Evaluating Quantum Computing Investments: Rigetti And IonQ Case Study (2025)

Table of Contents

Understanding the Quantum Computing Landscape in 2025

By 2025, the quantum computing industry will have significantly matured, but challenges remain.

Technological Maturity

Advancements in quantum computing technology are expected to be substantial by 2025. However, hurdles still need to be overcome:

- Qubit counts: The number of qubits in a quantum computer will continue to increase, but achieving fault-tolerant quantum computation requires significantly higher numbers.

- Coherence times: Extending the coherence time (the time qubits maintain their quantum state) is crucial for performing complex calculations. Improvements here are vital.

- Error rates: Reducing error rates in qubit operations is paramount for reliable computation. Advanced error correction techniques will be essential.

- Algorithm development: Creating efficient quantum algorithms tailored to specific applications will drive adoption.

- Application progress: Demonstrating the practical applicability of quantum computers in various fields (e.g., drug discovery, materials science, finance) will be key to market growth.

Market Analysis & Projections

The quantum computing market is predicted to experience exponential growth by 2025. Multiple market research firms project substantial increases in market size, fueled by:

- Market research reports from leading analysts indicate a rapidly expanding market.

- Industry forecasts suggest significant investment in both hardware and software.

- Potential growth sectors such as pharmaceuticals (drug discovery and development), finance (risk management and portfolio optimization), and materials science (designing new materials) are expected to drive demand.

Identifying Key Players and Investment Opportunities

Beyond Rigetti and IonQ, several other significant players are shaping the quantum computing investment landscape:

- Public and private companies: A growing number of companies are developing various quantum computing technologies and platforms.

- Investment strategies: Investors are employing a range of strategies, from early-stage venture capital to investments in publicly traded companies.

- Different investment vehicles: Venture capital (VC) funding remains crucial, while initial public offerings (IPOs) are providing alternative investment avenues.

A Deep Dive into Rigetti Computing

Rigetti Computing is a prominent player focusing on superconducting qubits and quantum cloud computing.

Business Model and Technology

Rigetti's business model revolves around providing access to their quantum computers through cloud services and developing quantum algorithms for specific applications.

- Strengths: Scalable architecture and a focus on cloud access.

- Weaknesses: Competition from other superconducting qubit players and potential challenges in maintaining qubit coherence at scale.

- Competitive advantages: Early mover advantage and a strong focus on software development.

- Target markets: Research institutions, enterprises seeking to explore quantum computing applications.

Financial Performance and Investment Outlook (2025)

Predicting Rigetti's financial performance in 2025 involves considering various scenarios:

- Revenue projections: Will depend on customer adoption of their cloud services and the success of their algorithm development efforts.

- Profitability: Reaching profitability will be a key milestone, contingent on revenue growth and cost management.

- Funding rounds: Further funding rounds may be necessary to support continued R&D and expansion.

- Potential valuation: The company's valuation will depend on market perception of their technology and its potential for future growth. Tracking Rigetti stock (if publicly traded) will be crucial for investors.

A Deep Dive into IonQ

IonQ is another leading quantum computing company, specializing in trapped ion qubits and focusing on practical applications.

Business Model and Technology

IonQ's business model centers on providing access to their quantum computers through cloud services and collaborating with various industries to develop applications.

- Strengths: High-fidelity qubits and a strong emphasis on practical applications.

- Weaknesses: Scalability challenges associated with trapped ion technology.

- Competitive advantages: High-quality qubits and a focus on practical problem-solving.

- Target markets: Businesses seeking to solve specific problems using quantum computing, focusing on quantum computing applications.

Financial Performance and Investment Outlook (2025)

Analyzing IonQ's financial performance in 2025 requires consideration of several factors:

- Revenue projections: Growth will depend on customer adoption and the success of collaborations with various industries.

- Profitability: Achieving profitability is a significant goal, reliant on revenue growth and operational efficiency.

- Funding rounds: Further funding may be necessary to fuel research and development.

- Potential valuation: Market perception of its technology and its potential for future growth will influence its valuation. Monitoring IonQ stock is essential.

Comparative Analysis: Rigetti vs. IonQ

A comparison of Rigetti and IonQ highlights the different approaches to building quantum computers.

Technology Comparison

The core difference lies in the underlying qubit technology:

- Superconducting qubits vs. trapped ions: Superconducting qubits offer potential for scalability but face challenges with coherence times and error rates. Trapped ion qubits boast high fidelity but face scalability challenges. This forms the basis of a crucial quantum technology comparison.

- Qubit comparison: Metrics like coherence times, gate fidelities, and error rates need to be carefully considered.

- Scalability: Both companies face challenges in scaling up their systems to a sufficient number of qubits for fault-tolerant computation.

Investment Considerations

Investing in either company involves considering several factors:

- Market capitalization: The size of the company's market capitalization influences risk and return potential.

- Growth potential: The potential for future growth in revenue and market share is a key driver of investment value.

- Technological risks: Technological hurdles and the competitive landscape pose risks. Thorough risk assessment is critical.

- Competitive landscape: The presence of other players in the field affects the competitive dynamics and the potential for success. A strong quantum computing investment comparison helps investors understand the risks and opportunities.

Conclusion: Making Informed Decisions about Quantum Computing Investments

This analysis of Rigetti and IonQ highlights the potential and challenges of quantum computing investments in 2025. Both companies offer unique technological approaches and present varying investment risks and potential rewards. The key takeaway is the importance of thorough due diligence. Before committing funds, investors must understand the technological landscape, market dynamics, and the financial projections of the companies involved.

Key Takeaways:

- Thorough due diligence is crucial before investing in any quantum computing company.

- Understanding the technological advantages and disadvantages of different qubit technologies is essential.

- Analyzing the financial performance and growth potential of target companies is crucial for informed decision-making.

Call to Action: Continue your journey into evaluating quantum computing investments, and remember to consider factors beyond Rigetti and IonQ before making your investment decisions. Deepen your understanding of quantum computing investment opportunities by exploring other promising companies and technologies in this rapidly evolving field.

Featured Posts

-

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Olumlu Haberler Mi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Olumlu Haberler Mi

May 21, 2025 -

6 Revenue Decline For Fremantle In Q1 Budget Cuts Take Their Toll

May 21, 2025

6 Revenue Decline For Fremantle In Q1 Budget Cuts Take Their Toll

May 21, 2025 -

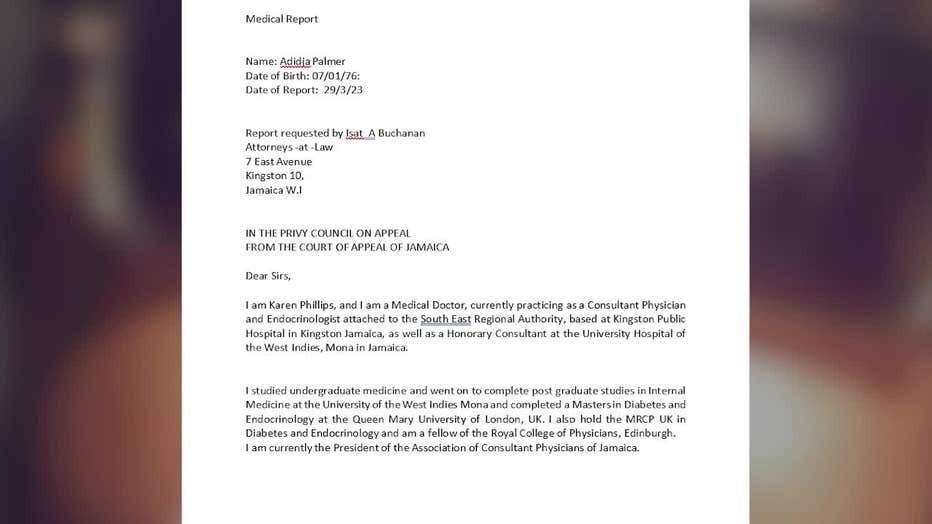

T And T Minister Imposes Restrictions On Vybz Kartels Activities

May 21, 2025

T And T Minister Imposes Restrictions On Vybz Kartels Activities

May 21, 2025 -

Paulina Gretzky Channels Her Inner Soprano In A Stunning Leopard Dress

May 21, 2025

Paulina Gretzky Channels Her Inner Soprano In A Stunning Leopard Dress

May 21, 2025 -

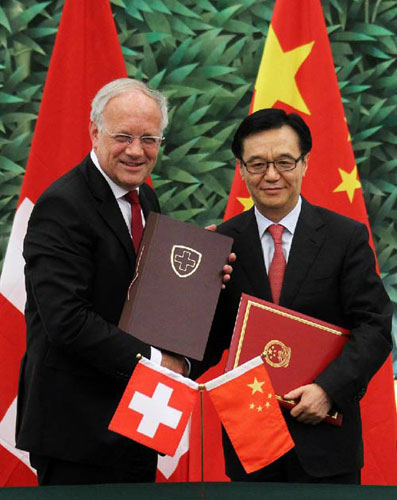

China And Switzerland Urge Dialogue To Resolve Tariff Disputes

May 21, 2025

China And Switzerland Urge Dialogue To Resolve Tariff Disputes

May 21, 2025