Figma's Planned IPO: A Year Since Abandoning Adobe Acquisition

Table of Contents

Analyzing Figma's Post-Adobe Trajectory

The failed Adobe acquisition, while initially shocking, seemingly spurred Figma to accelerate its growth and solidify its market position. Let's examine its progress since then.

Financial Performance and Growth Since the Failed Acquisition

Since the deal fell apart, Figma has demonstrated impressive financial health.

- Revenue Growth: Reports suggest significant year-over-year revenue increases, fueled by a growing user base and increasing adoption across various industries.

- User Base Expansion: Figma continues to attract both individual designers and large enterprise clients, expanding its user base significantly. This widespread adoption highlights the platform's versatility and ease of use.

- Market Share Gains: While precise figures are unavailable publicly, analysts suggest Figma has strengthened its market share in the collaborative design software sector. Its competitive pricing and intuitive interface are likely contributing factors.

- Key Partnerships Formed: Figma has proactively sought strategic partnerships to expand its reach and integrate its platform with other popular design and development tools. These collaborations enhance its ecosystem and offer more value to users.

This robust growth demonstrates Figma's resilience and its ability to thrive independently, bolstering investor confidence ahead of the IPO.

Competitive Landscape and Market Positioning

Figma operates in a competitive market, with established players like Adobe XD and Sketch vying for market share. However, Figma possesses several key advantages:

- Collaborative Features: Figma's real-time collaboration capabilities remain a major differentiator.

- Ease of Use: Its intuitive interface makes it accessible to designers of all skill levels.

- Browser-Based Platform: Its browser-based nature eliminates the need for expensive software downloads and installations, making it more cost-effective for individuals and companies.

- Strong Developer Community: A large and active developer community constantly contributes to Figma's plugins and extensions, expanding its functionalities.

While competitors continue to innovate, Figma's strengths in collaboration, accessibility, and a thriving ecosystem position it favorably in the market.

Strategic Decisions Leading to the IPO

Figma’s journey toward its IPO has been marked by several strategic decisions:

- Product Development Roadmap: Continued investment in new features and improvements to the core platform, addressing user feedback and market demands.

- Expansion into New Markets: Aggressive pursuit of new market segments and geographic regions to broaden its user base.

- Strategic Investments: Investments in emerging technologies and tools to enhance its platform and offer more advanced capabilities.

- Talent Acquisition: Attracting top-tier talent in engineering, design, and marketing to fuel its growth and innovation.

These strategic initiatives demonstrate a clear vision for future growth and demonstrate readiness for the demands of a publicly traded company.

Factors Influencing Figma's IPO Valuation

Several factors will play a crucial role in determining Figma's IPO valuation:

Market Conditions and Investor Sentiment

Figma's IPO valuation will be significantly impacted by the prevailing market conditions:

- Current State of the IPO Market: The overall health of the IPO market, with its fluctuations and investor confidence, is a major influence.

- Investor Appetite for Tech Companies: Investor sentiment towards technology companies, particularly in the software sector, will play a key role.

- Macroeconomic Factors: Broader macroeconomic factors, such as interest rates and inflation, also affect investor behavior and valuations.

Figma's Revenue Model and Profitability

Figma's revenue model, primarily subscription-based, is a key factor in its valuation:

- Pricing Strategy: The effectiveness of its pricing strategy in attracting and retaining customers.

- Subscription Growth: The rate of subscription growth and the overall number of paying users.

- Potential for Future Revenue Streams: Opportunities to diversify revenue streams, such as enterprise-level partnerships and premium features, add value.

Risk Factors and Potential Challenges

While promising, Figma faces several potential challenges:

- Competition: The intense competition from established players and emerging startups.

- Dependence on Key Customers: Over-reliance on a small number of large enterprise clients.

- Integration Challenges: Potential difficulties in integrating its platform with other design and development tools.

- Security Concerns: The need to maintain robust security measures to protect user data and intellectual property.

Implications of Figma's IPO for the Design Software Industry

Figma's IPO will have significant implications for the broader design software industry:

Impact on Competition and Innovation

Figma's public debut will likely:

- Increase Competition: Stimulate further innovation and competition within the market, potentially leading to new features and pricing strategies.

- Accelerate Innovation: Drive faster innovation in design software as companies strive to remain competitive.

- Change Industry Dynamics: Reshape the industry's dynamics, potentially leading to mergers, acquisitions, and further consolidation.

Opportunities for Collaboration and Partnerships

Figma's IPO may foster:

- Increased Collaboration: Encourage greater collaboration between design software companies and other technology providers.

- Opportunities for Partnerships: Create opportunities for new partnerships and collaborations, expanding the design ecosystem.

- Expansion of the Design Ecosystem: Lead to the expansion of the overall design ecosystem, benefiting designers and developers alike.

Conclusion: Looking Ahead to Figma's Public Debut

Figma's journey since the failed Adobe acquisition has been marked by impressive growth and strategic maneuvering. Its upcoming IPO represents a pivotal moment, not only for the company but for the entire design software industry. The factors discussed above – financial performance, competitive landscape, market conditions, and potential risks – will all influence its valuation and future trajectory. The success of its IPO will significantly impact the competitive landscape, innovation, and collaboration within the design software industry. Stay tuned for updates on Figma's IPO and the future of the design software market. Keep an eye on the Figma stock price and the impact of this significant event.

Featured Posts

-

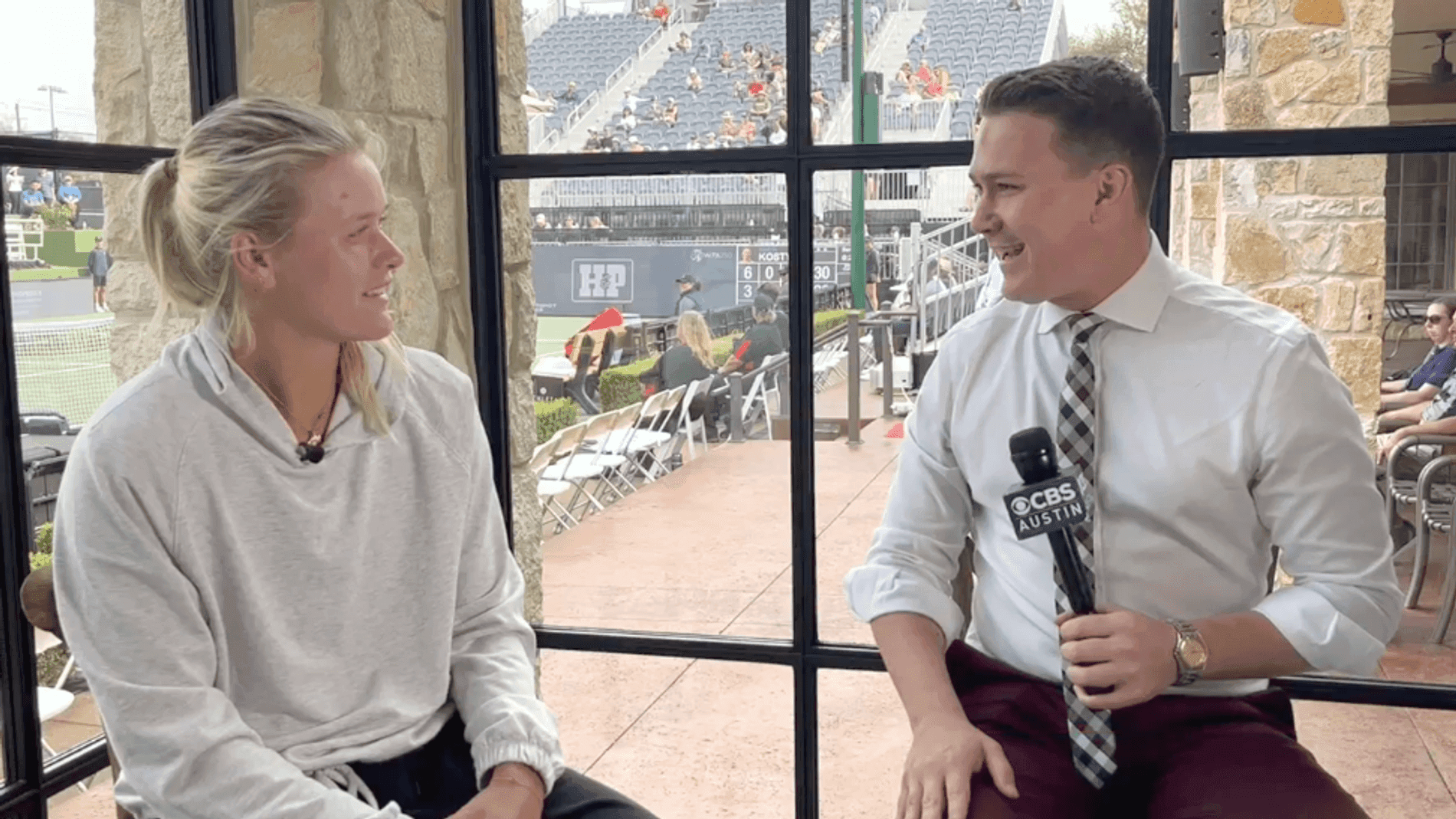

Wta Austin Open Peyton Stearns Upset Loss

May 14, 2025

Wta Austin Open Peyton Stearns Upset Loss

May 14, 2025 -

The Long Shadow Of A Giants Legend

May 14, 2025

The Long Shadow Of A Giants Legend

May 14, 2025 -

Transfer News Bellingham Asking Price Stuns Chelsea And Tottenham

May 14, 2025

Transfer News Bellingham Asking Price Stuns Chelsea And Tottenham

May 14, 2025 -

Man Utds Strong Interest In Championship Star Price Tag And Rival Clubs Revealed

May 14, 2025

Man Utds Strong Interest In Championship Star Price Tag And Rival Clubs Revealed

May 14, 2025 -

E Toros Return To The Ipo Stage Seeking 500 Million In Funding

May 14, 2025

E Toros Return To The Ipo Stage Seeking 500 Million In Funding

May 14, 2025

Latest Posts

-

Indulge In Chocolate Lindts New Shop In Central London

May 14, 2025

Indulge In Chocolate Lindts New Shop In Central London

May 14, 2025 -

Discover Lindts Chocolate Paradise A New London Experience

May 14, 2025

Discover Lindts Chocolate Paradise A New London Experience

May 14, 2025 -

Central Londons Newest Chocolate Destination Lindt

May 14, 2025

Central Londons Newest Chocolate Destination Lindt

May 14, 2025 -

Central London Welcomes Lindts Chocolate Haven

May 14, 2025

Central London Welcomes Lindts Chocolate Haven

May 14, 2025 -

New Lindt Chocolate Shop Opens In Central London

May 14, 2025

New Lindt Chocolate Shop Opens In Central London

May 14, 2025