G-7 Nations Debate Lowering Tariffs On Chinese Imports: A De Minimis Threshold Analysis

Table of Contents

The Current Tariff Landscape and the De Minimis Threshold

Understanding the current tariff structure on Chinese imports is crucial to analyzing the potential effects of any adjustments. G-7 nations currently maintain a diverse range of tariffs on various Chinese goods, reflecting differing national priorities and sensitivities. The de minimis threshold, a critical component of this system, refers to the value below which imported goods are exempt from customs duties and certain other import regulations. This threshold simplifies customs procedures for smaller shipments, reducing administrative burdens for both importers and customs authorities.

A lower de minimis threshold would have several implications:

-

Impact on Small Businesses and Consumers: Lowering the threshold could facilitate the import of smaller quantities of goods, potentially benefiting small businesses by reducing import costs and opening access to a wider range of Chinese products. Consumers could also benefit from increased product variety and potentially lower prices for certain goods.

-

Examples of Current De Minimis Thresholds in Different G-7 Countries: The current thresholds vary significantly across G-7 nations. For instance, Canada might have a threshold of $20, while the UK might have a higher threshold of $150. These disparities create complexities in trade and need to be considered in any harmonization efforts.

-

Impact on Import Costs for Businesses and Consumers: While a lower threshold may offer some benefits, it could increase the administrative burden on customs agencies and potentially lead to increased processing times for imports. The net effect on import costs will depend on the specific goods, the volume of imports, and the efficiency of customs operations.

-

Potential Administrative Challenges of a Lower Threshold: A significantly lower threshold could lead to increased paperwork and processing demands for customs authorities, potentially slowing down the import process and causing delays for businesses and consumers.

Arguments for Lowering Tariffs and Adjusting the De Minimis Threshold

Advocates for reducing tariffs and lowering the de minimis threshold emphasize several potential economic and diplomatic advantages:

-

Economic Benefits: Lower tariffs could stimulate economic growth by increasing consumer choice and reducing prices, ultimately benefiting consumers and boosting demand. This, in turn, could encourage greater competition and innovation within G-7 markets.

-

Increased Economic Growth and Competitiveness: By removing trade barriers, businesses within G-7 nations could access cheaper inputs and increase their global competitiveness. This increased competitiveness could lead to higher exports and overall economic growth.

-

Fostering Stronger Diplomatic Relations: Reducing trade tensions and fostering a more collaborative approach to trade could significantly improve diplomatic relations between the G-7 nations and China.

-

Specific Examples and Data: Studies indicating a correlation between tariff reduction and economic growth (e.g., WTO reports) could provide empirical support. Examples of successful tariff reduction agreements between other nations could highlight the potential for positive outcomes. Analyzing the impact on specific industries within G-7 countries (e.g., increased manufacturing efficiency due to cheaper imported components) would offer further support.

Arguments Against Lowering Tariffs and Concerns Regarding a Lower De Minimis Threshold

Opponents of tariff reductions highlight several potential negative consequences:

-

Negative Impacts on Domestic Industries and Jobs: Lower tariffs could increase competition from Chinese imports, potentially harming domestic industries and leading to job losses in sectors unable to compete with lower prices.

-

Concerns about Unfair Trade Practices: Concerns about dumping (selling goods below cost) and intellectual property theft from China must be addressed to ensure a level playing field.

-

Increased Trade Deficits and National Security: Lower tariffs could worsen trade imbalances and increase reliance on Chinese goods, potentially raising national security concerns related to supply chain vulnerabilities.

-

Examples and Data: Specific industries vulnerable to increased competition (e.g., textiles, manufacturing) need identification. Data demonstrating the potential job losses or economic downturns in specific sectors due to increased imports from China would solidify this argument. Counterarguments to the claims supporting tariff reductions (e.g., focusing on the long-term impacts and potential job creation in other sectors) need careful consideration.

Analyzing the Impact of Different De Minimis Threshold Levels

A thorough analysis requires exploring the effects of various de minimis threshold adjustments on key economic indicators:

-

Scenario Modeling: Developing models to simulate the impact of different threshold levels (e.g., 10%, 20%, 50% reduction) on trade volumes, import costs, and domestic industries would provide valuable insights.

-

Data Visualization: Graphs and charts visualizing the projected outcomes for key economic indicators (e.g., GDP growth, employment levels, trade balance) would make the analysis more accessible and impactful.

-

Comparative Analysis: Comparing the projected outcomes of different policy options (e.g., different de minimis threshold levels combined with other trade policy instruments) will facilitate informed decision-making.

Conclusion: A Balanced Perspective on G-7 Trade Policy with China

The debate surrounding lowering tariffs on Chinese imports and adjusting the de minimis threshold is complex, with significant potential benefits and risks. While reducing tariffs could boost economic growth and consumer welfare, it's crucial to address potential negative consequences for domestic industries and national security. A balanced approach requires careful consideration of all factors, including scenario modeling and thorough impact assessments. The G-7 nations' ongoing debate on this crucial trade policy requires informed public discourse and a commitment to evidence-based decision-making. We encourage readers to further research the topic and engage in informed discussions about adjusting tariffs on Chinese imports, conducting further de minimis threshold analysis for G7 trade, and contributing to a comprehensive understanding of G-7 trade policy on Chinese goods.

Featured Posts

-

Peppa Pigs Sibling Arrives The Name Secret Finally Out

May 22, 2025

Peppa Pigs Sibling Arrives The Name Secret Finally Out

May 22, 2025 -

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025 -

Detroit Tigers 8 6 Victory Over Rockies Underdogs Triumph

May 22, 2025

Detroit Tigers 8 6 Victory Over Rockies Underdogs Triumph

May 22, 2025 -

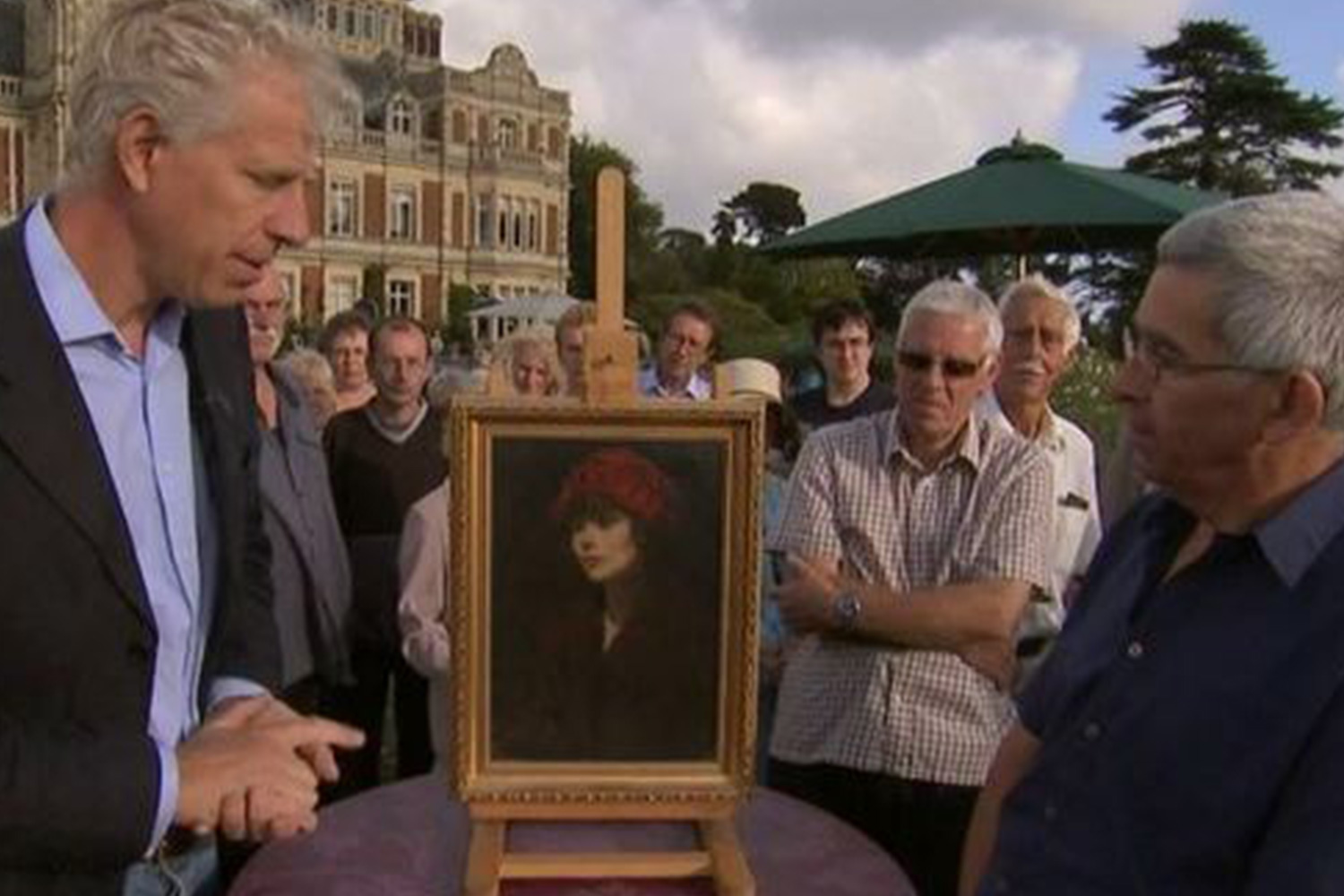

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 22, 2025

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 22, 2025 -

Wordle 1358 Saturday March 8th Hints And Solution

May 22, 2025

Wordle 1358 Saturday March 8th Hints And Solution

May 22, 2025