Extreme Price Hike: Broadcom's VMware Acquisition Faces AT&T Backlash

Table of Contents

The Details of the VMware Acquisition and the Price Hike

Broadcom's Acquisition Strategy

Broadcom, a prominent semiconductor company, has a history of strategic acquisitions aimed at expanding its market reach and product portfolio. The VMware acquisition, valued at approximately $61 billion, represents one of Broadcom's largest ventures to date. Their rationale centers on integrating VMware's virtualization and cloud technologies into their existing offerings, aiming for significant synergies and enhanced market dominance.

- Acquisition Cost: Approximately $61 billion, a substantial investment reflecting VMware's market position.

- Broadcom's Market Capitalization: The acquisition significantly boosted Broadcom's overall market capitalization, solidifying its position as a tech giant.

- VMware's Market Share: VMware holds a substantial market share in virtualization and cloud infrastructure, making it a highly attractive target for acquisition.

- Projected Synergies: Broadcom anticipates significant cost savings and revenue growth through integrating VMware's technology into its existing product lines.

The Price Increase Concerns

The primary source of contention surrounding the Broadcom-VMware deal is the anticipated price increase for VMware's products and services. Industry analysts predict substantial hikes, potentially impacting businesses heavily reliant on VMware solutions for their IT infrastructure. These increases could significantly strain IT budgets and force businesses to re-evaluate their technology strategies.

- Specific Examples of Price Hikes: While specific numbers remain undisclosed, leaked internal documents and analyst predictions point to double-digit percentage increases across the VMware product line.

- Percentage Increase: Early estimates suggest price increases ranging from 10% to 30% or even more, depending on the specific product and service.

- Projected Cost for Various Businesses: The overall impact varies greatly depending on business size and reliance on VMware solutions, but even small increases can add up to substantial costs over time.

- Comparison with Competitor Pricing: Concerns are rising that post-acquisition price increases will leave VMware significantly more expensive than its competitors, limiting business choices and potentially stifling innovation.

AT&T's Opposition and Antitrust Concerns

AT&T's Arguments Against the Acquisition

AT&T, a major telecommunications company, has voiced strong opposition to the Broadcom-VMware acquisition, citing significant concerns about the potential for reduced competition and inflated prices. AT&T's reliance on VMware solutions makes it particularly vulnerable to the anticipated price increases.

- AT&T's Dependency on VMware: AT&T utilizes VMware's technology extensively in its network infrastructure, making it directly affected by any price hikes.

- Fear of Reduced Competition: The merger reduces the number of major players in the virtualization and cloud infrastructure market, potentially leading to less innovation and higher prices.

- Potential for Monopolistic Practices: Critics worry that Broadcom's increased market power could lead to monopolistic practices, harming consumers and businesses.

- Impact on AT&T's Services and Costs: The increased costs associated with VMware products will directly translate into higher operational expenses for AT&T and could impact their service offerings and pricing.

Antitrust Scrutiny and Regulatory Investigations

The acquisition is currently under intense scrutiny by antitrust authorities worldwide, including the Federal Trade Commission (FTC) in the US and similar regulatory bodies in the EU. These investigations aim to determine whether the merger violates antitrust laws by significantly reducing competition.

- Agencies Involved in Investigations: The FTC, the European Commission, and other international regulatory bodies are actively investigating the potential antitrust implications of the Broadcom-VMware merger.

- Potential Legal Challenges: Legal challenges and lawsuits are possible, depending on the findings of the ongoing investigations.

- Timeline for Regulatory Decisions: The regulatory process is expected to take several months, potentially leading to delays or even a block of the acquisition.

- Possible Outcomes: Possible outcomes range from unconditional approval to conditional approval with stipulations, or even complete rejection of the merger.

Potential Impacts on the Technology Market

Impact on Businesses

The Broadcom-VMware acquisition has far-reaching implications for businesses across various sectors. Increased prices for essential virtualization and cloud technologies will impact IT budgets, potentially hindering innovation and forcing businesses to make difficult choices.

- Increased IT Costs for Businesses: Higher VMware prices will directly increase IT expenditure for businesses, potentially reducing investments in other crucial areas.

- Reduced Innovation: Reduced competition could stifle innovation in the virtualization and cloud infrastructure market, limiting the development of new technologies and features.

- Limited Choices for Businesses: Fewer vendors mean businesses will have less choice, potentially leading to vendor lock-in and reducing their bargaining power.

- Potential for Vendor Lock-in: Businesses could become locked into using VMware's products, reducing flexibility and increasing their dependence on Broadcom.

Impact on Consumers

While the direct impact might not be immediately apparent, the price hikes stemming from the Broadcom-VMware acquisition could indirectly affect consumers through increased costs for goods and services. Companies using VMware technologies may pass on these increased costs to consumers.

- Increased Prices for Consumer Products and Services: Businesses may increase prices for consumer goods and services to offset the higher costs of VMware technology.

- Reduced Product Features: Companies might reduce product features or services to compensate for increased IT costs.

- Slower Technological Innovation for Consumers: Reduced competition and innovation in the underlying technology could lead to slower advancements and fewer choices for consumers.

Conclusion

Broadcom's acquisition of VMware, while strategically sound for Broadcom, presents significant challenges for the technology market. The anticipated extreme price hikes, coupled with AT&T's strong opposition and ongoing antitrust investigations, highlight the potential for reduced competition, stifled innovation, and increased costs for businesses and consumers. The long-term consequences of this merger are still unfolding, and the outcomes of regulatory investigations will play a crucial role in shaping the future of the virtualization and cloud infrastructure landscape. Stay tuned for updates on the Broadcom VMware acquisition and its extreme price hikes. Follow our coverage on the potential antitrust ramifications of the Broadcom VMware deal and learn more about the impact of the Broadcom VMware acquisition on your business.

Featured Posts

-

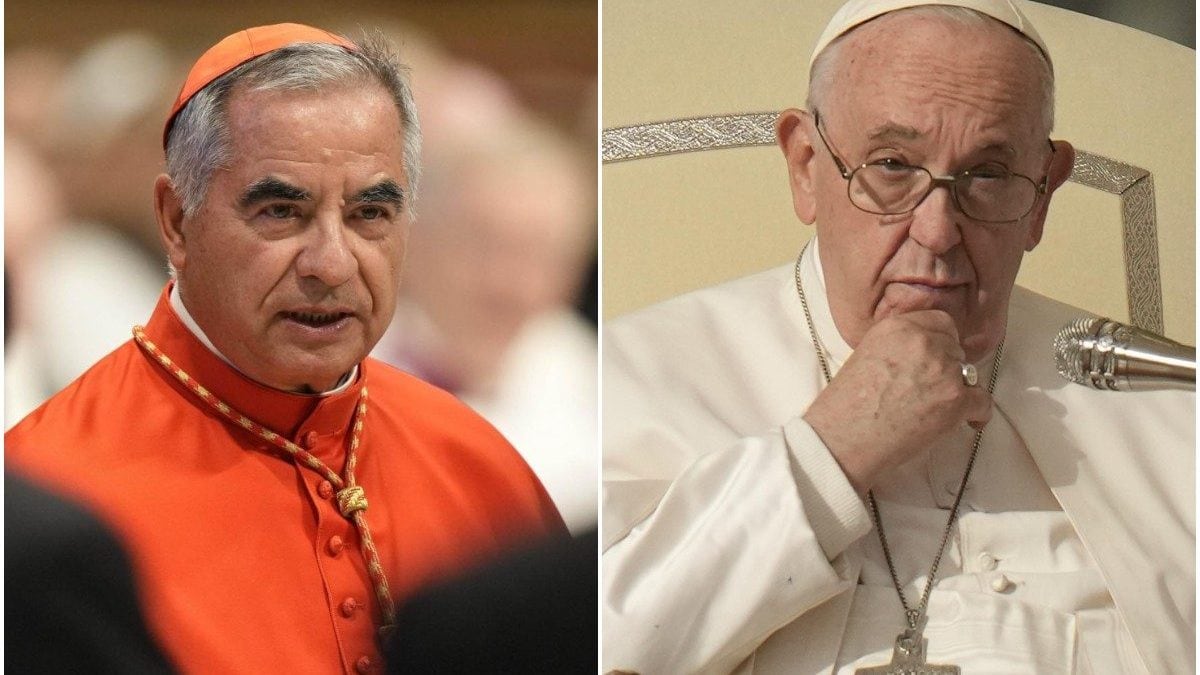

Becciu Nuova Data Per L Udienza Sul Caso 8xmille

May 01, 2025

Becciu Nuova Data Per L Udienza Sul Caso 8xmille

May 01, 2025 -

Te Ipukarea Society Unveiling The Mysteries Of Rare Seabirds

May 01, 2025

Te Ipukarea Society Unveiling The Mysteries Of Rare Seabirds

May 01, 2025 -

Tran Chung Ket Thaco Cup 2025 Lich Thi Dau Kenh Phat Song Va Thong Tin Huu Ich

May 01, 2025

Tran Chung Ket Thaco Cup 2025 Lich Thi Dau Kenh Phat Song Va Thong Tin Huu Ich

May 01, 2025 -

O Novo App De Ia Da Meta Uma Alternativa Ao Chat Gpt

May 01, 2025

O Novo App De Ia Da Meta Uma Alternativa Ao Chat Gpt

May 01, 2025 -

Kshmyr Ky Jng Pak Fwj Ka Ezm Jawyd

May 01, 2025

Kshmyr Ky Jng Pak Fwj Ka Ezm Jawyd

May 01, 2025

Latest Posts

-

O Lempron Tzeims Stoys 50 000 Pontoys Mia Statistiki Analysi

May 01, 2025

O Lempron Tzeims Stoys 50 000 Pontoys Mia Statistiki Analysi

May 01, 2025 -

Lempron Tzeims 50 000 Pontoi Kai I Klironomia Toy Sto Nba

May 01, 2025

Lempron Tzeims 50 000 Pontoi Kai I Klironomia Toy Sto Nba

May 01, 2025 -

Il Processo Becciu Cosa Rivelano Le Chat Segrete Dal Vaticano

May 01, 2025

Il Processo Becciu Cosa Rivelano Le Chat Segrete Dal Vaticano

May 01, 2025 -

I Istoriki Epidosi Toy Lempron Tzeims 50 000 Pontoi

May 01, 2025

I Istoriki Epidosi Toy Lempron Tzeims 50 000 Pontoi

May 01, 2025 -

Scandalo Becciu Analisi Delle Chat Segrete E Delle Accuse Di Complotto

May 01, 2025

Scandalo Becciu Analisi Delle Chat Segrete E Delle Accuse Di Complotto

May 01, 2025