Financial Planning's Future: CFP Board CEO Announces 2026 Retirement

Table of Contents

Impact of the CEO's Retirement on the CFP Board

The retiring CEO leaves behind a substantial legacy, having significantly contributed to the growth and prestige of the CFP certification. Their tenure likely involved navigating complex regulatory environments, advocating for the profession, and driving initiatives to enhance the value of the CFP designation. The transition period will present both challenges and opportunities for the CFP Board. Success hinges on a smooth and effective succession plan. Key considerations during this transition include:

- Succession planning: Ensuring a seamless transfer of leadership and maintaining the organization's strategic direction is paramount. A well-defined succession plan, including leadership development programs, will be crucial.

- Maintaining the integrity of the CFP certification: The CFP Board must continue its rigorous standards for certification and uphold the high ethical standards expected of CFP professionals. This protects the value of the certification for consumers and professionals alike.

- Addressing current challenges: The financial planning industry faces numerous challenges, including increasing regulatory complexity, technological disruption, and the need to address the growing skills gap. The new leadership will need to prioritize strategies to overcome these hurdles.

- Future strategic direction: The CFP Board needs a clear vision for the future of financial planning, encompassing technological innovation, evolving client needs, and global market trends. This includes proactively addressing the increasing demand for financial planning services and the rising influence of ESG (environmental, social, and governance) factors in investment decisions.

The Future of Financial Planning: Trends and Predictions

The financial planning industry is poised for significant transformation in the coming years. Several key trends will shape its future:

- Rise of robo-advisors and fintech solutions: Technology is rapidly changing how financial advice is delivered. Robo-advisors and other fintech solutions offer convenient, often low-cost, access to financial planning tools. However, the human element of financial planning remains crucial for complex situations.

- Increasing demand for holistic financial planning: Clients increasingly seek comprehensive financial plans addressing all aspects of their financial lives, from retirement planning and investment management to tax optimization and estate planning. This necessitates a holistic approach from financial planners.

- Growing importance of financial literacy and education: The demand for financial literacy programs is growing as individuals seek to better manage their finances. CFP professionals play a vital role in educating clients and empowering them to make informed decisions.

- Impact of regulatory changes: Regulatory changes, such as those related to fiduciary duty and cybersecurity, will continue to shape the financial planning landscape. CFP professionals must stay informed about and adapt to these changes.

- Integration of ESG factors: The growing awareness of ESG factors is influencing investment decisions. Financial planners need to integrate these considerations into their advice, aligning client portfolios with their values and sustainability goals.

Preparing for the Next Generation of Financial Planners

Attracting and retaining talented individuals is crucial for the future of the financial planning profession. Addressing the skills gap and fostering diversity and inclusion are paramount. Key strategies include:

- Addressing the skills gap: Investing in robust educational programs and training initiatives is essential to equip future financial planners with the skills and knowledge needed to thrive in the evolving landscape.

- Promoting diversity and inclusion: Creating a more diverse and inclusive profession is essential to better serve the diverse needs of the client base. This includes actively recruiting from underrepresented groups and fostering an inclusive workplace culture.

- Enhancing educational pathways: Improving access to quality financial planning education and streamlining the pathways to becoming a CFP professional is crucial. This includes making the certification process more accessible and affordable.

- Adapting to changing client needs: Understanding and anticipating the changing needs of clients is crucial. This involves staying informed about emerging trends, technological advancements, and client preferences.

Key Considerations for CFP Professionals in Light of the CEO's Retirement

For CFP professionals, the upcoming retirement signifies a time for reflection and proactive adaptation. Staying informed about developments within the CFP Board and the wider financial planning industry is paramount. Key actions include:

- Staying current with CFP Board updates and regulations: Regularly reviewing CFP Board announcements, guidelines, and regulatory changes is crucial to maintain compliance and provide best-in-class advice.

- Networking and building professional relationships: Networking with colleagues and peers provides valuable opportunities for knowledge sharing, collaboration, and staying abreast of industry developments.

- Embracing continuing education opportunities: Participating in continuing education programs ensures CFP professionals maintain their expertise and stay ahead of emerging trends and technologies.

- Focusing on client needs and providing exceptional service: Prioritizing client needs and providing personalized, high-quality service is essential for building trust and long-term client relationships.

Conclusion: Securing the Future of Financial Planning

The retirement of the CFP Board CEO presents both challenges and opportunities for the future of financial planning. Maintaining the high standards of the CFP designation, adapting to evolving industry trends, and fostering a new generation of skilled professionals are crucial for securing the profession's future. The CFP designation remains a hallmark of excellence in financial planning, and securing "Financial Planning's Future" requires continued commitment to professional development, ethical practices, and client-centric service. To stay informed about the latest developments and ensure your continued success in this dynamic field, actively engage in continuing education and explore the resources available on the CFP Board website. Consider pursuing CFP certification to shape the future of financial planning and contribute to a thriving profession.

Featured Posts

-

Gop Candidates Nc Supreme Court Appeal What It Means

May 03, 2025

Gop Candidates Nc Supreme Court Appeal What It Means

May 03, 2025 -

Barrow Afc Supporters Pedal For Charity In Sky Bet Relay

May 03, 2025

Barrow Afc Supporters Pedal For Charity In Sky Bet Relay

May 03, 2025 -

Strategies For Enhancing Mental Health Literacy Education Programs

May 03, 2025

Strategies For Enhancing Mental Health Literacy Education Programs

May 03, 2025 -

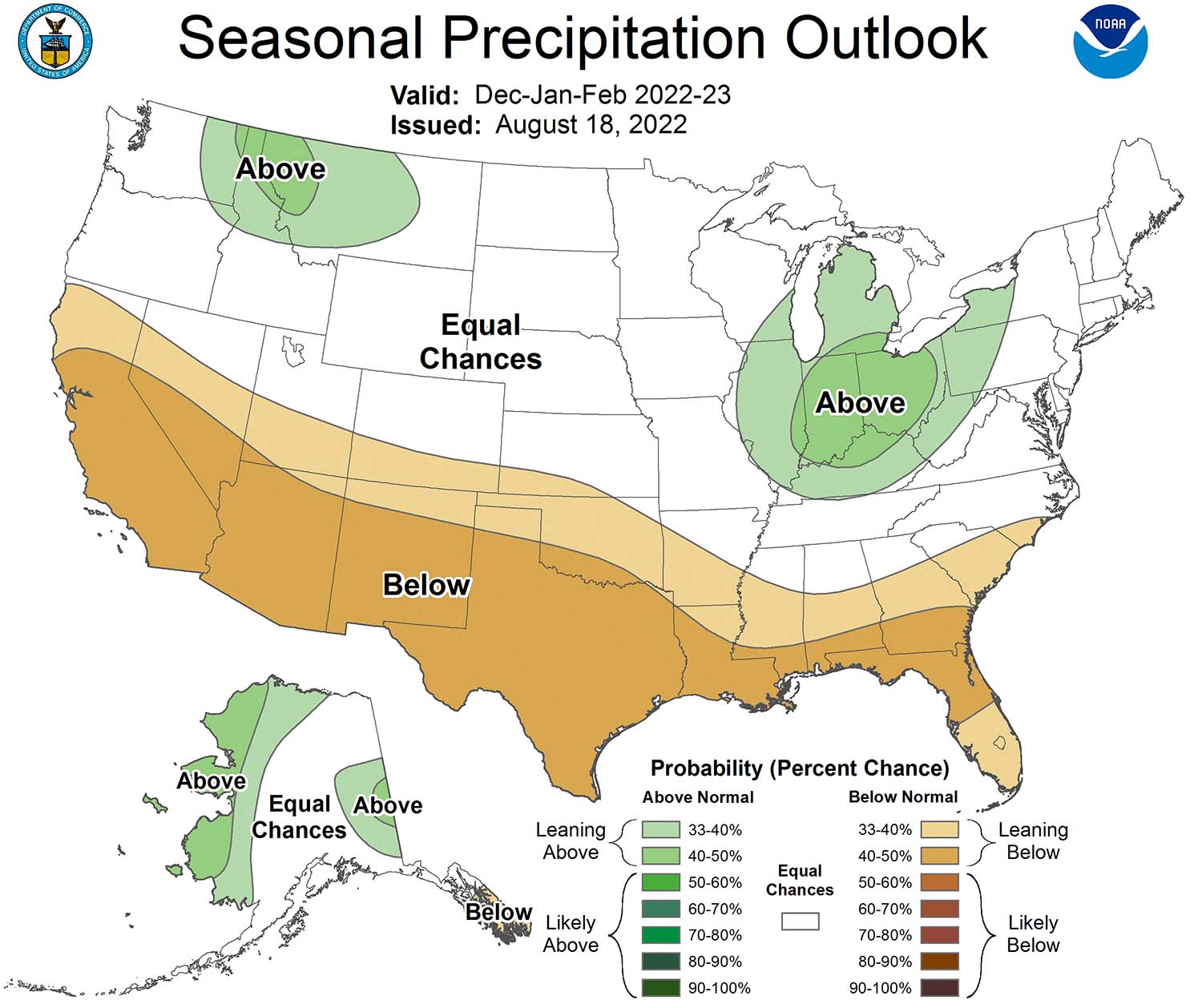

Tulsa Winter Weather 2024 A Statistical Overview

May 03, 2025

Tulsa Winter Weather 2024 A Statistical Overview

May 03, 2025 -

Ai Chip Export Restrictions Nvidia Ceos Plea To Trump

May 03, 2025

Ai Chip Export Restrictions Nvidia Ceos Plea To Trump

May 03, 2025

Latest Posts

-

Even Marvel Knows Its Movies And Shows Need Improvement

May 04, 2025

Even Marvel Knows Its Movies And Shows Need Improvement

May 04, 2025 -

Bookstore Discovery 45 000 Rare Novel Surfaces

May 04, 2025

Bookstore Discovery 45 000 Rare Novel Surfaces

May 04, 2025 -

Rare 45 000 Novel Found Bookstore Treasure Unearthed

May 04, 2025

Rare 45 000 Novel Found Bookstore Treasure Unearthed

May 04, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development At 2024 Event

May 04, 2025

Open Ai Unveils Streamlined Voice Assistant Development At 2024 Event

May 04, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 04, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 04, 2025