Find The Best Personal Loan Interest Rates Today: Compare & Save

Table of Contents

Understanding Personal Loan Interest Rates

Personal loan interest rates represent the cost of borrowing money. Lenders charge interest as compensation for the risk they take in lending you funds. Understanding how these rates work is crucial for securing the best deal.

-

APR (Annual Percentage Rate): The APR is the annual cost of borrowing, including interest and other fees. It's a crucial figure to compare across different loan offers. Always look for the APR, not just the interest rate alone, to get a complete picture of the loan's cost. A lower APR is always better.

-

Fixed vs.VariableInterest Rates: Fixed interest rates remain constant throughout the loan term, providing predictable monthly payments. Variable interest rates fluctuate based on market conditions, leading to potentially higher or lower payments over time. Fixed rates offer stability, while variable rates might initially offer a lower rate but carry more risk.

-

Factors Affecting Interest Rates: Several factors influence the interest rate you'll receive:

- Credit Score: Your credit history is a major determinant. A higher credit score typically qualifies you for lower interest rates.

- Loan Amount: Larger loan amounts might come with slightly higher interest rates.

- Loan Term: Longer loan terms generally result in lower monthly payments but higher overall interest costs.

Factors Affecting Your Personal Loan Interest Rate

Your personal loan interest rate isn't set in stone; several factors significantly influence the rate you'll be offered. Understanding these factors allows you to take proactive steps to improve your chances of securing a lower rate.

-

Credit Score: This is arguably the most crucial factor. A high credit score (750 or above) demonstrates creditworthiness to lenders, leading to significantly lower interest rates. A low credit score increases the perceived risk, resulting in higher rates or even loan rejection.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, indicates your ability to manage additional debt. A lower DTI generally improves your chances of loan approval and can influence the interest rate offered.

-

Loan Amount and Term: As mentioned earlier, both the loan amount and the repayment term significantly impact the overall cost. Borrowing a larger amount or opting for a longer term usually results in a higher interest rate.

-

Lender's Policies and Market Conditions: Different lenders have varying policies and risk assessments. Current economic conditions and prevailing interest rates in the market also play a significant role.

-

Tips for Improving Credit Score:

- Pay bills on time.

- Keep credit utilization low (less than 30% of your available credit).

- Monitor your credit report regularly for errors.

- Avoid applying for multiple loans simultaneously.

Where to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rates requires comparing offers from multiple lenders. Several options exist, each with its own advantages and disadvantages.

-

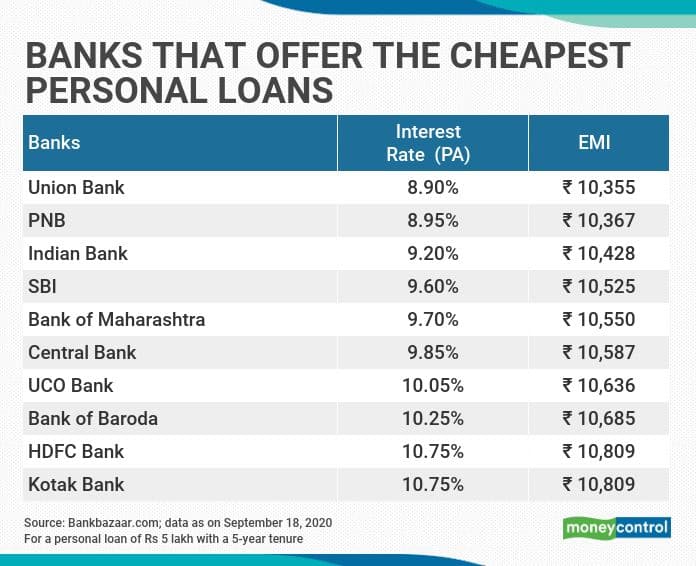

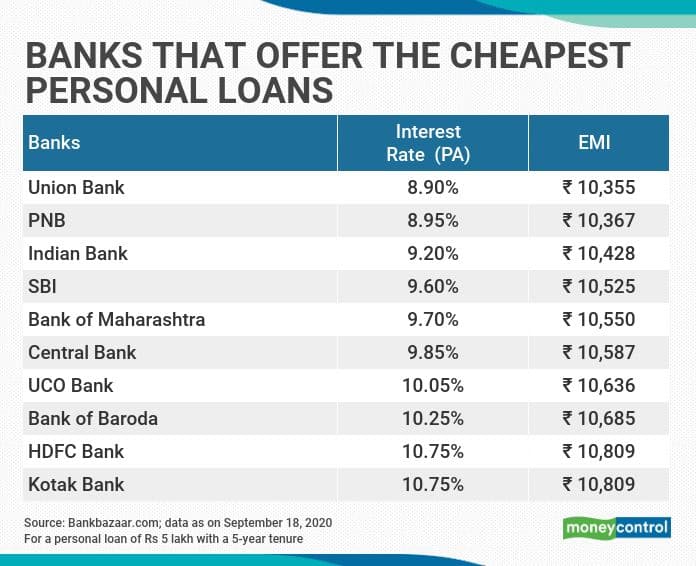

Banks: Traditional banks often offer competitive rates, but their application processes can be more rigorous.

-

Credit Unions: Credit unions are member-owned financial institutions that frequently offer lower rates and more personalized service than banks.

-

Online Lenders: Online lenders often provide streamlined applications and quick approval times but may charge higher fees.

-

Peer-to-Peer Lending Platforms: These platforms connect borrowers with individual investors, potentially offering competitive rates but with potentially less regulation.

-

Reputable Online Resources for Comparing Personal Loan Rates: Several websites offer tools to compare personal loan rates from different lenders simultaneously. These can save you valuable time and effort in your search for the best personal loan interest rates.

How to Compare Personal Loan Offers Effectively

Don't solely focus on the interest rate when comparing offers. Consider these factors:

-

Fees: Origination fees, late payment fees, and prepayment penalties can significantly add to the overall cost.

-

Repayment Terms: Understand the loan term, monthly payment amounts, and the total amount you'll repay.

-

Prepayment Penalties: Some lenders charge penalties if you repay the loan early.

-

Checklist for Comparing Loan Offers:

- APR

- Fees (origination, late payment, prepayment)

- Loan Term

- Repayment Schedule

- Customer service reputation

Tips for Negotiating Lower Interest Rates

While you can't always guarantee a lower rate, you can improve your chances by:

-

Negotiate: Don't be afraid to negotiate with lenders. Explain your financial situation and your good credit history.

-

Leverage Your Credit Score: A strong credit score is your best negotiating tool.

-

Shop Around: Comparing offers from multiple lenders puts you in a stronger position to negotiate.

-

Questions to Ask Lenders:

- "What are the fees associated with this loan?"

- "Is there any flexibility in the interest rate?"

- "What are the penalties for early repayment?"

Conclusion: Find the Best Personal Loan Interest Rates and Save Money

Finding the best personal loan interest rates requires diligent comparison and understanding of the various factors involved. By comparing offers from multiple lenders, considering your credit score and DTI, and negotiating effectively, you can significantly reduce the overall cost of your loan. Remember that even a small reduction in your interest rate can translate into substantial savings over the loan's lifespan. Secure the best personal loan rates by actively comparing loan offers, understanding the factors impacting your rate, and taking steps to improve your creditworthiness. Start comparing personal loan interest rates today to find the lowest personal loan interest rates and achieve long-term financial health!

Featured Posts

-

San Diego Padres Vs Atlanta Braves Acunas Impact

May 28, 2025

San Diego Padres Vs Atlanta Braves Acunas Impact

May 28, 2025 -

Hugh Jackman Takes A Cheeky Swipe At Ryan Reynolds His Biggest Gripe

May 28, 2025

Hugh Jackman Takes A Cheeky Swipe At Ryan Reynolds His Biggest Gripe

May 28, 2025 -

Alcaraz And Zverev Missed Opportunities While Sinner Shines

May 28, 2025

Alcaraz And Zverev Missed Opportunities While Sinner Shines

May 28, 2025 -

Smartphone Samsung Galaxy S25 256 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 256 Go Avis Prix Et Bon Plan

May 28, 2025 -

Irish Euro Millions Lottery Two Players Win Big Ticket Locations Announced

May 28, 2025

Irish Euro Millions Lottery Two Players Win Big Ticket Locations Announced

May 28, 2025