Final Trump Tax Bill Passes House Following Amendments

Table of Contents

Key Amendments to the Trump Tax Bill

The final version of the Trump Tax Bill significantly differs from earlier proposals, incorporating several key amendments that altered the tax landscape for both corporations and individuals.

Corporate Tax Rate Changes

The most significant change is the final corporate tax rate. While initial proposals floated a rate around 20%, the amended bill settled on a rate of [Insert Final Corporate Tax Rate Here]%. This represents a [Percentage Change - e.g., substantial reduction] compared to the previous rate of [Previous Corporate Tax Rate].

- Deduction Changes: Amendments included [Specific changes to deductions, e.g., limitations on interest deductions, changes to depreciation schedules].

- Tax Credit Modifications: The bill also adjusted several tax credits, including [Specific examples of tax credit changes].

- Economic Impact: Economists predict this lower corporate tax rate will stimulate economic growth by [Predicted economic impact, e.g., encouraging investment and job creation]. However, concerns remain about the potential for increased income inequality. Data from [Source, e.g., the Congressional Budget Office] suggests a [Specific data point, e.g., projected increase in GDP of X%].

Individual Tax Rate Adjustments

The Trump Tax Bill also brought changes to individual income tax brackets and deductions. While the number of tax brackets remained largely unchanged, the rates themselves were adjusted.

- Bracket Adjustments: The [Specific bracket] now has a tax rate of [New rate]%, compared to the previous [Previous rate]%.

- Standard Deduction Increase: The standard deduction saw a significant increase, providing tax relief for many lower- and middle-income taxpayers. The new standard deduction for single filers is [Amount] and for married couples filing jointly is [Amount].

- Impact on Income Levels: These changes disproportionately benefit higher-income earners, while providing some relief to lower-income families through the increased standard deduction. For example, a single filer earning [Income level] will see a tax reduction of approximately [Amount], while a family earning [Income level] will see a reduction of [Amount].

Changes to Pass-Through Entities

The bill also made adjustments to how pass-through entities, such as S corporations and partnerships, are taxed. Previous versions included [Previous provisions]. However, amendments introduced [Specific changes to the taxation of pass-through entities].

- Deduction Limits for Pass-Through Income: The bill implemented [Explain the changes to the deduction limits].

- Impact on Small Business Owners: These changes will significantly impact small business owners, potentially leading to [Positive or negative consequences for small business owners, depending on the amendments].

- Further Information: For detailed information on the taxation of pass-through entities, refer to the IRS website: [Link to relevant IRS resource].

The House Voting Process and Political Implications

The House vote on the final Trump Tax Bill was closely watched, with significant political implications.

Breakdown of the Vote

The bill passed the House with a vote of [Number] to [Number]. The vote largely fell along party lines, with [Percentage]% of Republicans voting in favor and [Percentage]% of Democrats voting against. [Mention any significant bipartisan support or opposition].

Reactions from Key Players

President Trump celebrated the bill's passage, stating [Quote from President Trump]. House Speaker [Name] also lauded the bill's passage, highlighting [Key points from House Speaker's statement]. Conversely, Democratic leaders criticized the bill, arguing that it [Summarize Democratic criticisms]. Numerous news outlets and commentators weighed in, with [Mention prominent opinions and their sources].

Long-Term Economic Effects of the Final Trump Tax Bill

The long-term economic consequences of the final Trump Tax Bill are a subject of ongoing debate among economists.

Potential Economic Growth

Supporters of the bill argue that the tax cuts will stimulate economic growth through increased investment and job creation. Forecasts suggest [Economic forecasts, e.g., a potential increase in GDP of X% over the next Y years]. However, critics argue that these benefits will primarily accrue to corporations and wealthy individuals, exacerbating income inequality. [Cite sources for these differing perspectives].

Impact on National Debt

A major concern surrounding the Trump Tax Bill is its potential impact on the national debt. The bill is projected to [Projected increase or decrease in the national debt]. This could lead to [Potential consequences, e.g., reduced government spending in other areas]. Reports from organizations like the Congressional Budget Office provide further analysis on the bill's fiscal impact [Link to relevant report].

Conclusion

The final Trump Tax Bill, passed by the House after several key amendments, introduces significant changes to both corporate and individual taxation. These changes, including adjustments to corporate tax rates, individual tax brackets, and the taxation of pass-through entities, will have far-reaching consequences for the American economy and the national debt. Understanding the intricacies of this legislation is crucial for taxpayers and businesses alike. To understand the final Trump Tax Bill and how it impacts your specific situation, visit the IRS website or consult a qualified tax professional. Navigate the changes in the Trump Tax Bill effectively and learn more about the impact of the Trump tax law to make informed financial decisions.

Featured Posts

-

Early F1 Testing Mc Laren Sets The Pace

May 23, 2025

Early F1 Testing Mc Laren Sets The Pace

May 23, 2025 -

Steal Cat Deeleys Look Denim Midi Dress And Cowboy Style

May 23, 2025

Steal Cat Deeleys Look Denim Midi Dress And Cowboy Style

May 23, 2025 -

Today Show Features Sheinelle Jones Navigating Everyday Life During Absence

May 23, 2025

Today Show Features Sheinelle Jones Navigating Everyday Life During Absence

May 23, 2025 -

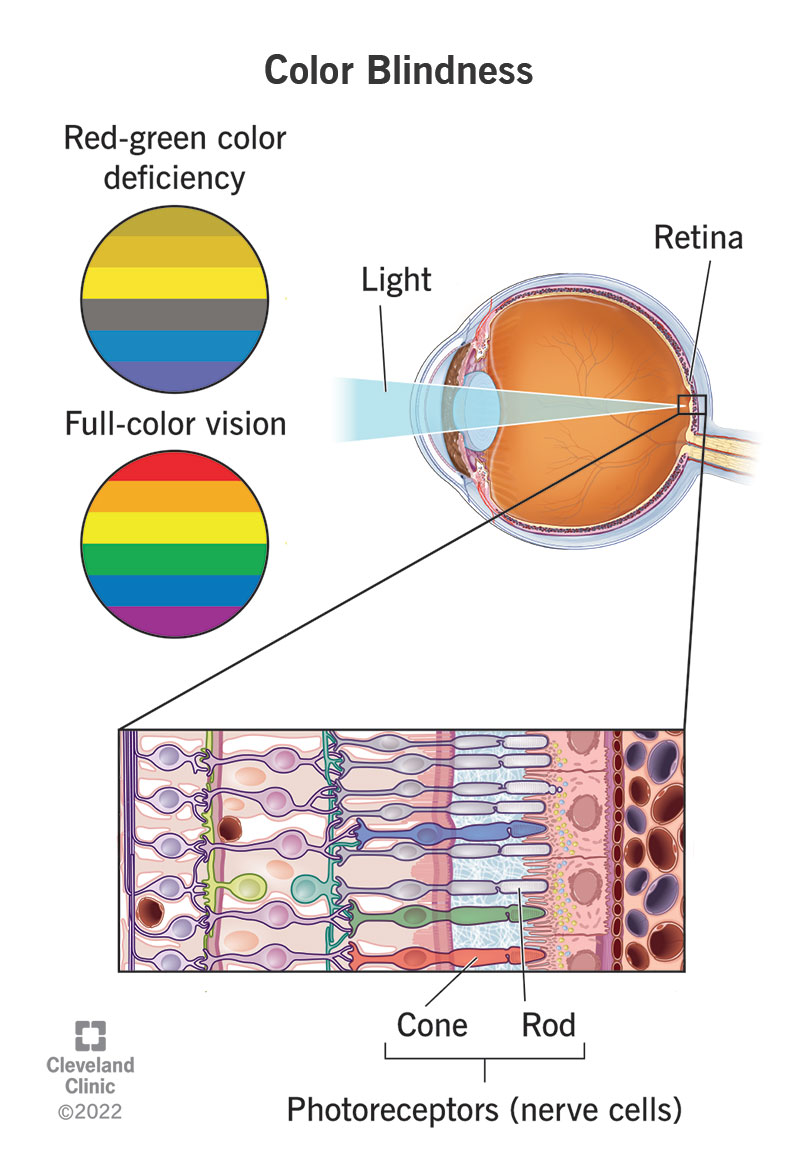

Roger Daltreys Degenerating Health Facing Blindness And Deafness

May 23, 2025

Roger Daltreys Degenerating Health Facing Blindness And Deafness

May 23, 2025 -

From Dreams To Reality Nuphys Vybz Kartel Tour Experience

May 23, 2025

From Dreams To Reality Nuphys Vybz Kartel Tour Experience

May 23, 2025

Latest Posts

-

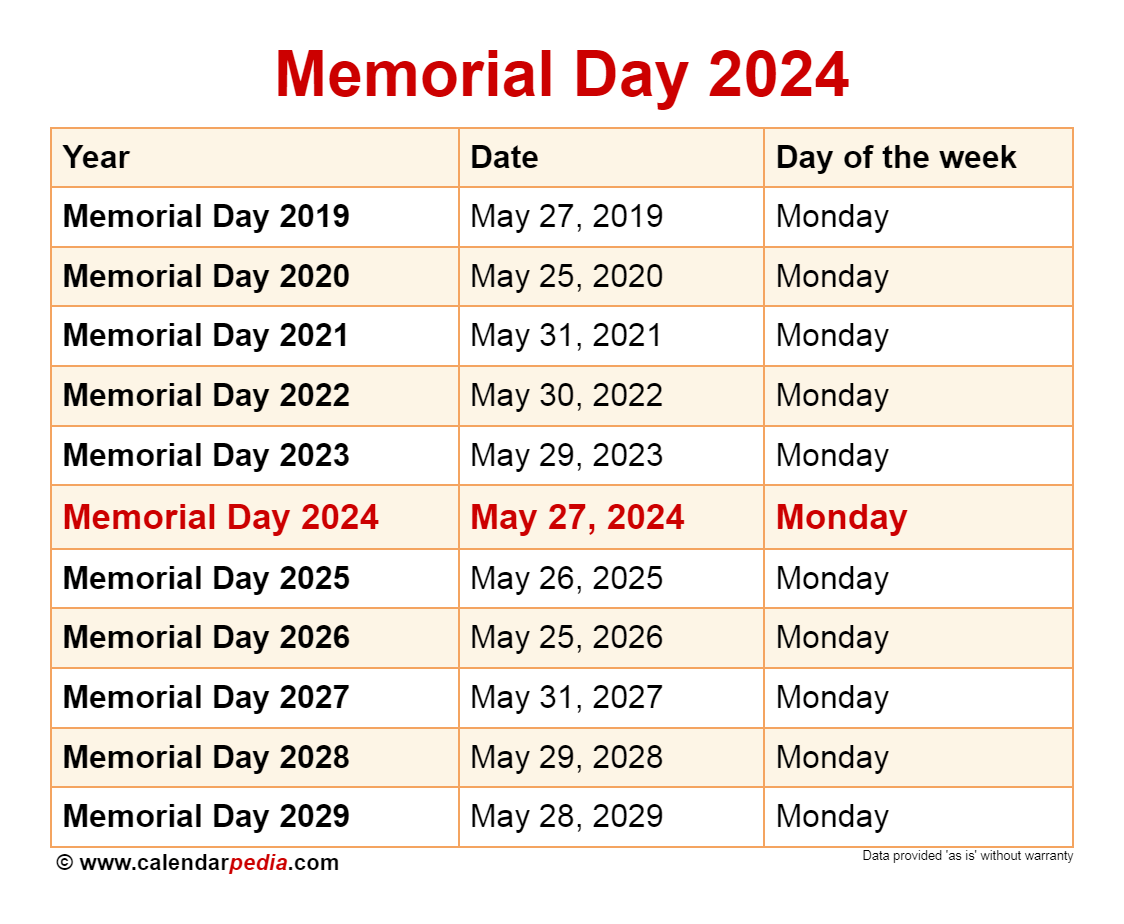

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025 -

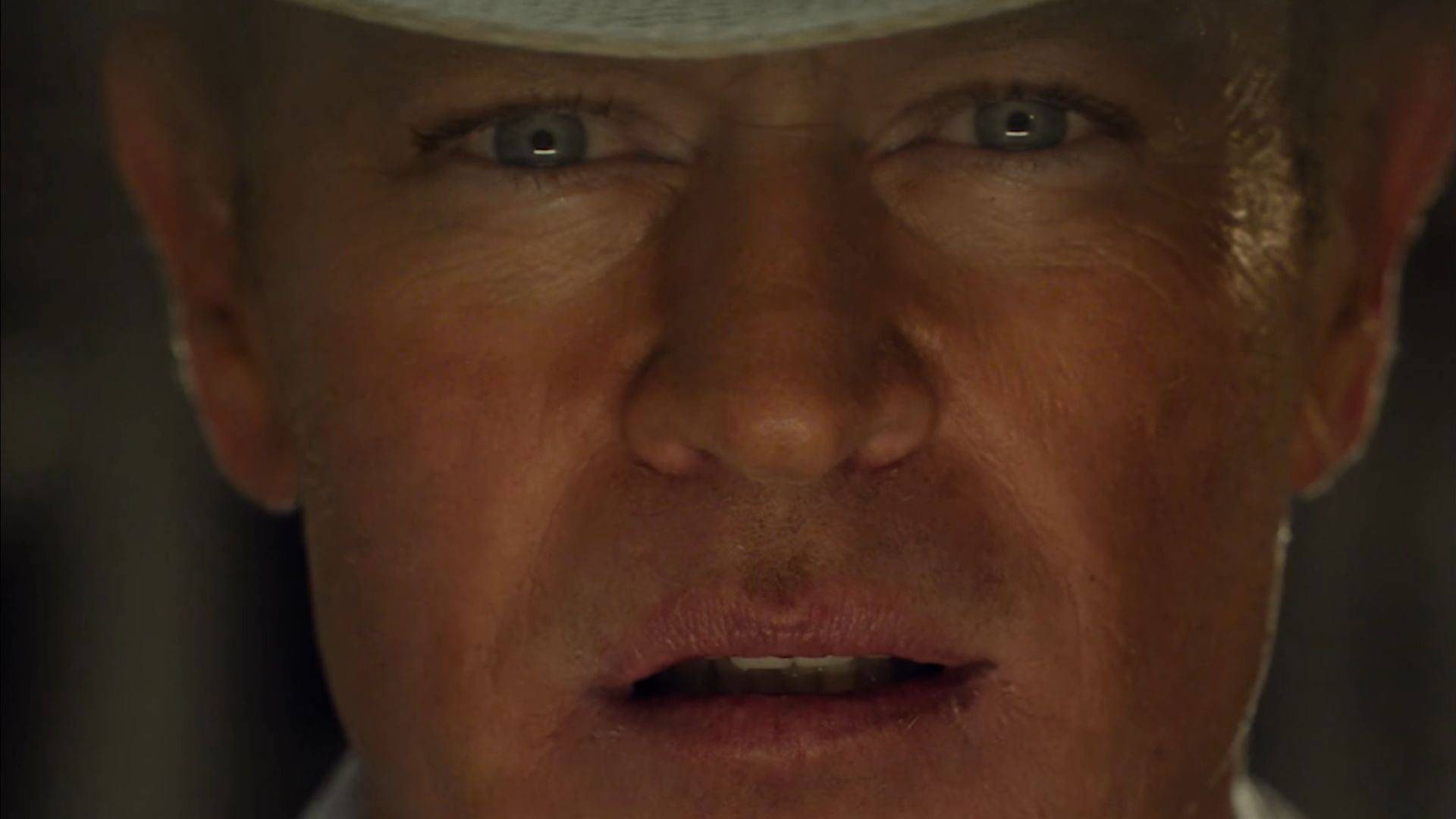

Review Neal Mc Donough In The Last Rodeo

May 23, 2025

Review Neal Mc Donough In The Last Rodeo

May 23, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025 -

Exploring Neal Mc Donoughs Character In The Last Rodeo

May 23, 2025

Exploring Neal Mc Donoughs Character In The Last Rodeo

May 23, 2025