Federal Election Results And Their Impact On The CAD

Table of Contents

Government Policies and CAD Volatility

A new government's policies significantly influence the Canadian dollar's value. Understanding the interplay between fiscal and monetary policy is key to predicting CAD movements.

Fiscal Policy Changes

The government's fiscal policy—its approach to taxation and spending—directly impacts the CAD exchange rate.

- Potential changes to taxes: Tax increases can curb consumer spending and economic growth, potentially weakening the CAD. Conversely, tax cuts could stimulate the economy but may also lead to increased inflation and a weaker CAD if not managed carefully.

- Changes to government spending: Increased government spending, particularly deficit spending, can fuel inflation, weakening the CAD. Conversely, responsible spending on infrastructure projects could boost long-term economic growth and strengthen the CAD.

- Impact on budget deficits: Large budget deficits can erode investor confidence, potentially leading to a weaker CAD as investors seek higher returns elsewhere.

For example, past periods of significant deficit spending have often coincided with periods of CAD weakness. Conversely, periods of fiscal prudence have generally been associated with a stronger CAD. The details of the newly elected government's budget proposals will be crucial in determining the near-term impact on the CAD.

Monetary Policy Interactions

The Bank of Canada (BoC) plays a crucial role in managing inflation and influencing the CAD value. Its monetary policy decisions, particularly interest rate adjustments, are heavily influenced by the government's fiscal policies.

- Interest rate adjustments: Higher interest rates generally attract foreign investment, strengthening the CAD. Lower interest rates can weaken the CAD as investors seek higher returns in other currencies.

- Inflation targeting: The BoC's primary mandate is to maintain price stability. If the government's fiscal policies lead to increased inflation, the BoC may respond by raising interest rates, potentially strengthening the CAD in the short term but potentially slowing economic growth.

- Interplay of fiscal and monetary policy: A coordinated approach between fiscal and monetary policy is essential for a stable CAD. Conflicting policies can create uncertainty and volatility in the CAD exchange rate.

Market Sentiment and Investor Confidence

The election results significantly impact market sentiment and investor confidence, directly affecting the CAD.

Impact on Business Investment

Uncertainty following an election can deter business investment. Clear policy direction, on the other hand, fosters investor confidence and encourages investment, strengthening the CAD.

- Policy uncertainty: Uncertainty about the new government's economic policies can lead to a wait-and-see approach by businesses, delaying investment decisions and potentially weakening the CAD.

- Investor confidence: Positive signals from the government, such as clear economic plans and commitment to fiscal responsibility, can bolster investor confidence, leading to increased investment and a stronger CAD.

- Economic growth projections: Government policies that promote economic growth, such as investments in infrastructure and innovation, generally attract foreign investment, leading to CAD appreciation.

Foreign Exchange Market Reactions

The foreign exchange market reacts swiftly to election results. The immediate and long-term reactions can significantly influence the CAD trading value.

- Immediate reactions: The CAD often experiences short-term volatility immediately following an election as investors react to initial policy announcements.

- Long-term effects: The long-term impact depends on the government's policies and their effectiveness in managing the economy.

- International trade and capital flows: The CAD's value in the global market is influenced by international trade balances and capital flows. Favorable trade balances and significant inward capital flows tend to strengthen the CAD.

Sector-Specific Impacts

The federal election results have varying impacts on different sectors of the Canadian economy, creating ripple effects on the CAD.

Resource Sector Sensitivity

The resource sector (oil, gas, mining) is particularly sensitive to government policies.

- Environmental regulations: Stricter environmental regulations can increase the cost of resource extraction, impacting commodity prices and potentially weakening the CAD.

- Trade agreements: Trade deals influence export volumes and prices of commodities, thus affecting the CAD. New trade agreements can create opportunities, while protectionist measures can harm the sector and weaken the CAD.

- Government support: Government policies that support the resource sector, such as tax incentives or infrastructure investments, can strengthen the CAD by boosting production and export revenues.

Technology and Innovation

Government support for technology and innovation can drive long-term economic growth, impacting the CAD positively.

- Government investment in R&D: Increased government funding for research and development can stimulate innovation, leading to stronger economic growth and a potentially stronger CAD.

- Attracting foreign investment in tech: Policies that make Canada an attractive destination for foreign tech investment can boost economic activity and strengthen the CAD.

- Skilled worker immigration: Policies that attract skilled workers in the tech sector can boost innovation and economic growth, potentially strengthening the CAD.

Conclusion

The outcome of the federal election has significant implications for the CAD, impacting everything from government spending and monetary policy to investor confidence and foreign exchange market reactions. By analyzing the policies of the newly elected government and their potential effects on various sectors, we can gain a better understanding of the likely trajectory of the Canadian dollar. Understanding these factors is essential for navigating the economic landscape and making informed decisions regarding investments and business operations. Staying informed about Federal Election Results and their Impact on the CAD is crucial for successful financial planning.

Featured Posts

-

Army Chyf Ka Byan Bhart 10 Jngwn Kw Bhy Tyar He Mdhakrat Ka Rasth Kya He

May 01, 2025

Army Chyf Ka Byan Bhart 10 Jngwn Kw Bhy Tyar He Mdhakrat Ka Rasth Kya He

May 01, 2025 -

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025 -

Dallas Tv Star Dies Another 80s Soap Legend Lost

May 01, 2025

Dallas Tv Star Dies Another 80s Soap Legend Lost

May 01, 2025 -

Rm 36 45 Juta Disalurkan Laporan Tabung Baitulmal Sarawak Untuk Asnaf Sehingga Mac 2025

May 01, 2025

Rm 36 45 Juta Disalurkan Laporan Tabung Baitulmal Sarawak Untuk Asnaf Sehingga Mac 2025

May 01, 2025 -

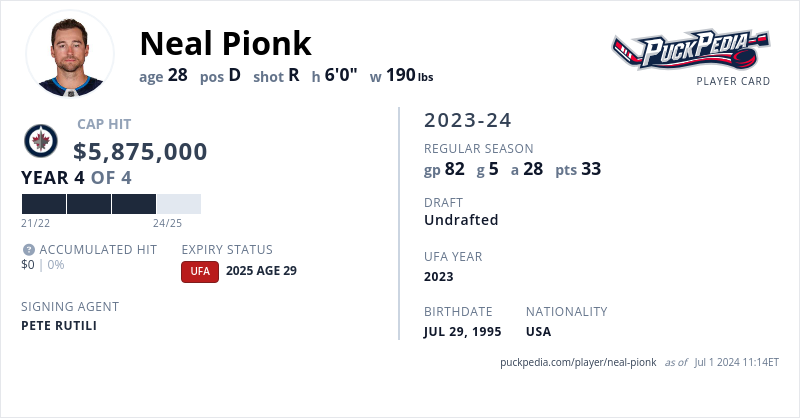

Neal Pionk Contract Status And Future Outlook

May 01, 2025

Neal Pionk Contract Status And Future Outlook

May 01, 2025

Latest Posts

-

O Lempron Tzeims Kai To Orosimo Ton 50 000 Ponton

May 01, 2025

O Lempron Tzeims Kai To Orosimo Ton 50 000 Ponton

May 01, 2025 -

Victory For Minnesota Edwards Performance Outshines Brooklyn

May 01, 2025

Victory For Minnesota Edwards Performance Outshines Brooklyn

May 01, 2025 -

Edwards Key Role In Minnesotas Win Over Brooklyn Nets

May 01, 2025

Edwards Key Role In Minnesotas Win Over Brooklyn Nets

May 01, 2025 -

Minnesotas Edward Shines Leading Team To Win Against Brooklyn

May 01, 2025

Minnesotas Edward Shines Leading Team To Win Against Brooklyn

May 01, 2025 -

Edward Leads Minnesota To Victory Against Brooklyn

May 01, 2025

Edward Leads Minnesota To Victory Against Brooklyn

May 01, 2025