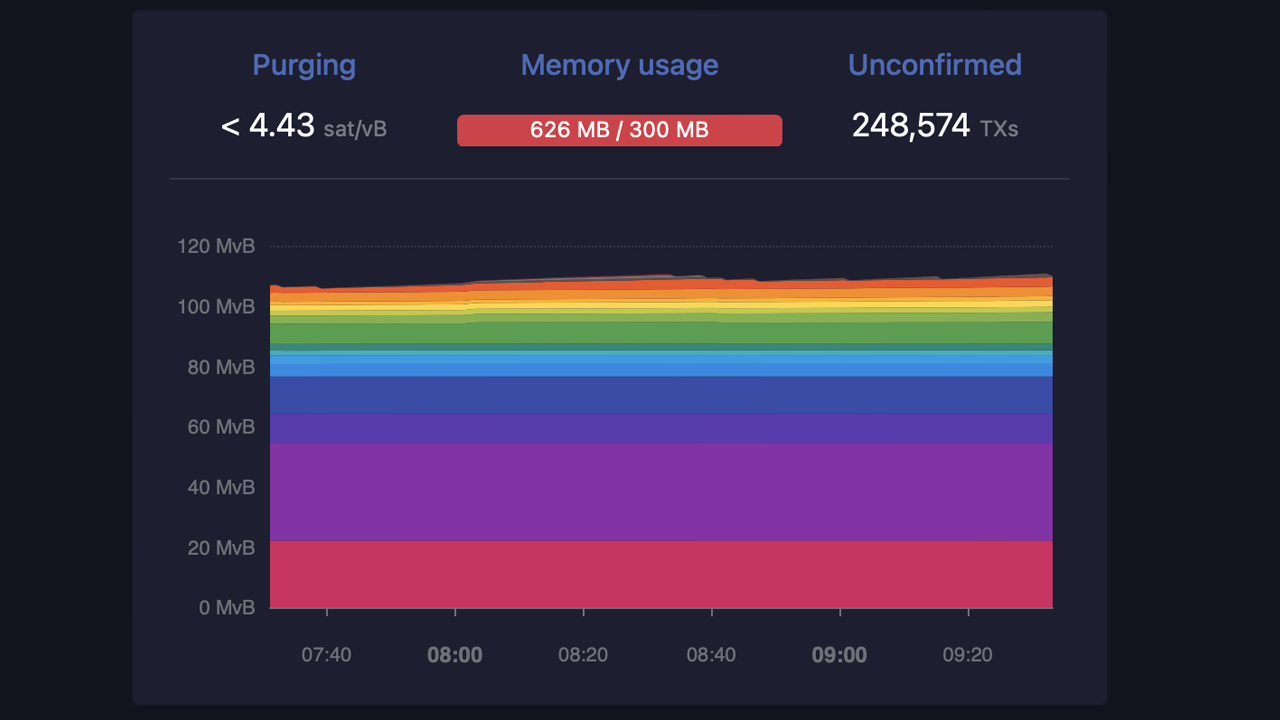

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025

Understanding The Recent Surge In Bitcoin Mining Hashrate

May 08, 2025 -

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 08, 2025

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 08, 2025 -

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Ke Khatme Ka Nwtyfkyshn

May 08, 2025

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Ke Khatme Ka Nwtyfkyshn

May 08, 2025 -

Recent Bitcoin Mining Boom A Deep Dive Into The Causes

May 08, 2025

Recent Bitcoin Mining Boom A Deep Dive Into The Causes

May 08, 2025