Financial Constraints: Practical Solutions And Strategies For Success

Table of Contents

Creating a Realistic Budget: The Foundation of Financial Stability

A realistic budget is the cornerstone of financial stability, acting as a roadmap to navigate your finances effectively. Without a clear understanding of your income and expenses, managing financial constraints becomes nearly impossible.

Tracking Your Spending

Accurately monitoring your income and expenses is the first step. This provides a clear picture of your current financial situation, highlighting areas where you can cut back and save.

- Utilize budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital are popular choices offering automated tracking and insightful reports.

- Employ spreadsheets: Excel or Google Sheets allow for customized tracking and analysis, providing flexibility in categorization and reporting.

- Manual tracking: For those preferring a more hands-on approach, a simple notebook or journal can effectively track income and expenses. Ensure you categorize your expenses (housing, transportation, food, entertainment, etc.) to understand where your money is going. This crucial step reveals opportunities for potential savings.

Budgeting Techniques

Several budgeting methods can help you effectively manage your finances.

- The 50/30/20 Rule: Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. This simple rule provides a clear framework for spending.

- Zero-Based Budgeting: Assign every dollar a specific purpose, ensuring your income equals your expenses. This meticulous approach leaves no room for overspending.

- Envelope System: Allocate cash to different spending categories in labeled envelopes. Once the cash is gone, that category's spending is finished for the period. This visual method promotes mindful spending.

Adjusting Your Budget

Your budget isn't static; it requires regular review and adaptation. Life throws curveballs – unexpected expenses, job changes, or even salary increases.

- Cut unnecessary expenses: Identify areas where you can reduce spending without significantly impacting your lifestyle. This might involve canceling subscriptions, finding cheaper alternatives, or reducing eating out.

- Prioritize needs over wants: Focus on essential expenses (housing, food, transportation, healthcare) before allocating funds to discretionary spending.

- Explore different income streams: Consider a side hustle, freelance work, or selling unused items to increase your income and alleviate financial constraints.

Effective Debt Management Strategies

Debt can significantly exacerbate financial constraints. Addressing it strategically is crucial for long-term financial health.

Understanding Your Debt

Knowing the types of debt you have and their associated interest rates is essential for effective management.

- High-interest debt: Credit card debt typically carries high interest rates, making it a priority for repayment.

- Lower-interest debt: Student loans and mortgages generally have lower interest rates, allowing for a more flexible repayment strategy.

Debt Consolidation and Refinancing

Consolidating high-interest debts into lower-interest options can significantly reduce your monthly payments and save you money in the long run.

- Debt consolidation loans: These loans combine multiple debts into a single, lower-interest loan.

- Balance transfer credit cards: These cards offer a temporary 0% APR period, allowing you to pay down debt without accruing interest. However, be mindful of balance transfer fees and the eventual interest rate.

- Professional Advice: If navigating debt feels overwhelming, seek professional financial advice to create a personalized debt management plan.

Creating a Debt Repayment Plan

Several methods can help you systematically eliminate debt.

- Debt Snowball Method: Pay off the smallest debt first, regardless of interest rate, for motivational wins.

- Debt Avalanche Method: Prioritize paying off the debt with the highest interest rate first, saving money on interest in the long run.

Smart Saving and Investing Strategies for Long-Term Financial Health

Saving and investing are crucial for building long-term financial security and overcoming financial constraints.

Setting Realistic Savings Goals

Establish both short-term and long-term savings goals.

- Emergency Fund: Aim for 3-6 months' worth of living expenses in a readily accessible savings account.

- Retirement Savings: Contribute regularly to retirement accounts like 401(k)s or IRAs to ensure a comfortable retirement.

Automating Savings

Automating transfers to your savings accounts ensures consistent savings, even when facing financial constraints. Set up automatic transfers from your checking to savings account each payday.

Investing for the Future

Investing your savings can help your money grow over time.

- Stocks: Represent ownership in a company and offer potential for high returns, but also higher risk.

- Bonds: Lower-risk investments that provide fixed income payments.

- Mutual Funds: Diversified investments that pool money from multiple investors to invest in a variety of assets.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Consult with a qualified financial advisor for personalized guidance.

Seeking Professional Financial Advice and Support

Navigating financial constraints can be challenging. Don't hesitate to seek professional help.

Identifying Qualified Financial Advisors

Research and vet potential advisors carefully, ensuring they are certified and have a proven track record.

Utilizing Free Financial Resources

Numerous free resources are available to help manage finances.

- Government websites (e.g., the Consumer Financial Protection Bureau)

- Non-profit organizations offering financial literacy programs

- Educational materials from reputable financial institutions

Negotiating Bills and Expenses

Don't be afraid to negotiate with creditors and service providers to lower your expenses.

Conclusion

Overcoming financial constraints requires a multifaceted approach. Creating a realistic budget, effectively managing debt, implementing smart saving and investing strategies, and seeking professional advice when needed are all crucial elements in achieving financial freedom and building a secure future. Start tackling your financial constraints today by creating a realistic budget. Take control of your finances and pave the way for a more secure financial future. Begin your journey towards financial planning and break free from the limitations of financial constraints.

Featured Posts

-

Chi Varto Putinu Rizikuvati Obman Trampa Ta Yogo Potentsiyni Naslidki

May 22, 2025

Chi Varto Putinu Rizikuvati Obman Trampa Ta Yogo Potentsiyni Naslidki

May 22, 2025 -

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025 -

Loto Du Patrimoine 2025 Decouverte En Images Du Theatre Tivoli A Clisson

May 22, 2025

Loto Du Patrimoine 2025 Decouverte En Images Du Theatre Tivoli A Clisson

May 22, 2025 -

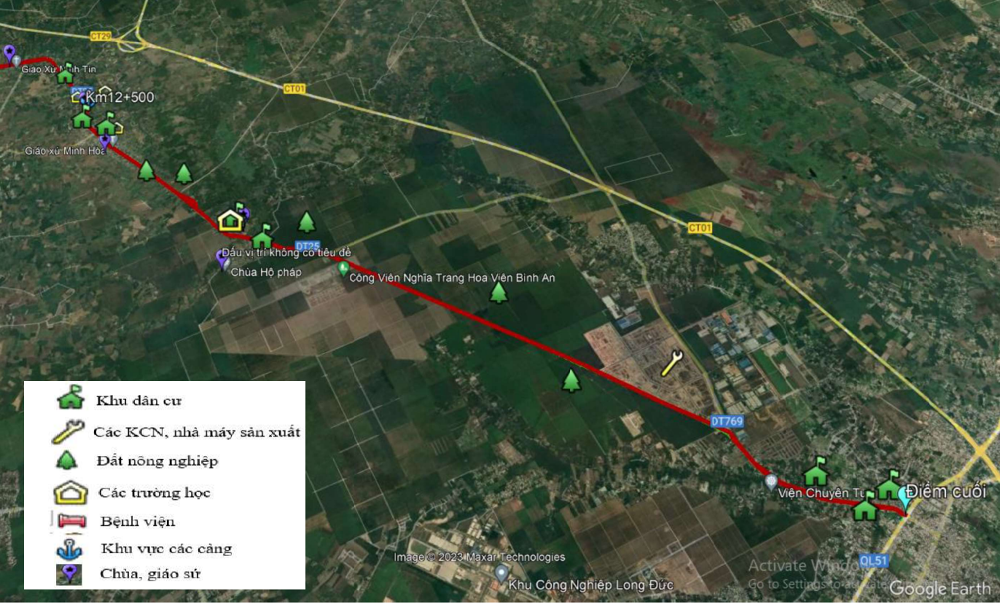

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025 -

Dropout Kings Lead Singer Adam Ramey Dead At 32

May 22, 2025

Dropout Kings Lead Singer Adam Ramey Dead At 32

May 22, 2025