Fed's Cautious Approach: Why No Rate Cuts Yet?

Table of Contents

The U.S. economy is navigating choppy waters. While many anticipate the Federal Reserve (Fed) to slash interest rates to stimulate growth, the reality is quite different. The prevailing narrative is one of the Fed's cautious approach, a deliberate strategy leaving many wondering: why are rate cuts still off the table? This article delves into the key reasons behind the Fed's cautious approach and what it means for the future of the American economy.

Inflation Remains a Key Concern

Stubbornly High Inflation

Inflation remains a significant headwind, stubbornly clinging above the Fed's 2% target. The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index, key measures of inflation, continue to show elevated readings, indicating that the battle against rising prices is far from over. The persistence of inflation is a primary factor driving the Fed's cautious approach.

- Impact on Consumers: High inflation erodes purchasing power, impacting consumer spending and overall economic growth. Rising prices for essential goods like food and energy disproportionately affect low-income households.

- Contributing Factors: Several factors contribute to persistent inflation, including lingering supply chain disruptions, elevated energy prices driven by geopolitical instability, and robust wage growth fueled by a tight labor market. These interconnected issues make it challenging for the Fed to quickly bring inflation down.

- Fed's Mandate: Price stability is a core mandate of the Federal Reserve. Prematurely cutting interest rates risks reigniting inflation, potentially requiring even more aggressive measures later, thus hindering the eventual return to the 2% inflation target.

Labor Market Strength

Tight Labor Market Conditions

The U.S. labor market remains remarkably resilient. Unemployment sits at historically low levels, indicating a strong demand for workers. This, however, presents a double-edged sword.

- Job Creation and Labor Participation: Strong job creation numbers and a relatively high labor participation rate contribute to the overall economic health, yet also feed inflationary pressures. A tight labor market allows workers to demand higher wages, which can further drive up prices.

- Wage-Price Spiral: The Fed is concerned about the potential for a wage-price spiral, a self-reinforcing cycle where rising wages lead to higher prices, which in turn lead to even higher wage demands. This scenario would make controlling inflation considerably more challenging.

Uncertainty in the Economic Outlook

Assessing Economic Risks

Predicting the future economic trajectory is fraught with challenges. The Fed faces significant uncertainty in its decision-making process.

- Geopolitical Events: The ongoing war in Ukraine, along with other geopolitical tensions, adds a layer of unpredictable risk to the global economy. These events can significantly impact energy prices, supply chains, and investor sentiment.

- Recessionary Risks: The possibility of a recession looms, further complicating the Fed's decision-making. A recession would necessitate a different monetary policy response compared to a scenario of sustained, albeit slower, growth. The severity and duration of any potential downturn remain hotly debated among economists.

- Data Dependency: The Federal Reserve is data-dependent, carefully scrutinizing economic indicators before making policy adjustments. The uncertainty surrounding the data makes a swift shift in monetary policy risky.

Gradual Approach to Monetary Policy

Avoiding Policy Mistakes

The Fed prefers a measured and gradual approach to monetary policy, aiming to avoid potentially destabilizing mistakes.

- Risks of Rapid Changes: Sudden and drastic shifts in interest rates can have unpredictable consequences, potentially triggering financial market volatility and harming economic growth.

- Data-Driven Decision Making: The Fed prioritizes a data-driven approach, closely monitoring various economic indicators before making policy adjustments. This cautious approach minimizes the risk of misjudging the economy’s trajectory.

- Soft Landing Goal: The Fed's ultimate goal is to achieve a "soft landing"—slowing economic growth sufficiently to curb inflation without triggering a recession. This necessitates a delicate balancing act and a gradual approach.

Conclusion

The Fed's cautious approach to monetary policy is driven by a confluence of factors: persistent inflation, a robust labor market, significant economic uncertainty, and a preference for gradual adjustments. These interconnected issues make it improbable that rate cuts will occur in the near future. The Fed's priority remains to tame inflation and guide the economy towards a sustainable path, even if it means foregoing immediate rate cuts. Understanding the Fed's cautious approach is crucial for navigating the current economic climate. Stay updated on the Federal Reserve's cautious strategy and its implications for your financial planning. Understanding the Fed's approach is key to making informed financial decisions in these uncertain times.

Featured Posts

-

Posthaste Soaring Down Payments Block Canadian Homeownership

May 09, 2025

Posthaste Soaring Down Payments Block Canadian Homeownership

May 09, 2025 -

Analysis Trumps Nomination Of Casey Means And The Maha Movements Influence

May 09, 2025

Analysis Trumps Nomination Of Casey Means And The Maha Movements Influence

May 09, 2025 -

Palantir Stock Forecast Revised A Deep Dive Into The Market Shift

May 09, 2025

Palantir Stock Forecast Revised A Deep Dive Into The Market Shift

May 09, 2025 -

Dam Bao An Toan Cho Tre Em O Cac Co So Giu Tre Sau Vu Viec Tien Giang

May 09, 2025

Dam Bao An Toan Cho Tre Em O Cac Co So Giu Tre Sau Vu Viec Tien Giang

May 09, 2025 -

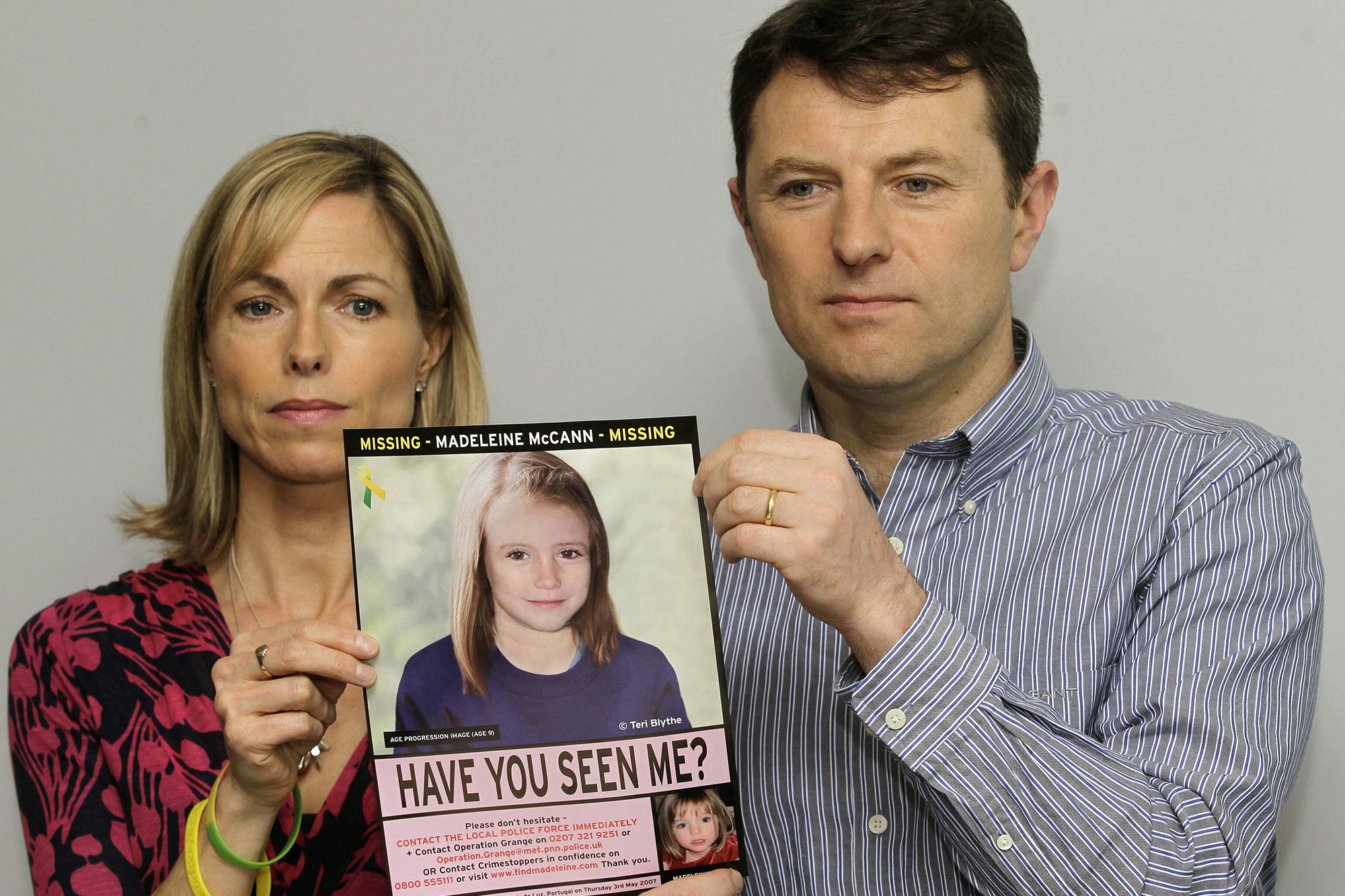

Madeleine Mc Cann Case Womans Dna Test Results Fuel Speculation

May 09, 2025

Madeleine Mc Cann Case Womans Dna Test Results Fuel Speculation

May 09, 2025