Fremantle's Q1 Revenue Falls 5.6% Amidst Buyer Budget Constraints

Table of Contents

Buyer Budget Constraints: The Primary Culprit

The primary driver behind Fremantle's Q1 revenue decline appears to be the tightening of buyer budgets across the media industry. This is a multifaceted issue with several contributing factors.

Reduced advertising revenue is significantly impacting production companies like Fremantle. Traditional broadcasters, facing competition from streaming platforms, are reducing their overall spending on content. This translates directly into fewer commissions for production companies and lower licensing fees.

Streaming services, while seemingly offering a lucrative alternative, are also contributing to the problem. The intense competition among platforms has led to a more cautious approach to content acquisition. They're demanding more favorable deals, resulting in lower overall payouts for content creators. The pressure to attract and retain subscribers means that streaming platforms are carefully evaluating their content spending, leading to increased scrutiny and potentially lower budgets allocated to new projects.

The broader economic climate is further exacerbating this situation. Global economic uncertainty and inflation are prompting many businesses, including media buyers, to adopt a more conservative approach to spending. This cautious spending directly translates into reduced investment in new television and film productions.

- Decreased spending from traditional broadcasters.

- Increased competition for streaming deals, leading to lower licensing fees.

- Economic uncertainty leading to cautious spending by buyers.

Impact on Fremantle's Key Projects and Strategies

The impact of these buyer budget constraints is already being felt across Fremantle's production pipeline. While specific details regarding affected projects haven't been publicly released, it's reasonable to assume that several initiatives have experienced budget cuts or delays.

The potential consequences include production delays for new seasons of flagship shows, cancellations of less commercially viable projects, and a general tightening of budgets across the board. Fremantle, like other production companies, is likely responding to these challenges through cost-cutting measures, including streamlining production processes, potentially renegotiating contracts with talent, and seeking more cost-effective locations for filming. This might also involve a strategic shift towards formats that are less expensive to produce but still have high potential for audience engagement.

- Impact on flagship shows (potential reduced episode counts or budget cuts).

- Potential delays in new project launches.

- Revised production budgets and strategies (exploring lower-cost alternatives).

Looking Ahead: Fremantle's Future in a Changing Media Landscape

The future for Fremantle, and the broader television production industry, hinges on adapting to the evolving media landscape. The current trends indicate a continued focus on cost-efficiency, innovation, and diversification of content offerings.

Fremantle needs to explore and implement cost-effective production methods, such as embracing new technologies and potentially collaborating with other production companies on projects to share costs. Investing in new genres and formats that align with current audience demands will also be crucial. Finally, exploring alternative revenue streams, such as branded content or direct-to-consumer platforms, can help mitigate the reliance on traditional buyers.

- Focus on cost-effective production methods (e.g., utilizing new technologies).

- Investment in new genres and formats (adapting to changing viewer preferences).

- Exploring alternative revenue streams (diversifying income sources).

Conclusion

Fremantle's 5.6% Q1 revenue drop reflects a broader trend of buyer budget constraints impacting the entire media industry. This decline underscores the significant challenges faced by content creators in a rapidly evolving landscape. The company's ability to adapt its strategies, embrace innovation, and explore diverse revenue streams will be crucial for navigating this challenging period. Understanding these dynamics is vital for predicting the future of television production and the success of companies like Fremantle.

Call to Action: Stay informed about the latest developments in Fremantle's financial performance and the broader media industry. Follow our updates on Fremantle’s Q1 revenue and the impact of buyer budget constraints for valuable insights into the future of television production and content creation. Understanding the evolving dynamics of Fremantle's revenue and the overall impact of buyer budget constraints is crucial for anyone interested in the future of the media industry.

Featured Posts

-

Charles Leclercs Ferrari Future Imola Statement Implications

May 20, 2025

Charles Leclercs Ferrari Future Imola Statement Implications

May 20, 2025 -

Ferraris Chinese Gp Start Hamilton Leclerc Contact And Its Fallout

May 20, 2025

Ferraris Chinese Gp Start Hamilton Leclerc Contact And Its Fallout

May 20, 2025 -

Engineers Union And Nj Transit Reach Tentative Agreement Preventing Strike

May 20, 2025

Engineers Union And Nj Transit Reach Tentative Agreement Preventing Strike

May 20, 2025 -

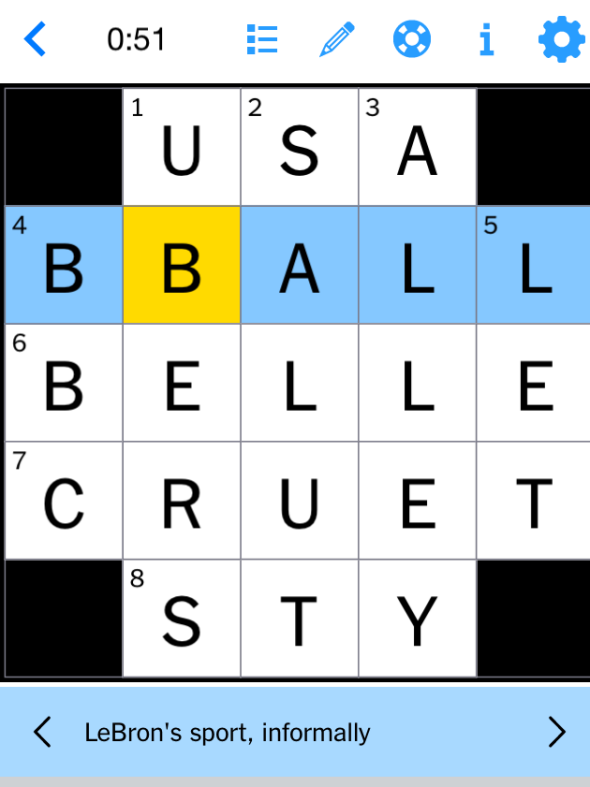

Solve The Nyt Mini Crossword April 13th Answers

May 20, 2025

Solve The Nyt Mini Crossword April 13th Answers

May 20, 2025 -

Transfert De Melvyn Jaminet Kylian Jaminet S Exprime Sur L Argent Et Le Transfert De Son Frere

May 20, 2025

Transfert De Melvyn Jaminet Kylian Jaminet S Exprime Sur L Argent Et Le Transfert De Son Frere

May 20, 2025

Latest Posts

-

Unpacking The Debate An Australian Trans Influencers Groundbreaking Achievement

May 21, 2025

Unpacking The Debate An Australian Trans Influencers Groundbreaking Achievement

May 21, 2025 -

Fastest Crossing Man Completes Record Breaking Australian Foot Journey

May 21, 2025

Fastest Crossing Man Completes Record Breaking Australian Foot Journey

May 21, 2025 -

Scrutinizing Success The Case Of An Australian Trans Influencers Record

May 21, 2025

Scrutinizing Success The Case Of An Australian Trans Influencers Record

May 21, 2025 -

Record Breaking Run Man Fastest To Cross Australia On Foot

May 21, 2025

Record Breaking Run Man Fastest To Cross Australia On Foot

May 21, 2025 -

Australian Trans Influencers Record Fact Or Fiction A Deep Dive

May 21, 2025

Australian Trans Influencers Record Fact Or Fiction A Deep Dive

May 21, 2025