FTC's Appeal Challenges Court Ruling On Microsoft's Activision Buyout

Table of Contents

The District Court's Decision and the FTC's Disagreement

A US District Court judge initially sided with Microsoft, rejecting the FTC's attempt to block the $69 billion acquisition of Activision Blizzard. The court found that the FTC hadn't presented enough evidence to prove the merger would substantially lessen competition. However, the FTC vehemently disagreed with this assessment, arguing the court’s analysis was flawed and failed to adequately consider the long-term implications for the gaming market.

The FTC's key objections center on several points:

-

Concerns about reduced competition in the cloud gaming market: The FTC argued that Microsoft's control over Activision Blizzard's popular titles like Call of Duty, Candy Crush, and World of Warcraft would stifle competition in the burgeoning cloud gaming market, giving Microsoft an unfair advantage. They highlighted Microsoft's existing market power in cloud gaming services like Xbox Cloud Gaming.

-

Arguments against Microsoft's proposed remedies: Microsoft offered concessions, promising to license Call of Duty to competitors. The FTC argued these remedies were insufficient to address the anti-competitive concerns, claiming they lacked sufficient detail and were not enforceable.

-

Allegations of insufficient market analysis by the court: The FTC contends that the court's analysis of the gaming market was incomplete and failed to accurately reflect the dynamic and rapidly evolving nature of the industry, particularly in the cloud gaming space.

FTC Chair Lina Khan has been a prominent voice in this ongoing legal battle, emphasizing the agency's commitment to preventing anti-competitive mergers.

The FTC's Arguments on Appeal: Anti-Competitive Practices

The FTC's appeal strategy focuses on demonstrating that the district court erred in its assessment of Microsoft's potential for anti-competitive behavior. The core of their argument rests on the assertion that the merger would significantly reduce competition, harming both consumers and rival companies.

The FTC's anti-competitive arguments include:

-

Focus on Microsoft's market power and potential for abuse: The FTC argues that Microsoft's substantial market power, combined with Activision Blizzard's extensive game portfolio, would allow Microsoft to leverage its position to exclude competitors and harm innovation.

-

Discussion of exclusive content deals and their impact on rivals: A key concern is Microsoft's potential to make Activision Blizzard games exclusive to its Xbox ecosystem, harming competitors like Sony PlayStation and Nintendo Switch. This strategy could limit consumer choice and stifle competition.

-

Analysis of the long-term effects on the gaming market: The FTC emphasizes the long-term implications, asserting that the merger would create barriers to entry for new competitors and lead to a less dynamic and innovative gaming market.

The FTC is likely to cite relevant legal precedents related to mergers in other tech sectors to support its claims.

Potential Outcomes and Implications for the Gaming Industry

Several potential outcomes exist for the FTC's appeal: The appellate court could affirm the district court's ruling, reverse it, or remand the case back to the lower court for further consideration.

A reversal would significantly impact Microsoft and Activision Blizzard, potentially forcing them to abandon or renegotiate the merger. The implications for the gaming industry are vast:

-

Effect on future mergers and acquisitions in the gaming sector: A successful FTC appeal could set a new precedent, leading to increased regulatory scrutiny of future mergers and acquisitions in the gaming industry.

-

Impact on regulatory scrutiny of tech giants: The outcome will significantly influence how regulators approach mergers involving large tech companies, potentially setting a standard for future antitrust enforcement.

-

Potential changes to antitrust enforcement: The case could lead to changes in antitrust enforcement practices, potentially impacting the way regulators assess market power and the potential for anti-competitive behavior.

The reactions from various stakeholders, including game developers, investors, and consumers, will heavily depend on the final outcome.

The Future of Gaming Mergers and the Role of Regulators

This case highlights the growing importance of antitrust enforcement in the rapidly evolving tech landscape. The FTC and other regulatory bodies, including the EU Commission, are playing an increasingly crucial role in shaping the future of mergers and acquisitions in the tech sector.

The future landscape will likely include:

-

Increased scrutiny of large tech acquisitions: Expect heightened regulatory scrutiny for mergers involving significant market power.

-

Potential for stricter regulations on mergers and acquisitions: This case could pave the way for stricter regulations governing mergers and acquisitions in the tech industry.

-

The need for a balanced approach that promotes innovation while preventing monopolies: The challenge lies in finding a balance that fosters innovation and competition while preventing the formation of monopolies that harm consumers.

Conclusion: The Ongoing Battle Over the Microsoft Activision Buyout

The FTC's appeal against the initial ruling allowing the Microsoft Activision buyout represents a significant challenge to the merger. The FTC’s arguments center on concerns regarding reduced competition, especially within the cloud gaming market, and the inadequacy of Microsoft’s proposed remedies. The outcome of this appeal will have far-reaching consequences for the gaming industry, setting precedents for future mergers and acquisitions and influencing regulatory scrutiny of tech giants. We can expect increased regulatory oversight and a more cautious approach to large-scale tech mergers moving forward. Stay tuned for updates on this landmark case affecting the future of the Microsoft Activision buyout and the gaming industry. Continue following this space for more analysis on the FTC's appeal and the evolving landscape of gaming mergers and acquisitions.

Featured Posts

-

Elon Musks Twitter Rename Fuels Gork Meme Coin Price Surge

May 16, 2025

Elon Musks Twitter Rename Fuels Gork Meme Coin Price Surge

May 16, 2025 -

Microplastiche In Acqua Quali Sono Le Fonti Principali Di Contaminazione

May 16, 2025

Microplastiche In Acqua Quali Sono Le Fonti Principali Di Contaminazione

May 16, 2025 -

Padres Welcome Back Former Ace Jake Peavy As Special Assistant

May 16, 2025

Padres Welcome Back Former Ace Jake Peavy As Special Assistant

May 16, 2025 -

Bidens Rebuttals Fact Checking The Claims

May 16, 2025

Bidens Rebuttals Fact Checking The Claims

May 16, 2025 -

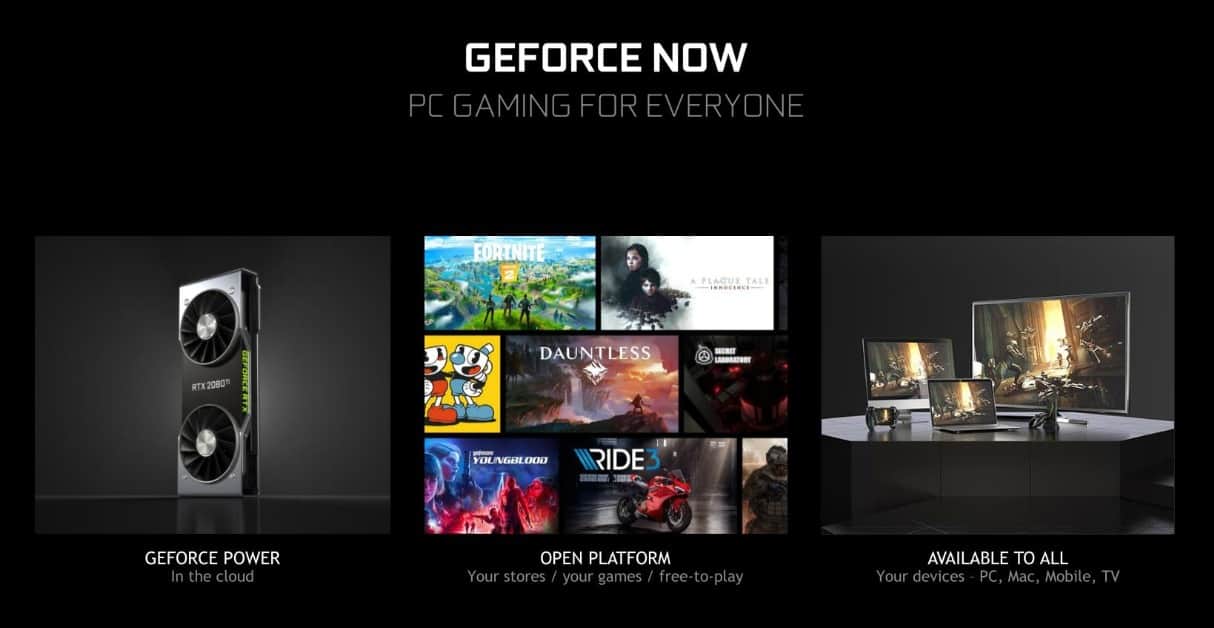

Nouveautes Ge Force Now 21 Jeux Cloud Disponibles Maintenant

May 16, 2025

Nouveautes Ge Force Now 21 Jeux Cloud Disponibles Maintenant

May 16, 2025