Europe Shares Rise On Trump Tariff Hints, LVMH Falls

Table of Contents

European Market Surge – A Response to Trump's Tariff Hints?

The European stock market saw a significant share price increase today, with major indices experiencing notable gains. While President Trump's comments regarding potential tariff adjustments undoubtedly played a role, a more nuanced analysis reveals a confluence of factors driving this market volatility. The seemingly positive response to Trump's hints might reflect a bet by investors on a potential de-escalation of trade tensions, or perhaps a recalibration of expectations after a period of heightened uncertainty.

Reasons for the Rise:

- Positive economic data: Recent positive economic indicators from several European countries may have boosted investor confidence.

- Shifting investor sentiment: A general improvement in investor sentiment, potentially driven by factors beyond Trump's comments, may have contributed to the upward trend.

- Strategic positioning: Some investors may be strategically repositioning themselves in anticipation of future market developments.

Specific Share Price Movements:

- DAX (Germany): Experienced a [insert percentage]% increase.

- CAC 40 (France): Saw a [insert percentage]% rise.

- FTSE 100 (UK): Recorded a [insert percentage]% gain.

[Insert chart visually representing the share price increases of the DAX, CAC 40, and FTSE 100]

LVMH's Decline: Uncoupling from Broader Market Trends

In stark contrast to the overall European market surge, luxury goods giant LVMH experienced a significant drop in its stock price. This decline presents a compelling case study in how individual company performance can decouple from broader market trends. The reasons for LVMH's fall are likely multifaceted and require a closer examination of the company's specific circumstances within the context of the luxury goods sector.

Factors Contributing to LVMH's Fall:

-

Company-specific news: [Insert any relevant company-specific news, e.g., a disappointing earnings report, a change in management, etc.]

-

Sector-specific challenges: The luxury goods sector faces unique challenges, including shifts in consumer spending patterns and increasing competition.

-

Geopolitical uncertainty: While the broader market reacted positively to Trump's hints, LVMH's exposure to international markets might make it particularly vulnerable to geopolitical uncertainty.

-

Market capitalization impact: The LVMH stock price drop led to a decrease in its market capitalization by [insert figures].

[Insert chart showing LVMH's share price movement over the relevant period]

Analyzing the Disconnect: Why the Divergent Market Reactions?

The contrasting performances of the European market and LVMH highlight the complex interplay of factors influencing market behavior. The apparent disconnect underscores the importance of considering sector-specific influences, investor sentiment, and the broader geopolitical landscape when analyzing market trends.

Sector-Specific Influences:

- Tariff impact: Different sectors are affected differently by tariffs. While some sectors might benefit from de-escalation, others might remain vulnerable. The luxury goods sector, with its global supply chains, may be particularly sensitive to trade disputes.

Investor Sentiment and Speculation:

- Risk assessment: Investors' risk appetite plays a crucial role. The surge in European shares might reflect a willingness to take on more risk, while LVMH's fall could indicate a more cautious approach towards luxury goods investments.

The Role of Geopolitical Uncertainty

President Trump's tariff hints represent a significant element of geopolitical uncertainty. These hints create ripple effects throughout the global economy, influencing international trade and investment decisions. The impact on global markets is complex and multifaceted, with varying effects across different sectors and regions. The uncertainty surrounding trade negotiations continues to pose a significant risk assessment challenge for investors worldwide.

Conclusion: Understanding Europe Shares and Trump's Impact

The unexpected rise in European shares, despite LVMH's fall, reveals the intricate and often unpredictable nature of the market. President Trump's tariff hints acted as a significant catalyst, triggering a complex interplay of factors influencing both positive and negative market movements. Understanding this disconnect requires careful analysis of sector-specific influences, investor sentiment, and the ongoing geopolitical landscape. The market outlook remains uncertain, and careful monitoring of these dynamic conditions is essential for formulating effective investment strategies. To stay informed on the latest developments in Europe shares and related market movements, subscribe to our newsletter [link to newsletter]. Understanding the evolving landscape of Europe shares is crucial for navigating the complexities of the global economy.

Featured Posts

-

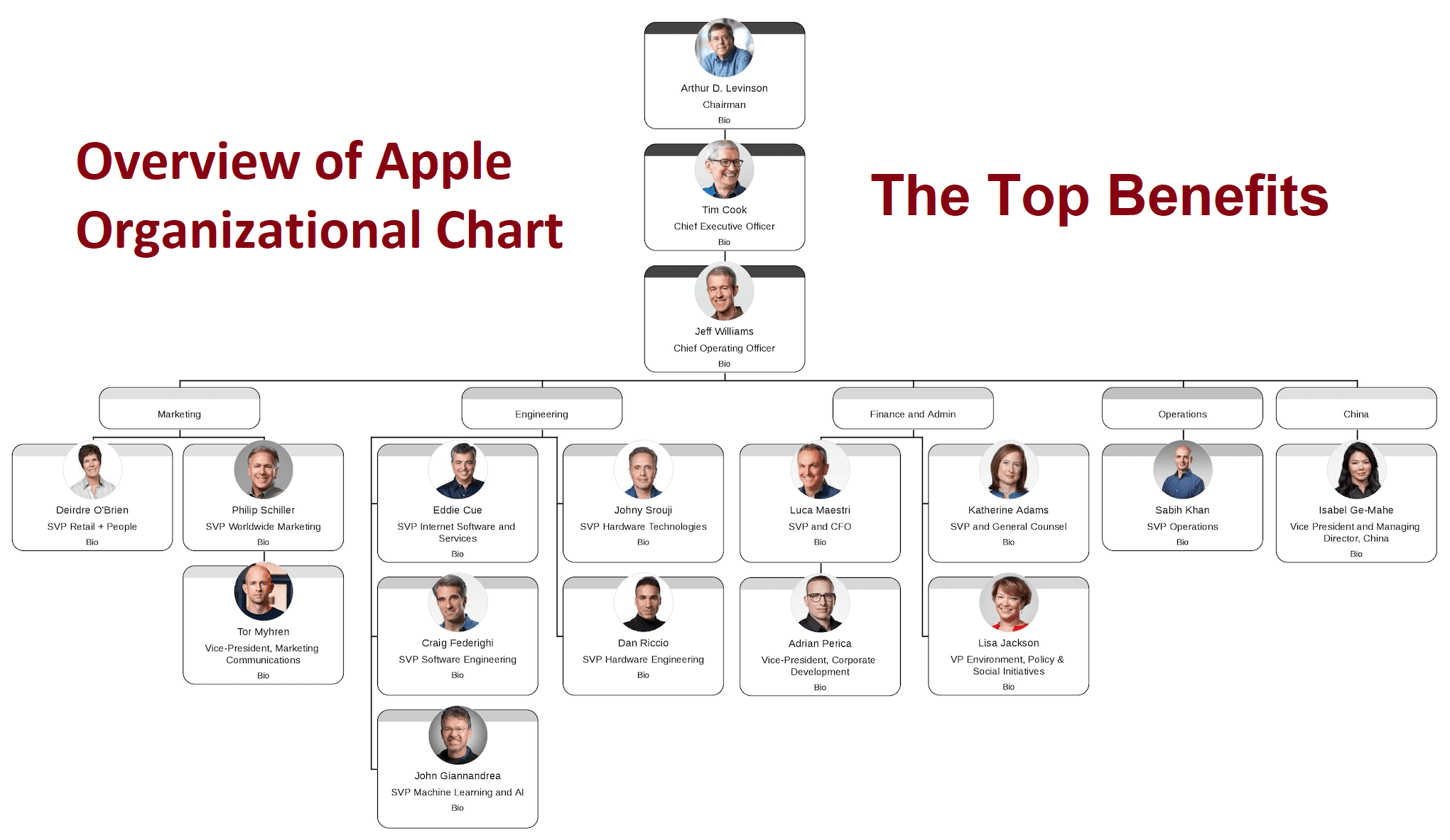

Tim Cooks Challenging 2023 Apples Struggles

May 25, 2025

Tim Cooks Challenging 2023 Apples Struggles

May 25, 2025 -

Former French Pm Critiques Macrons Decisions

May 25, 2025

Former French Pm Critiques Macrons Decisions

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Policy A Call For Accountability

May 25, 2025

Mia Farrow On Trumps Venezuelan Deportation Policy A Call For Accountability

May 25, 2025 -

Aex Stijgt Na Trump Uitstel Analyse Van De Winsten

May 25, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Winsten

May 25, 2025

Latest Posts

-

Myrtle Beach Officer Involved Shooting 1 Dead 11 Injured

May 25, 2025

Myrtle Beach Officer Involved Shooting 1 Dead 11 Injured

May 25, 2025 -

Dispelling The Myth Myrtle Beachs Safety Record Examined

May 25, 2025

Dispelling The Myth Myrtle Beachs Safety Record Examined

May 25, 2025 -

Myrtle Beach Cleanup Volunteers Needed

May 25, 2025

Myrtle Beach Cleanup Volunteers Needed

May 25, 2025 -

Myrtle Beach Rebuts Unsafe Beach Study Facts And Figures

May 25, 2025

Myrtle Beach Rebuts Unsafe Beach Study Facts And Figures

May 25, 2025 -

Myrtle Beach Fights Back Against Most Unsafe Beach Ranking

May 25, 2025

Myrtle Beach Fights Back Against Most Unsafe Beach Ranking

May 25, 2025