Federal Debt: A Growing Threat To Mortgage Affordability

Table of Contents

The Direct Impact of Federal Debt on Interest Rates

Government Borrowing and Increased Demand

Increased government borrowing to finance the federal debt significantly impacts interest rates. When the government needs to borrow large sums of money, it increases the demand for loanable funds in the market. This increased demand pushes interest rates higher, affecting not only government bonds but also other forms of borrowing, including mortgages.

- Increased competition for funds: Government borrowing competes with private sector borrowing for available capital, driving up the cost of borrowing for everyone.

- Impact on the Treasury market: Higher demand for U.S. Treasury bonds, often used as a benchmark for other interest rates, directly influences the yields on these bonds, which subsequently affect mortgage rates.

- Ripple effect on other borrowing rates: The increase in Treasury yields ripples through the financial system, impacting interest rates on mortgages, corporate bonds, and other loans.

Detail: Over the past decade, we've seen a strong correlation between rising federal debt and increasing interest rates. For example, the 10-year Treasury yield, a key indicator for mortgage rates, has shown a marked increase during periods of significant federal debt growth. These increases directly translate to higher monthly mortgage payments for homebuyers.

Inflationary Pressures and Mortgage Costs

The Link Between Federal Debt and Inflation

Government spending financed by borrowing can fuel inflation, especially when it exceeds the economy's productive capacity. This occurs through several mechanisms:

- Money supply increases: Increased government borrowing can lead to an expansion of the money supply, potentially exceeding the economy's ability to produce goods and services.

- Demand-pull inflation: Increased government spending can boost aggregate demand, driving up prices as consumers compete for limited goods and services.

- Cost-push inflation: Higher borrowing costs for businesses due to increased interest rates caused by government borrowing can lead to businesses raising prices to maintain profit margins.

Detail: Inflation directly impacts mortgage affordability by increasing the cost of building materials, labor, and land. The rising costs of lumber, concrete, and other construction supplies, fueled by inflation, directly translate into higher home prices, making mortgages less affordable. For instance, the recent surge in lumber prices significantly contributed to increased home construction costs.

Government Policy Responses and Their Impact on Mortgages

Fiscal Policy and Monetary Policy

Government responses to high debt levels (fiscal policy) and the Federal Reserve's actions to control inflation (monetary policy) significantly influence mortgage rates and availability.

- Fiscal policy: Tax increases or spending cuts aimed at reducing the deficit can dampen economic growth, potentially affecting demand for housing and impacting mortgage rates.

- Monetary policy: The Federal Reserve often raises interest rates to combat inflation. While this helps control inflation, it also increases mortgage rates, making homes less affordable. Conversely, quantitative easing (QE), a monetary policy tool, can initially lower interest rates, but its long-term effects on inflation are complex.

- Government intervention: The government might intervene directly in the housing market, such as through programs to incentivize homeownership or to support the mortgage market. However, these interventions can have both positive and negative impacts on affordability.

Detail: Raising interest rates to combat inflation, a common monetary policy response, directly impacts mortgage affordability. Higher interest rates increase the cost of borrowing, leading to higher monthly mortgage payments and reduced purchasing power for homebuyers.

Long-Term Implications for Homeownership

Challenges for First-Time Homebuyers

Rising mortgage costs disproportionately affect first-time homebuyers, who often have limited savings and rely heavily on financing.

- Reduced homeownership rates: Higher mortgage payments can lead to reduced homeownership rates, particularly among younger generations and lower-income households.

- Increased reliance on rental housing: Inability to afford a mortgage pushes more people into the rental market, potentially increasing rental costs and reducing financial stability.

- Widening wealth gap: The decreased ability to build equity through homeownership contributes to the widening wealth gap between homeowners and renters.

Detail: Statistics consistently show a correlation between increased mortgage costs and decreased homeownership rates, particularly among millennials and Gen Z. This trend has significant implications for generational wealth building and social mobility.

Conclusion

The ever-increasing federal debt presents a significant and escalating threat to mortgage affordability. The interplay between government borrowing, interest rates, inflation, and government policy creates a complex challenge for prospective homeowners. Understanding this relationship is crucial for individuals planning to buy a home and for policymakers striving to maintain a healthy and accessible housing market. To navigate this challenging landscape, stay informed about federal debt levels, interest rate trends, and government policies impacting federal debt and mortgage affordability. By actively monitoring these factors, you can make more informed decisions about your future homeownership plans.

Featured Posts

-

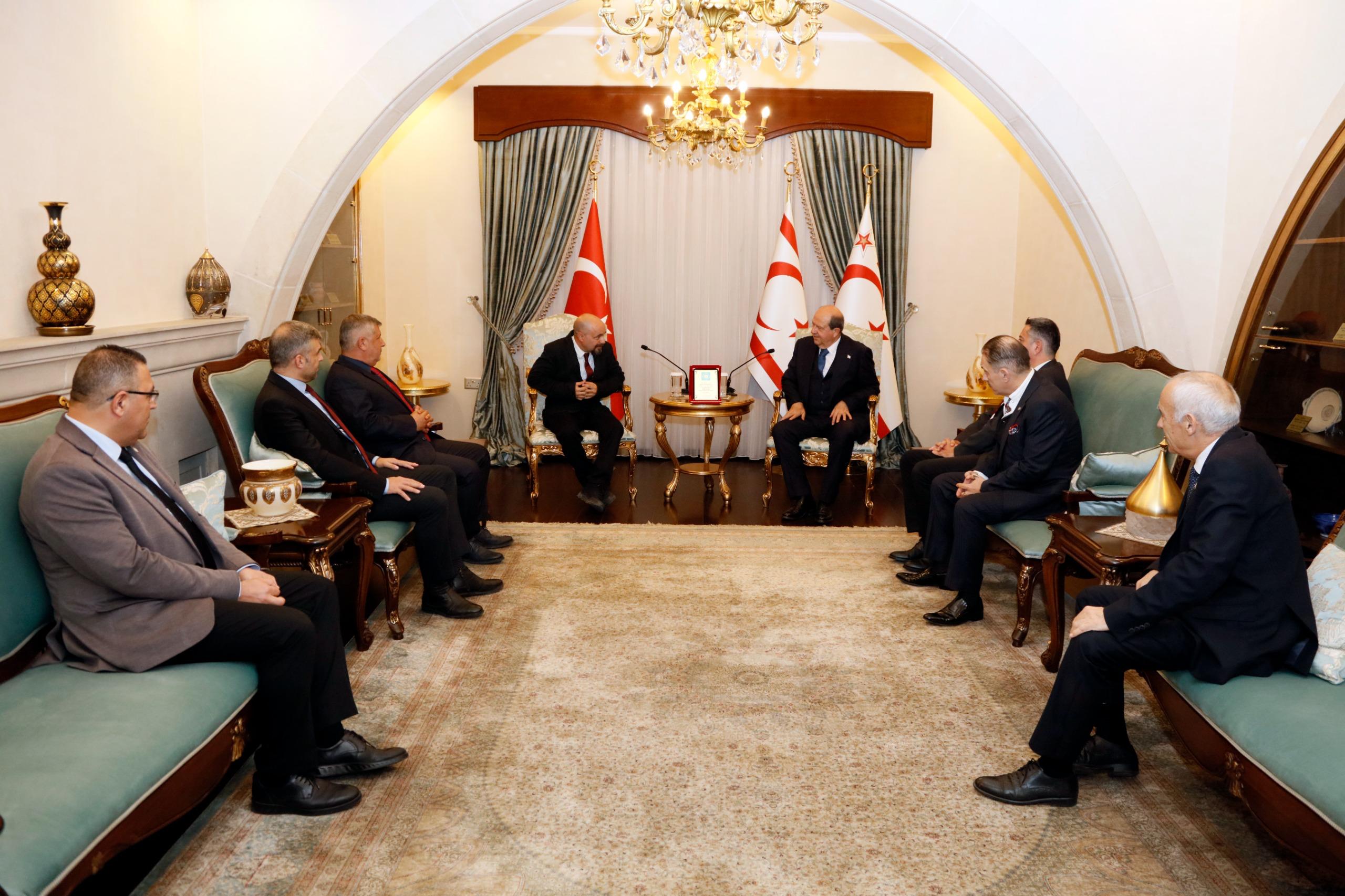

12 Milyon Avroluk Kktc Yardimi Tuerk Devletleri Destegi Ve Sonuclari

May 19, 2025

12 Milyon Avroluk Kktc Yardimi Tuerk Devletleri Destegi Ve Sonuclari

May 19, 2025 -

Seis Enlaces Confirman El Cne Apaga Su Sitio Web Arbitrariamente

May 19, 2025

Seis Enlaces Confirman El Cne Apaga Su Sitio Web Arbitrariamente

May 19, 2025 -

Kelowna Bear Spray Attack On Halloween Accounts From Victims

May 19, 2025

Kelowna Bear Spray Attack On Halloween Accounts From Victims

May 19, 2025 -

Justyna Steczkowska Recznik Eurowizja I Taniec

May 19, 2025

Justyna Steczkowska Recznik Eurowizja I Taniec

May 19, 2025 -

Bmw Porsche And The Growing Pains Of The Chinese Automotive Market

May 19, 2025

Bmw Porsche And The Growing Pains Of The Chinese Automotive Market

May 19, 2025

Latest Posts

-

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025

Muere Joan Aguilera El Primer Espanol En Ganar Un Masters 1000 Nos Deja

May 19, 2025 -

Pregnant Jennifer Lawrence Steps Out In New York City

May 19, 2025

Pregnant Jennifer Lawrence Steps Out In New York City

May 19, 2025 -

Nyc Spotting Jennifer Lawrence And Her Visible Baby Bump

May 19, 2025

Nyc Spotting Jennifer Lawrence And Her Visible Baby Bump

May 19, 2025 -

Jennifer Lawrence Shows Off Growing Baby Bump In New York City

May 19, 2025

Jennifer Lawrence Shows Off Growing Baby Bump In New York City

May 19, 2025 -

Cooke Maroney And Jennifer Lawrence Announce Second Babys Arrival

May 19, 2025

Cooke Maroney And Jennifer Lawrence Announce Second Babys Arrival

May 19, 2025