From Crypto To Corporations: Elon Musk's Strategic Shift

Table of Contents

The Cryptocurrency Cooling-Off

Dogecoin and the Shifting Sands of Crypto Influence

Elon Musk's early embrace of Dogecoin catapulted the meme-based cryptocurrency into the spotlight. His enthusiastic tweets, often driving significant price swings, solidified his influence within the crypto community. However, this period of intense engagement was followed by a noticeable distancing. Musk's pronouncements became less frequent, and his overall engagement with Dogecoin seemed to wane.

- Price volatility linked to Musk's tweets: The Dogecoin price became notoriously volatile, directly correlating with Musk's social media activity. This unpredictability highlighted the inherent risks associated with cryptocurrencies and the potential for market manipulation.

- Regulatory scrutiny of crypto endorsements: Musk's enthusiastic endorsements drew increased regulatory scrutiny regarding the potential for market manipulation and the need for greater transparency in cryptocurrency promotions.

- Potential legal ramifications of market manipulation: The significant price swings linked to Musk's tweets raised concerns about potential legal ramifications, with investigations into possible market manipulation. This legal risk likely contributed to his more cautious approach. Keywords: Dogecoin, cryptocurrency volatility, crypto regulation, Elon Musk crypto influence, market manipulation, SEC investigation.

Bitcoin's Diminishing Role in Tesla's Strategy

Tesla's initial acceptance of Bitcoin as a payment method was a landmark moment for the cryptocurrency. However, this decision was later reversed, prompting speculation about Musk's changing priorities.

- Environmental concerns about Bitcoin mining: The energy-intensive nature of Bitcoin mining, often relying on fossil fuels, clashed with Tesla's commitment to sustainable energy solutions. This environmental concern played a significant role in the reversal.

- Price fluctuations impacting Tesla's bottom line: The volatile nature of Bitcoin's price created uncertainty for Tesla's financial stability, potentially impacting its bottom line. A more stable investment strategy became a priority.

- Shifting focus towards sustainable energy solutions: Tesla's renewed focus on its core mission of sustainable energy and electric vehicle production likely contributed to the decision to distance itself from the environmentally questionable aspects of Bitcoin. Keywords: Tesla Bitcoin, Bitcoin environmental impact, sustainable energy, corporate sustainability, Tesla's financial stability.

The Rise of Traditional Corporate Power Plays

Twitter Acquisition and its Strategic Implications

The acquisition of Twitter (now X) represents a significant shift towards traditional corporate power plays. While the motives behind the acquisition remain subject to debate, it presents several strategic implications for Musk's other ventures.

- Integration challenges: Integrating Twitter (X) with Musk's existing businesses has proven to be a complex undertaking, presenting significant integration challenges and requiring substantial resources.

- Restructuring efforts: Significant restructuring efforts have been undertaken at Twitter (X), impacting staffing levels and operational strategies. This signifies a more hands-on approach to traditional corporate management.

- Advertising revenue strategies: Musk is actively pursuing new strategies to increase advertising revenue on the platform. This signals a focus on traditional business models.

- Potential for AI integration: The potential for AI integration within Twitter (X) offers numerous opportunities for synergy with Musk's other ventures, showcasing a commitment to long-term technological advancement. Keywords: Twitter acquisition, Elon Musk Twitter, X platform, social media integration, AI integration, advertising revenue.

Focus on Long-Term Investments and Strategic Partnerships

Musk's activities increasingly involve long-term strategic investments and partnerships within established corporate structures. This shift represents a departure from the speculative nature of cryptocurrency investments.

- Investments in SpaceX: Continued investment in SpaceX showcases a commitment to long-term goals within the aerospace industry, indicating a preference for established business models with predictable returns.

- Tesla's expansion plans: Tesla's ongoing expansion into new markets and product lines reflects a commitment to traditional corporate growth strategies, prioritizing long-term sustainability and profitability.

- Collaborative efforts with established corporations: Increasingly, Musk is engaging in collaborations with established corporations across various sectors, illustrating a focus on synergy and strategic partnerships rather than independent ventures. Keywords: SpaceX investment, Tesla expansion, strategic partnerships, long-term corporate strategy, corporate growth.

The Underlying Reasons for the Shift

Regulatory Scrutiny and Legal Risks

The increasing regulatory scrutiny surrounding the cryptocurrency market has significantly impacted Musk's approach. The potential for legal challenges related to past actions in the crypto market likely played a role in his shift in focus.

- SEC investigations: Potential SEC investigations into Musk's past actions related to cryptocurrency endorsements and market activity have increased the legal risks associated with remaining heavily involved in the crypto space.

- Potential lawsuits: The volatility of the cryptocurrency market and Musk's highly public involvement have created a climate of potential legal action related to market manipulation or misleading information.

- Evolving regulatory landscape for digital assets: The ever-evolving regulatory landscape for digital assets creates an environment of uncertainty and potential risk for businesses operating in the space. Keywords: SEC investigation, crypto regulation, legal risks, market manipulation, regulatory scrutiny.

Shifting Priorities and Long-Term Vision

Musk's evolving priorities and long-term vision for his companies have likely influenced his strategic shift away from cryptocurrency and towards a more traditional approach.

- Focus on sustainability: A renewed focus on sustainability and environmental responsibility across his various ventures suggests a preference for investments and business strategies aligned with these values.

- Technological advancements: Musk's persistent focus on technological advancements across his companies – from electric vehicles to space exploration – reflects a long-term vision that requires significant investment and strategic partnerships within established corporate structures.

- Expansion into new markets: The expansion into new markets within traditional industries, such as energy and space exploration, indicates a shift towards more established and predictable growth strategies.

- Building lasting corporate empires: The ultimate goal appears to be building lasting and sustainable corporate empires, a strategy better served by focusing on established corporate structures and long-term investment strategies. Keywords: long-term vision, corporate strategy, sustainable development, technological innovation, corporate empires.

Conclusion

Elon Musk's strategic shift away from the fluctuating world of cryptocurrency and towards a more traditional corporate focus represents a significant change in his overall approach to business. This evolution, driven by factors including regulatory scrutiny, shifting market dynamics, and a broader long-term vision, underscores the complexities of navigating the rapidly evolving technological and financial landscapes. Understanding this "Elon Musk's Strategic Shift" is crucial for anyone following his ventures and the broader impact of his decisions on the global economy and technology sector. To stay updated on the latest developments regarding Elon Musk's strategic moves and their consequences, continue to follow reputable news sources and analyses focusing on Elon Musk's Strategic Shift and its various facets.

Featured Posts

-

The Good Life How To Build A Life You Love

May 31, 2025

The Good Life How To Build A Life You Love

May 31, 2025 -

New Study Highlights Positive Impacts Of Tulsa Remote Worker Program

May 31, 2025

New Study Highlights Positive Impacts Of Tulsa Remote Worker Program

May 31, 2025 -

Vada Flags Positive Result For Jaime Munguia Implications And Next Steps

May 31, 2025

Vada Flags Positive Result For Jaime Munguia Implications And Next Steps

May 31, 2025 -

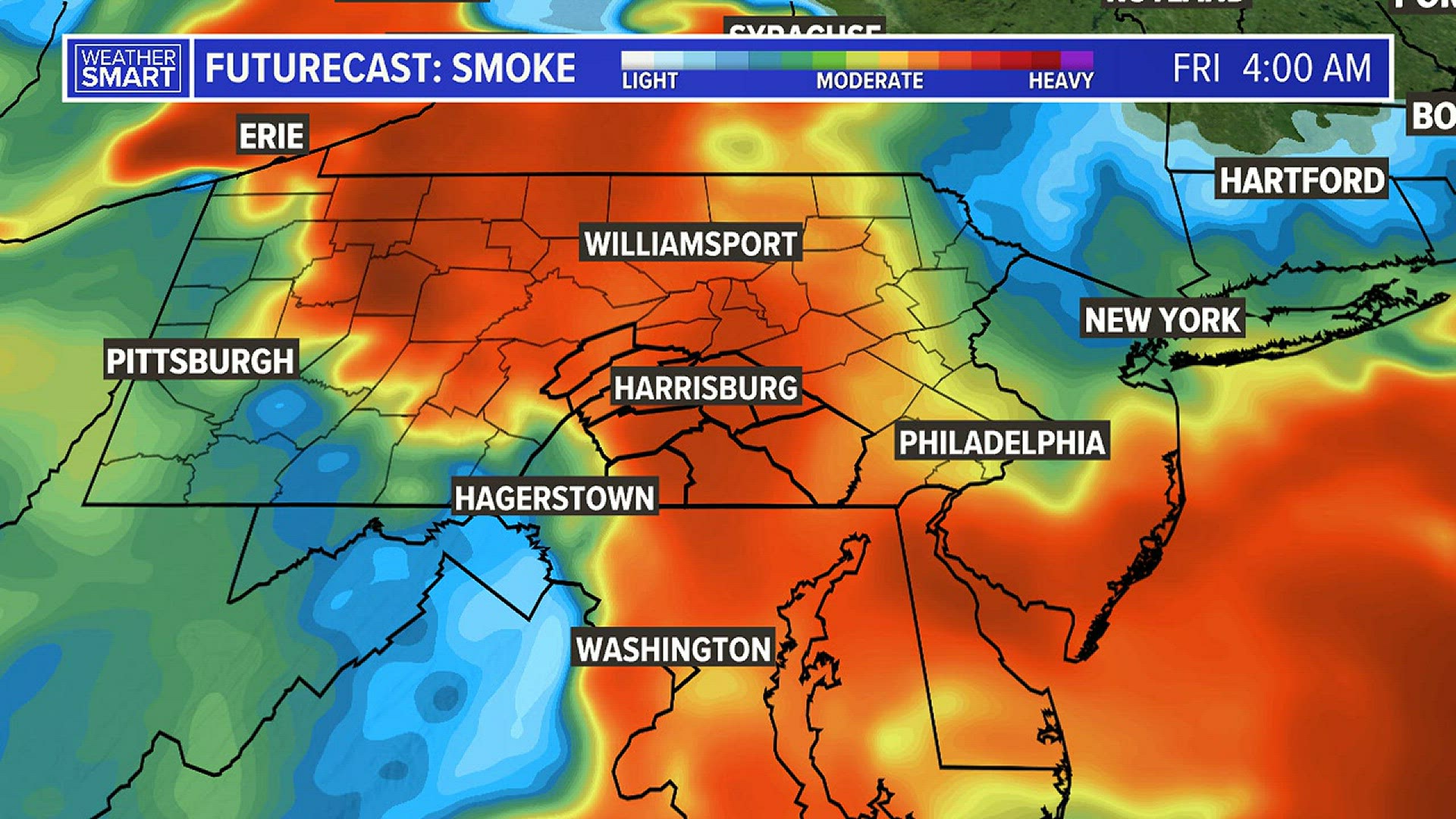

Canada Wildfires Record Breaking Evacuation And Us Smoke Impact

May 31, 2025

Canada Wildfires Record Breaking Evacuation And Us Smoke Impact

May 31, 2025 -

Before The Last Of Us Kaitlyn Devers Unforgettable Role In A Gripping Crime Drama

May 31, 2025

Before The Last Of Us Kaitlyn Devers Unforgettable Role In A Gripping Crime Drama

May 31, 2025