Evaluating Uber (UBER) As A Long-Term Investment

Table of Contents

Uber's Business Model and Market Dominance

Uber's success is built upon a multifaceted business model that extends far beyond its initial ride-hailing service. Understanding this model is crucial for any UBER stock analysis focused on long-term potential.

Ride-Sharing Services: The Foundation of Uber's Success

Uber's core ride-hailing service remains its cornerstone. Its global reach, combined with strong brand recognition, gives it a significant competitive advantage in the ride-sharing market.

- Global Reach: Uber operates in numerous countries worldwide, providing a diverse revenue stream and mitigating reliance on any single market.

- Brand Recognition: The Uber name is synonymous with ride-hailing, creating instant trust and accessibility for both riders and drivers.

- Technological Advancements: Continuous technological improvements to its app, including features like fare splitting and real-time tracking, enhance the user experience. The seamless integration with Uber Eats further strengthens its platform.

- Network Effects: The larger Uber's network of drivers and riders becomes, the more valuable the platform becomes for each user. This creates a powerful barrier to entry for competitors. Analyzing Uber's market share within specific regions offers valuable insights into its competitive strength in the ride-sharing market.

Uber Eats and Delivery Services: A Growing Revenue Stream

Uber Eats, Uber's food delivery service, has experienced rapid growth, becoming a significant contributor to the company's overall revenue. However, competition from established players like DoorDash and Grubhub presents a challenge.

- Market Penetration: Uber Eats has successfully penetrated numerous markets, leveraging Uber's existing driver network and brand recognition.

- Competition: The intensely competitive food delivery market requires continuous innovation and strategic marketing to maintain market share. Direct comparison with competitors like DoorDash and Grubhub in specific markets is essential for a complete Uber Eats investment analysis.

- Future Expansion Plans: Uber's plans for expanding Uber Eats into new markets and offering additional delivery services (e.g., grocery delivery) will significantly impact future revenue streams.

Autonomous Vehicles and Future Technologies: Shaping Uber's Future

Uber's investments in autonomous vehicle technology represent a significant long-term bet. While facing regulatory hurdles and technological challenges, the successful implementation of self-driving technology could revolutionize the company's operations and significantly reduce costs.

- Technological Advancements: Uber's ongoing research and development in autonomous driving technology could significantly improve efficiency and profitability in the future.

- Potential Cost Savings: Self-driving vehicles could eliminate the significant cost associated with employing human drivers.

- Regulatory Hurdles: The regulatory landscape surrounding autonomous vehicles varies widely across jurisdictions, presenting significant uncertainty.

- Timeline for Implementation: The timeline for widespread adoption of self-driving technology remains uncertain, impacting the potential return on investment in this area.

Financial Performance and Growth Prospects

Analyzing Uber's financial performance is crucial for evaluating its long-term investment potential. Looking at historical data and future projections offers valuable insight into UBER revenue growth and the overall health of the company.

Revenue and Profitability: A Key Indicator for Investors

Uber's financial statements provide a wealth of data regarding its revenue streams, operating margins, debt levels, and cash flow. These metrics are essential for assessing the company's overall financial health and its ability to generate profit. Examining Uber's profitability trends offers insights into the efficiency of its operations and its ability to manage costs. Key financial ratios, such as the debt-to-equity ratio and the operating margin, provide valuable context.

- Revenue Streams: Diversification of revenue streams through ride-sharing, food delivery, and freight services mitigates reliance on any single area.

- Operating Margins: Improving operating margins is crucial for long-term profitability and investor confidence.

- Debt Levels: High debt levels could pose a risk to the company’s financial stability during economic downturns.

- Cash Flow: Positive cash flow is essential for reinvestment in growth initiatives and for weathering economic uncertainty.

Growth Strategies and Expansion Plans: Driving Future Growth

Uber's strategic initiatives, including expansion into new markets and the development of new services, are key drivers of future growth. Analyzing these plans provides a crucial perspective on the company’s long-term potential.

- International Expansion: Expanding into underserved markets presents significant opportunities for revenue growth.

- New Service Offerings: Diversifying into new areas, such as freight transportation or logistics, can reduce reliance on the core ride-sharing business.

- Strategic Partnerships: Collaborations with other companies can open new markets and enhance existing services.

Risks and Challenges Facing Uber

Despite its impressive growth, Uber faces several significant risks and challenges that could impact its long-term prospects. A thorough Uber (UBER) long-term investment analysis must consider these potential obstacles.

Regulatory Scrutiny and Legal Challenges: Navigating a Complex Landscape

The ride-sharing industry faces intense regulatory scrutiny, with ongoing debates about driver classification and safety regulations. These regulatory uncertainties could significantly impact Uber's operational costs and profitability.

- Driver Classification: The legal battles surrounding the classification of drivers as independent contractors versus employees significantly impact Uber’s labor costs.

- Safety Regulations: Increasingly stringent safety regulations could lead to higher operating costs.

- Competition from Government-Backed Services: The emergence of government-backed ride-sharing or transportation services could increase competition and pressure margins.

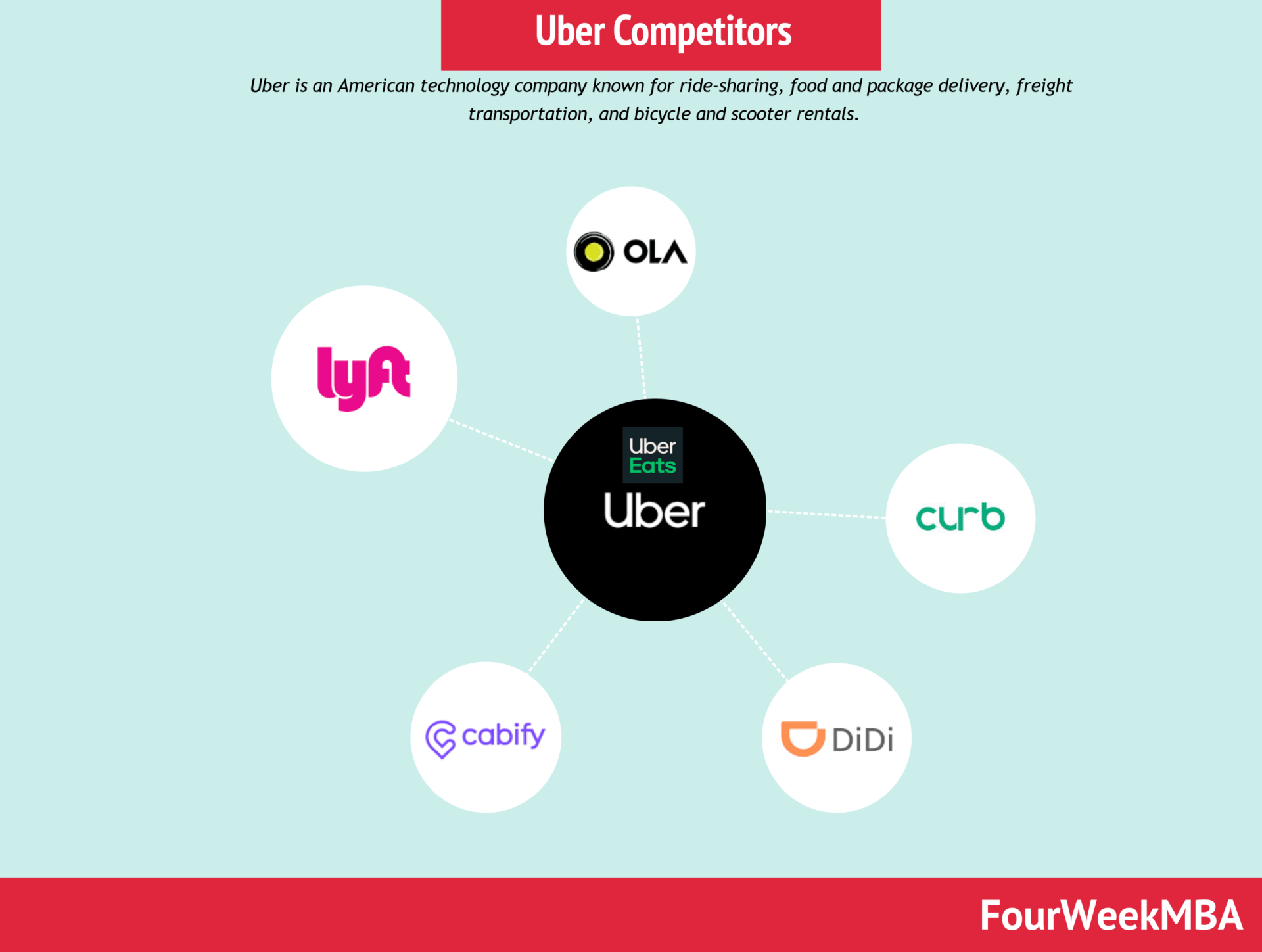

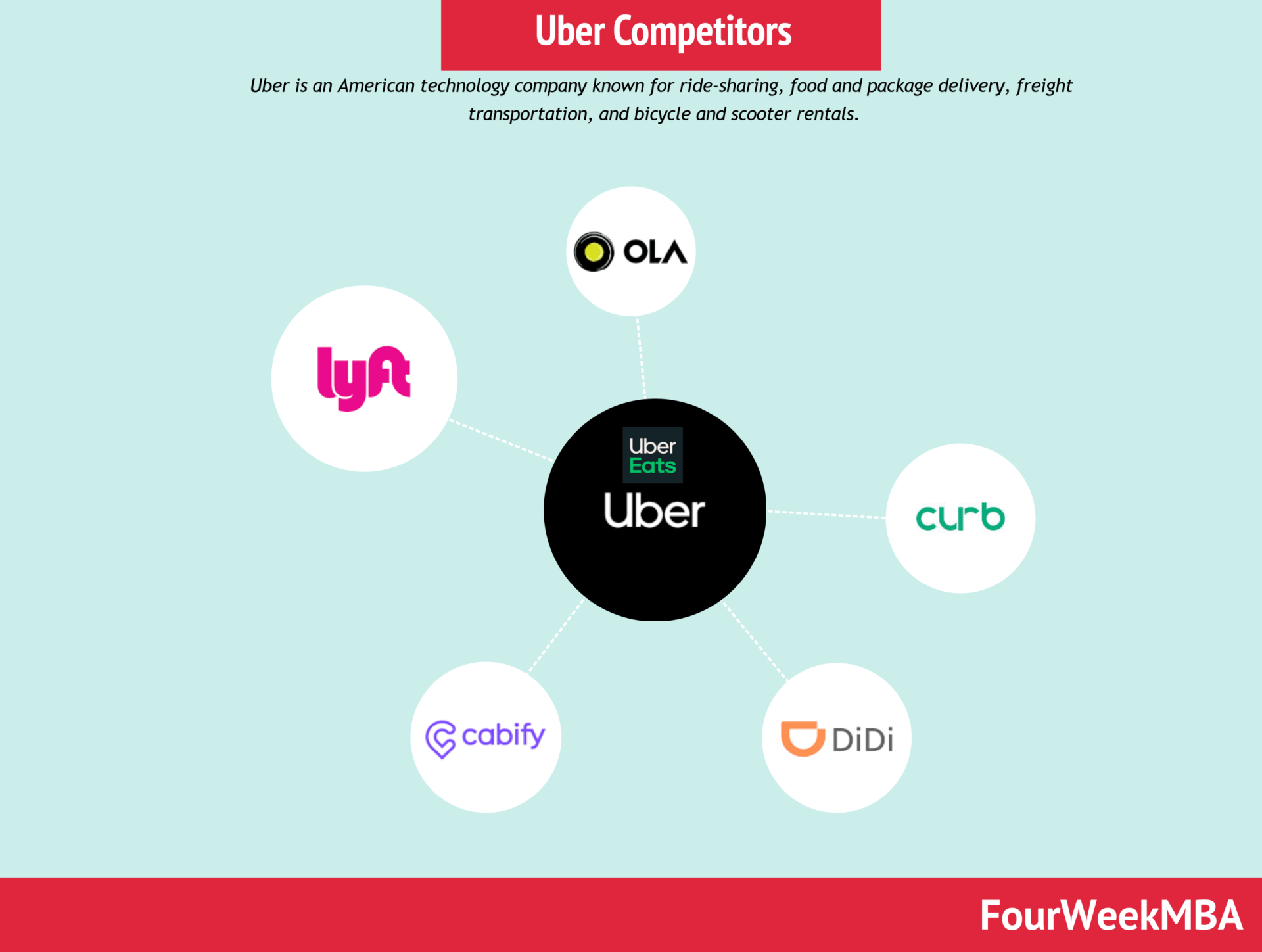

Competition and Market Saturation: Maintaining a Competitive Edge

The ride-sharing market is fiercely competitive, with established players like Lyft and potential new entrants constantly vying for market share. Market saturation in established markets also presents a significant challenge.

- Competition from Lyft: Lyft remains a major competitor, especially in the US market. A direct comparison of Uber and Lyft’s market share and strategies is crucial.

- Other Ride-Sharing Services: The emergence of smaller, regional ride-sharing services could further fragment the market.

- Public Transportation: The increasing availability and affordability of public transportation could impact the demand for ride-sharing services.

Economic Factors and External Risks: Navigating Global Uncertainty

Macroeconomic factors, such as recessions, fuel price fluctuations, and geopolitical events, could significantly impact Uber's financial performance and long-term prospects.

- Fuel Costs: Fluctuations in fuel prices directly impact driver earnings and Uber's operational costs.

- Economic Downturns: During economic recessions, demand for ride-sharing and delivery services may decline, impacting Uber's revenue.

- Geopolitical Instability: Geopolitical events can disrupt operations in affected regions and create uncertainty for investors.

Conclusion: Should You Invest in Uber (UBER) Long-Term?

Uber's dominant position in the ride-sharing market and its expansion into the lucrative food delivery sector present compelling reasons for long-term investment. However, significant risks, including regulatory uncertainty, intense competition, and exposure to macroeconomic factors, must be carefully considered. While the potential rewards are substantial, particularly with the potential success of autonomous vehicle technology, the path to long-term profitability is not without its challenges. Therefore, a balanced assessment of both the opportunities and risks is essential before making any investment decision.

Conduct thorough research and consult with a financial advisor before investing in Uber (UBER) or any other stock. Understanding the risks and potential rewards associated with an Uber (UBER) long-term investment is paramount to making an informed decision. Explore additional resources, including financial news sites and company filings, to deepen your understanding of this dynamic company and its position within the evolving transportation and delivery industries. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025 -

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025 -

The Xrp Market Recovery Hopes And Derivatives Market Challenges

May 08, 2025

The Xrp Market Recovery Hopes And Derivatives Market Challenges

May 08, 2025 -

Is This Hot New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025

Is This Hot New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025 -

Path Of Exile 2 What To Know About Rogue Exiles

May 08, 2025

Path Of Exile 2 What To Know About Rogue Exiles

May 08, 2025

Latest Posts

-

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Len Tieng Doi Cong Bang

May 09, 2025

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Len Tieng Doi Cong Bang

May 09, 2025 -

Can Lam Gi Sau Vu Bao Mau Tat Tre Em O Tien Giang Dam Bao An Toan Cho Tre Em

May 09, 2025

Can Lam Gi Sau Vu Bao Mau Tat Tre Em O Tien Giang Dam Bao An Toan Cho Tre Em

May 09, 2025 -

Wfmy News 2 Reports Nc Daycare Suspended By The State

May 09, 2025

Wfmy News 2 Reports Nc Daycare Suspended By The State

May 09, 2025 -

Brekelmans India Strategie Maximaliseren Van Samenwerking

May 09, 2025

Brekelmans India Strategie Maximaliseren Van Samenwerking

May 09, 2025 -

Tien Giang Phan Ung Manh Me Truoc Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025

Tien Giang Phan Ung Manh Me Truoc Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025