Finding Your Dream Home: A Practical Guide To Buying A Place In The Sun

Table of Contents

Defining Your Dream & Budget

Before diving into property listings, it's crucial to define your ideal "place in the sun" and establish a realistic budget. This involves careful consideration of several key factors.

Ideal Location & Lifestyle

Choosing the perfect location is paramount. Consider the climate – do you prefer warm beaches, cool mountains, or vibrant city life? What activities are important to you? Do you envision a beachfront escape, a rustic mountain retreat, or a charming townhome in a bustling city?

- Proximity to Family & Friends: Will your vacation home be a place for family gatherings, or a secluded escape?

- Airport Access: Easy access to an airport is crucial for convenient travel.

- Local Culture & Amenities: Research the local culture, restaurants, shops, and other amenities that matter to you.

- Safety Concerns: Prioritize safety and security in your chosen location.

Keywords: second home, vacation property, dream location

Setting a Realistic Budget

Buying a place in the sun is a significant financial undertaking. Determine your budget by exploring various financing options and understanding associated costs.

- Financing Options: Explore mortgages specifically designed for second homes, or determine if you'll be paying cash. Pre-approval for a mortgage is crucial.

- Down Payment: Save diligently for a substantial down payment to secure favorable mortgage terms.

- Ongoing Costs: Don't forget ongoing expenses like property taxes, insurance premiums, HOA fees (if applicable), utility bills, and maintenance. These can significantly impact your overall budget.

Keywords: property investment, financing options, budget planning

Finding the Right Property

Once you’ve defined your dream and budget, it’s time to actively search for your perfect property.

Utilizing Online Resources & Real Estate Agents

Leveraging online resources and working with a qualified real estate agent are key to finding the right property.

- Online Portals: Websites like Zillow, Realtor.com, and others offer extensive property listings. You can refine your search by location, price, property type, and features.

- Real Estate Agents: A local real estate agent specializing in second homes or vacation properties provides invaluable expertise. They have access to off-market listings, understand local market conditions, and can guide you through the negotiation process. Thoroughly research agents' reputations and experience before engaging their services.

Keywords: online property search, real estate agent, property listings

Due Diligence & Property Inspections

Thorough due diligence is essential before making an offer. This involves comprehensive inspections and legal review.

- Property Inspections: Hire qualified inspectors (structural, pest, etc.) to assess the property's condition.

- Title Search: Conduct a title search to verify ownership and identify any potential encumbrances.

- Legal Counsel: Consult with a real estate attorney to review the purchase contract and ensure your legal rights are protected.

Keywords: property inspection, title search, legal advice

Making an Offer & Closing the Deal

The final stages involve making an offer, negotiating terms, and completing the legal and financial processes.

Negotiating the Purchase Price

Making an offer involves presenting a competitive price while considering market value and your budget.

- Market Research: Research comparable properties (comps) to determine a fair market value.

- Offer Strategy: Prepare a well-structured offer, including contingencies (financing, inspection), to protect your interests.

- Negotiation: Be prepared to negotiate terms, including the purchase price, closing date, and other conditions.

Keywords: negotiating a purchase, making an offer, closing costs

Completing the Legal & Financial Processes

The closing process involves finalizing all legal and financial aspects of the transaction.

- Mortgage Approval: Ensure your mortgage is fully approved and ready to fund.

- Closing Documents: Carefully review all closing documents with your attorney or escrow agent.

- Final Walkthrough: Conduct a final walkthrough to verify the property's condition before closing.

Keywords: closing process, mortgage approval, property transfer

Conclusion

Buying a place in the sun is a rewarding experience, but it requires careful planning, thorough research, and professional guidance. By following the steps outlined in this guide – defining your dream, setting a realistic budget, finding the right property, and navigating the offer and closing process – you can increase your chances of successfully finding your perfect "place in the sun." Start your search for your dream vacation home today! Find your perfect place in the sun and begin creating unforgettable memories.

Featured Posts

-

Lotto 6aus49 Gewinnzahlen Des Mittwochs 9 4 2025

May 03, 2025

Lotto 6aus49 Gewinnzahlen Des Mittwochs 9 4 2025

May 03, 2025 -

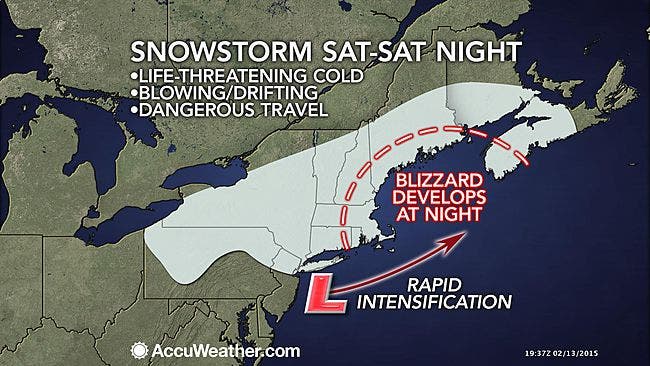

Near Blizzard Conditions Predicted For Tulsa Nws Update

May 03, 2025

Near Blizzard Conditions Predicted For Tulsa Nws Update

May 03, 2025 -

Vuelta Ciclista A Murcia Christen Se Impone En La Edicion 2024 Adaptar El Ano

May 03, 2025

Vuelta Ciclista A Murcia Christen Se Impone En La Edicion 2024 Adaptar El Ano

May 03, 2025 -

Mini Camera Chaveiro Onde Comprar E Como Funciona

May 03, 2025

Mini Camera Chaveiro Onde Comprar E Como Funciona

May 03, 2025 -

Reform Uks Struggle For Survival Five Reasons For Concern

May 03, 2025

Reform Uks Struggle For Survival Five Reasons For Concern

May 03, 2025

Latest Posts

-

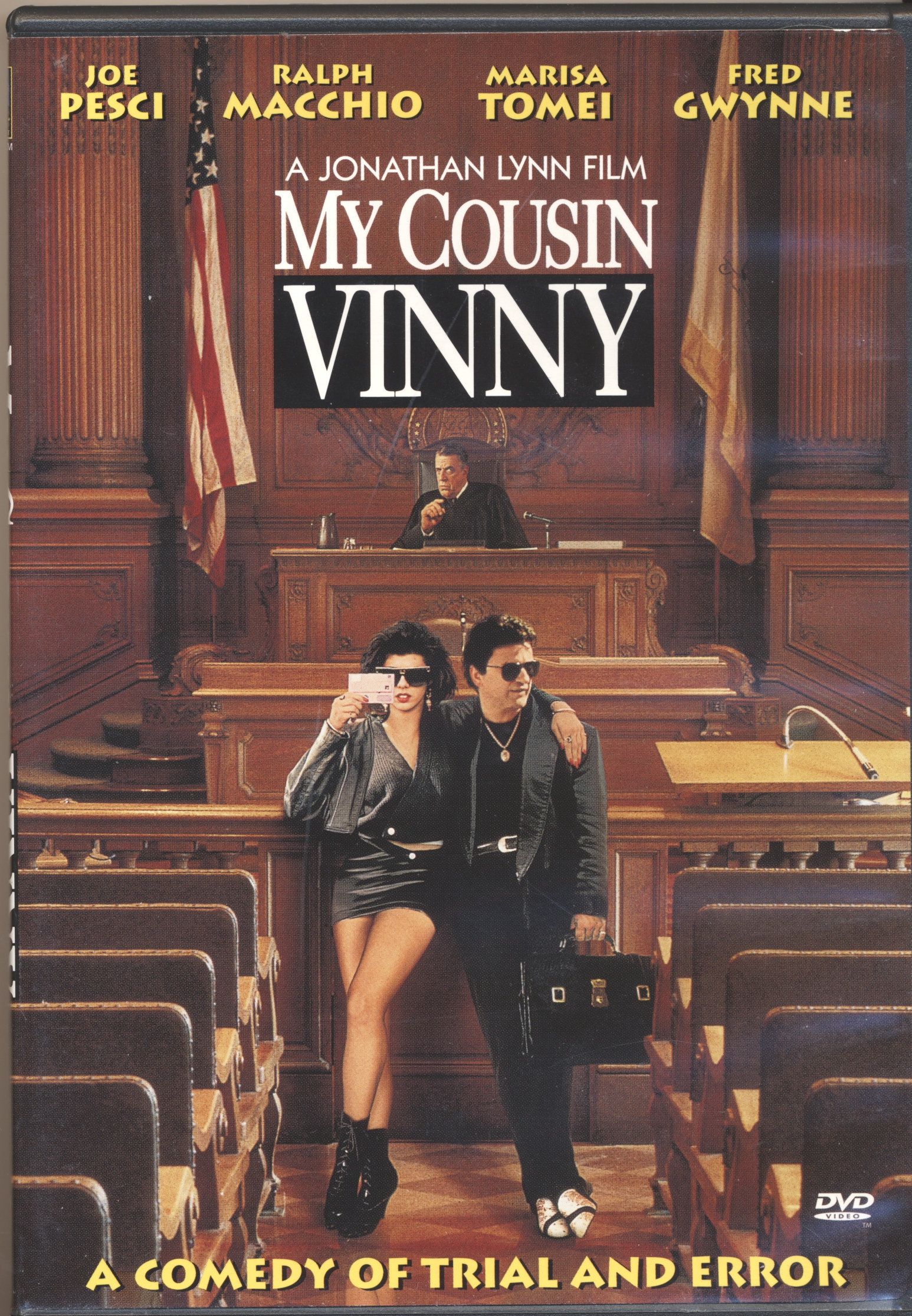

New My Cousin Vinny Reboot Details Revealed Ralph Macchio And Joe Pesci Update

May 07, 2025

New My Cousin Vinny Reboot Details Revealed Ralph Macchio And Joe Pesci Update

May 07, 2025 -

Ralph Macchio Offers Update On Potential My Cousin Vinny Reboot With Joe Pesci

May 07, 2025

Ralph Macchio Offers Update On Potential My Cousin Vinny Reboot With Joe Pesci

May 07, 2025 -

My Cousin Vinny Reboot Ralph Macchio On The Possibility And Joe Pescis Return

May 07, 2025

My Cousin Vinny Reboot Ralph Macchio On The Possibility And Joe Pescis Return

May 07, 2025 -

Ralph Macchio Provides My Cousin Vinny Reboot Update Joe Pescis Involvement Discussed

May 07, 2025

Ralph Macchio Provides My Cousin Vinny Reboot Update Joe Pescis Involvement Discussed

May 07, 2025 -

Oakland Athletics Win Over Seattle Mariners Rooker And Muncys Impact

May 07, 2025

Oakland Athletics Win Over Seattle Mariners Rooker And Muncys Impact

May 07, 2025