Exploring The Candidacy Of A Canadian Billionaire As Warren Buffett's Heir

Table of Contents

Identifying Potential Canadian Billionaire Candidates

Finding a suitable successor to Warren Buffett requires identifying individuals with exceptional business acumen, a similar investment philosophy, and the ability to manage a vast and complex conglomerate. While no Canadian billionaire has explicitly declared their interest in leading Berkshire Hathaway, speculation is inevitable. Let's consider some hypothetical candidates based on their public profiles and business achievements, keeping in mind the unique demands of the role:

-

Candidate A (Hypothetical): Let's imagine a Canadian billionaire known for their significant holdings in the technology sector. This hypothetical individual, with a net worth exceeding $X billion, has demonstrated a shrewd understanding of disruptive technologies and a long-term investment strategy. Their strengths lie in identifying high-growth potential and fostering innovation. However, their relative lack of experience in traditional value investing, a cornerstone of Berkshire Hathaway’s success, could be a significant weakness.

-

Candidate B (Hypothetical): This hypothetical Canadian billionaire has built a vast empire through astute investments in resource-based industries. With a net worth of approximately $Y billion, they possess a deep understanding of global markets and possess a more conservative investment style. Their strengths include risk management and a proven track record in long-term value creation. However, adapting to the diversified portfolio of Berkshire Hathaway, which spans far beyond natural resources, would present a significant challenge.

The rarity of a non-American inheriting such a prominent role cannot be overstated. Berkshire Hathaway is deeply rooted in American business culture and history. A Canadian successor would need to demonstrate exceptional leadership skills and an ability to navigate complex cultural and business nuances.

Assessing the Qualifications: A Comparison with Buffett's Style

To truly assess the suitability of any potential Canadian Billionaire Warren Buffett Heir, we must compare their approaches to Buffett's renowned strategies:

-

Value Investing Principles: Buffett's success is built on his unwavering commitment to value investing. A potential successor must demonstrate a similar understanding of intrinsic value, patience, and a long-term perspective. Can the hypothetical candidates demonstrate a consistent track record of identifying undervalued assets and capitalizing on long-term growth?

-

Long-Term Perspective: Buffett's famously patient approach to investing is a key element of his success. A potential successor must similarly resist the allure of short-term gains and focus on building sustainable, long-term value. Do the potential candidates demonstrate this long-term vision in their own investment portfolios?

-

Corporate Governance: Berkshire Hathaway is known for its strong corporate governance and ethical business practices. A potential successor must uphold these principles rigorously. How do the candidates' approaches to corporate governance and ethical conduct compare to Buffett's standards?

-

Ethical Considerations: Berkshire Hathaway's success is underpinned by its strong ethical reputation. Any potential successor needs to demonstrate a similar commitment to responsible business practices. Have the candidates demonstrated a commitment to ethical and sustainable business practices throughout their careers?

Challenges and Obstacles for a Canadian Successor

The selection of a non-American successor would present considerable challenges:

-

Cultural Differences in Business Practices: Navigating different business cultures and regulatory environments would demand exceptional adaptability.

-

Potential Regulatory Hurdles and Legal Complexities: Cross-border regulations and legal complexities could hinder the smooth transition of leadership.

-

Reactions from Shareholders and the Business Community: A non-American successor would face scrutiny from shareholders and the broader business community. Maintaining trust and confidence would be critical.

-

The Importance of Maintaining the Berkshire Hathaway Brand and Reputation: The success of the transition relies on maintaining the impeccable reputation and brand image of Berkshire Hathaway.

The Implications for Berkshire Hathaway's Future

The choice of a Canadian billionaire as Warren Buffett’s successor would have profound implications:

-

Potential Changes in Investment Focus and Portfolio Diversification: A Canadian successor might bring a different investment perspective, potentially leading to changes in the company's investment focus and portfolio diversification.

-

Impact on Berkshire Hathaway's International Expansion Plans: Their expertise in global markets could accelerate international expansion.

-

Effects on Shareholder Value and Company Culture: The leadership transition could impact shareholder value and company culture, requiring a careful balancing act.

-

The Long-Term Sustainability of Berkshire Hathaway under New Leadership: The long-term sustainability of Berkshire Hathaway under new leadership hinges on the successor's ability to maintain and build upon the company's legacy.

Conclusion

The possibility of a Canadian Billionaire Warren Buffett Heir presents both exciting opportunities and significant challenges for Berkshire Hathaway. While the selection process will undoubtedly favor candidates aligning closely with Buffett's values and investment style, a Canadian successor could potentially bring fresh perspectives and expertise. The key lies in finding a leader who embodies the same principles of long-term value creation, ethical conduct, and exceptional management. Further research into the investment strategies and business philosophies of prominent Canadian billionaires is encouraged. We invite you to share your thoughts on the candidacy of a Canadian billionaire as Warren Buffett's heir and engage in a discussion using relevant keywords like "Canadian Billionaire Berkshire Hathaway," "Warren Buffett Succession," and "Canadian Billionaire Investment Strategy." Leave your comments below!

Featured Posts

-

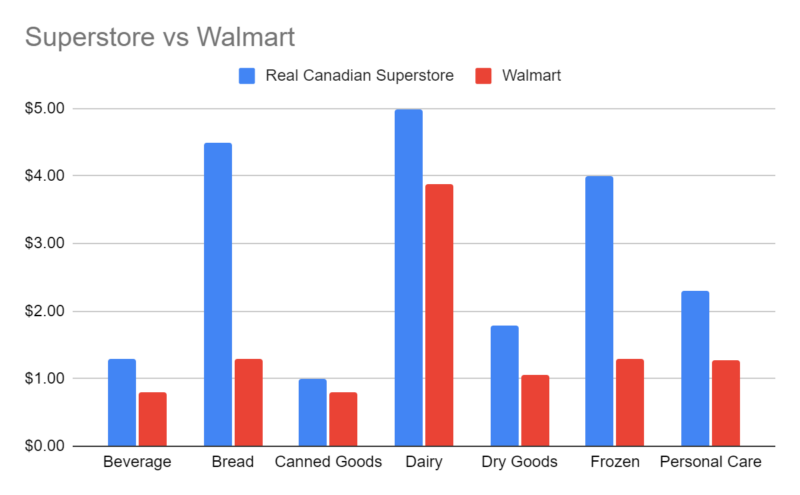

Compare Elizabeth Arden Prices Walmart Vs Other Retailers

May 09, 2025

Compare Elizabeth Arden Prices Walmart Vs Other Retailers

May 09, 2025 -

5 Factors Driving Todays Significant Rise In The Indian Stock Market Sensex And Nifty

May 09, 2025

5 Factors Driving Todays Significant Rise In The Indian Stock Market Sensex And Nifty

May 09, 2025 -

Is Daycare Always Bad For Kids A Working Parents Perspective

May 09, 2025

Is Daycare Always Bad For Kids A Working Parents Perspective

May 09, 2025 -

Red Wings Playoff Hopes Fade After Vegas Defeat

May 09, 2025

Red Wings Playoff Hopes Fade After Vegas Defeat

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Analyse En Perspectieven

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Analyse En Perspectieven

May 09, 2025