Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

Keywords: Euronext Amsterdam, stocks, stock market, Trump tariffs, tariff decision, market reaction, stock surge, investment, trading, stock tickers

The Euronext Amsterdam stock market experienced a significant 8% surge following a crucial Trump administration tariff decision. This unexpected jump sent ripples through the financial world, prompting investors to re-evaluate their strategies and analyze the long-term implications for Euronext Amsterdam stocks. This article delves into the details of this event, examining its immediate impact, the reasons behind the market reaction, and the potential future trajectory of Euronext Amsterdam investments.

The Trump Tariff Decision and its Immediate Impact on Euronext Amsterdam

On [Insert Date of Tariff Decision], the Trump administration announced [Clearly explain the specific tariff decision – e.g., a delay or removal of tariffs on specific goods imported from the EU]. This announcement immediately triggered a positive reaction in the Euronext Amsterdam stock market, resulting in an impressive 8% increase, translating to [Insert specific index points or quantitative data illustrating the 8% increase].

- Specific sectors positively affected: The technology and financial sectors witnessed the most significant gains, with several companies reporting double-digit percentage increases in their share prices.

- Examples of top-performing stocks: ASML Holding (ASML.AS), a major semiconductor equipment manufacturer, saw a considerable rise, along with several prominent banks like ING Groep (INGA.AS) and ABN AMRO (ABN.AS). [Include more examples with tickers].

- Quantitative data illustrating the 8% jump: The AEX index, a key benchmark for Euronext Amsterdam, climbed by [Insert precise numerical data], marking the largest single-day increase in [Specify timeframe].

- Initial analyst reactions: Many analysts attributed the surge to a reduction in uncertainty surrounding trade relations between the US and the EU, leading to positive forecasts for future economic growth.

Analysis of the Market Reaction: Why the 8% Surge?

The 8% surge on Euronext Amsterdam wasn't a random event; it reflected a confluence of factors related to investor sentiment and market anticipation.

- Market anticipation before the decision: Prior to the announcement, there was considerable market volatility and apprehension due to the ongoing trade disputes. Investors were clearly anticipating a resolution, either positive or negative.

- Alleviating existing concerns: The tariff decision directly addressed key concerns regarding trade barriers and uncertainty, leading to a wave of relief among investors. This relieved pressure on several key sectors.

- Positive economic forecasts: The announcement was interpreted by many economists as a positive sign for the European economy, leading to revised, more optimistic growth projections. This fueled further investment.

- Investor sentiment and trading activity: The positive news shifted investor sentiment dramatically from pessimism to optimism, resulting in a significant increase in buying activity and a subsequent surge in stock prices.

Long-Term Implications for Euronext Amsterdam Stocks

While the immediate impact was undeniably positive, the long-term implications for Euronext Amsterdam stocks remain to be seen.

- Potential for sustained growth: The technology and financial sectors, in particular, are expected to benefit from sustained growth, provided the positive trade environment persists.

- Risks and uncertainties: Geopolitical instability, future policy changes, and global economic headwinds could still impact market performance. It's important to remain cautious.

- Recommendations for investors: Investors should carefully consider their risk tolerance and diversify their portfolios to mitigate potential losses. Focus on companies with strong fundamentals.

- Future policy decisions: Any future changes in trade policy, both within the EU and globally, could significantly influence the trajectory of Euronext Amsterdam stocks.

Trading Strategies Following the Euronext Amsterdam Stock Surge

The market's reaction presents both opportunities and challenges for investors.

- Identifying investment opportunities: Focus on companies with strong growth potential within sectors positively affected by the tariff decision. Fundamental analysis is key.

- Risk management techniques: Employ stop-loss orders and diversification strategies to protect investments against potential market volatility.

- Importance of diversification: Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes to minimize risk.

- Seeking professional advice: Consult a financial advisor for personalized investment strategies tailored to your individual risk profile and financial goals.

Conclusion

The 8% surge in Euronext Amsterdam stocks following the Trump tariff decision highlights the significant impact of trade policy on global markets. While the immediate reaction was overwhelmingly positive, investors should approach the future with caution, carefully considering both the potential for sustained growth and the persistent risks. Understanding the complexities of the stock market and staying informed about evolving market conditions is crucial for making sound investment decisions. Don't miss out on the latest updates concerning Euronext Amsterdam stocks and their response to future policy decisions. Stay informed and learn more about navigating the complexities of the stock market by [link to relevant resource/subscription].

Featured Posts

-

Thlyl Daks 30 Tjawz Mstwa Mars Elamt Ela Anteash Alswq Alawrwbyt

May 24, 2025

Thlyl Daks 30 Tjawz Mstwa Mars Elamt Ela Anteash Alswq Alawrwbyt

May 24, 2025 -

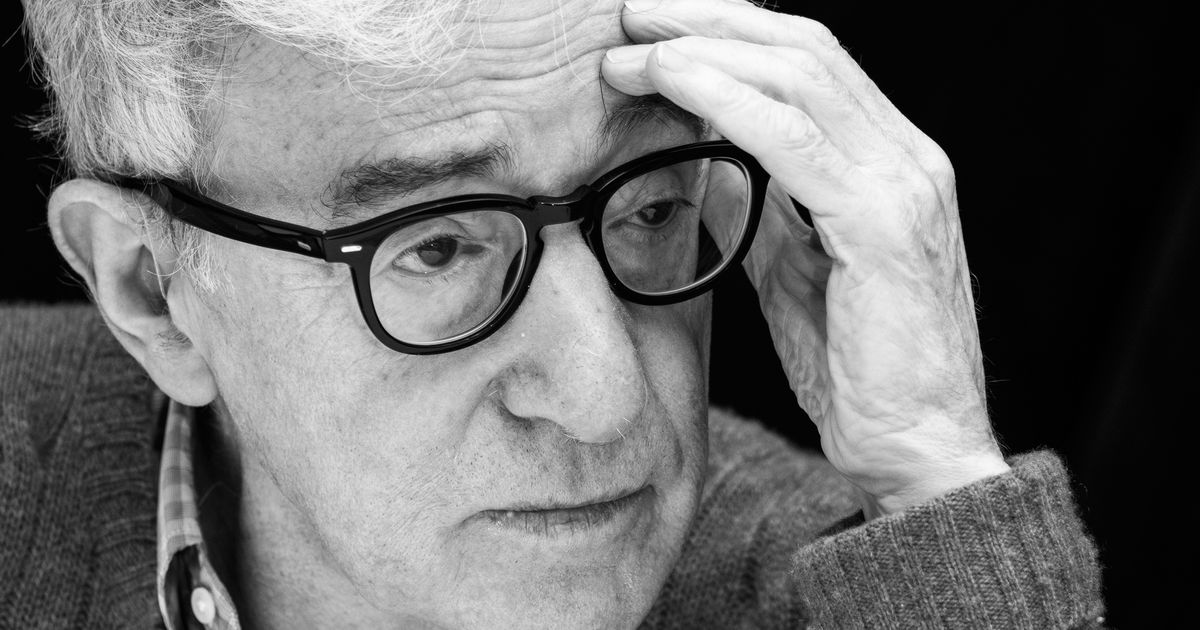

Is Sean Penns Support For Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025

Is Sean Penns Support For Woody Allen A Me Too Blind Spot A Critical Analysis

May 24, 2025 -

Top Gear And Accessories For Ferrari Owners And Enthusiasts

May 24, 2025

Top Gear And Accessories For Ferrari Owners And Enthusiasts

May 24, 2025 -

Gucci Supply Chain Officer Massimo Vians Exit

May 24, 2025

Gucci Supply Chain Officer Massimo Vians Exit

May 24, 2025 -

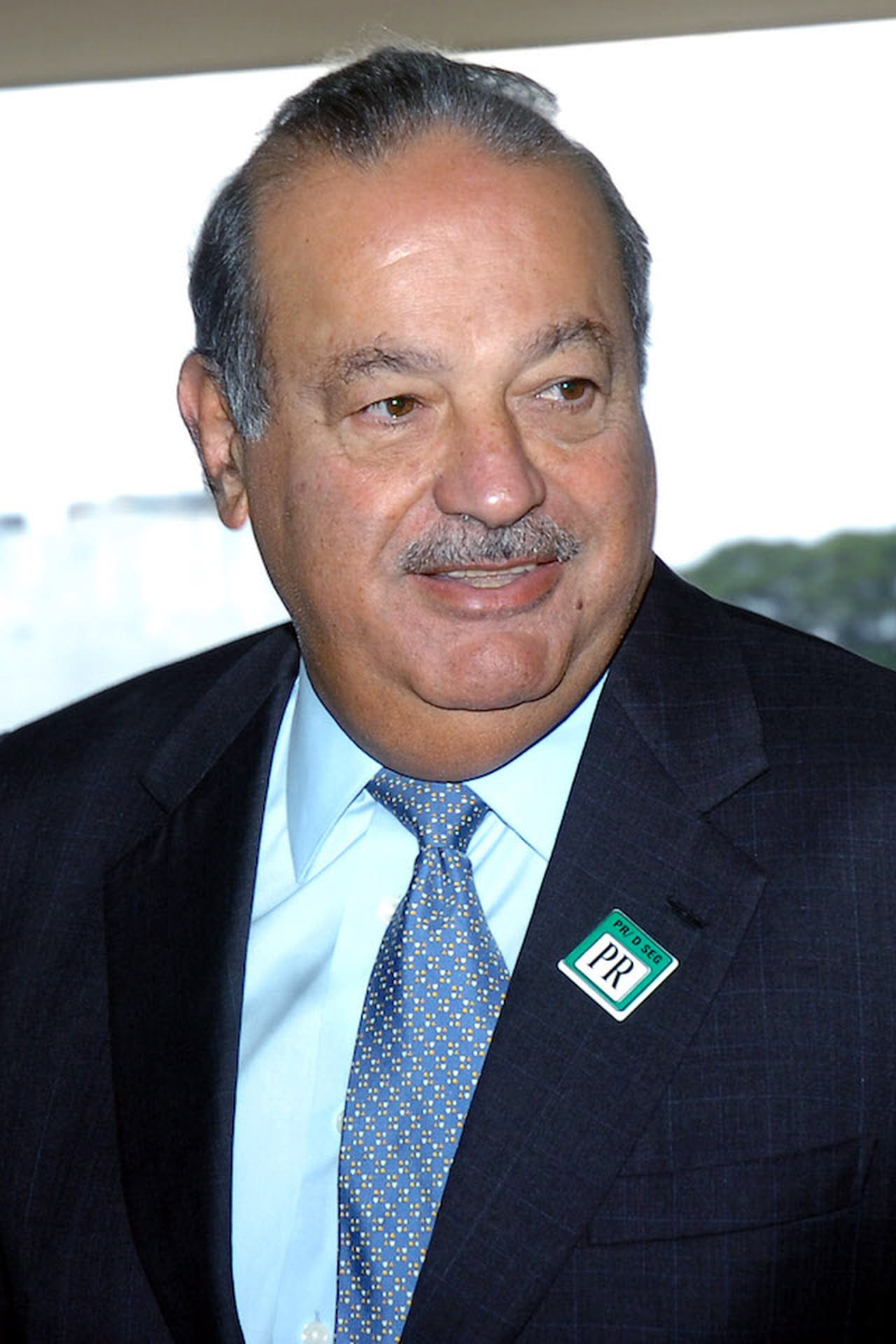

I Miliardari Piu Influenti Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

I Miliardari Piu Influenti Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

Latest Posts

-

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025 -

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025 -

Discover The Countrys Top New Business Locations A Geographic Overview

May 24, 2025

Discover The Countrys Top New Business Locations A Geographic Overview

May 24, 2025 -

New Business Hotspots Across The Country An Interactive Map And Analysis

May 24, 2025

New Business Hotspots Across The Country An Interactive Map And Analysis

May 24, 2025