Financial Planning: CFP Board CEO's Retirement In 2026

Table of Contents

The Significance of the CFP Board CEO's Retirement

The CFP Board CEO holds a position of immense influence within the financial planning industry. They oversee the certification process for Certified Financial Planners (CFPs), setting standards for professional conduct and education. Their retirement in 2026 represents a significant turning point, impacting various facets of the field.

-

Impact on CFP certification standards: The incoming CEO may bring new perspectives and potentially revise existing certification requirements, impacting the ongoing professional development of CFP professionals. This could involve changes to the curriculum, testing procedures, or continuing education mandates.

-

Potential changes in leadership and strategic direction: A new CEO will inevitably bring a fresh perspective and potentially shift the strategic direction of the CFP Board. This could result in changes to policy, advocacy efforts, and the overall approach to regulating the financial planning profession.

-

Implications for professional development programs for CFP professionals: Changes in leadership could also lead to adjustments in the types of professional development programs offered to CFP professionals, potentially focusing on emerging areas within financial planning or adapting to evolving regulatory landscapes.

Financial Planning Best Practices for High-Net-Worth Individuals (Like CEOs)

High-net-worth individuals, such as CEOs, face unique financial planning challenges. Their sophisticated financial needs require specialized strategies beyond those typically employed by the average individual. Effective financial planning for high-net-worth individuals requires a holistic approach encompassing:

-

Tax optimization strategies: Minimizing tax liabilities is crucial. Strategies include utilizing tax-advantaged accounts like 401(k)s, Roth IRAs, and utilizing various tax deductions and credits. Sophisticated tax planning might involve trusts and other complex financial instruments.

-

Estate planning considerations: Preserving and transferring wealth to heirs efficiently requires careful estate planning, including wills, trusts, and power of attorney documents. Minimizing estate taxes through strategic gifting and other techniques is also critical.

-

Charitable giving strategies: High-net-worth individuals often have significant philanthropic goals. Strategic charitable giving can offer tax advantages while supporting desired causes. This could involve establishing private foundations or donor-advised funds.

-

Investment diversification and portfolio management: A diversified investment portfolio is essential to manage risk. High-net-worth individuals may utilize sophisticated investment vehicles like hedge funds, private equity, and real estate to achieve their financial goals. Examples include Qualified Personal Residence Trusts (QPRTs) and Grantor Retained Annuity Trusts (GRATs).

Succession Planning and its Importance for the CFP Board

A smooth leadership transition is crucial for the CFP Board's continued success and stability. A well-defined succession plan ensures minimal disruption during the changeover and maintains the organization's commitment to its mission.

-

Key elements of effective succession planning: This includes identifying and developing potential successors, implementing comprehensive training programs, and establishing clear communication strategies to keep stakeholders informed throughout the transition process. Mentorship programs are also vital for nurturing future leaders.

-

Impact of a well-defined succession plan: A robust plan mitigates risk, preserves institutional knowledge, and provides continuity in upholding high professional standards within the CFP certification process. It also instills confidence among stakeholders, including CFP professionals and the public.

Lessons for CFP Professionals from the CEO's Retirement

The upcoming retirement of the CFP Board CEO offers valuable lessons for CFP professionals regarding the importance of proactive financial planning. This event underscores the need for meticulous planning, regardless of net worth.

- Practical steps CFP professionals can take for their own financial planning:

- Regularly review and adjust their retirement plan based on their financial goals and changing life circumstances.

- Diversify their investment portfolio to mitigate risk and maximize returns.

- Seek professional financial advice from a qualified financial planner to ensure their plan aligns with their personal circumstances and objectives.

- Consider working with a financial advisor specializing in retirement planning strategies.

Planning for Your Future: Taking Control of Your Financial Planning

The retirement of the CFP Board CEO in 2026 highlights the critical importance of proactive financial planning for everyone, not just high-net-worth individuals. The lessons learned from this event emphasize the need for comprehensive planning that considers tax optimization, estate planning, and investment diversification. Don't wait until retirement is imminent; take control of your financial future today. Seek professional financial planning services from a certified financial planner to develop a personalized and comprehensive plan that secures your financial well-being. Effective financial planning is an investment in your future – an investment that pays dividends for years to come.

Featured Posts

-

Accompagnement Numerique Pour Thes Dansants Simplifiez Votre Organisation

May 02, 2025

Accompagnement Numerique Pour Thes Dansants Simplifiez Votre Organisation

May 02, 2025 -

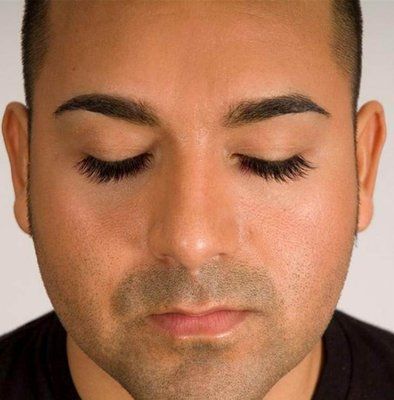

The Rise Of Male Eyelash Shaving Understanding The Reasons Behind It

May 02, 2025

The Rise Of Male Eyelash Shaving Understanding The Reasons Behind It

May 02, 2025 -

Frances Six Nations Victory Over Italy A Message To Ireland

May 02, 2025

Frances Six Nations Victory Over Italy A Message To Ireland

May 02, 2025 -

Fortnite Item Shop Update A Disappointment For Many Fans

May 02, 2025

Fortnite Item Shop Update A Disappointment For Many Fans

May 02, 2025 -

Fortnite Players Face Extended Wait Chapter 6 Season 2 Launch Delayed

May 02, 2025

Fortnite Players Face Extended Wait Chapter 6 Season 2 Launch Delayed

May 02, 2025

Latest Posts

-

Dutch Government Considers Reviving Ow Subsidies To Attract Bidders

May 03, 2025

Dutch Government Considers Reviving Ow Subsidies To Attract Bidders

May 03, 2025 -

Vuelta Ciclista A Murcia Christen Se Impone En La Edicion 2024 Adaptar El Ano

May 03, 2025

Vuelta Ciclista A Murcia Christen Se Impone En La Edicion 2024 Adaptar El Ano

May 03, 2025 -

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 03, 2025

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 03, 2025 -

Tomatins Strathdearn Project A Significant Step Towards Affordable Housing

May 03, 2025

Tomatins Strathdearn Project A Significant Step Towards Affordable Housing

May 03, 2025 -

45 Vuelta Ciclista A La Region De Murcia Victoria Para Fabio Christen

May 03, 2025

45 Vuelta Ciclista A La Region De Murcia Victoria Para Fabio Christen

May 03, 2025