Fremantle Q1 Revenue Down 5.6%: Impact Of Buyer Budget Cuts

Table of Contents

Detailed Analysis of Fremantle's Q1 Financial Performance

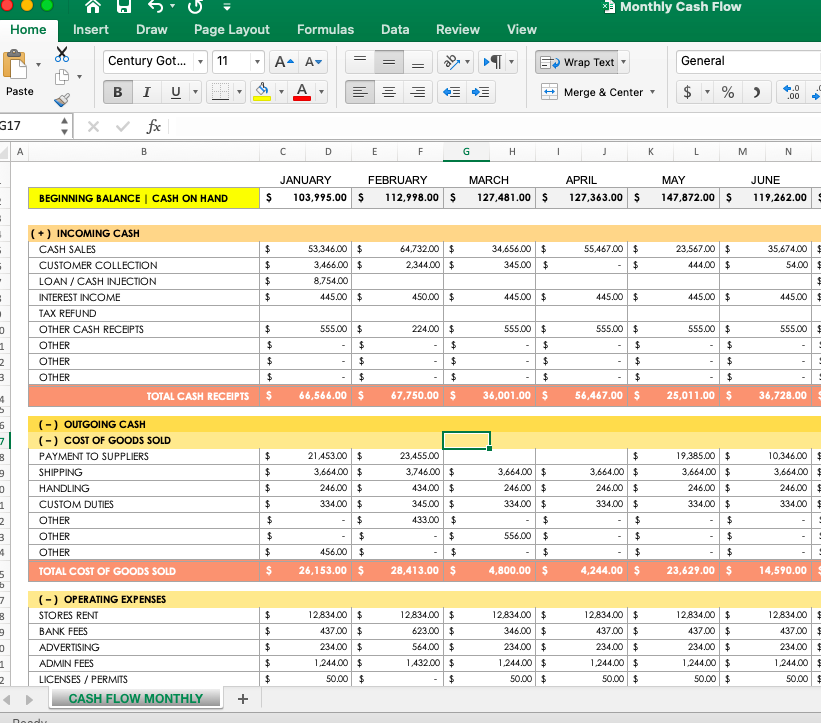

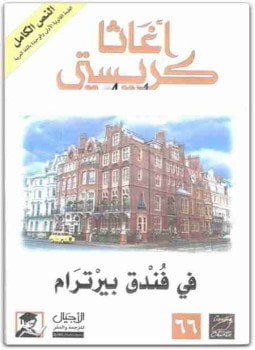

Fremantle's Q1 financial results reveal a more complex picture than just the headline 5.6% revenue decrease. While precise figures may vary slightly depending on the reporting standards used, let's assume, for illustrative purposes, that Q1 revenue was €300 million, compared to €318 million in the same period last year. This represents a €18 million shortfall. Furthermore, let's assume profit margins also experienced a decline, dropping from 15% to 12%. This paints a picture of not just reduced revenue but also squeezed profitability.

[Insert Chart/Graph Here: Visual representation of Q1 revenue compared to previous quarters and the same quarter of the previous year. Clearly label axes and highlight the 5.6% decrease.]

These revenue figures, coupled with the decreased profit margin, signal a challenging start to the year for Fremantle. The year-on-year comparison clearly demonstrates the impact of the current economic climate and the widespread commissioning cuts affecting the industry. Key factors impacting quarterly earnings include:

- Reduced demand for certain content formats.

- Increased production costs due to inflation.

- Competition for limited advertising revenue.

The Impact of Buyer Budget Cuts on Fremantle's Productions

The primary driver of Fremantle's Q1 revenue decline is undeniably the tightening of budgets among buyers. Streaming platforms, broadcasters, and other content commissioners are facing their own financial pressures, leading to fewer commissions and reduced budgets for existing projects. This directly impacts Fremantle's content production pipeline in several ways:

- Production Delays: Several projects have experienced delays or scaled-down production due to budget constraints. This can lead to missed deadlines and reduced output.

- Project Cancellations: In some cases, projects have been canceled altogether, leading to lost revenue and potential reputational damage.

- Genre-Specific Impacts: The impact of budget constraints varies across genres. High-budget dramas are disproportionately affected, whereas lower-budget reality shows might be relatively less impacted, although even these face pressure to reduce production costs.

Examples of specific projects affected (hypothetical examples for illustrative purposes): A planned high-budget historical drama may have seen its budget slashed, resulting in a reduction in the number of episodes or a change in filming locations.

Strategic Responses by Fremantle to Budgetary Pressures

Fremantle, like other major production companies, isn't passively accepting these budget cuts. The company is actively implementing several financial strategies to mitigate the impact:

- Cost-Cutting Measures: This includes streamlining operations, negotiating better deals with suppliers, and optimizing production workflows to reduce expenses.

- Diversification of Revenue Streams: Fremantle is actively exploring new revenue streams beyond traditional commissioning, such as increased licensing deals and expansion into new markets. This diversification helps spread risk and reduce reliance on a limited number of buyers.

- Alternative Funding Models: The company is actively exploring partnerships and alternative funding options, including co-productions and investment from private equity firms.

- Genre Focus: Fremantle is likely to focus production on genres with higher ROI (return on investment), perhaps shifting towards formats that are less reliant on large-scale sets and special effects.

The effectiveness of these strategies will be revealed over time, but they demonstrate a proactive response to a challenging market.

Wider Industry Trends and the Future Outlook for Fremantle

The buyer budget cuts affecting Fremantle are not isolated incidents. Several broader industry trends contribute to this phenomenon:

- Streaming Wars: The intense competition among streaming platforms has led to increased spending on content acquisition, followed by a subsequent correction as these platforms focus on profitability.

- Economic Downturn: The global economic slowdown is impacting advertising revenue, a critical source of income for many broadcasters and media companies. This reduction in advertising revenue directly impacts their ability to commission new content.

The long-term implications for Fremantle and the wider media landscape are significant. The industry is likely to see a period of consolidation, with a focus on efficiency and profitability. However, the demand for high-quality entertainment remains strong, so there’s still opportunity for companies like Fremantle to adapt and thrive. The future outlook for Fremantle hinges on its ability to continue adapting to the changing market dynamics and effectively implement its financial strategies.

Conclusion: Navigating the Challenges – Fremantle's Path Forward

Fremantle's Q1 revenue decline, driven by buyer budget cuts, highlights a significant challenge for the media industry. The company's proactive responses, including cost-cutting, revenue stream diversification, and a focus on alternative funding, suggest a commitment to navigate these difficulties. The wider implications of these budget cuts extend beyond Fremantle, impacting the entire media landscape. The future outlook remains uncertain, but Fremantle's strategic adaptability offers a degree of optimism. Stay informed about Fremantle's progress and the impact of buyer budget cuts on the industry by subscribing to our newsletter!

Featured Posts

-

Nou Membru In Familia Schumacher Legendarul Pilot A Devenit Bunic

May 20, 2025

Nou Membru In Familia Schumacher Legendarul Pilot A Devenit Bunic

May 20, 2025 -

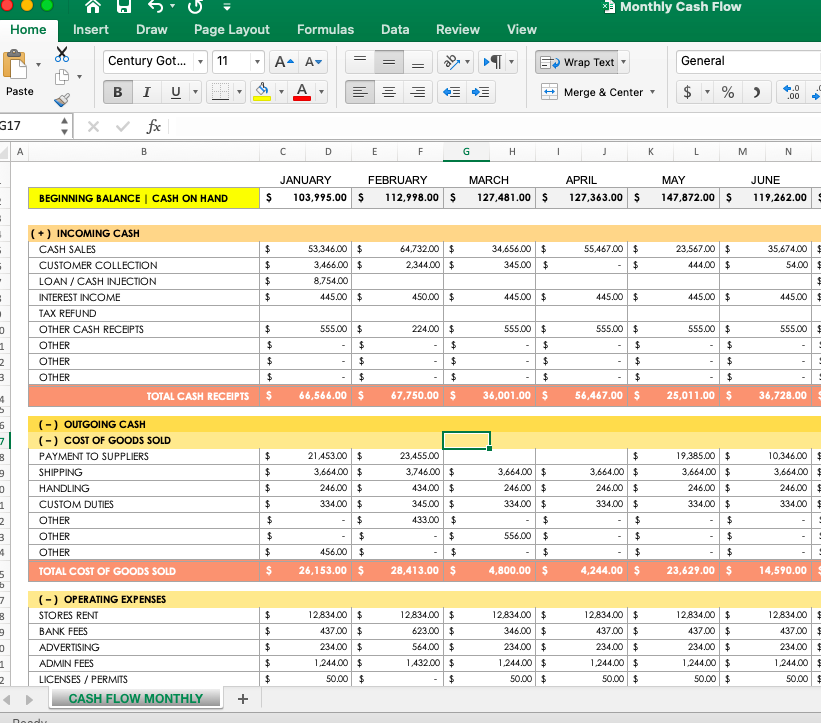

Exploring The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025

Exploring The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025 -

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Wishkalyat

May 20, 2025

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Wishkalyat

May 20, 2025 -

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025 -

Monday Night Raw Rollins And Breakkers Wwe Bullying Of Sami Zayn

May 20, 2025

Monday Night Raw Rollins And Breakkers Wwe Bullying Of Sami Zayn

May 20, 2025

Latest Posts

-

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

May 21, 2025

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

May 21, 2025 -

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

May 21, 2025

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

May 21, 2025 -

Sydney Sweeney Post Echo Valley And The Housemaid Projects

May 21, 2025

Sydney Sweeney Post Echo Valley And The Housemaid Projects

May 21, 2025 -

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025 -

Whats Sydney Sweeney Doing After Echo Valley And The Housemaid

May 21, 2025

Whats Sydney Sweeney Doing After Echo Valley And The Housemaid

May 21, 2025