Fremantle's Q1 Revenue Suffers 5.6% Drop Amidst Buyer Budget Cuts

Table of Contents

Fremantle's Q1 Revenue Decline: A Detailed Look at the 5.6% Drop

Fremantle's announcement of a 5.6% drop in Q1 revenue paints a concerning picture. While the exact financial figures haven't been fully disclosed, reports indicate a substantial shortfall compared to the same period last year. This represents a significant downturn for the company, particularly when compared to the robust growth seen in previous Q1 periods.

- Specific Financial Data Points: While precise numbers remain elusive, industry analysts suggest a multi-million dollar decrease in overall revenue compared to Q1 of the previous year. This decline is particularly pronounced in certain key geographic regions.

- Geographic Variations: Early reports suggest that the impact of budget cuts has been felt more acutely in certain regions, particularly in North America and Europe, where competition for streaming and broadcasting contracts is fierce.

- Positive Aspects (if any): Although the overall picture is negative, some analysts point to a potential uptick in digital content licensing as a small positive sign, suggesting a potential avenue for future growth.

Buyer Budget Cuts: The Primary Driver of Fremantle's Revenue Dip

The primary culprit behind Fremantle's revenue dip is the widespread implementation of buyer budget cuts across the entertainment industry. Streaming services, facing increased competition and subscriber acquisition challenges, are tightening their purse strings. Traditional broadcasters are also grappling with changing viewing habits and economic uncertainty.

- Examples of Specific Buyers and Budget Reductions: Several major streaming platforms are reported to have significantly reduced their commissioning budgets for the year, resulting in fewer greenlit projects and reduced spending on existing productions. Specific examples would ideally be included here if publicly available.

- Impact on Different Fremantle Productions: The impact has not been uniform across all Fremantle productions. Scripted dramas, often more expensive to produce, have likely been more severely affected than less costly unscripted formats.

- Industry-Wide Trends: Fremantle’s experience isn’t isolated. Numerous reports suggest that many other major production companies and studios are facing similar challenges, indicating a broader trend of belt-tightening within the entertainment industry.

Impact on Fremantle's Production Pipeline and Future Strategies

The revenue drop has significant implications for Fremantle's production pipeline and long-term strategies. The company is likely to reassess upcoming projects and implement cost-cutting measures to navigate this challenging economic environment.

- Potential Delays or Cancellations: Some projects currently in development may face delays or outright cancellations as Fremantle prioritizes resource allocation.

- Changes in Production Strategies: We can expect Fremantle to explore more cost-effective production strategies, potentially focusing on shorter-run series or formats that require less investment. This could involve shifting towards unscripted formats and leveraging cheaper international production locations.

- Exploration of New Revenue Streams: The company will likely explore new revenue streams, potentially focusing on international co-productions, digital distribution deals, and branded content opportunities.

Broader Implications for the Television and Media Industry

Fremantle's financial difficulties reflect a larger trend within the television and media industry. The confluence of economic uncertainty, the intensifying streaming wars, and evolving audience consumption patterns is creating a perfect storm.

- Comparison with Other Media Companies: Several major media corporations are reporting similar financial challenges, demonstrating that Fremantle's struggles are not unique.

- Predictions for the Future: The future of the industry hinges on adaptation. Companies that can successfully pivot towards more efficient production models, embrace innovative distribution strategies, and cultivate strong relationships with diverse buyers will be best positioned for success.

- Long-Term Effects of Budget Cuts on Content Creation: The long-term impact of these budget cuts on the quality and diversity of content remains to be seen. However, it's plausible that we could see a decrease in high-budget, ambitious projects in favor of more commercially-driven, lower-risk productions.

Conclusion

Fremantle's Q1 revenue drop of 5.6%, largely attributable to buyer budget cuts, underscores the significant challenges facing the global entertainment industry. This situation necessitates strategic adaptation and a reassessment of production strategies across the board. The impact extends beyond Fremantle, highlighting a wider trend of financial strain within the media landscape. Stay tuned for further updates on Fremantle's financial performance and the evolving landscape of the global entertainment industry. Follow us for ongoing analysis of Fremantle's revenue and the broader impact of budget cuts on television production. Learn more about the challenges facing Fremantle and other major players in the media industry.

Featured Posts

-

Giakoymakis I Kroyz Azoyl Ston Teliko Toy Champions League

May 21, 2025

Giakoymakis I Kroyz Azoyl Ston Teliko Toy Champions League

May 21, 2025 -

Good Morning America Without Michael Strahan The Story Behind His Exit

May 21, 2025

Good Morning America Without Michael Strahan The Story Behind His Exit

May 21, 2025 -

Unlock The Nyt Mini Crossword March 24 2025 Answers

May 21, 2025

Unlock The Nyt Mini Crossword March 24 2025 Answers

May 21, 2025 -

Blue Origin Rocket Launch Abruptly Halted Subsystem Problem

May 21, 2025

Blue Origin Rocket Launch Abruptly Halted Subsystem Problem

May 21, 2025 -

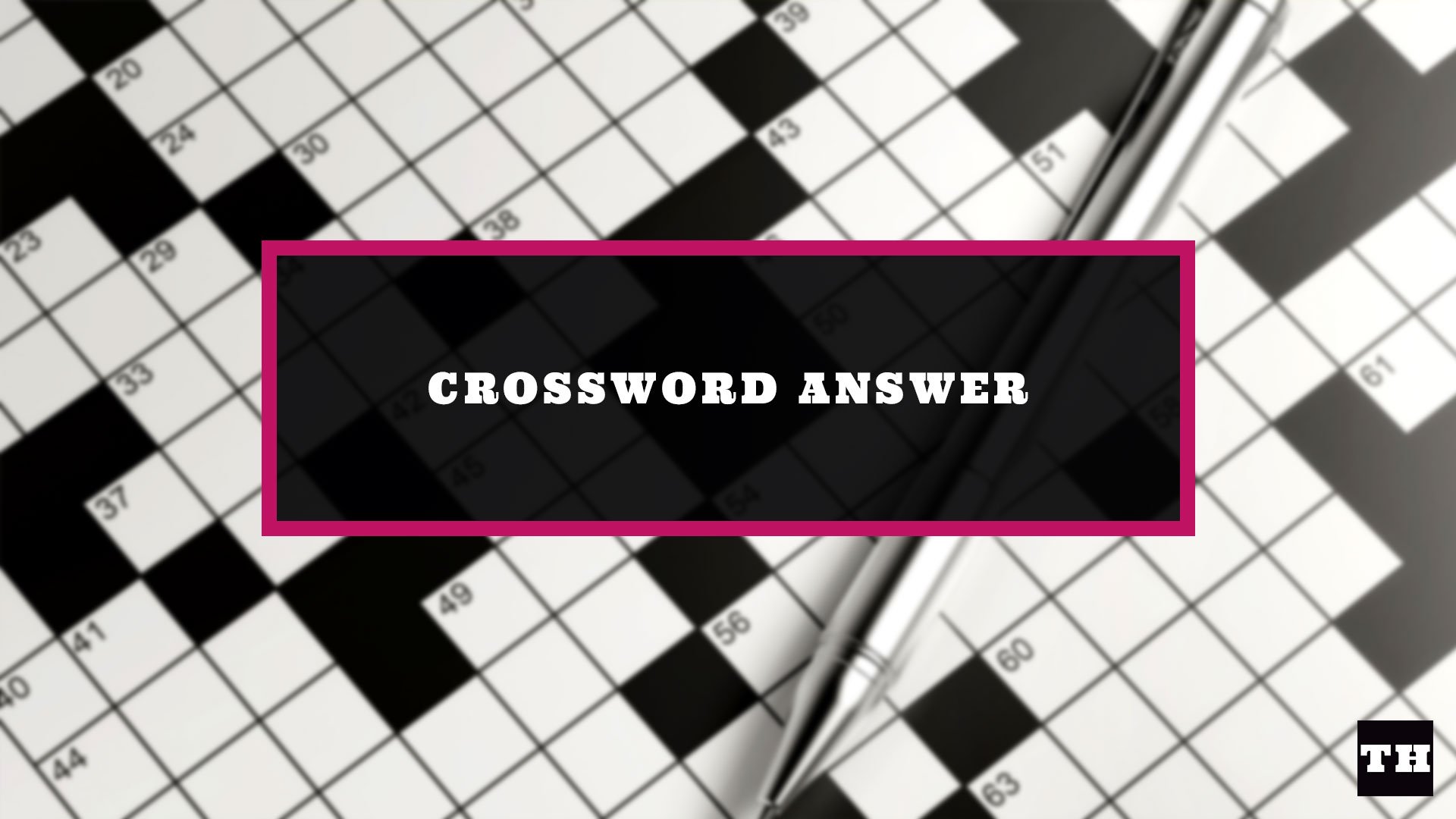

Sasol Sol Unpacking The 2024 Strategic Roadmap For Investors

May 21, 2025

Sasol Sol Unpacking The 2024 Strategic Roadmap For Investors

May 21, 2025