European Central Bank Unveils Plan To Simplify Banking Regulations

Table of Contents

Key Goals of the ECB's Simplification Plan

The primary objective of the ECB's initiative is to reduce the complexity and administrative burden associated with current banking regulations. The sheer volume of regulations currently in place often leads to increased compliance costs and administrative overhead for banks of all sizes. This, in turn, can hinder lending and investment activities.

The plan seeks to improve the clarity and transparency of existing rules, making them easier for banks to understand and implement. Ambiguous or overly complex regulations often lead to inconsistent application and increased risk of non-compliance. By clarifying the rules, the ECB aims to create a more predictable and stable regulatory environment.

Ultimately, the goal is to free up resources for banks to focus on lending to businesses and supporting economic growth. By reducing the time and resources spent on regulatory compliance, banks can allocate more capital to lending activities, ultimately stimulating economic activity and job creation. This is particularly important in supporting small and medium-sized enterprises (SMEs).

- Streamlining compliance processes: This involves simplifying procedures and reducing bureaucratic hurdles.

- Reducing reporting requirements: The ECB aims to minimize the number of reports banks are required to submit, thereby reducing their administrative burden.

- Improving the efficiency of supervisory reviews: Streamlined reviews will free up both bank and supervisory resources.

Specific Regulatory Changes Proposed by the ECB

The ECB is proposing several specific changes to existing regulations to achieve its simplification goals. These changes are designed to create a more efficient and effective regulatory framework without compromising financial stability.

The ECB is proposing amendments to existing capital requirements, aiming for a more risk-sensitive approach. This means that banks will be required to hold capital reserves in proportion to the actual risk they are taking, rather than adhering to a one-size-fits-all approach.

Simplification of the reporting framework for smaller banks is also a key element of the plan. Smaller banks often face disproportionately high compliance costs compared to their larger counterparts. Reducing their reporting burden will help level the playing field and encourage lending to SMEs.

Introducing a more standardized approach to supervisory processes across the Eurozone is crucial for creating a consistent and predictable regulatory environment. This will improve efficiency and reduce regulatory arbitrage.

- Revised capital adequacy ratios: A more risk-based approach to capital requirements.

- Reduced frequency of certain reporting requirements: Less frequent reporting will free up bank resources.

- Harmonization of supervisory methodologies: A more consistent approach across the Eurozone.

- Improved guidance on loan assessment criteria: Clearer guidelines will improve the efficiency and consistency of lending processes.

Impact on Smaller Banks and SMEs

The simplification plan is expected to significantly benefit smaller banks, easing the regulatory burden on their operations. This is crucial because smaller banks often play a vital role in providing credit to SMEs, which are the backbone of many European economies.

This, in turn, will facilitate increased lending to small and medium-sized enterprises (SMEs), boosting economic activity. Easier access to credit will allow SMEs to expand their operations, create jobs, and contribute to overall economic growth.

- Reduced compliance costs for smaller banks: This will free up resources for lending and other business activities.

- Increased access to credit for SMEs: This will boost investment and job creation.

- Enhanced competitiveness for smaller financial institutions: A more level playing field will encourage competition and innovation.

Potential Challenges and Criticisms of the Plan

While the ECB's plan to simplify banking regulations offers many potential benefits, some challenges and criticisms remain. A key concern is the potential for unintended consequences, such as reduced levels of financial stability. Critics argue that simplifying regulations could inadvertently weaken safeguards against financial risks.

Some argue that the proposed simplifications may compromise the effectiveness of existing regulatory safeguards. Striking the right balance between simplification and maintaining robust risk management is crucial for the success of this initiative. The ECB needs to ensure that the simplified regulations are effective in mitigating systemic risk.

Debate continues on the level of harmonization needed to ensure a level playing field across the Eurozone while maintaining sufficient flexibility for national authorities. Finding the optimal balance between harmonization and national flexibility is a complex challenge that will require careful consideration.

- Balancing simplification with robust risk management: This is a key challenge that requires careful consideration.

- Ensuring consistent implementation across different jurisdictions: Harmonization is crucial for a level playing field.

- Addressing potential loopholes in the revised regulations: Thorough review and testing are essential to prevent unintended consequences.

Conclusion

The ECB's plan to simplify banking regulations represents a significant step towards creating a more efficient and competitive financial landscape within the Eurozone. While challenges and criticisms remain, the potential benefits for banks, SMEs, and the broader economy are considerable. The initiative to streamline compliance processes and reduce the regulatory burden is a positive move, potentially unlocking significant resources for lending and economic growth. The success of this plan depends on careful implementation and ongoing monitoring to ensure its intended positive impact. For further details on the ECB's plan to simplify banking regulations, stay informed about official announcements and analyses from the European Central Bank and other reputable financial sources.

Featured Posts

-

Belinda Bencic Back In The Wta Final In Abu Dhabi

Apr 27, 2025

Belinda Bencic Back In The Wta Final In Abu Dhabi

Apr 27, 2025 -

Is Canada The New Top Travel Destination Recent Trends Suggest Yes

Apr 27, 2025

Is Canada The New Top Travel Destination Recent Trends Suggest Yes

Apr 27, 2025 -

Chillin In Alaska Ariana Biermanns Romantic Trip

Apr 27, 2025

Chillin In Alaska Ariana Biermanns Romantic Trip

Apr 27, 2025 -

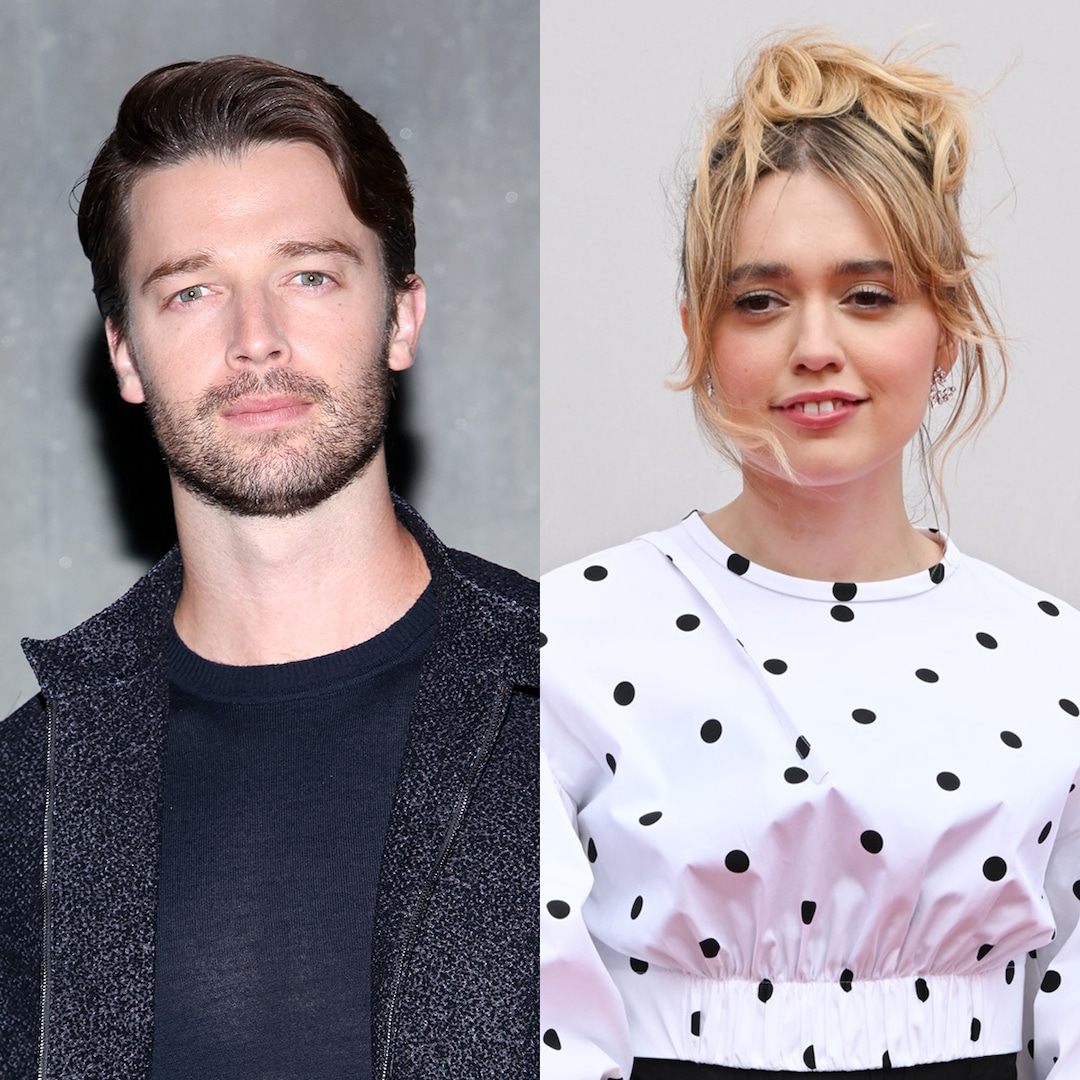

Ariana Grandes White Lotus Video Patrick Schwarzeneggers Unexpected Cameo

Apr 27, 2025

Ariana Grandes White Lotus Video Patrick Schwarzeneggers Unexpected Cameo

Apr 27, 2025 -

How Ariana Grande Achieved Her Stunning New Hair And Tattoos Professional Expertise Revealed

Apr 27, 2025

How Ariana Grande Achieved Her Stunning New Hair And Tattoos Professional Expertise Revealed

Apr 27, 2025

Latest Posts

-

Hudsons Bay Store Closing Sale Find Amazing Deals Now

Apr 28, 2025

Hudsons Bay Store Closing Sale Find Amazing Deals Now

Apr 28, 2025 -

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025 -

Final Days Of Hudsons Bay 70 Off Liquidation Event

Apr 28, 2025

Final Days Of Hudsons Bay 70 Off Liquidation Event

Apr 28, 2025 -

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025 -

Hudsons Bay Liquidation Up To 70 Off At Final Stores

Apr 28, 2025

Hudsons Bay Liquidation Up To 70 Off At Final Stores

Apr 28, 2025