Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Reasons Behind the DAX Decline

Several interconnected factors contributed to the DAX's decline. The current market volatility reflects a confluence of global and domestic pressures impacting investor sentiment and confidence.

Global Economic Uncertainty

Global economic uncertainty remains a significant headwind for the DAX. Rising interest rates implemented by central banks worldwide to combat persistent inflation are dampening economic growth. Geopolitical risks, particularly the ongoing conflict in Ukraine, continue to create uncertainty and disrupt supply chains. These factors, coupled with increasing recessionary pressures in major economies, are contributing to a pessimistic market outlook.

- Inflationary pressures: Persistent high inflation in many countries erodes purchasing power and increases uncertainty for businesses and consumers.

- Interest rate hikes: The European Central Bank's (ECB) aggressive interest rate hikes are aimed at curbing inflation but also risk slowing economic growth, potentially leading to a recession.

- Geopolitical tensions: The war in Ukraine continues to disrupt global supply chains and energy markets, increasing uncertainty and volatility.

- Recessionary fears: Many economists are forecasting a potential recession in Europe and the US, further impacting investor confidence and market sentiment.

- Affected Companies/Sectors: Companies heavily reliant on exports, such as automotive manufacturers and industrial goods producers, are particularly vulnerable to weakening global demand.

Weak Corporate Earnings

Disappointing corporate earnings reports from several major German companies have also weighed on the DAX. Weaker-than-expected profits are impacting investor sentiment and leading to downward revisions in stock valuations.

- Several companies in the automotive and industrial sectors reported lower-than-anticipated profits due to supply chain disruptions and high energy costs.

- Profit warnings from key DAX constituents have fueled concerns about the broader economic outlook and decreased investor confidence.

- The underperformance of certain sectors is impacting overall market sentiment, contributing to the downward trend of the DAX.

Energy Crisis Impact

The ongoing energy crisis in Europe, particularly in Germany, is significantly impacting the German economy and consequently, the DAX. High energy prices are increasing production costs for businesses, reducing profit margins, and weakening economic growth. While the government has implemented measures to mitigate the crisis, their long-term effectiveness remains uncertain.

- High energy costs are squeezing profit margins for many German businesses, leading to decreased investment and potential job losses.

- The energy crisis is exacerbating inflationary pressures and contributing to overall economic uncertainty.

- Government interventions, while intended to help, are not fully offsetting the negative impact of high energy prices.

Analysis of Key Sectors Affected

The DAX decline reflects a broad-based weakness across several key sectors of the German economy.

Automotive Industry

The German automotive industry, a cornerstone of the DAX, is facing headwinds from various factors. Supply chain disruptions, the ongoing semiconductor shortage, and the costly transition to electric vehicles are impacting production and profitability. Major German automakers have experienced pressure on their share prices as a result.

- Supply chain bottlenecks are delaying production and increasing costs.

- The ongoing chip shortage continues to constrain automotive production.

- The significant investment required for the transition to electric vehicles is impacting profitability.

Industrial Sector

The industrial sector is experiencing weakening global demand and rising production costs, putting pressure on profit margins and impacting the performance of DAX-listed industrial companies.

- Decreased global demand for manufactured goods is impacting sales volumes.

- Rising energy and raw material costs are squeezing profit margins.

- Increased production costs are leading to higher prices for consumers, impacting demand further.

Financial Sector

The financial sector, including banks and insurance companies, is also feeling the impact of rising interest rates and a more uncertain regulatory environment. Interest rate sensitivity is a major factor impacting profitability.

- Changes in interest rates influence profitability for banks and insurance companies.

- Regulatory changes and increasing compliance costs add to operational challenges.

- Investor sentiment towards the financial sector is influenced by broader economic conditions.

Potential Future Outlook for the DAX

Predicting the future trajectory of the DAX is challenging, given the numerous interconnected factors at play. In the short term, further volatility is likely as investors grapple with ongoing global uncertainties. A recovery depends significantly on easing inflationary pressures, resolving geopolitical tensions, and stabilizing energy markets. The long-term outlook will hinge on Germany's ability to adapt to the energy transition and maintain its competitiveness in the global economy.

Conclusion: Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points - What's Next?

The decline of the DAX below 24,000 points reflects a confluence of factors: persistent global economic uncertainty, weak corporate earnings, and the ongoing impact of the energy crisis. The automotive, industrial, and financial sectors are particularly vulnerable. While the short-term outlook remains uncertain, careful monitoring of global economic conditions, corporate earnings, and energy market developments is crucial. To stay informed about the DAX index performance and Frankfurt Stock Exchange updates, regularly check reputable financial news sources and follow expert market analysis. Understanding DAX market trends is key to navigating the current volatility.

Featured Posts

-

Your Dream Escape To The Country Making It A Reality

May 24, 2025

Your Dream Escape To The Country Making It A Reality

May 24, 2025 -

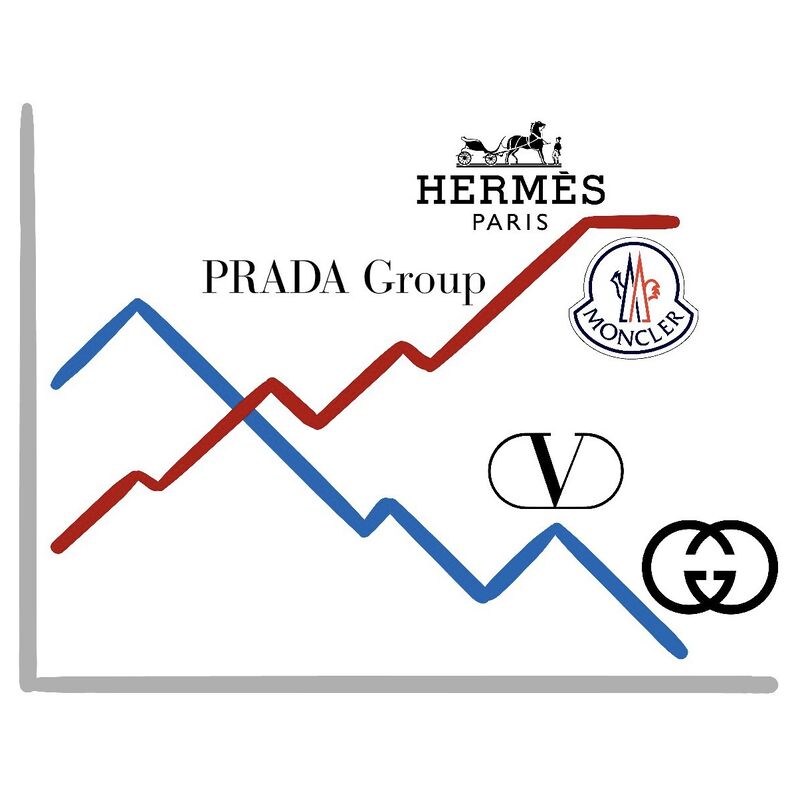

Come I Dazi Stati Uniti Influenzano I Prezzi Della Moda

May 24, 2025

Come I Dazi Stati Uniti Influenzano I Prezzi Della Moda

May 24, 2025 -

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025 -

Euronext Amsterdam Sees 8 Stock Increase After Trumps Tariff Halt

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase After Trumps Tariff Halt

May 24, 2025 -

Annie Kilner And Kyle Walker Examining The Poisoning Claims

May 24, 2025

Annie Kilner And Kyle Walker Examining The Poisoning Claims

May 24, 2025

Latest Posts

-

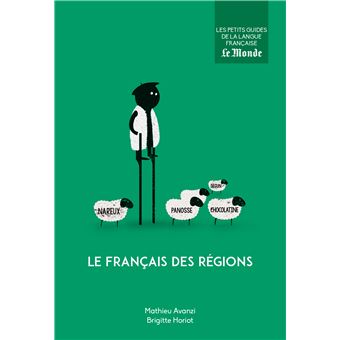

La Langue Francaise Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025

La Langue Francaise Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Growth

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 24, 2025 -

Collaboration And Growth At The Forefront Best Of Bangladesh In Europe 2nd Edition

May 24, 2025

Collaboration And Growth At The Forefront Best Of Bangladesh In Europe 2nd Edition

May 24, 2025 -

Focusing On Collaboration And Growth The 2nd Best Of Bangladesh In Europe

May 24, 2025

Focusing On Collaboration And Growth The 2nd Best Of Bangladesh In Europe

May 24, 2025