G-7 To Debate Lowering Tariffs On Chinese Imports: A Closer Look

Table of Contents

Arguments for Lowering Tariffs on Chinese Imports

Lowering tariffs on Chinese imports presents a compelling case for several reasons, primarily focusing on economic benefits for consumers and businesses alike.

Reduced Consumer Prices

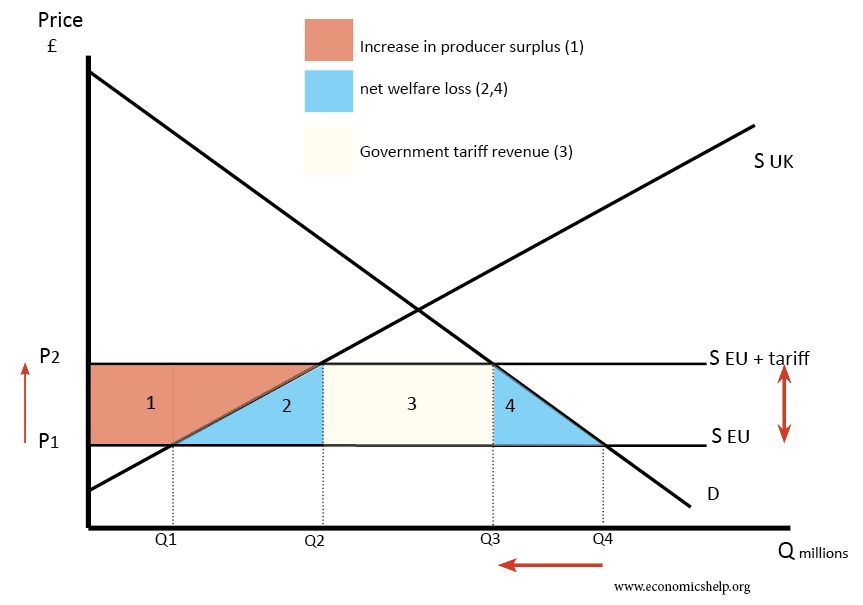

Lower import tariffs translate directly into cheaper consumer goods. This is because tariffs, essentially taxes on imported products, directly increase the final price paid by consumers. Reducing these tariffs would lead to a decrease in the consumer price index (CPI), effectively combating inflation and making a wide range of products more affordable.

- Examples: Lower tariffs could significantly reduce the price of electronics, clothing, furniture, and many other consumer staples sourced from China.

- Potential Savings: Consumers could see substantial savings on their monthly budgets, freeing up disposable income for other expenditures.

- Impact on Inflation: Reduced import prices could help mitigate inflationary pressures, benefiting overall economic stability.

Increased Competition and Innovation

Reduced tariffs foster increased competition in domestic markets. The influx of lower-priced Chinese goods forces domestic producers to become more efficient and innovative to maintain competitiveness. This competition ultimately leads to better quality products and lower prices for consumers.

- Examples: Industries such as electronics, textiles, and manufacturing could experience a surge in competition, driving innovation in product development and manufacturing processes.

- Potential for Increased Innovation: The pressure to compete will spur businesses to invest more in research and development, leading to technological advancements and improved product offerings.

- Impact on Market Dynamics: Increased competition can result in a more dynamic and efficient market, benefiting both consumers and businesses.

Strengthening Global Supply Chains

China plays a pivotal role in global supply chains, particularly in manufacturing. High tariffs disrupt these supply chains, leading to delays, increased costs, and shortages. Lowering tariffs would contribute to smoother trade flows, boosting efficiency and resilience in global manufacturing.

- Examples: Reduced tariffs could alleviate bottlenecks in the supply of essential components for various industries, improving manufacturing efficiency and reducing production costs.

- Benefits of Smoother Trade Flows: More predictable and efficient supply chains lead to lower costs and greater stability for businesses, ultimately benefiting consumers.

- Positive Impact on Manufacturing: Improved supply chain resilience can boost overall manufacturing output and contribute to economic growth.

Arguments Against Lowering Tariffs on Chinese Imports

While the economic advantages of reduced tariffs are appealing, several significant concerns warrant careful consideration.

Concerns about Fair Trade Practices

Lowering tariffs without addressing unfair trade practices could exacerbate existing issues. Concerns remain regarding intellectual property rights (IPR) theft, unfair competition from state-subsidized industries, and human rights violations within China's manufacturing sector.

- Specific Examples: The theft of intellectual property costs billions of dollars annually for G7 nations, hindering innovation and harming domestic businesses.

- Impact on Domestic Industries: Unfair competition from state-subsidized Chinese industries can cripple domestic businesses and lead to job losses.

- Potential for Job Losses: Without sufficient safeguards, lowering tariffs could lead to job displacement in sensitive industries within G7 countries.

National Security Concerns

Increased reliance on Chinese imports in strategically important sectors raises national security concerns. This vulnerability could have severe consequences in times of geopolitical instability or conflict.

- Examples: Over-reliance on Chinese imports in areas like technology, critical minerals, and defense-related materials could compromise national security.

- Potential Vulnerabilities: Disruptions to Chinese supply chains could have a devastating impact on essential services and infrastructure.

- Importance of Diversification of Supply Chains: G7 nations need to diversify their supply chains to mitigate risks associated with over-reliance on a single source.

Environmental Impact

Increased imports from China could exacerbate environmental problems, including carbon emissions and pollution. China's manufacturing sector is known for its significant environmental footprint.

- Examples: Increased imports of goods manufactured with environmentally unfriendly practices could lead to a surge in carbon emissions and air/water pollution.

- Potential Increase in Carbon Emissions: The transportation of goods over long distances contributes significantly to carbon emissions.

- Importance of Sustainable Trade Practices: Promoting sustainable trade practices and environmental regulations is crucial to mitigate the negative environmental consequences.

Potential Outcomes and Global Implications

The G7's decision on lowering tariffs on Chinese imports will have significant and far-reaching consequences.

Impact on the G7 Economies

The effects on each G7 nation will vary depending on its economic structure and trade relationships with China. Some nations might experience economic gains, while others may face challenges.

- Specific Examples: Countries heavily reliant on specific imports from China could see substantial price reductions, while those with competing domestic industries may face increased pressure.

- Potential Economic Gains and Losses: A careful cost-benefit analysis is needed to evaluate the potential economic impact on each G7 nation.

Implications for the World Trade Organization (WTO)

The G7's decision will undoubtedly impact the World Trade Organization (WTO) and its authority in regulating international trade. The decision could either strengthen or weaken the multilateral trade system.

- Potential Challenges to the WTO: The G7's actions could set a precedent that challenges the WTO's rules and norms.

- Implications for Future Trade Negotiations: The outcome of the G7 debate will influence future trade negotiations and the overall global trade architecture.

Conclusion

The debate surrounding lowering tariffs on Chinese imports is multifaceted and complex, with strong arguments both for and against the proposal. The potential economic benefits, including reduced consumer prices and increased competition, are undeniable. However, concerns regarding fair trade practices, national security, and environmental impact cannot be ignored. The G7's decision will have significant repercussions for global trade relations and the international economic order. Follow the debate on lowering tariffs on Chinese imports closely to stay updated on the G7's stance on Chinese import tariffs and learn more about the implications of adjusting tariffs on Chinese goods. Understanding this evolving landscape is crucial for navigating the complexities of global trade in the years to come.

Featured Posts

-

Hjwm Washntn Mnfdh Alhjwm Ela Sfart Alahtlal Ytalb Bhryt Flstyn

May 23, 2025

Hjwm Washntn Mnfdh Alhjwm Ela Sfart Alahtlal Ytalb Bhryt Flstyn

May 23, 2025 -

Mayysta Athka Yelken Acan 3 Burc Athk Cekimi Kapyda

May 23, 2025

Mayysta Athka Yelken Acan 3 Burc Athk Cekimi Kapyda

May 23, 2025 -

The Who The Untold Story Behind Their Iconic Name

May 23, 2025

The Who The Untold Story Behind Their Iconic Name

May 23, 2025 -

Analysis Of X101 5s Big Rig Rock Report 3 12 Playlist

May 23, 2025

Analysis Of X101 5s Big Rig Rock Report 3 12 Playlist

May 23, 2025 -

2025 Memorial Day Weekend Beach Forecast For Ocean City Rehoboth And Sandy Point

May 23, 2025

2025 Memorial Day Weekend Beach Forecast For Ocean City Rehoboth And Sandy Point

May 23, 2025

Latest Posts

-

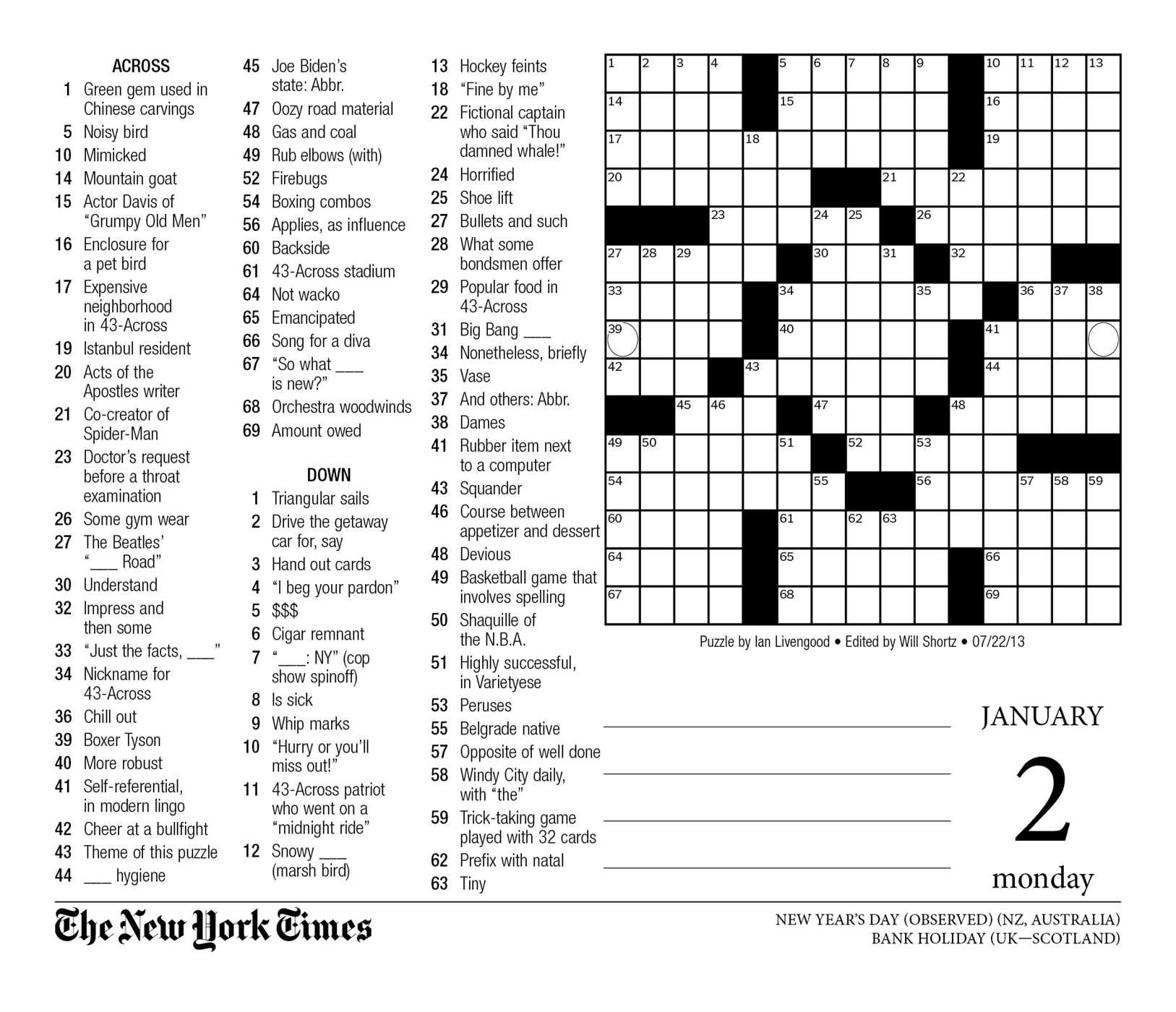

Nyt Mini Crossword April 8 2025 Tuesday Complete Solutions

May 23, 2025

Nyt Mini Crossword April 8 2025 Tuesday Complete Solutions

May 23, 2025 -

Shajee Traders In Essen Geschlossen Hygienemaengel Fuehrten Zur Schliessung

May 23, 2025

Shajee Traders In Essen Geschlossen Hygienemaengel Fuehrten Zur Schliessung

May 23, 2025 -

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 23, 2025

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 23, 2025 -

Essen Shajee Traders An Der Schuetzenbahn Wegen Hygienemaengeln Geschlossen

May 23, 2025

Essen Shajee Traders An Der Schuetzenbahn Wegen Hygienemaengeln Geschlossen

May 23, 2025 -

Sunday May 11 Nyt Mini Crossword Hints Clues And Solutions

May 23, 2025

Sunday May 11 Nyt Mini Crossword Hints Clues And Solutions

May 23, 2025