Finding The Right Funding For Your Sustainable SME

Table of Contents

Understanding Your Funding Needs as a Sustainable SME

Before diving into funding options, it’s crucial to understand your specific needs. This requires a robust business plan that clearly articulates your sustainability initiatives and their contribution to your bottom line. Investors, whether they focus on green finance or broader ESG investing, need to see a clear return on investment (ROI). Simply stating your commitment to sustainability isn't enough; you must demonstrate its positive impact on your financial performance.

- Develop a compelling business plan: This document should detail your business model, market analysis, and financial projections, highlighting your sustainability initiatives as key differentiators. This is vital for attracting impact investing.

- Demonstrate ROI on sustainable investments: Quantify the financial benefits of your sustainable practices. This could involve reduced operational costs due to energy efficiency, increased customer loyalty due to ethical sourcing, or higher sales due to eco-friendly products.

- Quantify your environmental and social impact: Use metrics such as carbon footprint reduction, waste reduction, fair labor practices, and community engagement to demonstrate your commitment to sustainability and attract investors interested in ESG investing.

Key Steps:

- Assess your current financial situation (assets, liabilities, cash flow).

- Determine the precise amount of funding you require for your specific goals.

- Clearly outline the purpose of the funding (e.g., expansion, new technology, research and development).

- Define key performance indicators (KPIs) to measure the success of your project and demonstrate your commitment to sustainable business funding principles.

Exploring Funding Options for Sustainable Businesses

The funding landscape for sustainable businesses is diverse. Let’s explore some key options:

Grants and Subsidies

Governments worldwide are increasingly offering grants and subsidies to support sustainable businesses. These programs often target specific sectors or initiatives. Thorough research is key to identifying relevant opportunities.

- Research national and regional government programs dedicated to green finance and sustainable business funding.

- Carefully review eligibility criteria to ensure your business qualifies.

- Prepare a strong and compelling grant application that showcases your business’s impact and aligns with the program's goals. Examples include grants for renewable energy adoption, sustainable agriculture practices, or circular economy initiatives.

Green Loans and Impact Investing

Green loans offer favorable terms for environmentally friendly projects. Impact investing focuses on generating positive social and environmental impact alongside financial returns.

- Compare interest rates and loan terms from various banks and financial institutions offering green finance.

- Understand the due diligence process involved in securing green loans and impact investments.

- Identify and network with reputable impact investors and organizations focused on ESG investing and sustainable business funding.

Crowdfunding and Social Impact Bonds

Crowdfunding platforms allow you to raise capital from a large number of individuals. Social impact bonds involve investors providing upfront capital for a social program, with returns linked to achieving predetermined outcomes.

- Develop a compelling crowdfunding campaign that clearly communicates your business's mission and sustainability impact.

- Build and manage positive investor relations to maintain momentum and trust.

- Understand the legal and regulatory aspects associated with social impact bonds.

Venture Capital and Private Equity for Sustainable SMEs

Venture capitalists (VCs) and private equity (PE) firms are increasingly investing in sustainable businesses. However, securing this type of funding requires a strong track record and a compelling business plan.

- Prepare a sophisticated pitch deck that emphasizes your sustainability initiatives and their potential for significant growth.

- Actively network with VCs and PEs that have a demonstrated interest in sustainable business funding and ESG investing.

- Be prepared to meet their expectations regarding financial projections, scalability, and exit strategies.

Tips for a Successful Funding Application

Regardless of your chosen funding route, a successful application requires meticulous planning and execution.

- Craft a compelling narrative: Tell your story convincingly, highlighting your business's positive environmental and social impact. This is crucial for securing impact investing.

- Demonstrate financial viability: Present realistic and detailed financial projections demonstrating the long-term sustainability of your business model.

- Provide clear financial statements: Ensure your financial statements are accurate, up-to-date, and easy to understand. This shows transparency and builds trust for investors interested in sustainable business funding.

Essential Elements:

- Showcase your team's expertise and passion for sustainability.

- Conduct thorough market research and clearly define your target audience.

- Anticipate potential investor questions and prepare thoughtful responses.

- Seek professional advice from financial advisors specializing in sustainable business funding and green business financing.

Securing the Right Funding for Your Sustainable SME's Success

This article explored several avenues for securing funding for your sustainable SME, including grants, loans, impact investments, crowdfunding, and venture capital. Remember, a well-structured business plan that clearly articulates your sustainability strategy and its financial implications is paramount. A compelling narrative showcasing your positive impact is essential for attracting investors interested in sustainable SME funding and impact investment opportunities. Don't be afraid to explore multiple avenues. Find the best fit for your business's unique needs and stage of development.

Start exploring your funding options today and find the right funding for your sustainable SME's growth! Leave a comment below or contact us for further advice.

Featured Posts

-

Deciphering The Trials Ending Teas Guilt And Her Parents Destiny

May 19, 2025

Deciphering The Trials Ending Teas Guilt And Her Parents Destiny

May 19, 2025 -

St Louis Cardinals Wednesday Afternoon News And Updates

May 19, 2025

St Louis Cardinals Wednesday Afternoon News And Updates

May 19, 2025 -

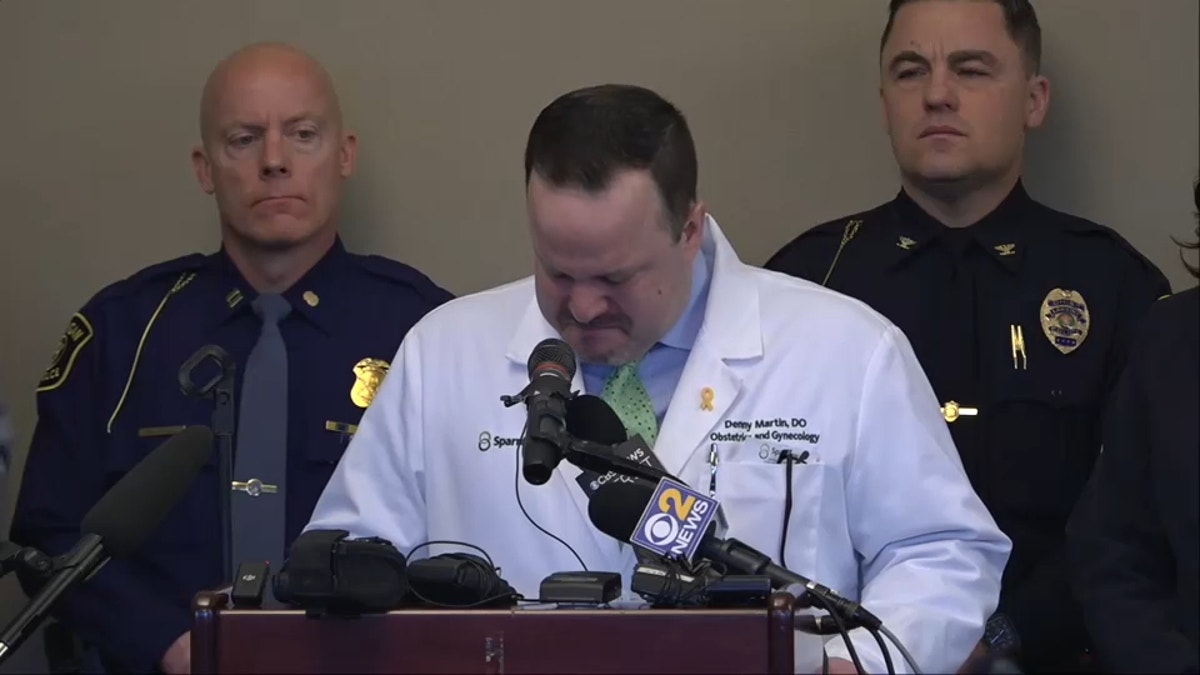

Florida State University Shooting Unveiling The Victims Family Background

May 19, 2025

Florida State University Shooting Unveiling The Victims Family Background

May 19, 2025 -

The Eus Squeeze The Impact On European Citizens

May 19, 2025

The Eus Squeeze The Impact On European Citizens

May 19, 2025 -

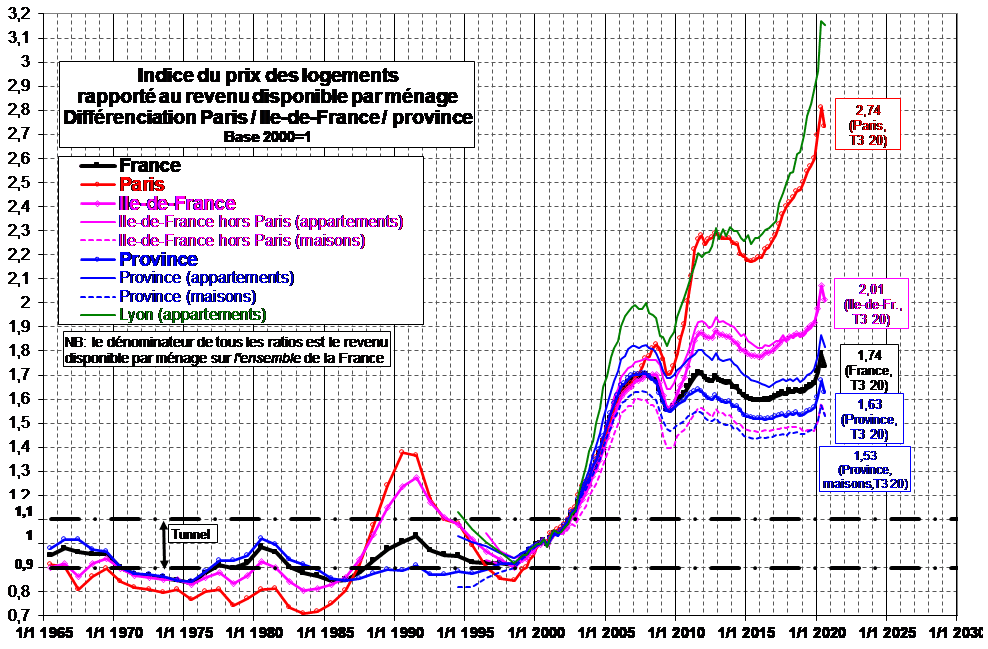

Consultez La Carte Prix Des Maisons Et Evolution En France Donnees Notaires

May 19, 2025

Consultez La Carte Prix Des Maisons Et Evolution En France Donnees Notaires

May 19, 2025