Extreme Price Hike For VMware: AT&T Sounds The Alarm On Broadcom Deal

Table of Contents

AT&T's Concerns and the VMware Price Hike

AT&T's concerns regarding the Broadcom-VMware deal center on the anticipated substantial increase in VMware product pricing. The company, a major user of VMware virtualization solutions, fears a dramatic shift in the cost of maintaining its critical IT infrastructure. This VMware cost increase could significantly impact AT&T's operational budget and potentially force difficult choices regarding IT investments.

- Specific Statements: AT&T hasn't minced words, expressing serious apprehension about the potential for "unjustified" and "substantial" price hikes following the acquisition. Their statements highlight the potential for Broadcom to leverage its market power to drastically increase VMware licensing fees.

- Percentage Increase: While precise figures remain elusive, industry analysts predict VMware licensing costs could increase by a significant percentage – potentially in the double digits – impacting businesses already grappling with rising IT expenses.

- Budgetary Impact: For AT&T, a substantial VMware price hike translates to millions, if not billions, of dollars in additional expenditure. This added cost could force difficult decisions on other vital IT projects and initiatives.

- Reliance on VMware: AT&T, like many large enterprises, heavily relies on VMware's virtualization solutions for its core operations. A price hike would not only affect their budget but also potentially disrupt their existing infrastructure and workflows.

Broadcom's Acquisition Strategy and Potential Antitrust Issues

Broadcom's acquisition strategy is characterized by a history of large-scale mergers and acquisitions, often involving significant players in the technology industry. The VMware acquisition raises significant antitrust concerns, particularly regarding the potential for stifling competition within the virtualization software market.

- Acquisition History: Broadcom has a track record of acquiring companies and integrating them into its existing portfolio. However, the scale of the VMware acquisition and its potential impact on the virtualization market are unprecedented.

- Anti-Competitive Practices: Critics worry that Broadcom might engage in anti-competitive practices after acquiring VMware, such as raising prices, reducing innovation, or limiting customer choices. This could create a vendor lock-in scenario, hindering competition and ultimately harming customers.

- Regulatory Scrutiny: Regulatory bodies in various jurisdictions, including the US Department of Justice and the European Commission, are currently reviewing the acquisition. The outcome of these reviews will significantly influence the future landscape of the virtualization software market.

- Expert Analysis: Industry experts express mixed views. While some argue the acquisition might lead to innovation and cost synergies, others express concern about the potential for monopolistic practices and the resulting harm to competition.

Impact on the Broader Enterprise Software Market

The potential for extreme VMware price hikes extends beyond AT&T's concerns. A significant increase in VMware licensing costs could ripple across the broader enterprise software market, impacting other vendors and customers.

- Price Increases for Related Software: The acquisition could trigger price increases in related enterprise software, as vendors might leverage the increased market power to command higher prices.

- Increased Vendor Lock-in: Higher prices coupled with limited alternatives could lead to increased vendor lock-in, forcing businesses to remain with VMware even if better, more affordable options emerge.

- Impact on Cloud Migration Strategies: The VMware price hike could accelerate cloud migration strategies for businesses seeking to reduce reliance on on-premise virtualization solutions and potentially reduce costs.

- Alternative Virtualization Solutions: The increased VMware costs are likely to boost the adoption of alternative virtualization solutions, including open-source options and cloud-native platforms.

Potential Alternatives and Mitigation Strategies

Businesses facing potential extreme VMware price hikes need to explore alternatives and develop mitigation strategies to protect their IT budgets and operational efficiency.

- Competitor Offerings: Several strong competitors exist, offering compelling alternatives to VMware vSphere. These include open-source options like Proxmox VE and commercial solutions like Citrix XenServer and Microsoft Hyper-V.

- Negotiating Licensing Agreements: Companies should proactively negotiate with VMware (and explore options with alternative providers) to secure the most favorable licensing agreements possible.

- Cloud Migration: Migrating workloads to cloud platforms like AWS, Azure, or Google Cloud can reduce dependence on on-premise VMware infrastructure and potentially offer cost savings.

- Budget Planning: Businesses need to carefully plan their IT budgets, factoring in potential VMware price increases and exploring ways to optimize costs and resource allocation.

Conclusion

AT&T's concerns regarding the potential for extreme VMware price hikes following Broadcom's acquisition are legitimate and highlight broader issues within the enterprise software market. The potential for anti-competitive practices and the impact on the broader virtualization market necessitate careful monitoring of regulatory decisions. Businesses must proactively assess their reliance on VMware and explore alternative virtualization solutions and cost mitigation strategies to avoid the negative implications of this acquisition. Stay informed about the ongoing developments in the Broadcom-VMware deal, and prepare for potential changes in VMware pricing and the wider virtualization landscape. Understanding the implications of this acquisition is crucial for all businesses relying on VMware virtualization.

Featured Posts

-

15 Billion Ev Plant On Hold Hondas Ontario Project Faces Market Headwinds

May 15, 2025

15 Billion Ev Plant On Hold Hondas Ontario Project Faces Market Headwinds

May 15, 2025 -

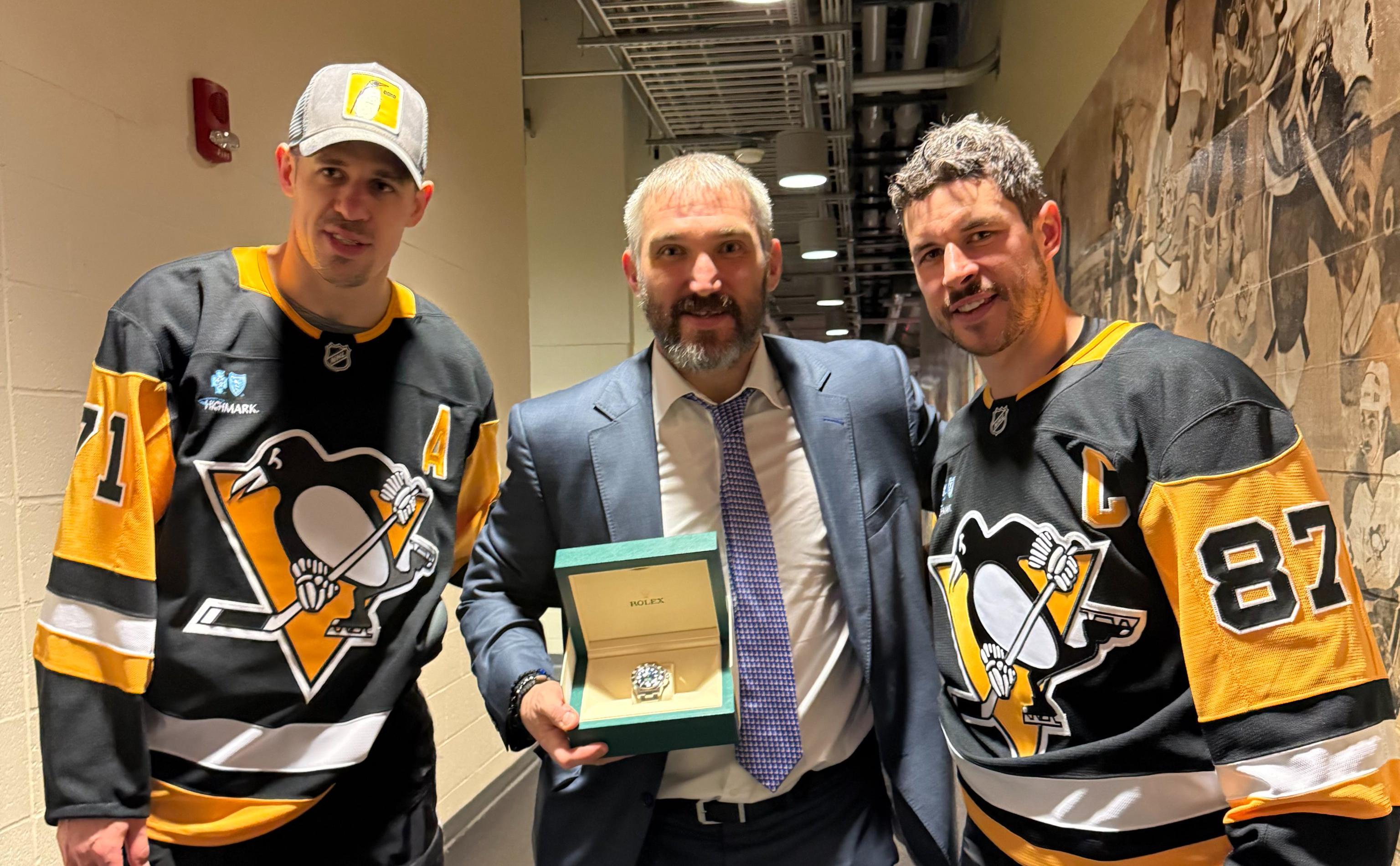

Podarok Ot Kinopoiska Soski S Izobrazheniem Ovechkina V Chest Rekorda N Kh L

May 15, 2025

Podarok Ot Kinopoiska Soski S Izobrazheniem Ovechkina V Chest Rekorda N Kh L

May 15, 2025 -

Sensex Soars Top Bse Stocks That Surged Over 10

May 15, 2025

Sensex Soars Top Bse Stocks That Surged Over 10

May 15, 2025 -

Analiza Riscuri Consumul Apei De La Robinet In Diverse Zone Din Romania

May 15, 2025

Analiza Riscuri Consumul Apei De La Robinet In Diverse Zone Din Romania

May 15, 2025 -

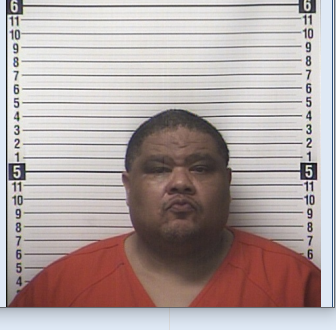

2023 Warner Robins Murder Case Jury Delivers Verdict

May 15, 2025

2023 Warner Robins Murder Case Jury Delivers Verdict

May 15, 2025