Falling Iron Ore Prices: China's Steel Output Restrictions Take Hold

Table of Contents

China's Steel Production Restrictions: The Driving Force

China's commitment to environmental protection and its ambitious carbon neutrality goals are significantly impacting its steel industry. The country, the world's largest steel producer and iron ore consumer, is implementing a series of policies aimed at curbing emissions and promoting sustainable development. This has directly translated into reduced steel production, significantly affecting the demand for iron ore.

Environmental Concerns and Policy Changes

China's government has implemented several key policies to limit steel production, including:

- Stricter environmental regulations: Increased scrutiny of emissions, stricter penalties for exceeding emission limits, and mandatory environmental upgrades for steel mills.

- Carbon emission targets: Ambitious targets for reducing carbon emissions across all sectors, including a significant reduction in emissions from steel production.

- Production quotas: Imposing production quotas on steel mills, limiting their overall output and capacity.

- Energy consumption restrictions: Limitations on energy consumption by steel mills, further restricting production capabilities.

These policies have resulted in a noticeable decline in China's steel output. For example, [insert statistic on steel production reduction in China – e.g., "China's crude steel production fell by X% in 2023 compared to the previous year"]. This reduction in production has had a direct and significant impact on the demand for iron ore.

Impact on Steel Demand

The reduction in China's steel production directly translates to lower demand for iron ore, the primary raw material used in steelmaking. This decreased demand is the primary driver of the falling iron ore prices.

- Correlation between steel output and iron ore consumption: A clear negative correlation exists between China's steel output and its iron ore imports. As steel production falls, so does the need for iron ore.

- Decline in iron ore imports: [Insert statistic on the decline in China's iron ore imports – e.g., "China's iron ore imports have decreased by Y% in the first half of 2024"]. This directly reflects the reduced demand driven by the production restrictions.

- Implications for other steel-producing nations: The reduced Chinese demand impacts global steel markets. Other steel-producing nations experience decreased export opportunities and face increased competition.

The Ripple Effect: Global Iron Ore Market Dynamics

The reduced demand from China has created significant volatility and uncertainty in the global iron ore market, leading to a dramatic drop in prices.

Price Volatility and Market Uncertainty

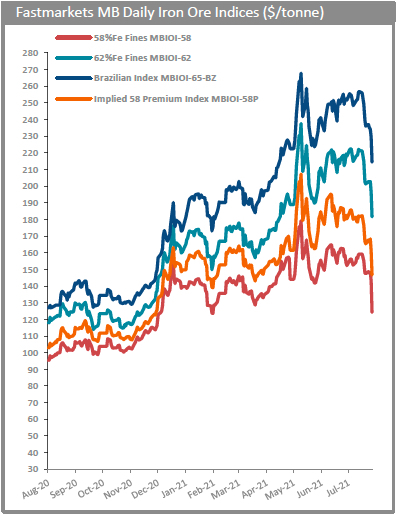

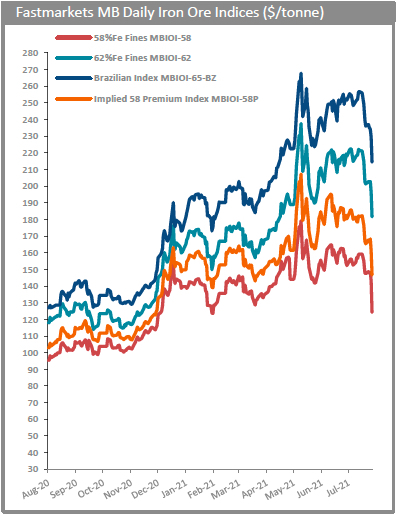

The price of iron ore has experienced significant fluctuations in recent months.

- Price trends: [Include a chart or graph illustrating the price trends of iron ore in recent months, clearly showing the downward trend. Reference the source of the data.]

- Impact on iron ore mining companies: The price drop has negatively impacted iron ore mining companies, leading to decreased profits and reduced stock prices. Many companies have had to adjust their production levels to adapt to the changing market conditions.

Impact on Major Iron Ore Producers

Major iron ore producing countries, such as Australia and Brazil, are directly affected by the falling prices.

- Production adjustments: Major producers are likely to adjust their production levels downward to mitigate losses. Some may even consider temporary mine closures.

- Economic impact: The reduced export revenue significantly impacts the economies of these countries, particularly their mining sectors. This can lead to job losses and decreased government revenue.

Future Outlook and Market Predictions

The future of iron ore prices remains uncertain, depending on several interconnected factors.

Potential for Price Recovery

Several scenarios could influence the potential for price recovery:

- Continued restrictions: If China continues its stringent steel output restrictions, iron ore prices may remain depressed or continue to decline.

- Easing of restrictions: If the Chinese government eases restrictions, based on economic needs or environmental progress, demand for iron ore could rise, potentially leading to price recovery.

- Increased global demand: Increased global demand from other regions could also offset the decline in Chinese demand and help stabilize or increase iron ore prices.

[Include expert opinions and market forecasts regarding the future of iron ore prices, citing credible sources.]

Long-Term Implications for the Steel and Iron Ore Industries

China's policy shift will have significant long-term implications:

- Industry restructuring: The steel and iron ore industries will likely undergo significant restructuring, with a focus on sustainability and efficiency.

- Technological advancements: Investment in greener steel production methods and technologies will be crucial for the industry's long-term viability. This includes exploring alternative raw materials and reducing carbon emissions.

- Shifts in global supply chains: The global supply chains for steel and iron ore may shift, with potentially new major players emerging.

Conclusion

China's steel production restrictions are the primary driver behind the fall in iron ore prices, creating volatility and uncertainty in the global market. Reduced demand from China, the impact on major producers, significant price fluctuations, and the long-term implications for the industry are key takeaways. Understanding the dynamics of falling iron ore prices is crucial for navigating the evolving landscape of the global commodities market. Stay informed about the latest developments in the iron ore market by following our updates and analyses on China’s steel production policies. Further research into sustainable steel production methods and the impact on global supply chains is recommended for a comprehensive understanding of this evolving situation.

Featured Posts

-

Opinion Celebrating Anchorages Arts And Local Medias Role

May 09, 2025

Opinion Celebrating Anchorages Arts And Local Medias Role

May 09, 2025 -

Adin Hills 27 Saves Lead Golden Knights To Victory Over Blue Jackets

May 09, 2025

Adin Hills 27 Saves Lead Golden Knights To Victory Over Blue Jackets

May 09, 2025 -

The Stranger Things It Connection What Stephen King Said

May 09, 2025

The Stranger Things It Connection What Stephen King Said

May 09, 2025 -

Bundesliga 2 Matchday 27 Results And Table Update Cologne On Top

May 09, 2025

Bundesliga 2 Matchday 27 Results And Table Update Cologne On Top

May 09, 2025 -

Uk Set To Implement Stricter Immigration Rules English Language Proficiency Key

May 09, 2025

Uk Set To Implement Stricter Immigration Rules English Language Proficiency Key

May 09, 2025