Exceptional Growth: BNP Paribas Equity Trading Hits Record Levels

Table of Contents

Record-Breaking Trading Volumes

BNP Paribas has witnessed a substantial surge in equity trading volumes, surpassing previous years' figures by a significant margin. While precise figures may be subject to internal reporting cycles, sources indicate a double-digit percentage increase in trading activity. This phenomenal growth can be attributed to several key factors:

- Increased activity in specific market sectors: The technology and energy sectors have experienced particularly robust trading activity, driven by both investor optimism and volatility within these markets. This surge in specific sectors significantly boosted overall trading volumes.

- Impact of global economic events on trading volume: Periods of global economic uncertainty and volatility often lead to increased trading activity as investors adjust their portfolios. BNP Paribas has successfully capitalized on these periods, demonstrating its ability to navigate challenging market conditions.

- Growth in both institutional and retail client trading: The increase in trading volumes is not limited to a single client segment; BNP Paribas has seen growth across both institutional and retail clients, showcasing the broad appeal of its services and offerings.

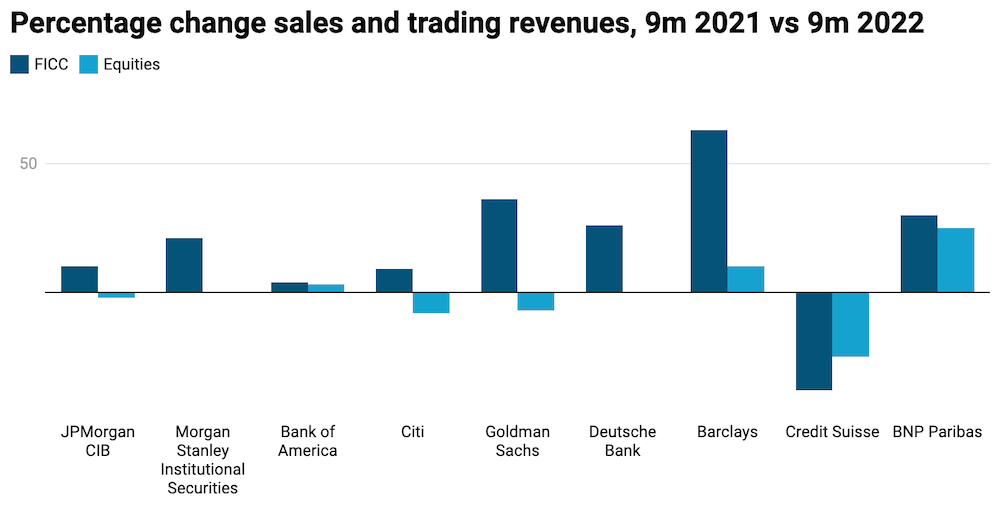

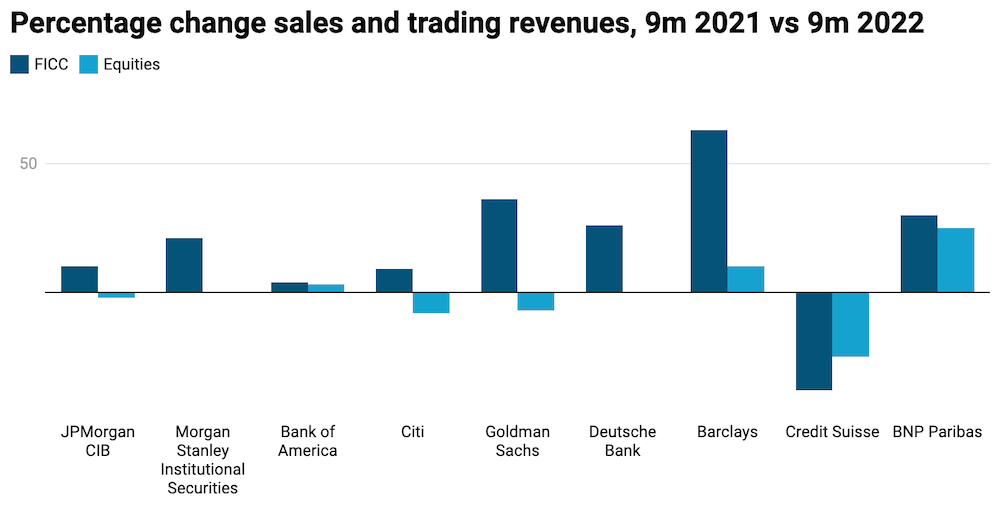

- Comparison to competitor performance in equity trading: While precise competitor data is confidential, internal analyses suggest that BNP Paribas’ growth significantly outpaces many key competitors in the equity trading market. This highlights the effectiveness of its strategic initiatives.

Strategic Initiatives Driving Success

BNP Paribas' success isn't accidental; it stems from a series of well-executed strategic initiatives:

- Investment in advanced trading technologies: BNP Paribas has significantly invested in cutting-edge technologies, including algorithmic trading and high-frequency trading systems. This investment has resulted in enhanced speed, efficiency, and accuracy in executing trades.

- Expansion of client base and geographic reach: The bank has actively pursued expansion into new markets and diversified its client base, broadening its access to a wider range of trading opportunities.

- Enhanced customer service and relationship management: A focus on superior customer service and proactive relationship management has fostered strong client loyalty and attracted new clients to BNP Paribas' platform.

- Successful recruitment and retention of top trading talent: Attracting and retaining experienced and skilled traders is crucial. BNP Paribas has succeeded in building a strong team of experts, driving innovation and execution.

- Focus on specific niche markets and investment strategies: Rather than a broad approach, BNP Paribas has targeted specific niche markets and investment strategies, allowing for more specialized expertise and higher returns.

Technological Advancements

The role of technology in BNP Paribas' success cannot be overstated. Investments in AI and machine learning are crucial components of its trading strategy. These technologies improve predictive modeling, risk management, and algorithmic trading capabilities, leading to more informed decisions and improved profitability. The integration of these advanced technologies enhances operational efficiency and reduces manual intervention.

Client Acquisition and Retention

BNP Paribas has implemented several effective strategies for client acquisition and retention: personalized service, tailored investment solutions, competitive pricing, and proactive communication. Building strong, long-term relationships with clients has been key to fostering loyalty and driving sustained growth.

Market Conditions and Opportunities

Several market conditions have contributed to BNP Paribas' success:

- Increased market volatility creating trading opportunities: Periods of heightened market volatility present opportunities for skilled traders, and BNP Paribas has effectively leveraged these opportunities.

- Impact of regulatory changes on the equity trading landscape: Navigating regulatory changes effectively is vital. BNP Paribas has demonstrated its ability to adapt and thrive within the evolving regulatory environment.

- Beneficial macroeconomic factors influencing investment decisions: Favorable macroeconomic conditions and investor confidence have contributed to increased trading activity.

- Emerging market opportunities contributing to growth: Expansion into emerging markets provides access to new opportunities and further fuels growth.

Future Outlook and Implications

The future outlook for BNP Paribas' equity trading division remains positive. Continued growth and expansion are expected, driven by technological advancements, strategic partnerships, and exploration of new market segments.

- Potential for continued growth and expansion: BNP Paribas is well-positioned for sustained growth, building upon its current successes.

- Challenges and risks facing the division: The equity trading landscape is competitive, and risks associated with market volatility and regulatory changes must be proactively managed.

- Strategic plans for maintaining market leadership: BNP Paribas will continue to invest in technology, talent, and strategic partnerships to maintain its leadership position.

- Long-term implications for BNP Paribas' overall financial performance: The strong performance of the equity trading division significantly contributes to BNP Paribas' overall financial health and stability.

Conclusion:

This article has highlighted the exceptional growth of BNP Paribas' equity trading division, driven by a combination of strategic initiatives, technological advancements, and favorable market conditions. The record trading volumes underscore BNP Paribas’ strong market position and commitment to innovation within the financial sector. The bank’s success is a testament to its strategic vision and effective execution.

Call to Action: Learn more about BNP Paribas' success in equity trading and its innovative approaches to investment strategies. Stay updated on the latest developments in BNP Paribas equity trading by [link to BNP Paribas website or relevant news source]. Explore the opportunities in BNP Paribas Equity Trading and witness the exceptional growth firsthand.

Featured Posts

-

Okc Road Conditions Watch Out For Icy Patches And Accidents

Apr 25, 2025

Okc Road Conditions Watch Out For Icy Patches And Accidents

Apr 25, 2025 -

The Ubiquitous You Tube Impact And Implications For Content Creators And Consumers

Apr 25, 2025

The Ubiquitous You Tube Impact And Implications For Content Creators And Consumers

Apr 25, 2025 -

Basel Greenlights Funding For Eurovision Village 2025

Apr 25, 2025

Basel Greenlights Funding For Eurovision Village 2025

Apr 25, 2025 -

Late Zappos Ceos Will A Twist In The Tale Of Tony Hsiehs Legacy

Apr 25, 2025

Late Zappos Ceos Will A Twist In The Tale Of Tony Hsiehs Legacy

Apr 25, 2025 -

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Ritoriki

Apr 25, 2025

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Ritoriki

Apr 25, 2025

Latest Posts

-

When And Where To Watch The Eurovision Song Contest 2025 In Australia

Apr 30, 2025

When And Where To Watch The Eurovision Song Contest 2025 In Australia

Apr 30, 2025 -

The Implications Of Lars Klingbeils Potential Appointment As German Finance Minister

Apr 30, 2025

The Implications Of Lars Klingbeils Potential Appointment As German Finance Minister

Apr 30, 2025 -

Spds Coalition Challenges Addressing Youth Anger In Germany

Apr 30, 2025

Spds Coalition Challenges Addressing Youth Anger In Germany

Apr 30, 2025 -

Confirmed Uk Eurovision 2025 Singer Revealed On Bbc Radio

Apr 30, 2025

Confirmed Uk Eurovision 2025 Singer Revealed On Bbc Radio

Apr 30, 2025 -

Eurovision 2025 The Uks Confirmed Entry A Familiar Face

Apr 30, 2025

Eurovision 2025 The Uks Confirmed Entry A Familiar Face

Apr 30, 2025