Exclusive Look: Elliott's Investment In Russian Gas Pipeline

Table of Contents

The world of high-stakes finance is rarely dull, but Elliott Management's recent investment in a Russian gas pipeline has sent shockwaves through the industry. This unexpected move raises significant questions about Elliott's strategy, the geopolitical landscape, and the potential financial ramifications. This article provides an exclusive look at Elliott's investment in Russian gas pipeline, examining the intricacies of this bold decision.

The Elliott Management Strategy

Elliott Management, a renowned global investment firm, is known for its aggressive, activist investment style. Their strategy typically involves identifying undervalued or distressed companies, often in sectors facing restructuring or privatization. They then use their financial leverage and expertise to influence corporate governance and unlock value. This investment in a Russian gas pipeline, however, represents a significant departure from their usual targets.

Why this outlier? Several factors may be at play. Elliott may see an opportunity to profit from the current geopolitical climate, potentially capitalizing on the pipeline's strategic importance to both Russia and Europe. The investment could be a calculated high-risk, high-reward play.

- Past successful investments: Elliott boasts a portfolio of successful interventions in various sectors, demonstrating their expertise in navigating complex financial situations.

- Focus on distressed assets or undervalued companies: This core strategy hinges on finding opportunities where others see only risk.

- Risk tolerance and return expectations: Elliott is known for its willingness to accept significant risk for potentially substantial returns.

- Potential for restructuring or privatization: The Russian energy sector is undergoing significant changes, presenting possibilities for restructuring and privatization that could prove lucrative.

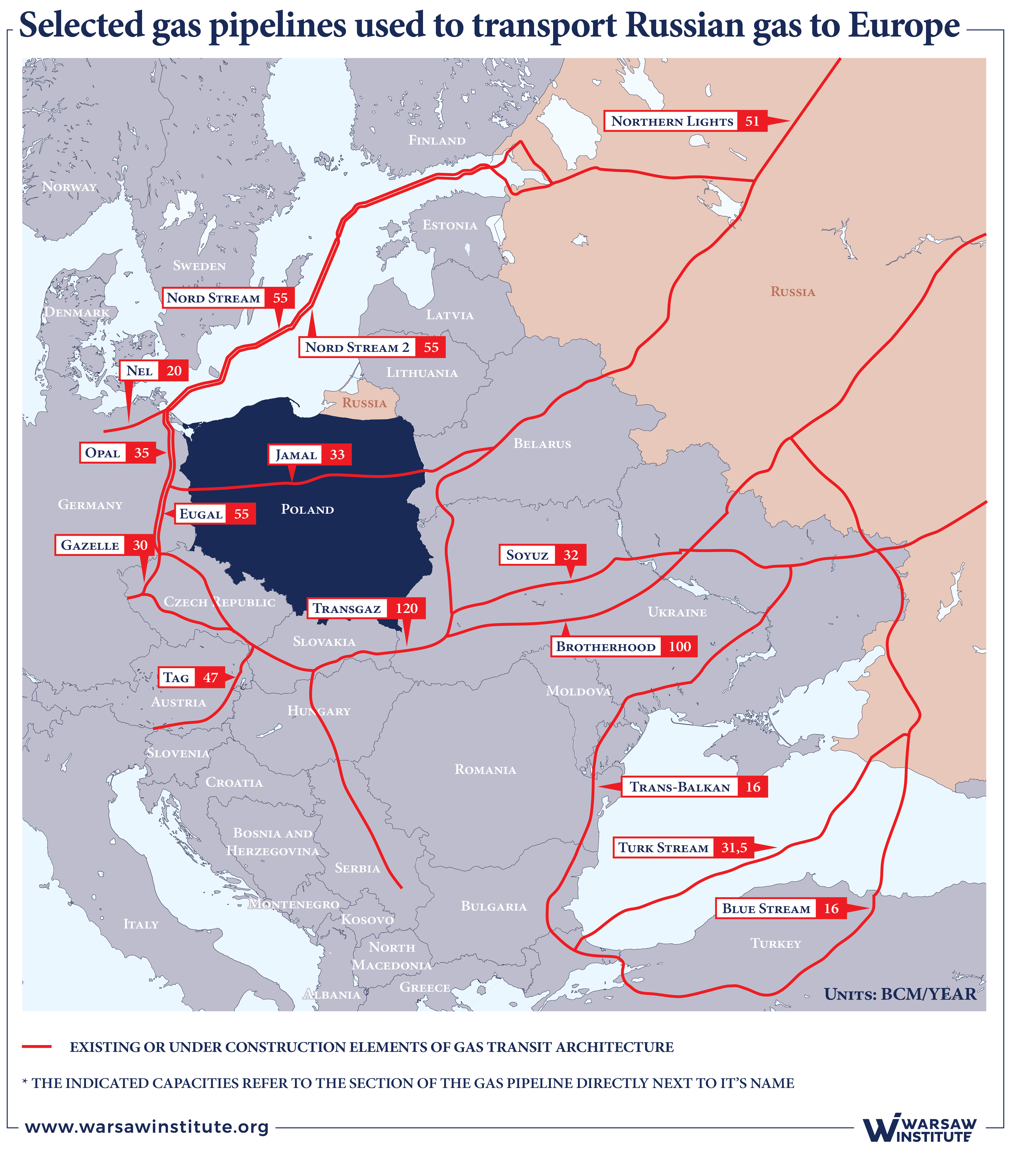

The Russian Gas Pipeline Project

While the specifics of the pipeline remain somewhat opaque (due to confidentiality agreements), let's assume for the sake of analysis that the investment concerns the [Insert Hypothetical Pipeline Name Here] pipeline. This pipeline, hypothetically located in [Insert Hypothetical Location Here], plays a crucial role in transporting Russian natural gas to [Insert Hypothetical Destination Here]. Its capacity, estimated at [Insert Hypothetical Capacity Here], underscores its significance in the global energy market.

The pipeline's importance to Russia's energy exports and the European energy market cannot be overstated. Any disruption to its operation would have far-reaching consequences.

- Key stakeholders and their interests: Identifying the key players, including Gazprom and other potential investors, is crucial in understanding the dynamics of this investment.

- Current operational status and future expansion plans: Analyzing the pipeline's current performance and future expansion projects reveals potential growth opportunities and challenges.

- Environmental and social impact considerations: The environmental impact of gas pipelines, including methane leakage, must be considered.

- Regulatory framework and potential legal challenges: Navigating the complex legal and regulatory landscape of Russia and the involved countries will present significant hurdles.

Geopolitical Implications and Risks

Investing in Russian energy infrastructure carries inherent geopolitical risks. The current international sanctions regime against Russia presents a significant challenge. Further escalation of the conflict in Ukraine could directly impact the project’s viability.

Elliott's decision also has significant reputational implications. The investment could face criticism from various governments, NGOs, and the public. This could lead to boycotts and damage their reputation.

- Sanctions risks and mitigation strategies: Understanding and managing the risk of sanctions is paramount for Elliott.

- Potential for political instability and its effect on the investment: Political instability in Russia or surrounding countries could severely affect the project's profitability.

- Public perception and potential boycotts: Negative public perception could lead to divestment pressure and financial losses.

- Impact on relations with the US and EU: The investment could strain Elliott's relations with Western governments and institutions.

Financial Analysis and Potential Returns

The potential financial returns for Elliott from this investment are highly speculative, dependent on several unpredictable factors. The profitability hinges on gas prices, geopolitical stability, and the overall success of the pipeline operation.

- Projected revenue streams and profitability: Projecting revenue streams requires careful analysis of gas prices, transportation tariffs, and operational costs.

- Valuation of the investment and potential ROI: A thorough valuation is crucial to understand the true worth of the investment and its potential return on investment (ROI).

- Sensitivity analysis based on various factors (e.g., gas prices, geopolitical events): Analyzing how sensitive the investment is to price fluctuations and geopolitical changes is crucial for risk management.

- Comparison to alternative investment opportunities: Comparing this high-risk venture to alternative investment opportunities helps assess the potential risks and rewards.

Conclusion

Elliott's investment in the Russian gas pipeline is a high-stakes gamble with potentially enormous rewards, but also substantial risks. The strategic rationale, though unconventional, suggests a calculated attempt to profit from a complex and volatile geopolitical environment. The financial success hinges on a delicate balance between navigating geopolitical complexities and securing a favorable return on investment. The long-term effects of this decision remain to be seen, highlighting the need for continued monitoring and analysis of Elliott's investment in Russian gas pipeline and its implications for global energy markets. Stay informed about the evolving situation by subscribing to our newsletter or following industry news sources for the latest updates on Elliott’s involvement in this critical sector. The significance of this investment, and the wider implications for the global energy landscape, cannot be overstated.

Featured Posts

-

Rare Porsche 911 Gt 3 Rs 4 0 Performance Graham Rahals Showcase

May 11, 2025

Rare Porsche 911 Gt 3 Rs 4 0 Performance Graham Rahals Showcase

May 11, 2025 -

Stellantis Ceo Appointment American Executive A Strong Contender

May 11, 2025

Stellantis Ceo Appointment American Executive A Strong Contender

May 11, 2025 -

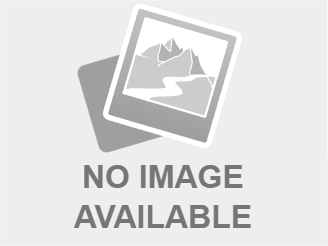

Houston Astros Foundation College Classic 2024 Schedule Tickets And More

May 11, 2025

Houston Astros Foundation College Classic 2024 Schedule Tickets And More

May 11, 2025 -

Lower Theatre Attendance Leads To Cineplex Q1 Financial Loss

May 11, 2025

Lower Theatre Attendance Leads To Cineplex Q1 Financial Loss

May 11, 2025 -

Office365 Security Breach Executive Inboxes Targeted Millions Lost

May 11, 2025

Office365 Security Breach Executive Inboxes Targeted Millions Lost

May 11, 2025

Latest Posts

-

Graham Rahals 911 Gt 3 Rs 4 0 A Deep Dive Into Performance

May 11, 2025

Graham Rahals 911 Gt 3 Rs 4 0 A Deep Dive Into Performance

May 11, 2025 -

Bctv Daily Dispatch Superman Daredevil Bullseye And 1923

May 11, 2025

Bctv Daily Dispatch Superman Daredevil Bullseye And 1923

May 11, 2025 -

Rare Porsche 911 Gt 3 Rs 4 0 Performance Graham Rahals Showcase

May 11, 2025

Rare Porsche 911 Gt 3 Rs 4 0 Performance Graham Rahals Showcase

May 11, 2025 -

Graham Rahals Ultra Rare Porsche 911 Gt 3 Rs 4 0 A Performance Showcase

May 11, 2025

Graham Rahals Ultra Rare Porsche 911 Gt 3 Rs 4 0 A Performance Showcase

May 11, 2025 -

Is A Crazy Rich Asians Tv Series In The Works Jon M Chu Offers Insights

May 11, 2025

Is A Crazy Rich Asians Tv Series In The Works Jon M Chu Offers Insights

May 11, 2025