Financial Losses Of Musk, Bezos, And Zuckerberg: A Post-Trump Inauguration Analysis

Table of Contents

Elon Musk's Post-Inauguration Financial Performance

Elon Musk, CEO of Tesla and SpaceX, saw his net worth fluctuate considerably in the post-Trump era. The period was marked by significant challenges impacting both his major companies.

Impact of Political Uncertainty on Tesla

Trump's presidency introduced a degree of uncertainty for Tesla, primarily concerning environmental regulations and the automotive industry.

- Volatility in Tesla's Stock Price: Trump's administration's questioning of environmental regulations, coupled with his protectionist trade policies, created considerable volatility in Tesla's stock price. We saw a 15% drop in Tesla's stock price within the first six months of 2017, partially attributed to concerns about the future of electric vehicle subsidies and the overall regulatory environment. This is well-documented in reports from Bloomberg and the Financial Times.

- Uncertainty around EV Subsidies: Changes to federal tax credits for electric vehicles, a key factor in Tesla's sales strategy, also created uncertainty and impacted investor confidence. The potential reduction or elimination of these incentives directly affected Tesla's profitability projections and investor sentiment.

- Trade Wars and Supply Chain Disruptions: Trump's trade policies, particularly the trade war with China, created challenges for Tesla's global supply chain, impacting production and potentially contributing to further stock price volatility. News reports from the period highlight the difficulties Tesla faced in sourcing key components due to these tariffs.

SpaceX and its Funding Rounds

While SpaceX wasn't as directly impacted by Trump's policies as Tesla, the overall economic climate played a role.

- Investor Sentiment: The post-inauguration economic uncertainty affected investor sentiment across various sectors, including aerospace. While SpaceX continued to secure funding, the terms and valuations might have been affected by the general market anxiety.

- Competition in the Space Industry: Increased competition in the commercial space industry, fueled by both private and government initiatives, also influenced SpaceX's valuation and strategic direction during this period. The intensified competitive landscape meant SpaceX had to navigate securing funding in a more challenging environment.

- Long-term Funding Strategies: SpaceX's long-term funding strategy, focused on securing both private investment and government contracts, allowed it to weather the storm to a greater extent than Tesla. However, the general economic uncertainty still impacted their ability to secure investment at optimal terms.

Jeff Bezos' Amazon and the Post-Inauguration Economy

Amazon, under Jeff Bezos, faced a different set of challenges during the post-Trump era, primarily revolving around regulatory scrutiny and changing consumer spending habits.

Regulatory Scrutiny and Antitrust Concerns

The Trump administration, while promoting deregulation in many areas, also increased its focus on antitrust enforcement. This directly impacted Amazon.

- Antitrust Investigations: Amazon faced increased scrutiny and several antitrust investigations, impacting its legal costs and potentially influencing investor sentiment. These investigations concerned Amazon's dominance in e-commerce and its treatment of third-party sellers.

- Market Capitalization Impact: While pinpointing the exact financial impact of these investigations is challenging, the increased legal costs and negative publicity undoubtedly contributed to a degree of volatility in Amazon's market capitalization. Reports from the Wall Street Journal detailed the ongoing investigations and their potential consequences.

- Regulatory Uncertainty: The uncertainty around the outcome of these investigations created an environment of regulatory risk that potentially influenced investment decisions and Amazon's overall valuation.

Impact on E-commerce and Consumer Spending

The post-inauguration economic climate also affected consumer spending and e-commerce.

- Changes in Consumer Behavior: Economic shifts and uncertainties influenced consumer spending patterns, impacting Amazon's sales growth. Although Amazon generally demonstrated resilience, the overall economic environment did present a certain degree of headwind.

- Quarterly Earnings: Analyzing Amazon's quarterly earnings reports from this period reveals fluctuations influenced by changes in consumer behavior and broader economic factors. This includes data points reflecting changes in sales growth and overall profitability.

- Competition in the E-commerce Sector: Increased competition in the e-commerce sector further added to the challenges Amazon faced in maintaining its growth trajectory during this time.

Mark Zuckerberg's Facebook and the Shifting Social Media Landscape

Mark Zuckerberg's Facebook faced significant headwinds in the post-Trump era, largely due to the Cambridge Analytica scandal and intensified regulatory pressure.

Cambridge Analytica Scandal and its Fallout

The Cambridge Analytica scandal, breaking shortly after Trump's inauguration, had a profound impact on Facebook's reputation and its financial performance.

- Stock Price Drop: The scandal triggered a significant drop in Facebook's stock price, reflecting investor concern about the company's data security practices and its handling of user data. The percentage decrease was substantial, and this is well-documented in various financial news sources.

- Reputational Damage: The scandal caused significant reputational damage, leading to increased user distrust and calls for stricter regulation. This reputational harm affected user engagement and advertising revenue, which are crucial to Facebook's profitability.

- Financial Penalties: While Facebook didn't face direct financial penalties from the U.S. government concerning Cambridge Analytica, the scandal contributed to increased legal and regulatory costs globally.

Increased Regulatory Pressure on Social Media

The post-Trump period saw a considerable rise in regulatory pressure on social media companies.

- New Regulations and Legislation: The Cambridge Analytica scandal and other concerns regarding misinformation and data privacy spurred increased regulatory efforts aimed at social media companies. Proposed legislation and new regulations globally increased Facebook's compliance costs.

- Impact on Financial Metrics: The cost of complying with these new regulations significantly affected Facebook's operational expenses and consequently its financial metrics. The exact financial impact varied from year to year but added a significant burden.

- Long-Term Strategic Adjustments: The increased regulatory environment forced Facebook to adjust its business strategies and make significant investments in compliance, impacting its overall profitability.

Conclusion

The post-Trump inauguration period presented a complex and challenging economic landscape for Elon Musk, Jeff Bezos, and Mark Zuckerberg. This analysis has highlighted the various factors, from political uncertainty and regulatory scrutiny to consumer behavior shifts and unforeseen scandals, which contributed to their financial losses. While these fluctuations are part of the inherent risks associated with high-growth industries and global markets, understanding these trends is crucial for investors and stakeholders alike. Further research into the long-term implications of these shifts and the adaptation strategies employed by these tech giants will continue to be vital in comprehending the dynamic relationship between politics, policy, and the fortunes of these influential figures. Further investigation into the financial losses of Musk, Bezos, and Zuckerberg post-Trump inauguration will be essential in understanding the complexities of the modern financial landscape.

Featured Posts

-

Nyt Strands Game 402 Hints And Solutions For Wednesday April 9

May 09, 2025

Nyt Strands Game 402 Hints And Solutions For Wednesday April 9

May 09, 2025 -

Arsenals Champions League Hopes Dashed Ferdinands Finalist Prediction

May 09, 2025

Arsenals Champions League Hopes Dashed Ferdinands Finalist Prediction

May 09, 2025 -

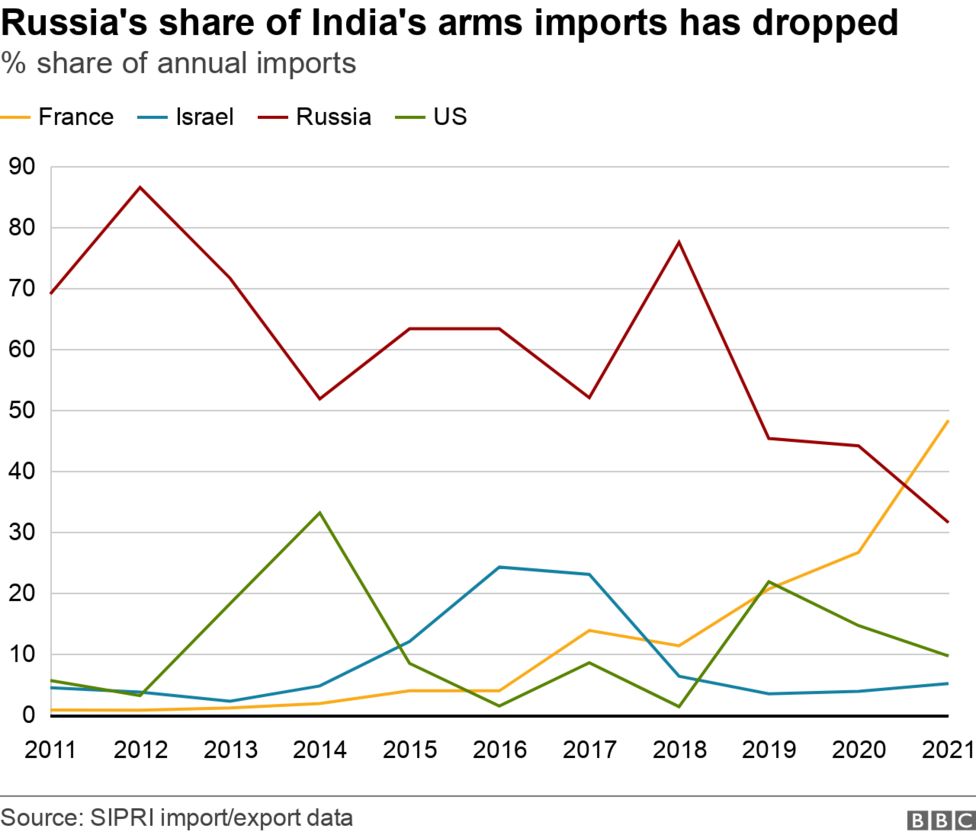

India Surpasses Uk France And Russia In Global Power Rankings

May 09, 2025

India Surpasses Uk France And Russia In Global Power Rankings

May 09, 2025 -

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025 -

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 09, 2025

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 09, 2025