Financial Strain Forces Canadians To Compromise On Vehicle Security

Table of Contents

Rising Costs and Reduced Spending on Vehicle Security

The escalating costs associated with owning and maintaining a vehicle in Canada are a major contributing factor to compromised vehicle security. Rising car insurance premiums, coupled with increasingly expensive repairs and maintenance, are forcing many Canadians to prioritize essential expenses over vehicle security upgrades. This means that crucial security features, like advanced alarms, GPS trackers, and immobilizers, are often overlooked or deemed unaffordable luxuries.

- Higher insurance premiums for older vehicles: Older cars, often more affordable upfront, frequently come with significantly higher insurance premiums due to their increased risk of theft and damage.

- The cost of replacing stolen parts: The expense of replacing stolen parts, such as catalytic converters or wheels, can be substantial, placing an even greater financial burden on already stressed budgets.

- The expense of advanced security systems: Modern anti-theft systems, while offering superior protection, can be costly to install and maintain, making them inaccessible for many.

- The financial burden of vehicle theft or damage: The financial consequences of vehicle theft or damage extend far beyond the immediate loss. Dealing with insurance claims, replacing personal belongings, and arranging alternative transportation can significantly impact financial stability.

Choosing Older, Less Secure Vehicles Due to Budget Constraints

Financial limitations are also driving many Canadians to purchase older, less expensive vehicles, leading to increased used car security risks. While affordability is a key consideration, this choice often comes with significant security trade-offs. Older vehicles typically lack the advanced security features found in newer models, making them considerably more vulnerable to theft and vandalism.

- Increased risk of theft for older models: Older vehicles are often targeted by thieves due to their lack of sophisticated anti-theft technology.

- Lack of advanced anti-theft technology in older cars: Many older cars lack features like immobilizers, alarm systems, or GPS tracking, making them easy targets for criminals.

- Higher maintenance costs potentially outweighing security investments: The cost of maintaining an older vehicle can be substantial, potentially leaving little room in the budget for additional security upgrades.

- Difficulties in finding affordable insurance for older, less secure vehicles: Securing affordable insurance for an older vehicle with inadequate security can be challenging, potentially leading to even greater financial strain.

Cutting Corners on Vehicle Security Maintenance

Financial stress often leads Canadians to cut corners on essential vehicle security maintenance, further compromising their vehicle's safety. This might involve delaying or foregoing crucial repairs, such as replacing broken locks or fixing faulty alarms. Neglecting these seemingly minor issues can significantly increase the risk of theft or vandalism.

- Compromised locks making the car easier to steal: Damaged or faulty locks significantly weaken a vehicle's security, making it an easier target for thieves.

- Malfunctioning alarms increasing vulnerability to theft: A broken or unreliable alarm system provides no deterrent to potential thieves, increasing the risk of vehicle theft.

- Lack of regular servicing leading to mechanical failures that can compromise security: Regular servicing can identify potential mechanical issues that could compromise security, such as faulty ignition systems or compromised braking systems.

- The cumulative cost of neglecting maintenance versus proactive security measures: The cost of repairing damage caused by theft or vandalism can far outweigh the cost of preventative maintenance and security upgrades.

The Impact on Car Insurance and Security

Car insurance and security are intrinsically linked. Compromised vehicle security directly impacts insurance claims and premiums. Individuals with vehicles that have experienced theft or vandalism are more likely to file insurance claims, leading to higher premiums in the future. In some cases, individuals with insufficient vehicle security might even struggle to obtain comprehensive insurance coverage.

- Increased likelihood of filing insurance claims due to compromised security: Vehicles with inadequate security are more likely to be targeted by thieves and vandals, resulting in a higher probability of filing insurance claims.

- Higher insurance premiums for vehicles with a history of theft or vandalism: Insurance companies assess risk based on a vehicle's history. Vehicles with a history of theft or vandalism will typically have significantly higher premiums.

- Potential difficulties in obtaining insurance coverage for vehicles with inadequate security: In extreme cases, individuals with vehicles lacking essential security features might face difficulties securing adequate insurance coverage.

- The long-term financial consequences of inadequate insurance coverage: Inadequate insurance coverage can leave individuals vulnerable to significant financial losses in the event of theft or damage.

Conclusion: Protecting Your Vehicle Without Breaking the Bank

In conclusion, financial strain significantly impacts Canadians' ability to prioritize vehicle security. The risks of compromised vehicle security are real and substantial, leading to vehicle theft, vandalism, and increased insurance costs. However, protecting your vehicle doesn't necessarily require breaking the bank. Simple yet effective measures, such as parking in well-lit areas, investing in basic anti-theft devices, and participating in community watch programs, can significantly enhance your vehicle's security. Don't compromise on your vehicle security. Explore affordable options to protect your investment and peace of mind. Learn more about balancing your budget and vehicle security needs today.

Featured Posts

-

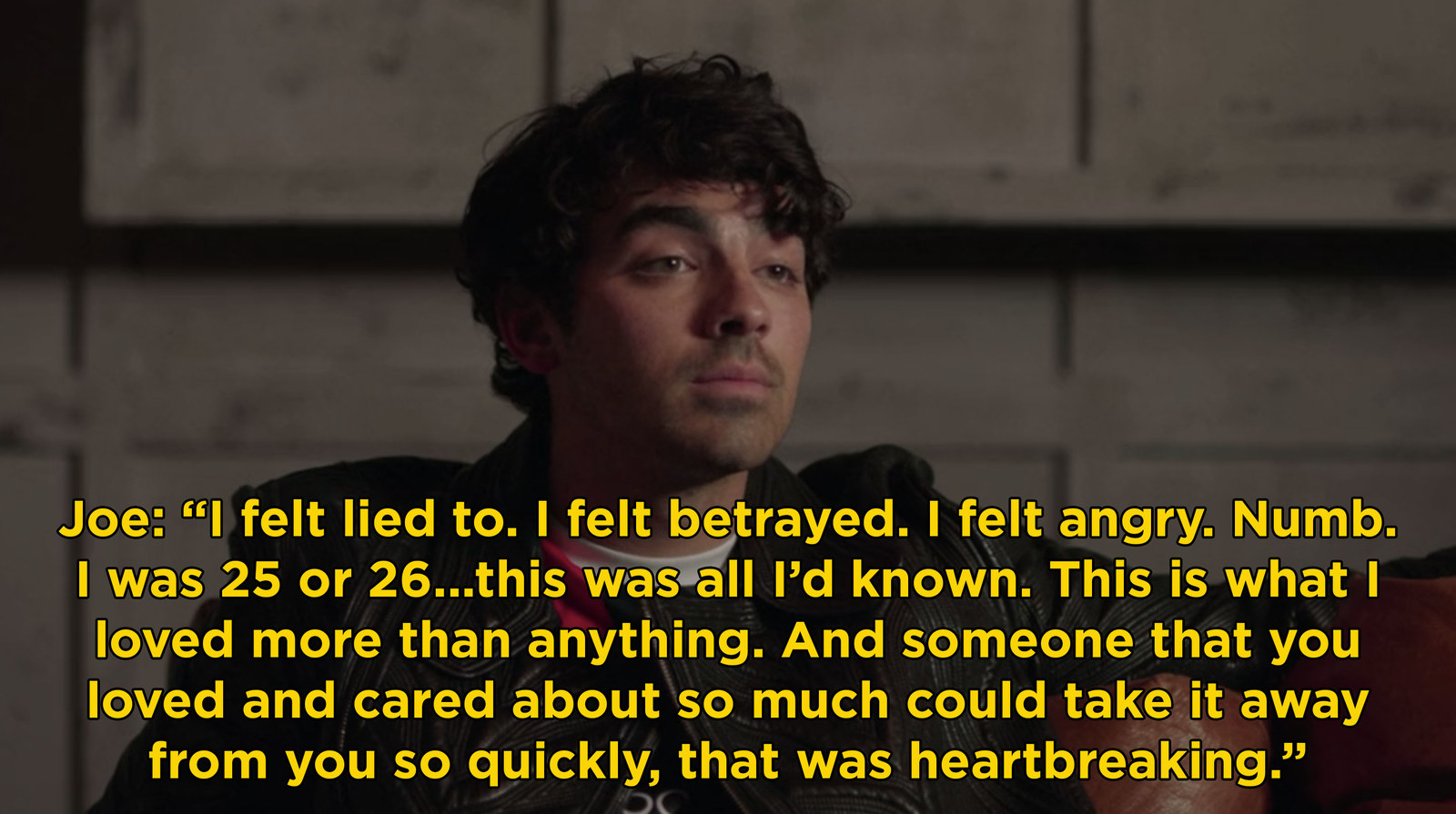

Joe Jonas And The Unexpected Marital Dispute His Response

May 23, 2025

Joe Jonas And The Unexpected Marital Dispute His Response

May 23, 2025 -

Englands Champions Trophy Hopes A Winter Of Waiting

May 23, 2025

Englands Champions Trophy Hopes A Winter Of Waiting

May 23, 2025 -

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025 -

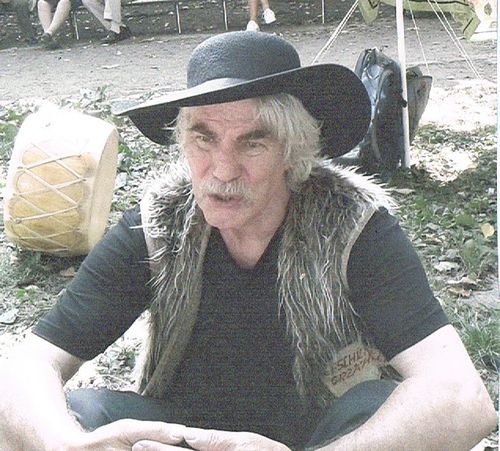

Grand Ole Oprys Centennial Celebration A London Spectacle

May 23, 2025

Grand Ole Oprys Centennial Celebration A London Spectacle

May 23, 2025 -

Milly Alcock And Meghann Fahy Face Toxic Workplace In New Siren Trailer

May 23, 2025

Milly Alcock And Meghann Fahy Face Toxic Workplace In New Siren Trailer

May 23, 2025

Latest Posts

-

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025 -

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025 -

Essen Uniklinikum Bewegendes Ereignis In Der Naehe Ruehrt Zu Traenen

May 24, 2025

Essen Uniklinikum Bewegendes Ereignis In Der Naehe Ruehrt Zu Traenen

May 24, 2025 -

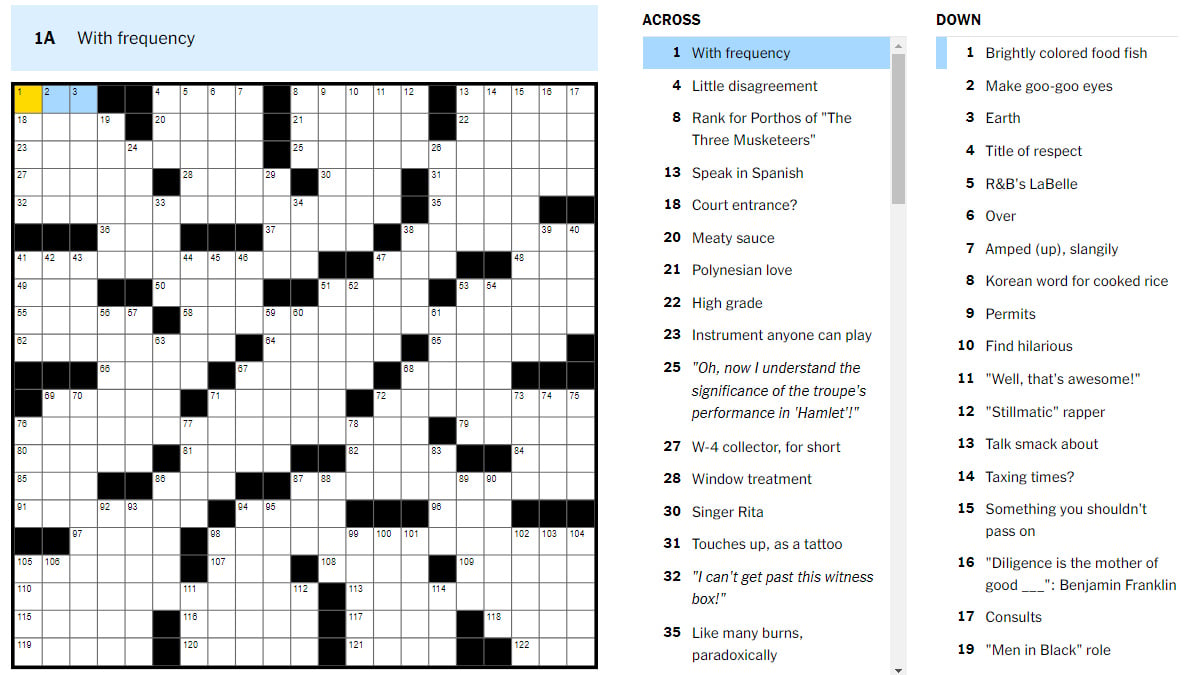

Nyt Mini Crossword March 24 2025 Solutions And Strategies

May 24, 2025

Nyt Mini Crossword March 24 2025 Solutions And Strategies

May 24, 2025 -

Solutions To The Nyt Mini Crossword April 18 2025

May 24, 2025

Solutions To The Nyt Mini Crossword April 18 2025

May 24, 2025